From June 17th to June 30th this year, Compound, the leader of DeFi 1.0, rose from 27 USDT to a high of 59.5 USDT. Especially in the six days from June 25th to June 30th, the maximum increase was about 100%. See the following chart:

Compound is an algorithm-based collateral lending agreement that provides users with floating rate deposits and lending services. As the leader of DeFi 1.0, it is highly valued by capital and is also a cornerstone of DeFi Lego. Although the fundamentals of Compound are good, it is still worth exploring why it doubled in one week during a period when the overall market direction is unclear. We found the following four reasons:

1. On June 17th, Compound officially published an article on Medium titled “The Compound Protocol Belongs to the Community”, which stated that Compound has launched an on-chain system that freely distributes COMP tokens to protocol users, realizing community governance. This kind of power delegation to the community greatly promotes Compound users’ support for the community, which is also reflected in the secondary market price.

- Recent Development of DEX in Data Analysis

- Introduction to Creatorfi, a Blue Ocean Track, and sharing of potential projects

- The AI Revolution in Chain Games (Part 4): How is AI Actually Used in Games?

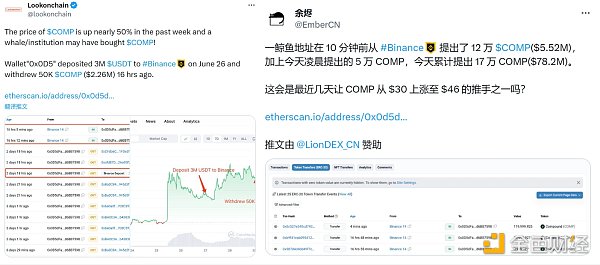

2. According to Lookonchain Twitter, on June 26th, a user with the address 0x0D5 deposited 3 million US dollars to Binance and withdrew 2.26 million COMP tokens within two hours, suspected to be an institutional entry. According to the observation of Twitter blogger Yujin, on June 29th, the same user with address 0x0D5 withdrew a total of 170,000 COMP from Binance. Through the observation of these two on-chain analysis bloggers, it also indicates or implies that institutions are entering the market to a certain extent.

3. On June 29th, Compound founder and CEO Robert Leshner announced the establishment of a new company Superstate, which aims at the current hot field RWA. They are committed to purchasing short-term US Treasury bonds and putting them on the chain. Through blockchain, they make secondary records and directly trade and circulate the ownership shares of the fund on the chain. At the same time, Compound announced that its new CEO Jayson Hobby took office. He has worked for well-known companies such as Coinbase and Uber. If placed in many other projects, CEO’s entrepreneurship is a negative behavior, but due to the possibility of linkage with Compound in business by the former founder’s new entrepreneurial project, plus the new CEO’s resume is relatively brilliant, it may become a driving force for the rise.

4. The first three points are the reasons for the recent possible rise in Compound. However, the impact of the cryptocurrency market environment cannot be ignored. The recent rebound of mainstream currencies such as BTC and ETH is conducive to the rise of high-quality blue-chip projects, which also needs to be taken into consideration.

However, the Odaily Planet Daily also issues a risk warning: Compound and other leading projects in the subdivision field have risen sharply recently, so users should be cautious of chasing after high prices. DYOR.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!