Editor’s note: WAVES is a Russian native public chain. During the initial period of the Russian-Ukrainian conflict last year, the Russian ruble depreciated sharply, and in this panic, Russian investors chose to buy WAVES as a hedge, causing its token price to soar. The same scenario happened again, with the Russian private armed group Wagner staging a “rebellion” and the ruble depreciating again, causing the WAVES token price to soar again. This article is a re-release of an old article, first published on March 30, 2022. The article will comprehensively explain the WAVES public chain, which is known as the “Russian Ethereum.”

Author: TinyHand

Source: Y2Z Capital

Foreword

- AI is driving the growth of NFTs and opening up new market opportunities.

- Quick Overview of EDX Markets’ Six Major Partners

- ASX: 31% of Australian young people still hold cryptocurrency despite disliking risks

I. Origin

II. Market Cap and Price

III. USD-Neutrino (USDN) Stablecoin

1. Market Capitalization and Distribution

2. Stablecoin System Design

3. How Does USDN Maintain Stability

4. How to Deal with the Impact of Reserve Asset Price Fluctuations on USDN

5. The Impact of USDN on the Price of Reserve Assets

6. Risks and Solutions

7. Summary

IV. Waves Ecosystem and Main Applications

1. Basic Introduction

2. Waves Locked Asset Distribution

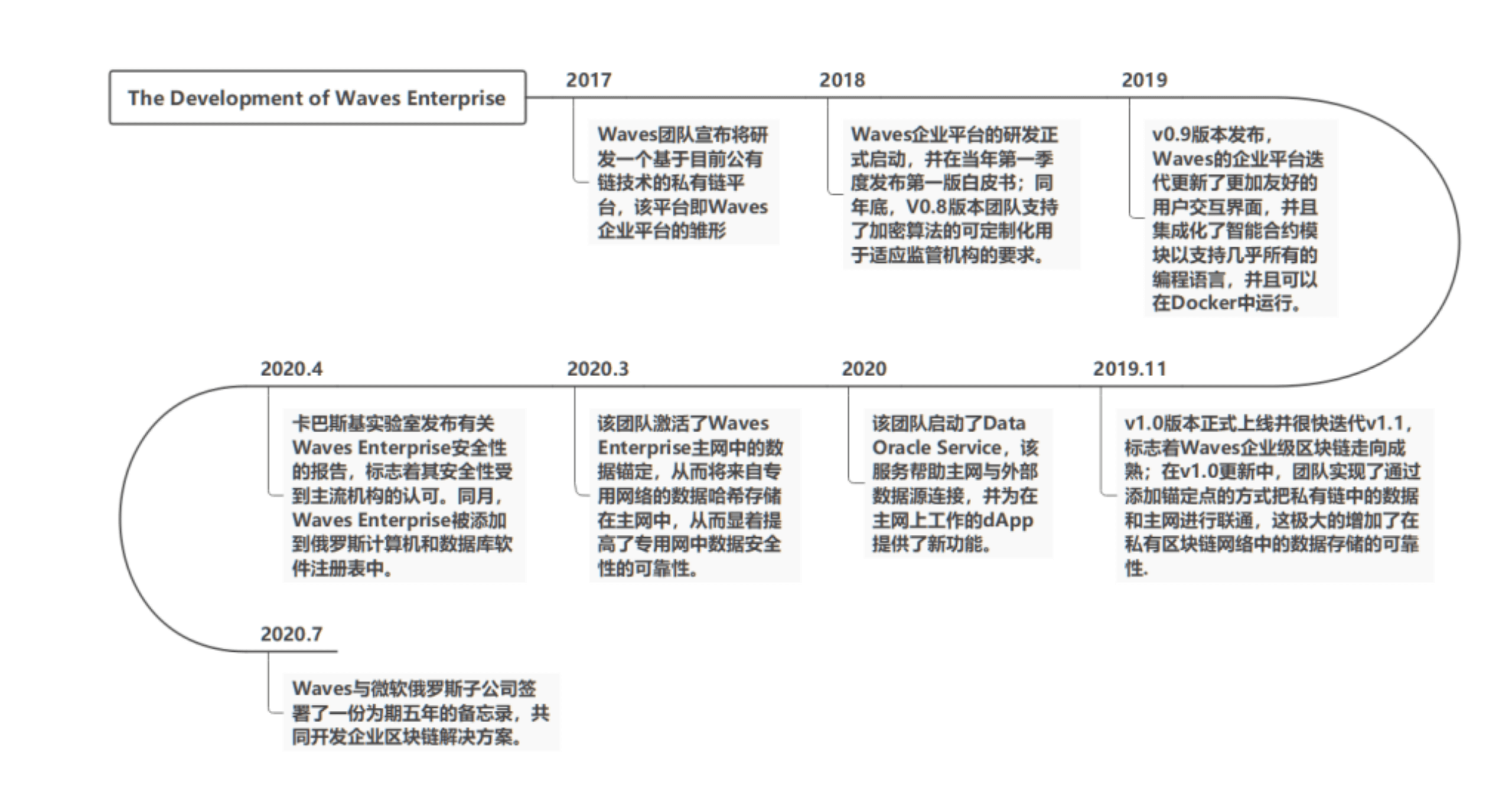

3. WavesEnterprise

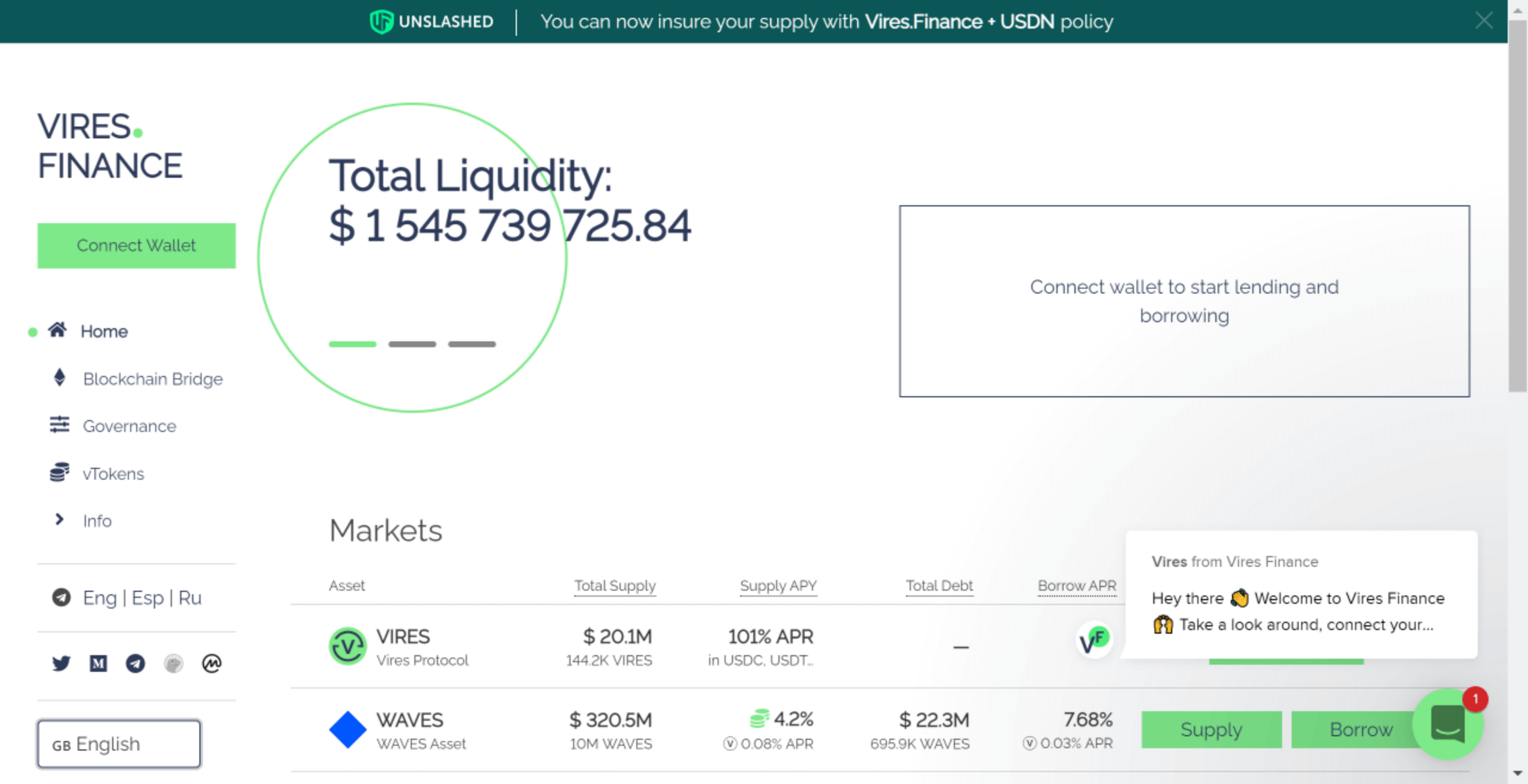

4. Vires Protocol

5. WavesExchange

6. WavesKeeper

7. Gravity Protocol

8. WavesDucks

9. Swop.fi

10. WavesAssociation

11. Future Plans

Conclusion

Foreword

Many people associate the rise in the price of Waves tokens with the Russian-Ukrainian war. From the perspective of product functionality analysis, Waves can indeed meet people’s needs for asset hedging and provide experiences for different needs, regardless of the hype in the news.

During the Russo-Ukrainian War, the price of Waves soared.

The reasons are as follows:

1. Waves has its own exchange, and through Waves Exchanges, you can directly purchase the USDN stablecoin. The exchange integrates the functions of centralized exchanges and decentralized exchanges, meeting the needs of people to directly purchase USDN with fiat currency and has a good trading experience.

2. Waves’ stablecoin system is well-designed, and the introduction of NSBT solves the problem of insufficient USDN reserve, further ensuring the stability of USDN. When the SWIFT international settlement system or other payment infrastructure is closed, USDN can play a role in transferring fiat value.

3. Waves has DeFo (decentralized forex trading). Different countries can use the DeFo tool to exchange USDN with various algorithmic stablecoins such as EURN, RUBN, CNYN, JPYN, UAHN, NGNN, BRLN, GBPN, TRYN, etc., meeting the needs of multiple stable asset transfers.

4. In addition to asset transfer, the ecological construction of the Waves public chain is also very complete, including secondary markets, lending and savings, NFT, games and other projects. Developers can build more usage scenarios relying on Waves development tools, meeting people’s needs for financial services and entertainment life.

5. The event of exchanges freezing Russian account assets occurred recently, and such things are highly unlikely to happen on Waves. Waves’ enterprise-level service platform WavesEnterprise has been cooperating with many Russian industrial asset companies for many years, and its business covers enterprise-level and government-level, from the transfer of industrial assets to the recording of office assets. Currently, only WavesEnterprise, an enterprise-level blockchain platform, has the ability to undertake such business, and as a service-oriented enterprise-level blockchain platform, Waves will not easily do things that make enterprise and government customers panic.

List of some Russian customers of WavesEnterprise

6. In addition to serving large companies like Microsoft through private chain technology, Waves is also relatively complete in public chain ecological construction, developing various DeFi, NFT, game wallets and other applications for the public.

Therefore, choosing a public chain as a hedge for assets is logical. Although there are many new public chain concepts at present, Waves is one of the few financial public chain projects that has been tested for many years.

1. Origin

Waves was founded in 2016 by Ukrainian scientist Sasha Ivanov.

Ivanov studied theoretical physics for 7 years in university and worked in the field of artificial intelligence for 7 years after graduation. In his spare time, he was active in online communities dominated by scientists. Later, the blockchain community became increasingly active, and Ivanov became deeply involved. After that, he decided to develop enterprise-level blockchain applications.

Waves founder Ivanov

Ivanov is very clear about Waves’ goal – to apply blockchain to the fields of securities, crowdfunding, fiat currency transfers, and pan-finance, thus creating a financial public chain.

Today, the Waves ecosystem not only realizes small circulation within the ecosystem, but also has outstanding solutions in cross-chain schemes, achieving a large circulation with other public chains. Its stablecoin USDN issued also supports various chains such as ETH, BSC, etc., and is currently in circulation in the market.

2. Market Value and Price

In 2016, Waves conducted an ICO in the form of receiving donated bitcoins, raising 30,000 bitcoins (about $16 million), becoming the third largest blockchain crowdfunding project at the time after The DAO and Ethereum.

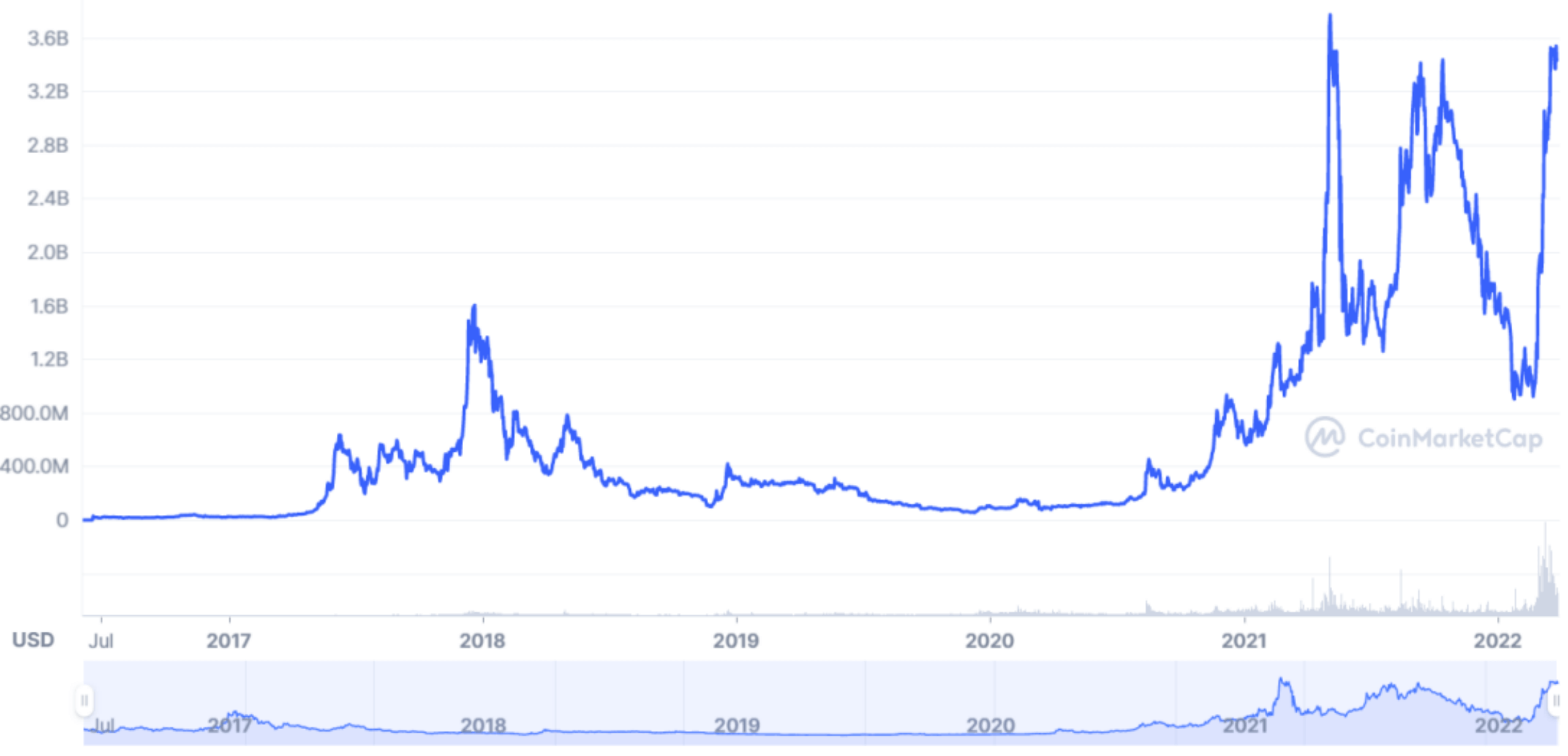

As of March 17, 2022, according to data from coinmarketcap.com, Waves has a market value of $3,422,333,753.19, ranking 45th in total market value, and is currently the largest public chain project in the Russian region.

Waves market value trend

Waves price trend

The price of Waves reached its historical high of $41.86 in May 2021.

Recently, Waves experienced 10 weeks of decline from $32.44 to $8.02 in October 2021. In February 21, 2022, when the market as a whole was falling, Waves began a strong rebound, rising sharply for three consecutive weeks, from $8.2 to $32.93, an increase of 300%, and is currently close to the historical pressure level of 32-34.

3. Stablecoins USD-Neutrino (USDN)

1. Market Capitalization and Distribution

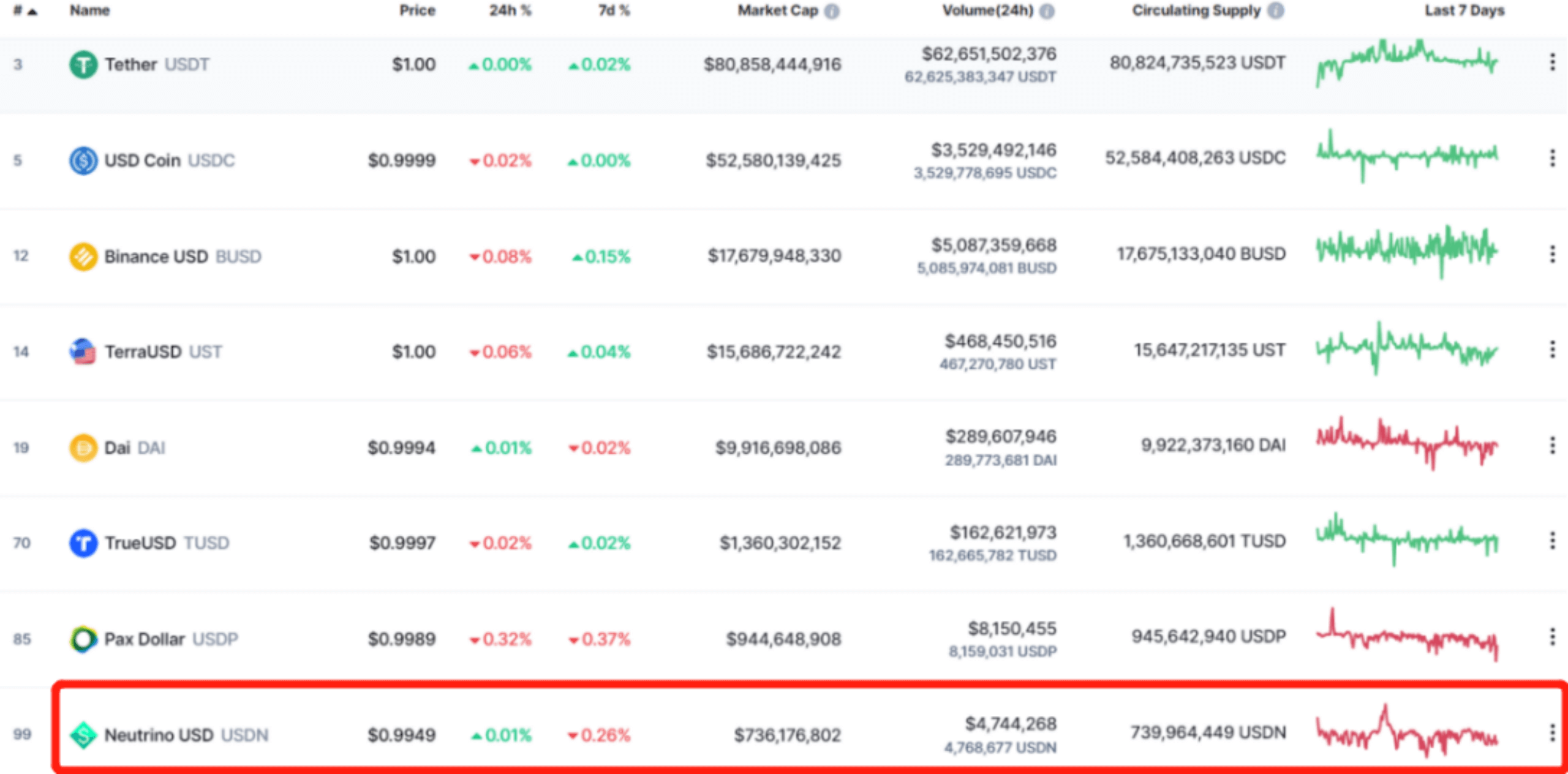

USDN ranks 8th in market capitalization among stablecoins, with only half the market capitalization of Terra USD, which is also an algorithmic stablecoin with its own ecosystem.

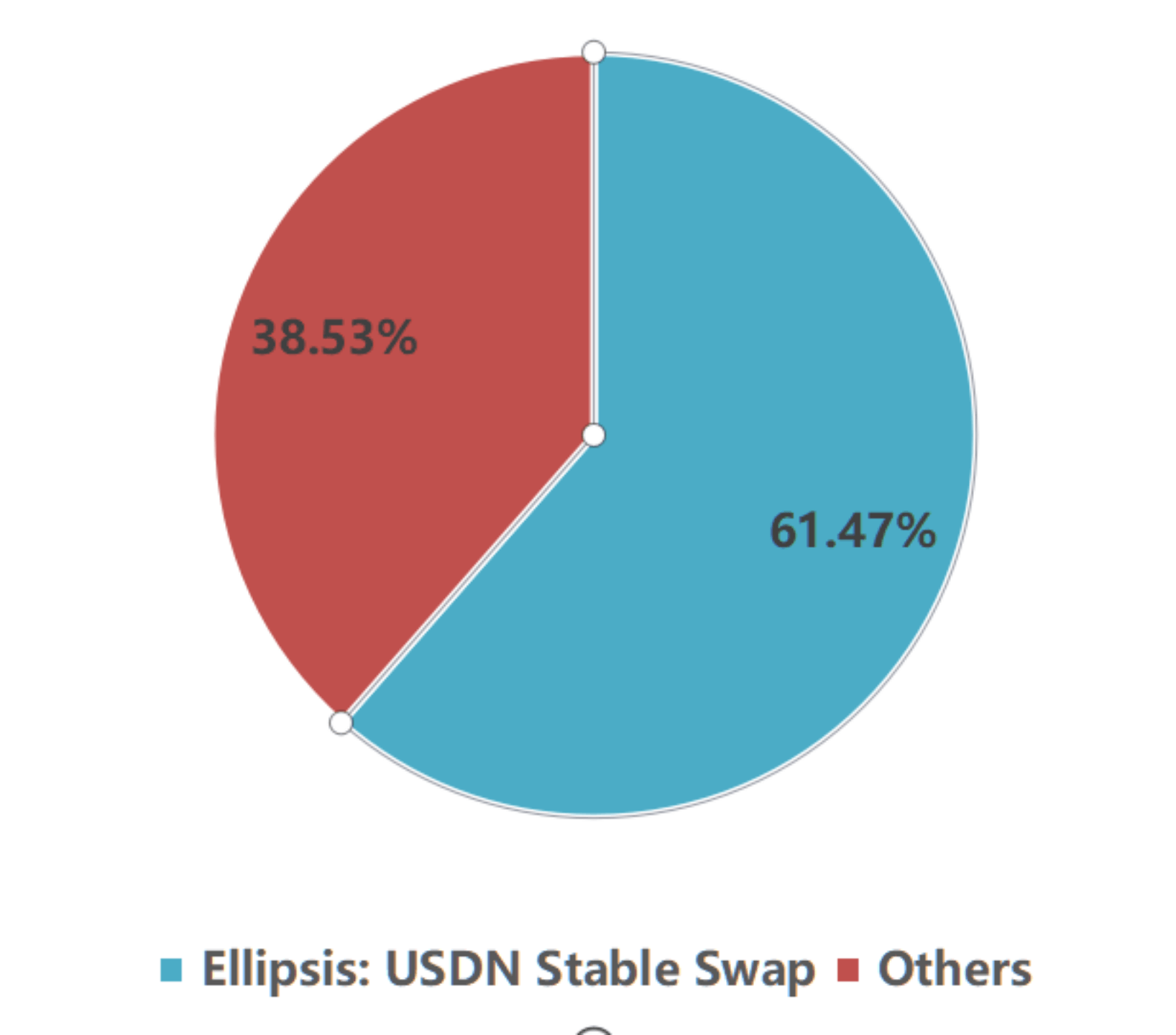

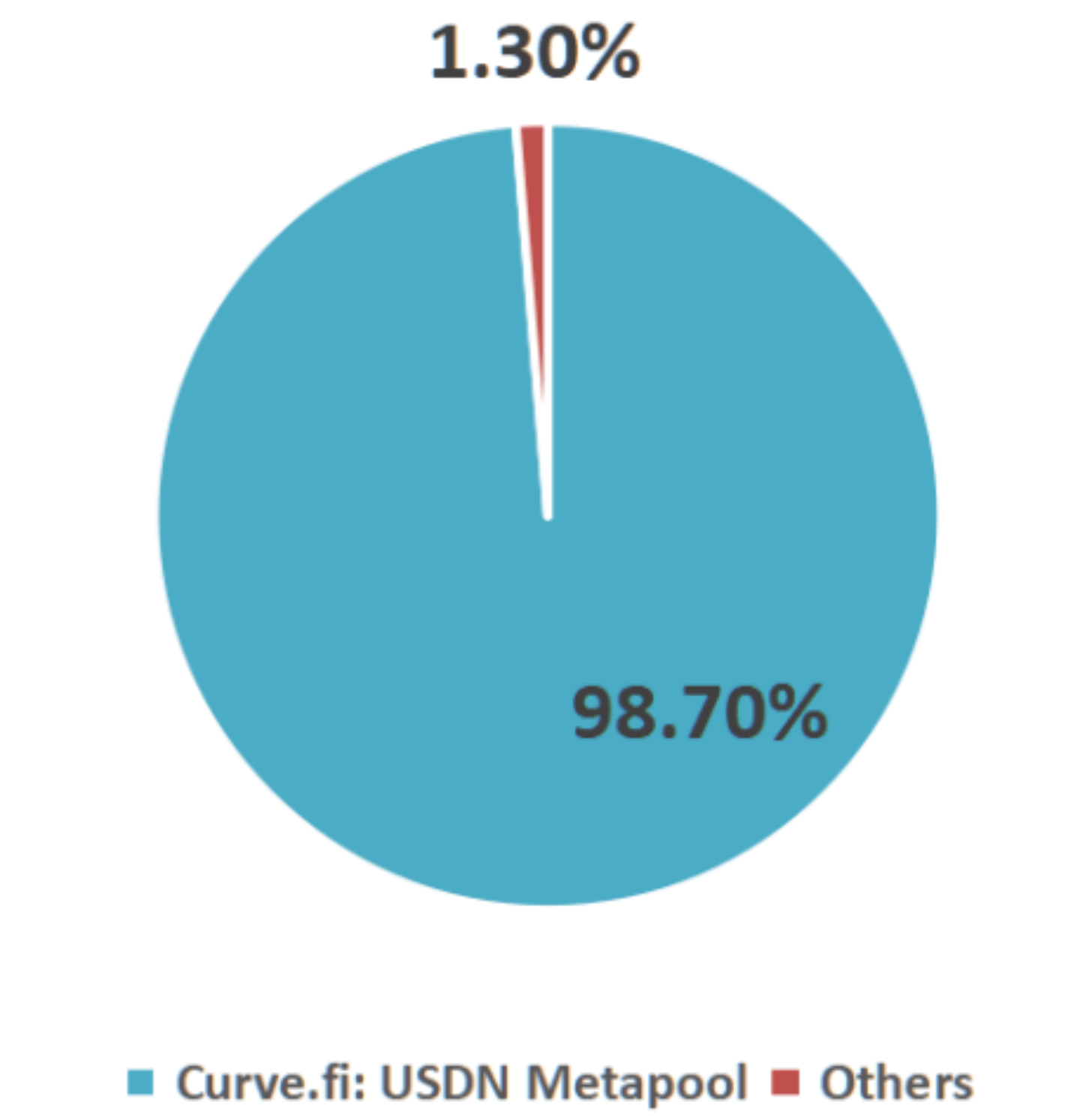

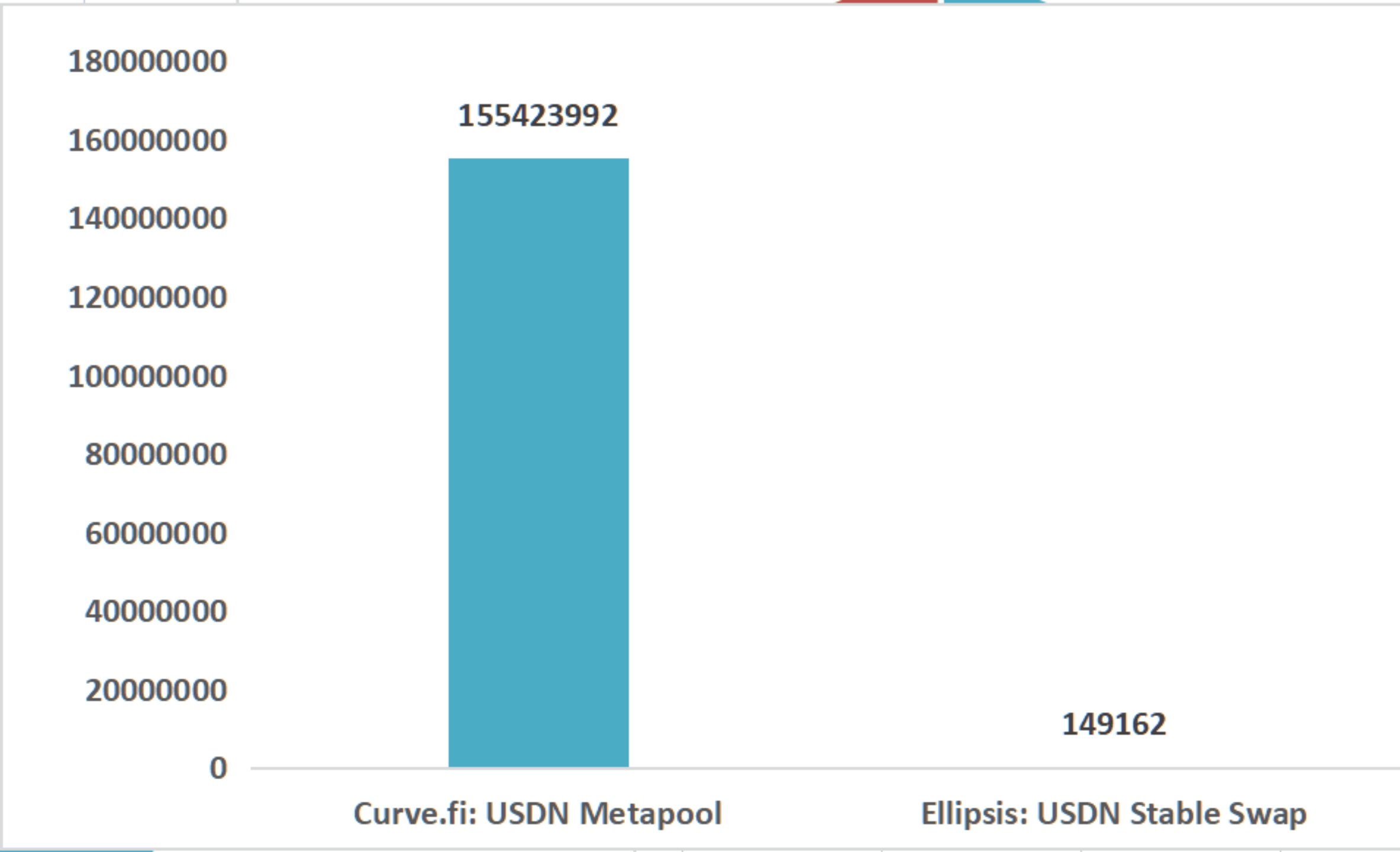

Almost all of the USDN on the ETH and BSC chains are used to provide liquidity in the Curve protocol, with the amount of USDN held on the ETH chain far exceeding that held on the BSC chain.

(Note: Ellipsis.finance is an authorized branch of Curve.fi that provides the StableSwap protocol of Curve to BNB chain users.)

Comparison of first USDN quantities held in ETH and BSC wallets

2. Stablecoin System Design

The most popular stablecoins on the market, such as USDT and USDC, have the biggest problem of relying on physical funds in the real world as reserves, which is still not decentralized enough . The Neutrino protocol is designed mainly to solve this problem.

First of all, Neutrino does not use fiat currencies as reserve funds like Tether’s USDT, but instead uses an algorithmic stablecoin protocol and on-chain assets as collateral for reserve funds. Currently, the main collateral asset is Waves. Secondly, the principle of Neutrino’s solution to insufficient reserve funds is still ” using market incentives for automatic adjustment “, but unlike Terra’s UST, Neutrino has added ” secondary marketization of reserve funds through the issuance of NSBT “.

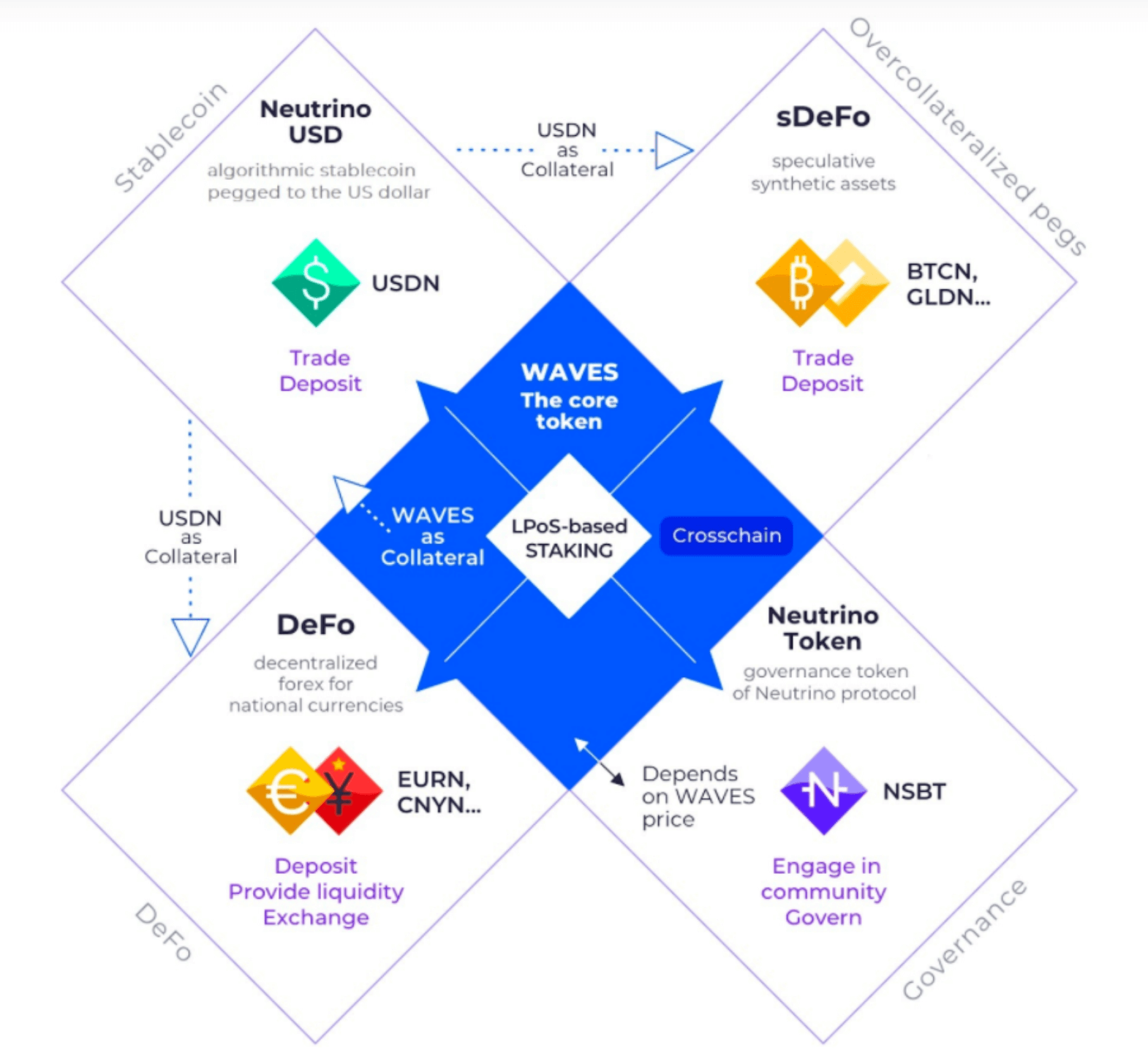

This stablecoin system is composed of Waves , USDN, and NSBT:

(1) Waves

The core token of the Waves ecosystem, used to pay transaction fees. It is based on the lPoS (leased proof of stake) consensus mechanism and can serve as collateral for USDN in the Neutrino system.

(2) USDN

An algorithmic stablecoin pegged to the US dollar that can be used as collateral for other assets.

The maximum supply of USDN depends on the maximum capitalization of the Waves token.

USDN has no pre-allocation or pre-mining. The increase and decrease of USDN supply is also controlled by the market.

(3) NSBT

Neutrino’s governance token, generated through smart contracts, whose parameters depend on the reserve deficit value of USDN, can be used to maintain the stability of USDN. The market price of NSBT is determined by the supply and demand dynamics of cryptocurrency exchanges and the Neutrino smart contract.

In addition to serving as a stable medium between Waves and USDN, the NSBT token can also be used as payment for protocol operations, creating collateral positions (for generating USDN from Waves) and paying fees to form “hedge funds” to generate new synthetic assets such as GLDN (gold), EURN (euro), etc.

Waves Token Architecture Diagram

3. How to Maintain the Stability of USDN

(1) Balance State

The generation of USDN is automatically realized through the smart contract system. When a certain value of Waves tokens is locked in the smart contract account, an equal value of USDN can be minted. Ideally, when the market value of USDN and the locked assets are equal, a balance is reached between the market values.

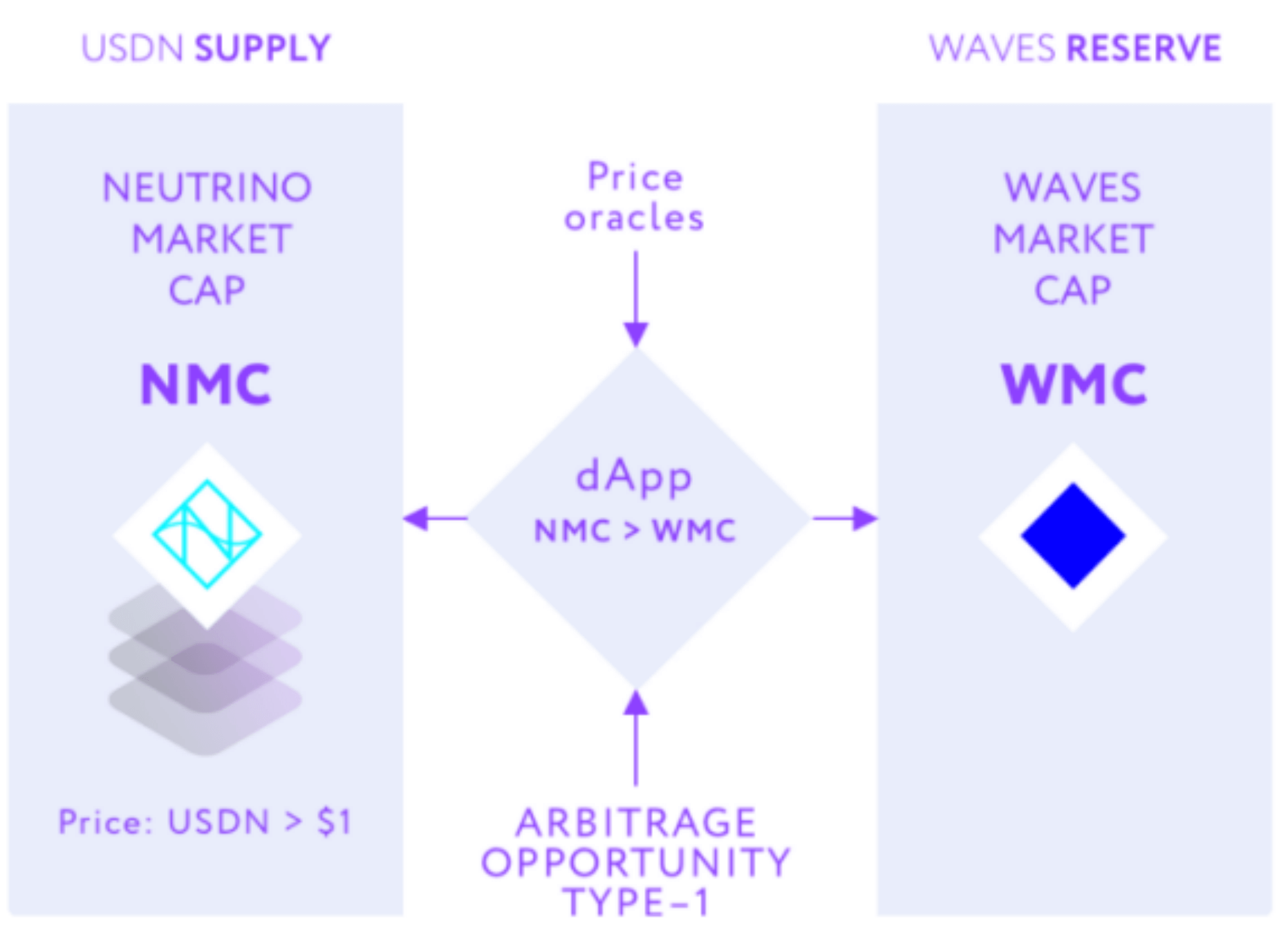

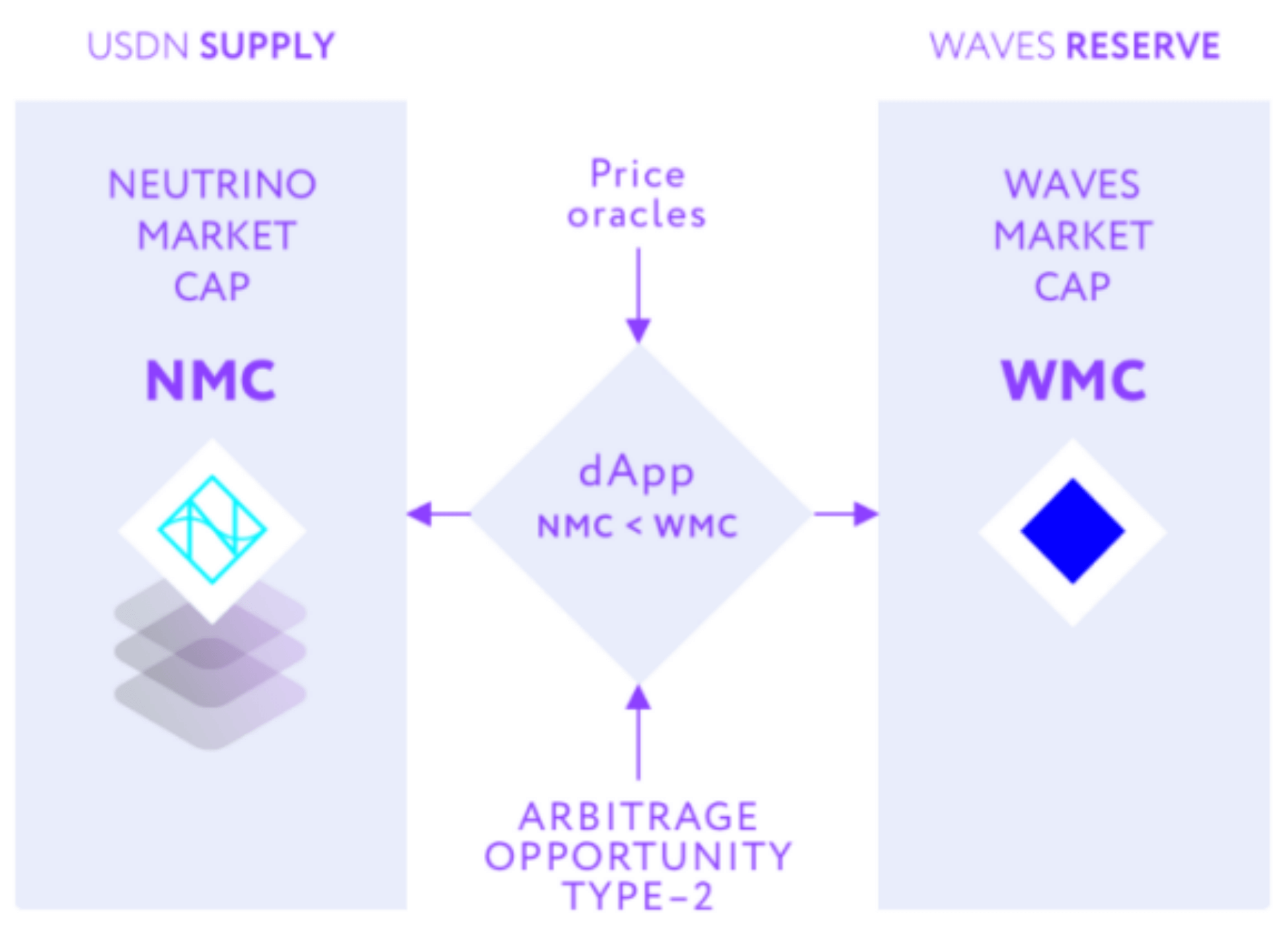

(2) Arbitrage Mechanism

When the market demand for USDN increases, the price of USDN will be higher than $1. At this time, traders can use the Neutrino protocol to exchange Waves tokens for USDN and then sell USDN at a higher price on the exchange to profit. Such arbitrage behavior will increase the supply of USDN in the market and maintain the price at $1.

Arbitrage Mechanism

Conversely, the supply of USDN on exchanges will significantly increase, causing the price of USDN to drop below $1. Traders can buy USDN on the market and use the Neutrino protocol to exchange it for Waves, then sell it to profit.

This is similar to the arbitrage mechanism of Terra UST, except that the Neutrino protocol also uses the issuance of NSBT to solve the problem of reserve asset price fluctuations.

4. How to deal with the impact of reserve asset price fluctuations on USDN

When the price of Waves rises, the market value of the reserve asset Waves begins to exceed that of the USDN stablecoin. In this case, the smart contract detects an excess of reserves and generates the corresponding amount of USDN to repurchase NSBT to increase the supply of USDN.

When the price of Waves falls, the value of the reserve asset will be lower than the corresponding value of USDN. In this case, the smart contract detects a shortage of reserves, which can be eliminated through auction. NSBT will be generated in the auction and required to be purchased with Waves (NSBT/Waves trading pair).

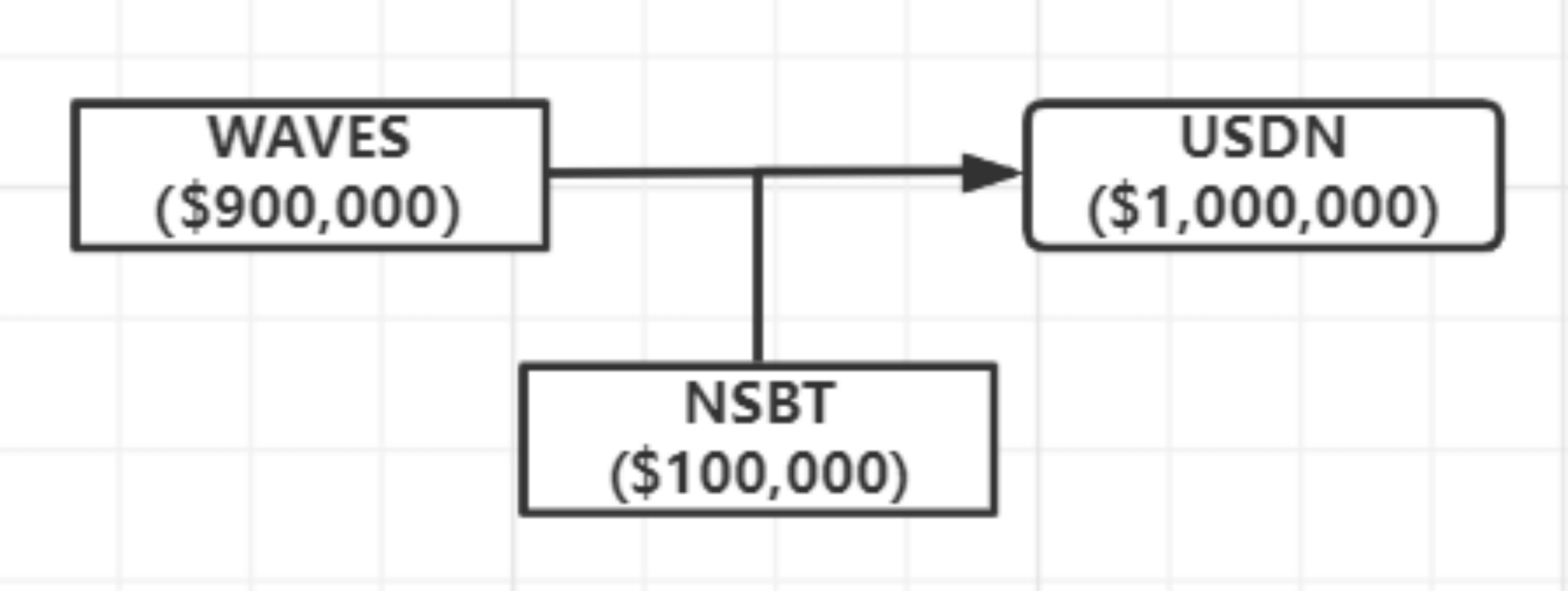

To facilitate understanding of the operation of NSBT, let’s take an example:

Assuming that USDN is currently worth $1 million and the price of Waves, which is used as a reserve asset, falls by 10%.

In this case, the Neutrino protocol has only $900,000 of reserve funds to pay for USDN.

To fill the $100,000 gap, the smart contract will issue NSBT. The amount of NSBT issued depends on the orders in the order book and their discount from traders.

Suppose there is only one trader who has placed an order with a suggested discount of 20%. This means that Waves worth $100,000 can get $125,000 worth of NSBT.

When the price of Waves rises again, the trader will be able to liquidate NSBT at a price of $125,000 or higher by placing an order. In this process, the arbitrageur makes a profit, and the Neutrino protocol fills the $100,000 reserve gap.

5. The impact of USDN on the price of reserve assets

When USDN begins to circulate gradually in the market, this mechanism of Neutrino will start to affect the tokens used as reserves (using Waves as an example).

(1) Deflation

The size of the reserve fund of Waves determines the amount of USDN issued. Conversely, when USDN is in short supply, due to the adjustment of the market and Neutrino mechanism, the amount of Waves used as reserves will increase, the circulation supply of Waves in the market will decrease, and Waves will experience deflation, leading to an increase in the price of Waves.

It is worth mentioning that the Neutrino Protocol is not only applicable to Waves, but can also provide deflationary mechanisms for DeFi-oriented blockchain platforms such as Ethereum, EOS, and Cosmos.

(2) Lossless Trading

In traditional token conversions, converting Waves to USD and then back to Waves can cause a certain price decrease. Unlike other third-party exchanges, Waves’ own ecosystem of smart contracts can avoid price changes caused by spreads or low liquidity during trading, ensuring that the conversion from Waves to USDN will not cause any value loss to Waves.

6. Risks and Solutions

The following are some identified risks and their corresponding risk mitigation plans:

|

Risk |

Description |

Solution |

|

Malicious attacks on smart contract infrastructure |

In the early stages, there may be vulnerabilities in the deployed smart contracts, which can be exploited by hackers to invade and steal system information. In the worst case, all tokens reserved in the smart contract are stolen, with no chance of recovery. |

Establish an emergency shutdown mechanism that allows USDN and NSBT users to retrieve their assets. Anomaly detection tools can be written using the RIDE programming language. The RIDE of the Waves ecosystem allows smart contracts to be migrated directly. |

|

Black swan events affecting the price of reserve tokens |

The price of Waves drops significantly |

The Neutrino smart contract will issue NSBTs to make up for the shortage of reserve funds. At the same time, an emergency oracle can unilaterally trigger the emergency shutdown of smart contract operations. |

|

Pricing errors, DDoS attacks |

Specifically, it refers to erroneous price feedback from oracles, abnormal market dynamics in Neutrino value for an extended period of time, and insufficient liquidity and stability provided by Neutrino. |

Neutrino status and conversion can be modeled, and different parameters can be simulated for these models to determine the various parameter, restriction, and threshold levels for various operations within the smart contract. |

7. Summary

Waves introduced NSBT to balance the market value of USDN and reserves, thus solving the problem of insufficient reserves. This scheme expanded our ideas in the design of algorithmic stablecoins. Although Waves has its own security protection mechanism, it still faces the above risks.

USDN’s market value ranks behind UST, which is also an algorithmic stablecoin. This is not only because USDN’s market value is closely related to Waves’ market value, and Waves’ market value ceiling determines the issuance ceiling of USDN, but also because of its application scenarios and narratives. Similar to UST of Terra, when Waves’ ecological applications are more extensive, USDN’s narrative will be larger, and the market value of the two will spiral upwards.

IV. Waves Ecosystem and Main Applications

1. Basic Introduction

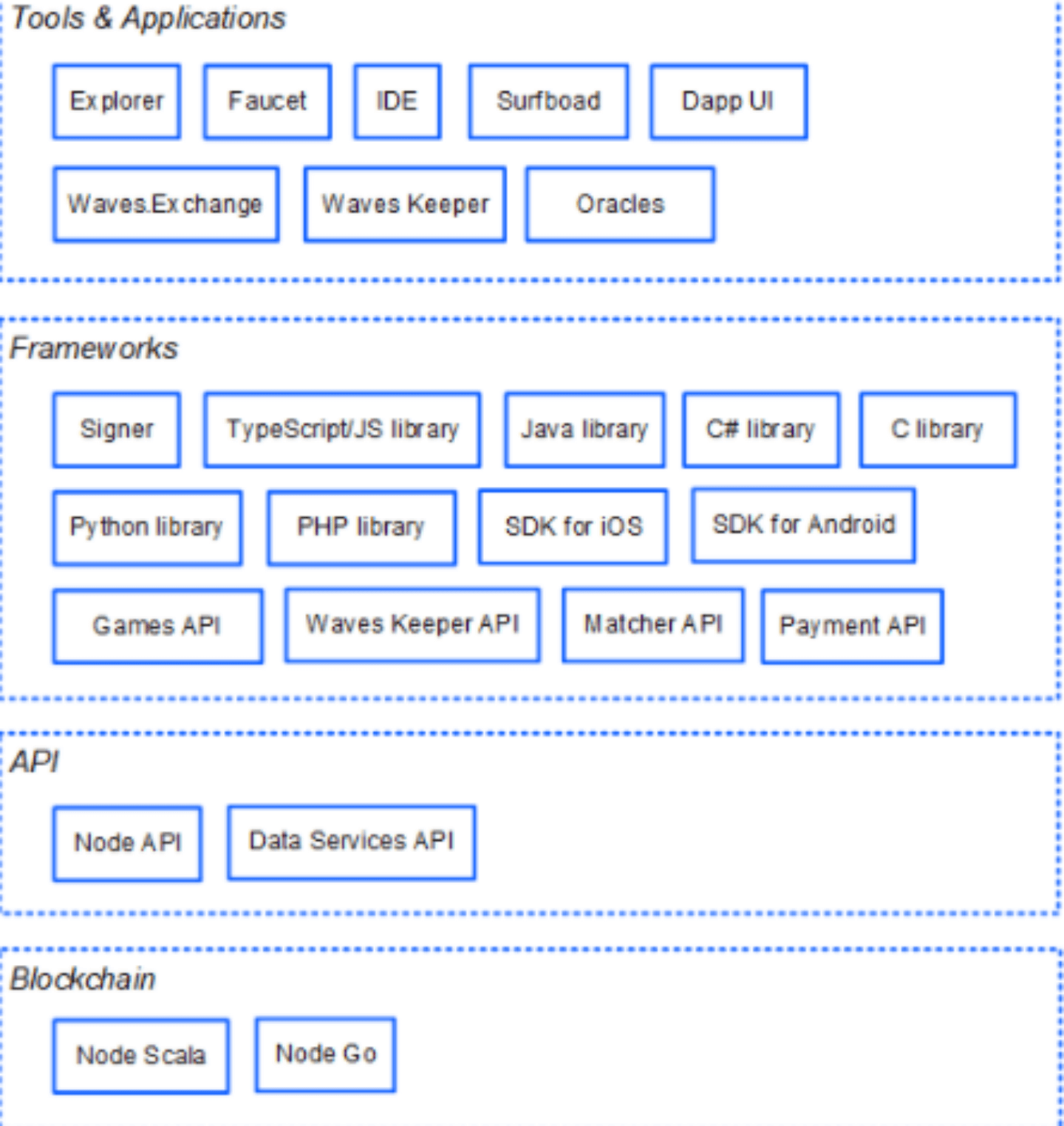

Currently, Waves’ main applications include the Waves Enterprise Service Platform, Neutrino Protocol, Gravity Protocol, and other applications in the DEFI and fintech fields. In addition, there are also NFT collections and game applications, etc.

Overview of Waves Ecosystem

At the same time, Waves launched its own Ride programming language and supporting developer tools for developers.

Waves Developer Components

2. Waves Locked Asset Distribution

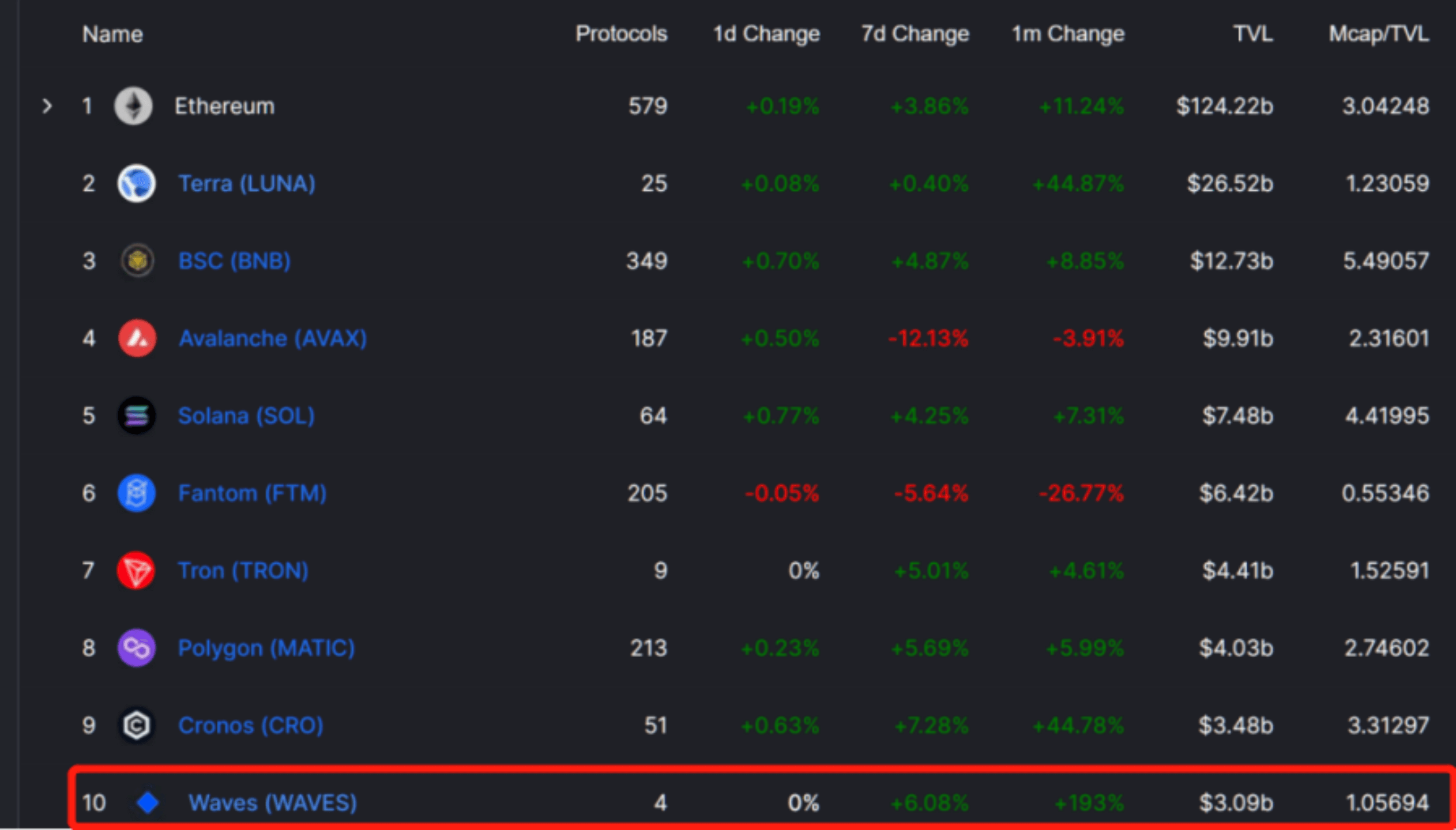

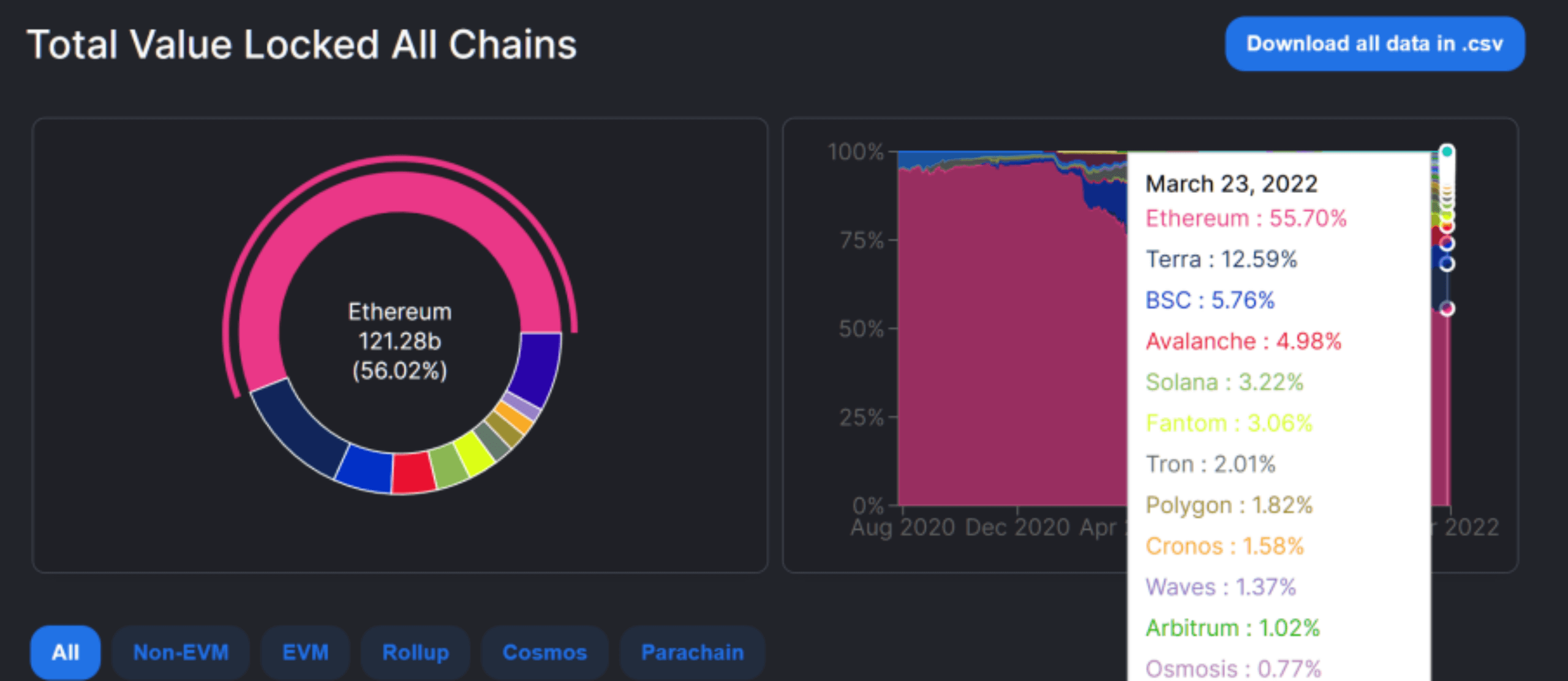

The number of protocols on the Waves ecosystem in the statistics is far behind the top 9, but TLV has ranked in the top 10, and the main locked assets are concentrated on the ETH chain, followed by the Terra chain. ( Statistical data comes from defillama.com )

Total Locked Assets Ranking of Public Chains

Waves Locked Asset Ranking on Various Chains

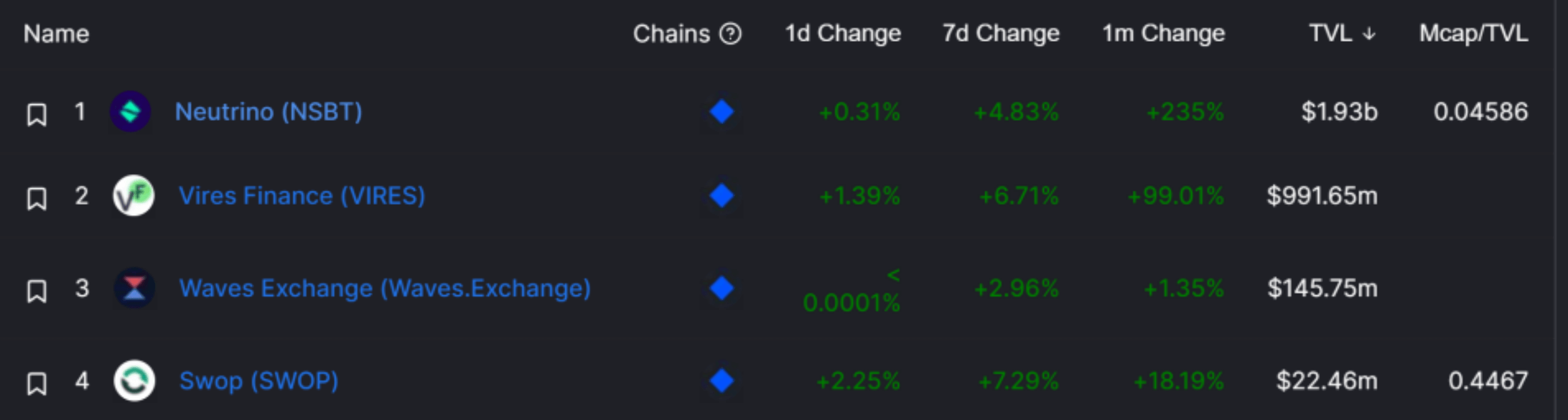

TVL ranking of Waves main protocol

It can be seen that the locked assets in the Waves ecosystem are mainly distributed in Neutrino (NSBT) and Vires Finance (VIRES).

3. Waves Enterprise

WavesEnterprise is a platform dedicated to providing blockchain technology services to enterprises and governments.

WavesEnterprise uses a hybrid model, which means that public chains and private chains are integrated in one ecosystem, combining the advantages of public and private blockchains. This way, Waves retains the security of decentralization, data storage, and privacy, while also taking into account legal compliance .

Many people cannot distinguish the relationship between WavesEnterprise and Waves. WavesEnterprise is an independent project with an independent team, which is ideologically consistent with the Waves ecosystem and can share the Waves ecosystem through the Gravity protocol. WavesEnterprise technology used to be a branch of the Waves protocol, but the target users are different, so the technical cross points will disappear over time.

The application areas of WavesEnterprise’s blockchain service solutions include: manufacturing, retail, art, healthcare, oil and gas, fintech, education, etc. Enterprises can choose to subscribe according to their needs.

The main partners include: Alfa·bank (Russia’s largest private bank), RUSAL (one of the top ten aluminum companies in the world), X5 RETAIL GROUP (Russia’s retail giant with 16,500 retail stores), ROSNEFT (Russia’s largest telecommunications company), Rosseti (Russia’s national power grid), etc. In addition, the national electronic voting system in cooperation with the Russian government has also been launched.

Waves cooperates with Microsoft

Most of them are giant companies in Russia’s traditional heavy industry and communication industry, but they are not limited to Russia’s industries. On July 16, 2020, WavesEnterprise and Microsoft Russia signed a memorandum of understanding on joint development of enterprise blockchains in Russia, reaching an agreement on enterprise blockchain solutions and cloud technology strategic cooperation. The list of such assets is very extensive, ranging from heavy machinery to basic office equipment.

Vires Protocol is a lending protocol on the Waves blockchain. Users, wallets, and dapps can participate as depositors or borrowers. Depositors provide liquidity to the market to earn passive income, while borrowers can obtain loans by overcollateralizing.

At Vires.finance, all deposited funds participate equally in interest-earning activities. The greater the market demand for borrowed assets, the greater the returns for APY lenders. Users can lend and borrow the following tokens: WAVES, USDN, USDT, ETH, and BTC. In addition, Vires.finance supports direct cross-chain asset transfers, with technology provided by WavesExchange.

Previously, the founder of Waves tweeted that Vires.finance could provide an APY of over 25%, which led people to draw comparisons to Anchor, which offers 20% APY to attract users. Similarly to the Terra ecosystem—UST—Anchor Protocol, Waves has formed a flow of funds from the Waves ecosystem—USDN—Vires Protocol.

5. Waves Exchange

Waves.Exchange is a decentralized trading application (DEX) that was one of the first built on the Waves blockchain. It not only integrates the functions of centralized exchanges, but also uses the AMM mechanism of decentralized automatic market makers. Users can use the limit order trading mode commonly used in CEX on Waves.Exchange, as well as the AMM mechanism of DEX.

Waves.Exchange features:

On Waves.Exchange, in addition to using a wallet, users can also exchange cryptocurrencies, buy and sell stablecoins, and earn passive income through investments. In addition, users can even issue their own cryptocurrency with a single click. It can be said that it is a powerful tool that interacts with many of the functionalities provided by the Waves protocol.

Waves.Exchange’s business includes:

Staking USDN for a return of 12-15% on waves.exchange, with daily settlement of earnings and the ability to withdraw at any time.

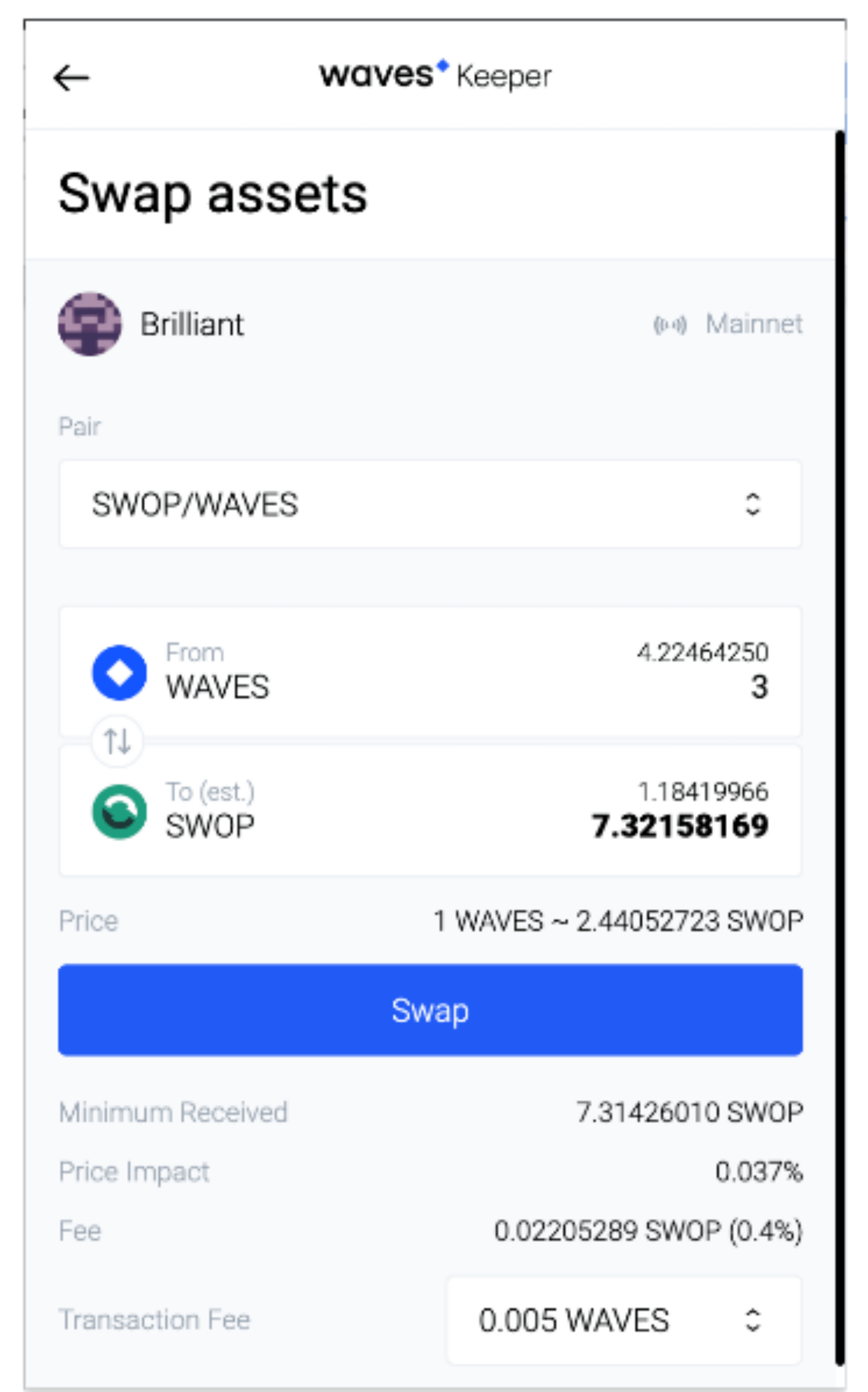

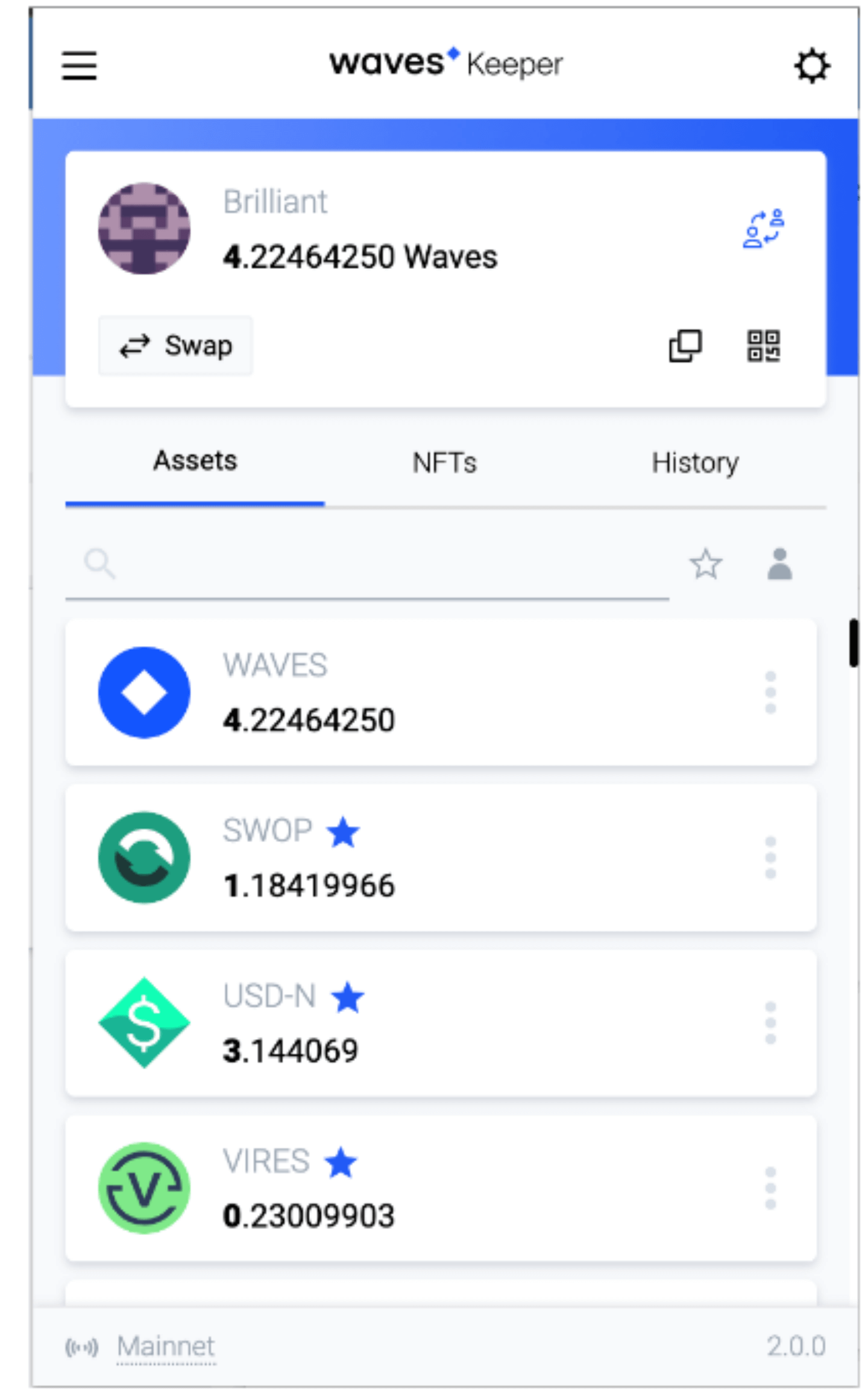

6. Waves Keeper

Keeper is a wallet tool in the Waves ecosystem, and currently the extension is available for all popular browsers including Google Chrome, Firefox, Opera, and Microsoft Edge.

Waves Keeper display page

Users can view account assets and NFTs through WavesKeeper, transfer funds in the WavesKeeper interface, and directly exchange assets through the integrated WavesKeeper with Swop.fi.

7. Gravity Protocol

The Gravity protocol is an oracle protocol in the Waves ecosystem, used to realize on-chain/off-chain data interaction and communication between multiple chains.

(1) Real data

Gravity does not issue its own tokens, which provides great convenience for other applications to integrate Gravity services. If an application wants to integrate Gravity’s oracle service, they can use the protocol’s own token for payment, and the Gravity node will share these revenues. Due to the interest binding relationship, the node will provide real and valid data very honestly.

(2) Open ecosystem

Gravity has created a more inclusive and open ecosystem, solving the problems of scalability and stability. The Gravity protocol not only helps nodes provide data, but also provides asset liquidity and cross-chain exchange.

At the same time, the Gravity protocol can link any blockchain to the outside world, allowing the construction of fully decentralized gateways on it, helping to complete the asset lock-in and transfer the lock-in information to another blockchain network, completing the cross-chain transfer of assets.

Gravity improves the liquidity and capital efficiency of encrypted assets, and provides a variety of use cases for building various DeFi products. Ducks is a digital duck chain game for collecting NFTs. All characters, items, resources, and achievements in WavesDucks are represented by NFTs.

The current average monthly active users have reached 296,000, becoming the main game of the Waves community, and the game also encourages the community to promote the Waves ecosystem together. The specific gameplay includes:

(1) Battle: Fight for different farms and get tokens as rewards

(2) Growth: Raise ducks and cultivate them into higher-level NFTs, which can increase the price of NFTs

(3) Breeding: Hatch NFT ducks to expand collections and earn money opportunities. Unlike most NFTs, ducks can produce EGG tokens that can be extracted or used in the game. Staking NFTs generates passive income.

(4) Guild: WavesDucks has set up communication communities such as Telegram groups for each activity organization.

Waves Ducks Community Activities

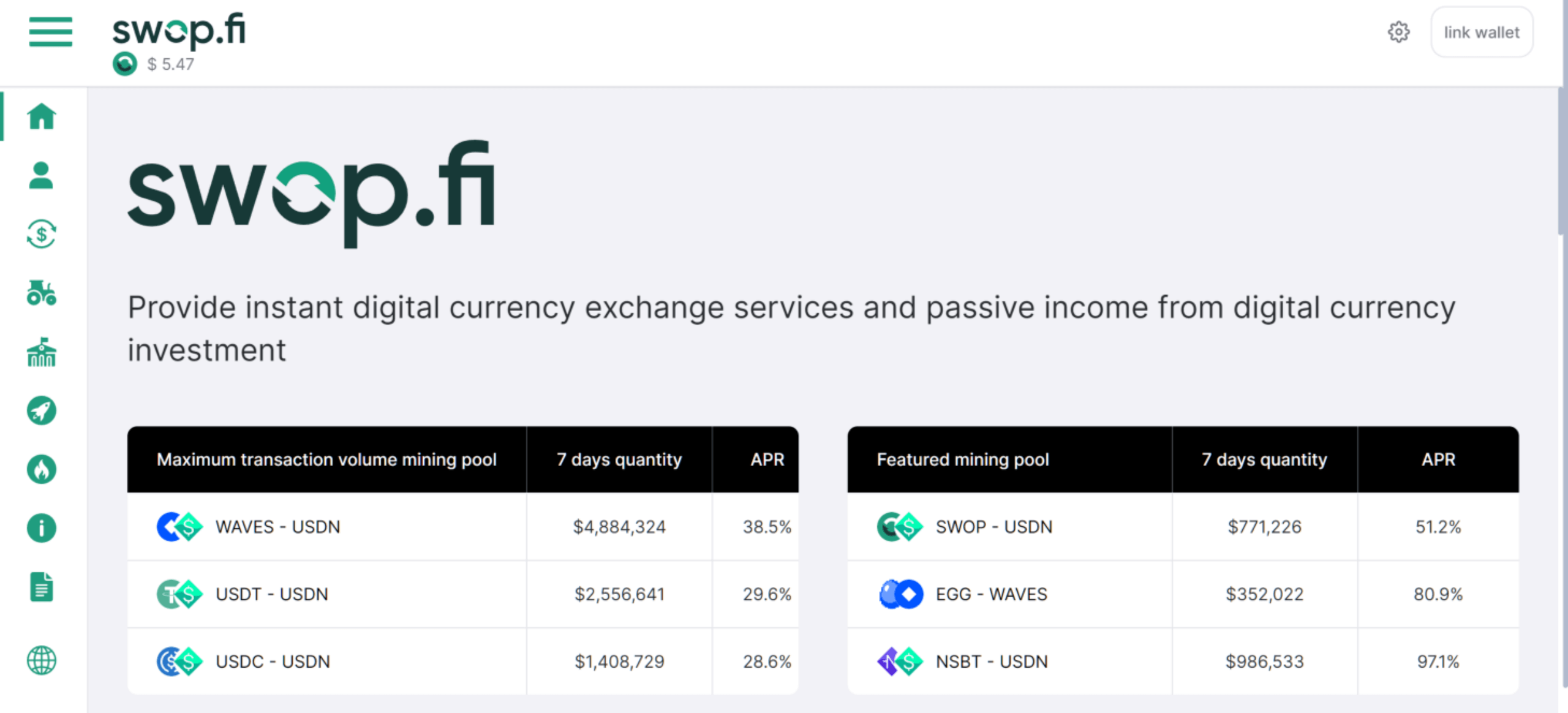

9. Swop.fi

Swop.fi is an AMM automatic market maker mechanism that allows users to instantly exchange their tokens without creating orders or waiting for transactions to execute. The Waves blockchain guarantees that each transaction can be completed within a few seconds, and the smart contract invocation fee is only 0.005. The project is open to liquidity providers: any user can supplement the mining pool and earn SWOP rewards. Current total value locked (TVL) of the project: $21,471,027 USD.

Users can earn a portion of the transaction fees of each pool by providing liquidity to the pool. Except for the Waves-BTC pool, all pools have USDN or EURN as one of the trading assets. The annualized return rate of the USDN staking is basically between 8-15%.

In addition to mining, exchanging currencies, and governance, Swop.fi can also serve as a project launchpad. Users can buy tickets based on the amount of SWOP pledged to participate in different projects.

Swop.fi IDO Project Details

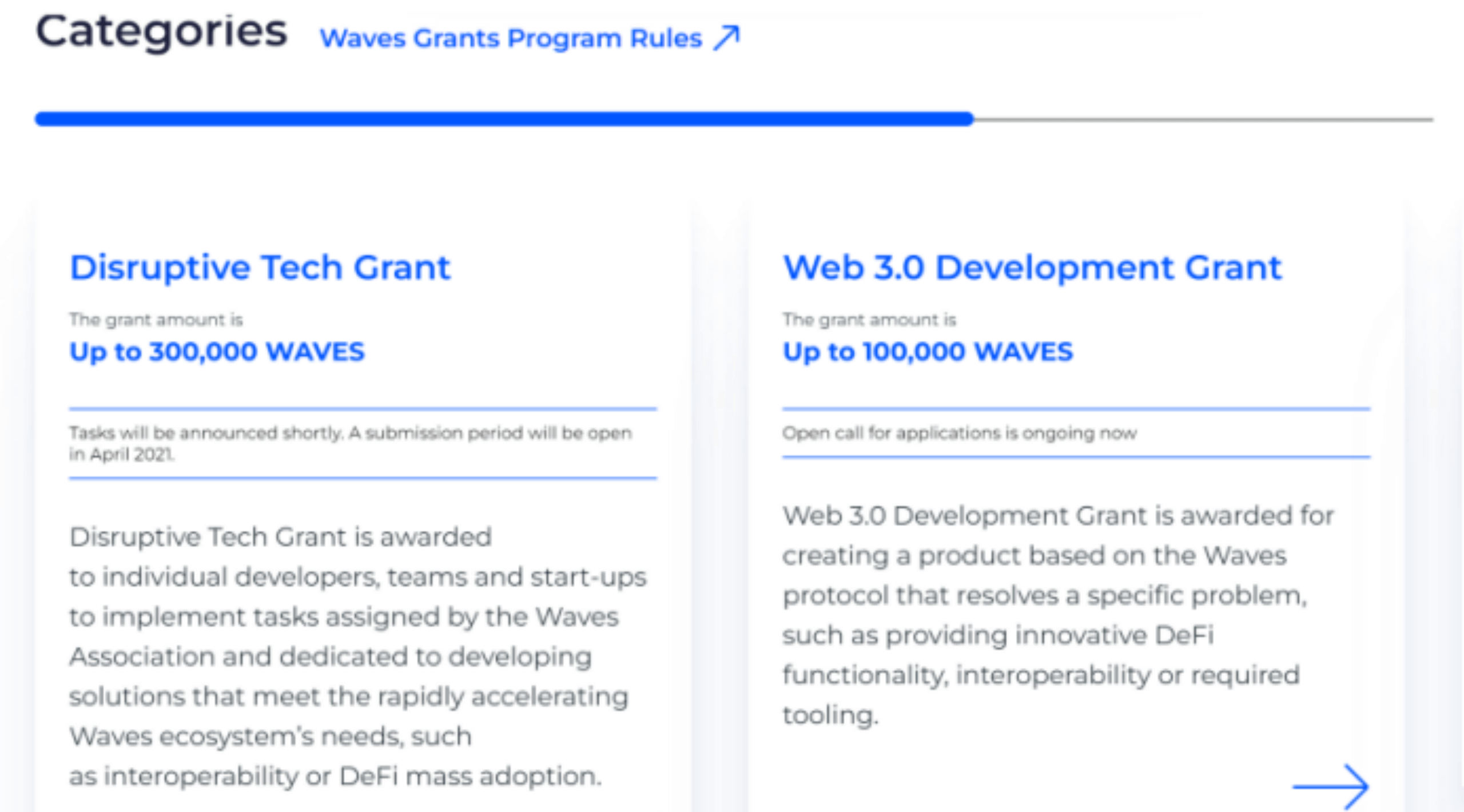

10. Waves Association

The Waves Association is a non-profit organization dedicated to promoting Web 3.0 worldwide, mainly used to promote research within the Waves ecosystem and provide funding support for projects based on the Waves protocol.

WavesGrants has launched a grant program similar to the Ethereum Foundation to support individual developers, teams, and startups who serve the Waves ecosystem.

The amount of funding is determined based on specific considerations including technical complexity, details of the proposed solution, needs of the developer/team, Waves project scale and significance, and other criteria.

All grants are made within the Waves system, and disbursement and award procedures are executed through DAO.

Waves Association Assistance Program

The Waves Association recently announced a $1 million Waves grants program to support projects developed on Waves infrastructure. As a core and binding component of WavesTech, the Waves Association provides governance and support to the entire Waves ecosystem and nurtures more Web3 talent for Waves.

11. Future Plans

Waves social media has added a name suffix (1 ➝ 2)

Waves has developed a specific content for the 1→2 version iteration, including:

(1) Support for Ethereum Virtual Machine

By providing infrastructure for a wide range of development and analysis tools, Waves becomes more easily accepted by external teams.

(2) Open new DAO governance model

Give extra rewards to participants and can have ‘skins’ in games. Waves DAO will upgrade the old futarchy concept, thus launching a new generic governance model that is said to have far-reaching applications beyond current blockchain technology.

(3) Cross-chain finance

Expand Gravity as a bridge to all industry chains, creating a universal integrated combination.

(4) Expand more business in the United States

In the first quarter of 2022, Waves established a U.S. company, Waves Labs, headquartered in Miami. The team is currently recruiting experienced engineering, business development, and marketing leaders.

In version 2.0, Waves announced that the United States is a key market driving large-scale adoption in 2022. The main KPI is the number of products built by U.S. teams on Waves.

This spring, it announced a $150 million fund and an incubation plan to meet this need and continue to develop and cultivate talent and market opportunities. In addition, an independent DeFi fund will be launched in the first quarter of 2022 for investment in selected Waves-based DeFi products.

Conclusion

The Waves ecosystem is very large, but as with the positioning of the Waves public chain, financial and pan-financial applications are the main products.

In terms of product composition, the Waves ecosystem, from the DeFi application Swop.fi to the game Waves Ducks, is linked by the stablecoin USDN, and also has its own Gravity oracle, which can achieve stablecoin exchange rate reading, cross-chain data interaction, and chain Off-chain data on-chain and other functions. The product interaction between Waves Exchanges and DeFi-like applications is interrelated, and the ecological experience is relatively smooth.

In terms of business selection, the Waves public chain serves the general consumer, and WavesEnterprise serves enterprises and governments, providing Waves ecosystem with a variety of demand scenarios, which is an advantage that other public chains do not have.

From the perspective of the public chain, from DEX to DEFI to stablecoins, Waves has been following up on hot technologies and has certain advantages in technology. These technology precipitations can bring added value to other applications in the ecosystem. For example, Waves has been precipitating cross-chain technology for many years, so USDN and NSBT tokens can be used in ecosystems such as Ethereum and Binance Smart Chain in addition to the Waves public chain.

In terms of stablecoins, the algorithmic mechanism design of USDN, which has the added value of the Neutrino protocol, is relatively complete, but the current market value of USDN still needs to be improved. As mentioned above, the impact of USDN on Waves is mutual. When the applications of the Waves ecosystem become broader and the narrative of stablecoins becomes larger, the layout of USDN will attract more capital for Waves, and people’s consensus on USDN and Waves will be stronger.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!