“`html

01. Recent Developments in the Cryptocurrency Industry

On June 5th and 6th, the US Securities and Exchange Commission (SEC) filed lawsuits against Binance and Coinbase, two virtual asset trading platforms, stating that certain cryptocurrencies were deemed “securities” due to meeting the Howey Test and must be regulated by the SEC. Looking back to March of this year, the US Commodity Futures Trading Commission (CFTC) deemed virtual assets as “commodities,” thereby giving them jurisdiction, and accused Binance of conducting unauthorized trading in the US. The dispute between the SEC and CFTC over jurisdiction of cryptocurrencies will continue until a draft that both parties accept is passed.

While US industry policies are uncertain, some Asian regions are embracing the Web 3.0 revolution.

Last Thursday (June 22nd), blockchain company Ripple received a principle-based approval for operations in Singapore, which is also good news for the global cryptocurrency industry. The license will allow Ripple to offer regulated digital payment token products and services and expand the cross-border transfer of XRP (a cryptocurrency closely related to the company) among its customers (banks and financial institutions). It should be noted that three years ago, the US SEC used similar litigation methods against Binance and Coinbase to deem certain cryptocurrencies offered by Ripple as “securities” and accused Ripple of providing unregistered securities trading services. The SEC and Ripple are still in a lengthy courtroom battle, and Judge Torres has repeatedly requested further legal clarification from the SEC.

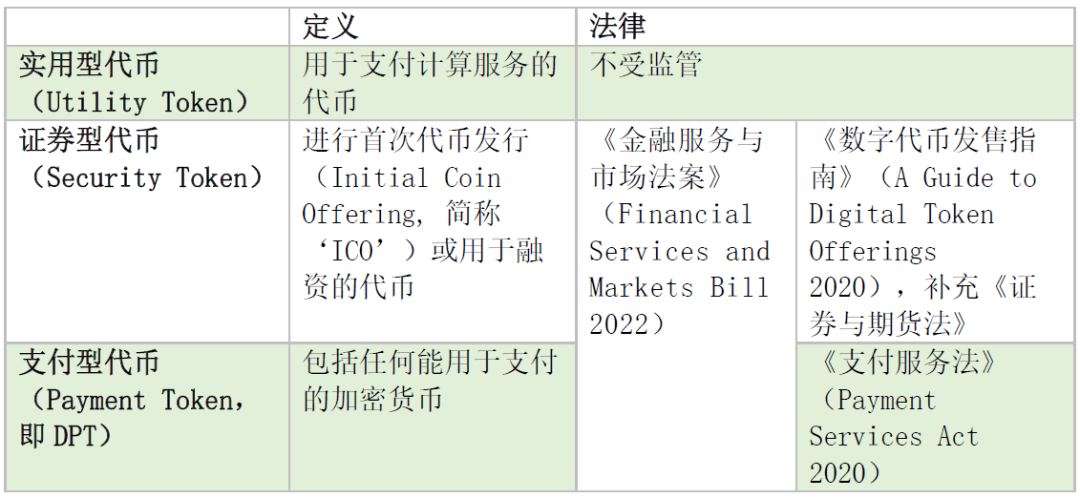

Singapore, as a leader in the Web 3.0 revolution in Asia, has made meticulous industry arrangements by enacting the Payment Services Act, the Guide to Digital Token Offerings, and the Securities and Futures Act since 2020. Hong Kong, China has followed suit, and the Securities and Futures Commission (SFC) of Hong Kong publicly announced the “Consultation Conclusions on Proposed Regulation of Virtual Asset Trading Platform Operators by the Securities and Futures Practice Supervision Committee” on May 23rd of this year. After the amended ordinance came into effect on June 1st, many virtual asset trading platforms rushed to apply for licenses in Hong Kong.

“`

02, Overview of Stablecoins

The high volatility of the cryptocurrency market makes cryptocurrency investment less suitable for ordinary trading, and stablecoins provide an alternative to the high volatility of popular cryptocurrencies, including Bitcoin (BTC). Therefore, stablecoins are more useful as an exchange medium than cryptocurrencies with greater volatility. Stablecoins can be pegged to currencies such as the US dollar or to the price of commodities such as gold. According to different stable mechanisms, common stablecoins on the market can be divided into:

(1) Centralized stablecoins that are pegged to fiat currencies (such as the US dollar or British pound): Fiat-backed stablecoins maintain reserves of fiat currency (or currency) as collateral to ensure the value of stablecoins. These reserves are maintained by independent custodians and audited regularly. For example, Tether (USDT) and True (TUSD).

(2) Stablecoins that overcollateralize crypto assets: Because the reserves of cryptocurrencies can also be highly volatile, this type of stablecoin is overcollateralized, meaning that the value of the reserve crypto assets exceeds the value of the stablecoins issued. For example, MakerDAO’s Dai (DAI) stablecoin is pegged to the US dollar, but is essentially supported by 150% collateral of Ethereum (ETH) and other cryptocurrencies circulating in DAI stablecoin value.

(3) Algorithm-based stablecoins: Algorithmic stablecoins may or may not hold reserve assets. Their main difference is in the strategy of maintaining the value of stablecoins stable by controlling the supply of stablecoins through an algorithm, which is essentially a computer program running a preset formula. Unlike traditional currencies, this currency does not have the endorsement of a central bank,

Recently, centralized stablecoins pegged to fiat currencies (such as the US dollar or British pound) have been the regulatory focus of major jurisdictions such as the United States, Singapore, and Hong Kong. In traditional fiat currencies, a 1% fluctuation in foreign exchange trading is rare. Therefore, compared to other currencies, this type of centralized stablecoin pegged to fiat currencies has stable prices, low market risks, and wide availability, making it the most potential to develop into a widely accepted payment method. The following section will analyze the qualitative, regulatory, and future trends of payment-type stablecoins in the United States, Singapore, and Hong Kong based on these stablecoins.

01, USA

In the SEC’s complaint against Binance, the SEC believes that BUSD (a stablecoin that is pegged to the US dollar at a 1:1 ratio) is a “security”.

On Thursday (June 22), Federal Reserve Chairman Powell expressed his views on privately issued stablecoins: “We do view them as a form of money. And in all developed economies, the ultimate backstop for the value of money is the central bank.”

According to the definition of payment-type stablecoins in the draft bill (June 8, 2023 version) (g:\VHLD\060823\D060823.010.xml) proposed by the US Congress, payment-type stablecoins are digital assets that are used or designed to be used as a means of payment or settlement. The issuer has an obligation to convert, redeem, or repurchase a fixed amount of monetary value. The stablecoin should maintain a stable value relative to the fixed amount of monetary value and is expected to remain stable. It is not a security issued by a national currency or investment company.

Although relevant US agencies are still arguing over the classification and jurisdiction of cryptocurrencies, the classification of payment-type stablecoins is relatively clear. Based on Powell’s remarks and the US Congress’ draft bill, payment-type stablecoins are likely to be recognized as a form of money (but not national currency), which will also affect the regulatory framework of other stablecoins in the future.

Singapore

The Monetary Authority of Singapore (MAS) classifies cryptocurrencies into three categories:

In Singapore, payment-type stablecoins (DPT) are considered a type of digital payment instrument, rather than a security or currency. This means that payment-type stablecoins are not considered a currency or security regulated by MAS, and are independently regulated as digital payment instruments.

DPT refers to digital currencies issued and transmitted through encryption technology, including but not limited to cryptocurrencies, digital tokens, and digital stablecoins. DPT is usually used for payment and trading, and has relatively high liquidity and exchangeability. Single-currency pegged stablecoins are a special type of DPT that have payment and settlement functions. Therefore, single-currency pegged stablecoins must comply with the regulatory requirements of DPT, including implementing anti-money laundering and counter-terrorism financing measures, protecting consumer rights, and disclosing risks; and also comply with the special requirements of single-currency pegged stablecoins, such as reserve ratio and price fluctuation limit.

03, Hong Kong

According to the Hong Kong Monetary Authority’s (HKMA) conclusion in January of this year, “payment-related stablecoins” are defined as stablecoins with the potential to become widely accepted as a means of payment. HKMA stated that stablecoins that purport to reference one or more fiat currencies (a payment-type stablecoin) will be given priority regulation. Regardless of whether they are anchored to fiat currency through algorithms or arbitrage mechanisms, and regardless of whether they are primarily used for retail, wholesale, or cryptocurrency asset transactions, stablecoins that claim to anchor fiat currency will be subject to regulation.

However, HKMA believes that a specific definition is necessary to exclude cryptocurrencies that are regulated by other regulatory agencies, such as security tokens regulated by HKSFC, to prevent regulatory arbitrage. HKMA has launched the second round of public consultations in early June of this year. It is believed that we can expect the issuance, circulation, and regulation of payment-type stablecoins in Hong Kong by next year at the latest.

03, Payment-Type Stablecoins: Prospects and Future

In recent years, stablecoins have received significant attention and adoption because they can combine the stability of fiat currency with the advantages of digital currency. Considering the various advantages that stablecoins provide in the financial ecosystem, the prospect of payment stablecoins is quite promising, including improving payment efficiency, increasing financial inclusion, and decentralized finance (DeFi) applications.

At the same time, the issuance and regulation of payment-type stablecoins still deserve attention:

1. Financial stability risks: The widespread use of payment-type stablecoins may have an impact on the stability of the financial system. If payment-type stablecoins experience credit risk, liquidity risk, and other issues as a popular payment tool, it may trigger panic and turmoil in the financial market.

2. Cross-border payment regulation: Payment-type stablecoins can easily enable cross-border payments, but this also poses challenges for regulatory agencies. Cross-border payments may involve issues such as money laundering and terrorist financing, requiring strengthened international cooperation and regulation.

3. Data Privacy and Security: The issuer of a payment stablecoin needs to ensure the privacy and security of user data, preventing data leaks and hacker attacks.

4. Competition and Anti-Monopoly Issues: If a certain payment stablecoin dominates the market, it may lead to an imbalance in market competition, affecting the fairness and efficiency of the financial market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!