Authors: Logicrw, Jaleel, BlockBeats

EDX Markets, a new cryptocurrency trading platform, announced its official launch and completion of a new round of fundraising last night. The main reason that caused a lot of discussion is that the trading platform has been supported by financial giants in the TradFi field, such as Citadel Securities, Fidelity, and Charles Schwab.

This announcement seems to have caused a huge ripple effect in the market. This morning, with the launch of the EDX Markets platform, the four mainstream cryptocurrencies that are not recognized as securities by the SEC—Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH)—have all seen significant gains. Among them, Bitcoin has broken through the $29,000 mark in a short period of time, with a 24-hour increase of 6.82%. Ethereum also saw a 24-hour increase of 3.41%, while BCH’s increase was even more amazing, soaring 24.3% in 24 hours.

In this new round of financing, EDX Markets has attracted a group of strategic investors in the financial trading industry. These include Miami International Holdings (MIH), DV Crypto, GTS, GSR Markets LTD, and HRT Technology, among others, with Miami International Holdings being the most prominent.

- ASX: 31% of Australian young people still hold cryptocurrency despite disliking risks

- Market turmoil continues behind the rebound of Bitcoin

- NFT trading market ZORA will launch a Layer2 network based on OP Stack called ZORA NETWORK.

New investor: Miami International Holdings

Miami occupies an important position in the global Bitcoin and cryptocurrency ecosystem due to its favorable policy environment. Well-known cryptocurrency companies such as FTX US and MoonBlockingy have set up their headquarters here. Although Miami International Holdings (MIH) has “Miami” in its name, its headquarters are actually located in New Jersey (with only an office in Miami), and it is one of the main options trading exchanges in the United States.

According to the official website, Miami International Holdings (MIH) was established in 2007 and mainly operates global financial trading platforms and execution services. The company has multiple US stock, equity options, and commodity exchanges, including the MIAX Exchange Group (consisting of MIAX, MIAX Pearl, MIAX Pearl Equities, and MIAX Emerald) and the Minneapolis Grain Exchange (MGEX). In addition, MIH also has a subsidiary, Miami International Technologies, which focuses on selling and licensing trading technology developed by the MIAX Exchange Group.

In May of this year, the Miami International Securities Exchange (MIAX) announced the completion of its acquisition of LedgerX, a derivatives trading platform owned by FTX. This move is seen as an important milestone for MIAX as it ventures into digital assets from traditional finance. LedgerX was one of the FTX assets approved for sale in January of this year and was acquired by FTX US in August 2021. LedgerX is a trading and clearing platform regulated by the US Commodity Futures Trading Commission (CFTC) and is registered with the CFTC as a designated contract market (DCM), derivatives clearing organization (DCO), and swap execution facility (SEF).

But MIAX had already had the idea of launching cryptocurrency derivatives earlier. According to the CoinCarp website, Miami International Holdings (MIH) participated in the $110 million E round financing of crypto data provider Lukka in January 2022. In June, MIAX announced a strategic alliance with Lukka to jointly develop and launch a proprietary set of crypto derivatives based on Lukka data.

In MIAX’s strategic planning, digital assets and cryptocurrencies are playing an increasingly prominent role. As the cryptocurrency market matures, various financial trading platforms are also constantly looking for innovative and development opportunities related to it. For MIH, the new round of financing for EDXM is just another step in its exploration of digital assets. In the future, we can expect to see more attempts by TradFi giants like this to combine digital assets with traditional financial products.

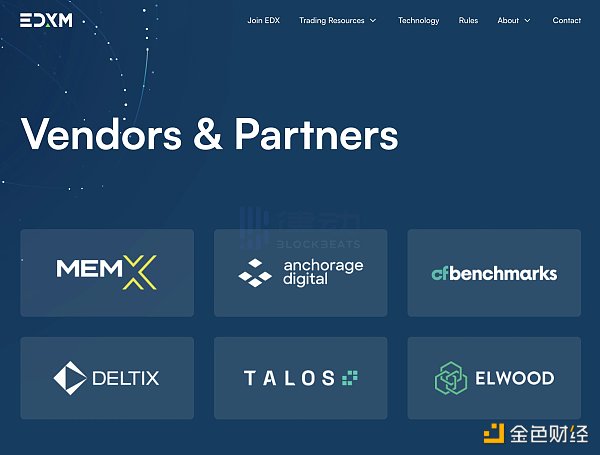

Suppliers and Partners

Aside from the new investor Miami International Holdings receiving great attention, the six suppliers and partners listed on the EDX Markets website have also sparked community discussion. They are: stock trading platform MEMX, crypto custodian Anchorage Digital, crypto index provider CF Benchmarks, trading software developer DELTIX, crypto institutional trading platform TALOS, and crypto technology company Elwood.

Stock trading platform MEMX

Members Exchange (MEMX) is an independently owned, technology-driven stock trading platform. The trading platform was founded in early 2019 by Bank of America Securities, Jane Street Capital, Citadel LLC, E-Trade, Fidelity Investments, Morgan Stanley, TD Ameritrade, UBS Group, and Virtu Financial, and competes with major stock trading platforms such as the New York Stock Exchange, Nasdaq, and the Chicago Options Exchange.

Since its founding, MEMX has also received investments from nine other financial services companies, including BlackRock, Citigroup, JPMorgan, Goldman Sachs, Fidelity, and Jane Street Capital. In May 2020, MEMX received approval from the U.S. Securities and Exchange Commission to operate as a national securities exchange. In March of this year, MEMX announced that it had completed a strategic financing round led by Optiver, a global leading market maker, to support the launch of its options trading platform, MEMX Options, in August.

Cryptocurrency Custodian Anchorage Digital

Anchorage Digital is a compliance-focused crypto platform founded in 2017, with early investors including a16z and Blockchain Capital. Visa became an investor in Anchorage Digital in 2019 and used the company to provide cryptocurrency payment services. Anchorage Digital Bank received a bank charter from the Office of the Comptroller of the Currency in 2021, becoming the first federally chartered crypto bank in the U.S.

Anchorage Digital provides comprehensive financial services and infrastructure solutions for institutions and is a digital asset custodian for banks, venture capital firms, fintechs, and governments. Anchorage Digital uses biometric authentication and hardware security modules to store and protect cryptocurrencies. Anchorage Digital announced a $350 million funding round in December 2021, valuing the company at $3 billion post-money.

Cryptocurrency Index Provider CF Benchmarks

CF Benchmarks is a digital asset index service provider authorized and regulated by the UK Financial Conduct Authority (FCA) and is a wholly-owned subsidiary of cryptocurrency exchange Kraken. CF Benchmarks covers over 40 digital assets, with its flagship product being the CME CF Bitcoin Reference Rate (BRR), which is used to settle bitcoin-dollar futures contracts listed by the CME Group and serves as a valuation benchmark for global asset management firms. In September of last year, BlackRock announced that it was using CF Benchmarks’ bitcoin index pricing product to launch its bitcoin product.

Trading Software Developer Deltix

Founded in 2005 by a group of computer scientists and mathematicians, Deltix is a company that provides quantitative research software and services for the financial industry. The company’s expertise involves applying complex mathematics to large datasets to help clients gain actionable insights and conduct ‘smart trading’. Deltix’s solutions typically involve customized deployments using its advanced product components in collaboration with clients.

Deltix’s customers include both buy-side and sell-side firms. On the buy-side, Deltix works with hedge funds, commodity trading advisors, proprietary trading firms, investment management firms, and banks. On the sell-side, Deltix provides algorithmic execution solutions for stock, futures, and forex orders to banks and brokers. Deltix’s solutions are also used by OTC trading platforms and crypto exchanges.

Crypto Trading Platform TALOS

Founded in 2018 and based in New York, TALOS provides technology to financial institutions to support digital asset trading. Its platform offers liquidity access, direct market access, price discovery, automated execution, clearing, and settlement. Talos provides the best trading solutions for institutional investors, and its products help clients view trading platform and market maker prices in one place and issue instructions for all stages of the trade – even the complex algorithmic stage.

Talos raised $40 million in Series A funding led by a16z in May 2021 and completed a $105 million Series B funding round at a valuation of $1.25 billion in May 2022.

Crypto Tech Company Elwood Technologies

Elwood Technologies is a cryptocurrency trading platform founded by Alan Howard, a well-known hedge fund manager in the UK. The company raised $70 million in a Series A funding round led by Goldman Sachs and Dawn Capital in May of last year. Elwood offers a technology platform similar to Bloomberg Terminal or BlackRock Aladdin investment portfolio management system, which aims to plug into existing trading software at financial institutions to help them manage and trade cryptocurrency investment portfolios. In February of last year, Elwood Technologies announced a strategic integration with Bloomberg to connect its software to the US trading platform’s order management system.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!