Author: Sid, IOSG Ventures

TL,DR;

- The programmable layer on FIL, known as FVM, enables the construction of trustless markets

- This requires an off-chain market, bringing FIL lending onto the chain, where retail FIL holders pledge their FIL and miners borrow FIL from a pool of funds

-

FIL lending essentially allows miners to access cash in advance by accumulating future rewards, making FIL mining more capital efficient

-

In protocol design, trade-offs need to be made between centralization, capital efficiency, and security

-

The market for borrowing FIL decreases over time, but the introduction of stablecoins and other factors can unlock opportunities to build unique projects on top of these protocols

Introduction

Launching a programmable layer on a battle-tested blockchain is often exciting. After Bitcoin blockchain introduced Stacks (STX), a new paradigm of thinking emerged around it.

A similar scenario occurred when Filecoin introduced FVM. The powerful Filecoin community can now see its vision from a completely different perspective. Many of the ecosystem’s challenges are now being addressed. Creating trustless markets through programmability is a key part of it.

Liquidity staking on Filecoin is the first “Request-for-build” released by the Protocol Labs team and has received high attention. To understand this, let’s first understand how Filecoin’s economics work.

How Filecoin Incentives Work

Unlike Ethereum validators, Filecoin does not have one-time staking. Whenever a miner provides storage space to clients, they need to stake FIL as collateral tokens. This stake amount is to seal storage blocks and keep the sealed storage blocks in the miner’s device. This structure ensures that miners will store data for clients during the agreed transaction period and receive incentives in return. Incentives are allocated through PoSt (Proof of Spacetime), where miners prove that they have stored the correct client data to receive rewards.

Miners are selected through a leader selection mechanism called DRAND. DRAND selects leaders based on some initial requirements and the percentage of network raw byte power controlled by the miners.

Miners must continually increase their Raw Byte Power (RBP) to be selected as leaders to mine blocks and receive rewards. This helps subsidize their storage costs.

While there are still many factors constraining the supply of these incentives, for storage providers/miners to maximize their profits, they must strive to maximize RBP and attract more (and sustain past) transactions.

This creates a positive feedback loop for the Filecoin network.

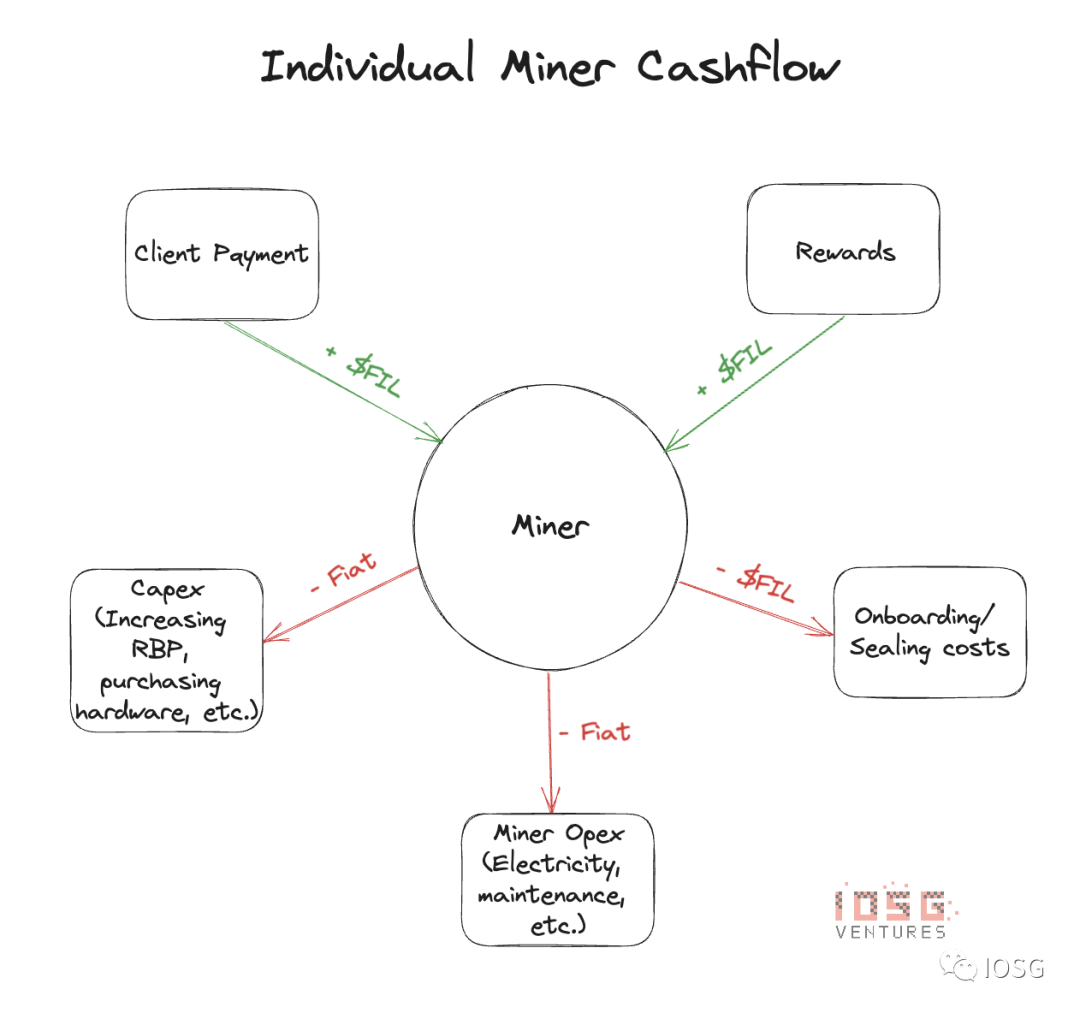

Miner Economics

When miners receive block rewards, these rewards are not liquid. Only 25% of the rewards are liquid, while the remaining 75% of block rewards will be linearly unlocked within 180 days (about 6 months). This poses a problem for miners. The rewards that should have been operating income for miners now become accounts payable that need to wait for payment, and can only be unlocked after miners attract (or continue) transactions.

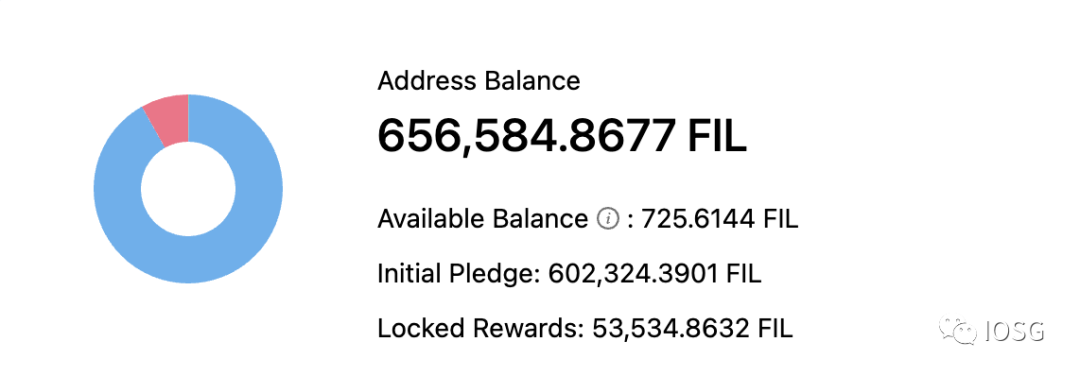

Let’s take a look at the balances of the top-ranked miners in the network (as of August 6, 2023).

Source: FilFox

From the chart, it can be seen that miners actually only have about 1% of the rewards (or operating income) that are liquid. If this miner wants to do any of the following:

-

Pay operating income

-

Upgrade hardware

-

Pay maintenance fees

-

Or attract/renew transactions

He will have to borrow fiat currency or borrow FIL tokens from a third party to make up for these “delayed” payments.

Currently, many storage providers (miners) in the network rely on CeFi borrowers such as DARMA Capital and Coinlist. Since these are loan products, storage providers must go through KYC and strict audit processes to borrow FIL.

When we look at the map below, we can see that Filecoin miners are highly concentrated in the Asian region, while centralized service providers are mainly concentrated in the Western region. For them, it is difficult to provide favorable FIL loans for Asian miners, and most Asian miners/storage providers cannot access these providers.

Source: Observable Dashboard by @jimpick

This not only hinders new miners from joining, but also limits the business scale of existing miners to the FIL pool size of these CeFi borrowers.

So why not borrow fiat currency from banks? Due to the volatility of FIL, this would bring additional capital management challenges for borrowing miners.

To solve this problem, a market needs to be established for FIL borrowers (miners) and lenders (who can be FIL holders).

Filecoin Pledge

With the launch of FVM, this market concept has become a reality. FIL lenders/pledgers can now put their FIL tokens to work, and miners can borrow from this pool (with or without permission), all managed by smart contracts.

There are already many participants in the ecosystem building this market and preparing to launch in the coming months.

Although this market is referred to as a pledge protocol, its nature is more akin to a loan protocol.

The key characteristics of such FIL loan products include:

1. Lenders pledge their idle FIL tokens to obtain “liquid pledge” tokens.

2. Borrowers (miners) can borrow from the pool based on the collateral in the miner’s smart role (basically the initial pledge amount + locked rewards).

3. Borrowers make interest payments by transferring the miner’s “OwnerID” to the smart contract on a weekly or other designated time period.

4. Lenders receive interest (deducting protocol fees) as the annualized yield (APY), which can be obtained by resetting tokens or accumulating value tokens.

Existing participants in the system include:

Source: DeFi Llama

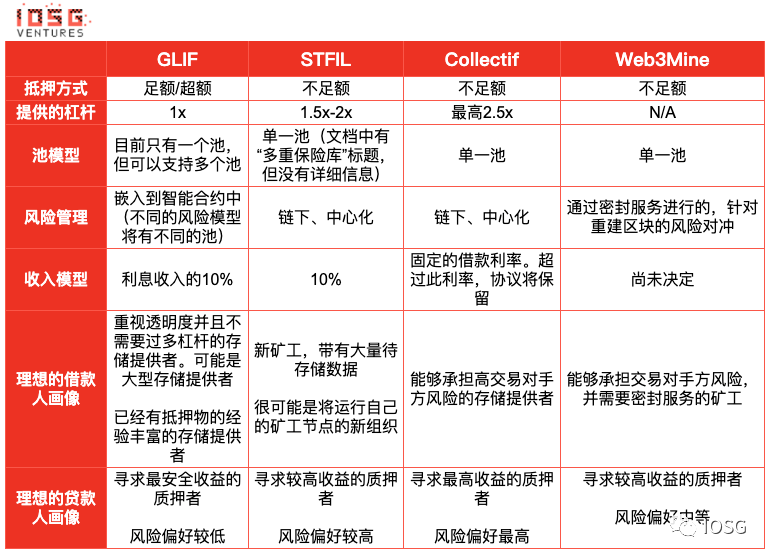

Different liquid pledge protocols have different approaches to borrowing:

Over-collateralization and Under-collateralization

In the over-collateralization or full-collateralization model, the debt-to-equity ratio is always less than or equal to 100%. This means that if my miner balance is 1000 FIL, I can borrow a maximum of 1000 FIL (depending on the protocol rules). This can be easily encoded into the smart contract and built-in default risk. It provides greater transparency and security for pledgers (lenders). Another advantage of this model is that it also allows for permissionless borrowing. In this case, the product is more like Aave/Compound rather than Lido or RocketPool.

In the under-collateralization model, lenders bear the risk, while the risk is managed by the protocol. Risk modeling in this model is a complex mathematical calculation that cannot be embedded in the smart contract and needs to be done off-chain, sacrificing transparency. However, due to leverage, the system is more capital-efficient for borrowers. The more permissionless the leverage system is, the greater the risk borne by lenders, which will require a very robust dynamic risk management model operated by protocol developers.

The considerations are:

-

Capital efficiency vs. pledger risk

-

Capital efficiency vs. transparency

-

Lender risk vs. borrower entry into the system

Single Pool vs Multi-pool

The protocol can also choose to build a multi-pool model, where lenders can choose to collateralize FIL tokens in different pools with different risk parameters. This can achieve on-chain risk management, but liquidity will be dispersed. In the single pool model, risk will have to be managed off-chain. Overall, the trade-offs will remain the same as mentioned above.

The trade-offs are: liquidity dispersion vs risk management transparency.

Risks

In the over-collateralization model, even if a miner is slashed multiple times, once the debt-to-equity ratio reaches 100%, the miner will be liquidated, and the pledger will be relatively safe.

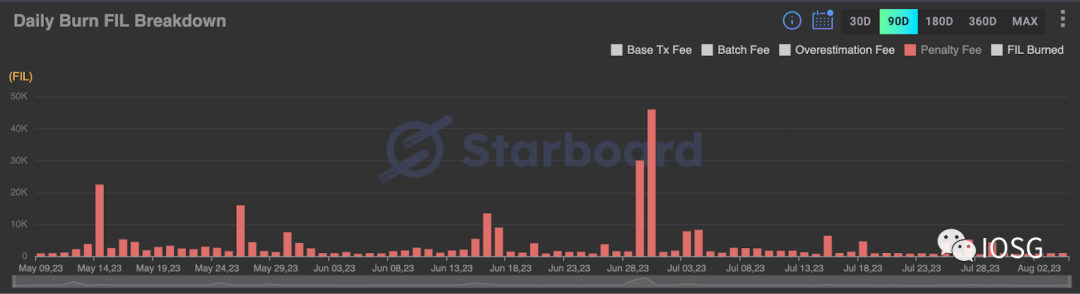

In the under-collateralization model, if the borrower fails to prove stored blocks, they may be penalized. This is more common in Filecoin than in PoS-type models. This will affect the collateral value and increase the leverage of the borrower. In this model, the liquidation threshold must be set very carefully.

Filecoin miner penalties (90 days). Source: Starboard

Comparison of Market Participants

What about Ethereum’s entry into the staking/lending protocol market?

In the Filecoin ecosystem, unlike Ethereum, the responsibilities of nodes (miners/validators/storage providers) go far beyond normal uptime. They need to self-market themselves to be selected as storage providers (SPs), regularly upgrade hardware to support more storage, sealing, maintenance, and retrieval of data. For SPs, Filecoin storage and reward mining is a full-time job.

Unlike Ethereum validators, there is no one-time collateral in Filecoin. Every time a storage provider provides storage to a client, they need to collateralize a certain amount of tokens. This collateral is for sealing storage blocks and keeping the sealed storage blocks on the miner’s device. Providing storage on Filecoin is a capital-intensive process, which makes many new miners unwilling to participate in the network and also makes existing miners unwilling to stay and contribute to the network.

Due to the limited participation of borrowers to miners, building borrower trust in the Filecoin ecosystem will also be a labor-intensive process for newcomers.

Based on Filecoin’s mechanisms alone, Ethereum’s staking or lending protocols cannot be easily deployed on the Filecoin Virtual Machine (FVM).

Protocol Economics

Is there enough FIL on the market to supply loans?

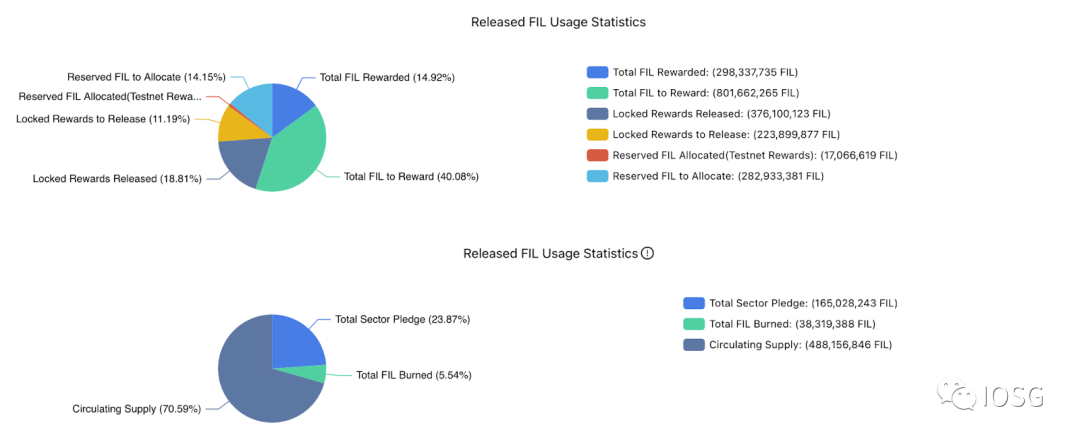

As of August 6, 2023, there are approximately 264 million FIL tokens in circulation that have not been pledged as collateral for storage blocks or pending rewards. These tokens can be considered as the total number of FIL tokens pledged by borrowers to the pool.

Source: FilScan

Is there enough borrowing demand?

Although FIL borrowing is important for miners, what are they actually borrowing? In the over-collateralized model, they make advance payments on locked rewards, while in the under-collateralized model, they make advance payments on future rewards.

From the chart above, it can be seen that the total locked rewards amount to approximately 223 million FIL tokens, which can meet the demand. The ratio of demand to supply is almost 84%. This shows the power dynamics between both parties, neither of whom can exert pressure on the other in terms of interest/annualized yield.

What will the future look like?

The estimate for the future FIL borrowing demand market is actually the number of FIL tokens released in the future.

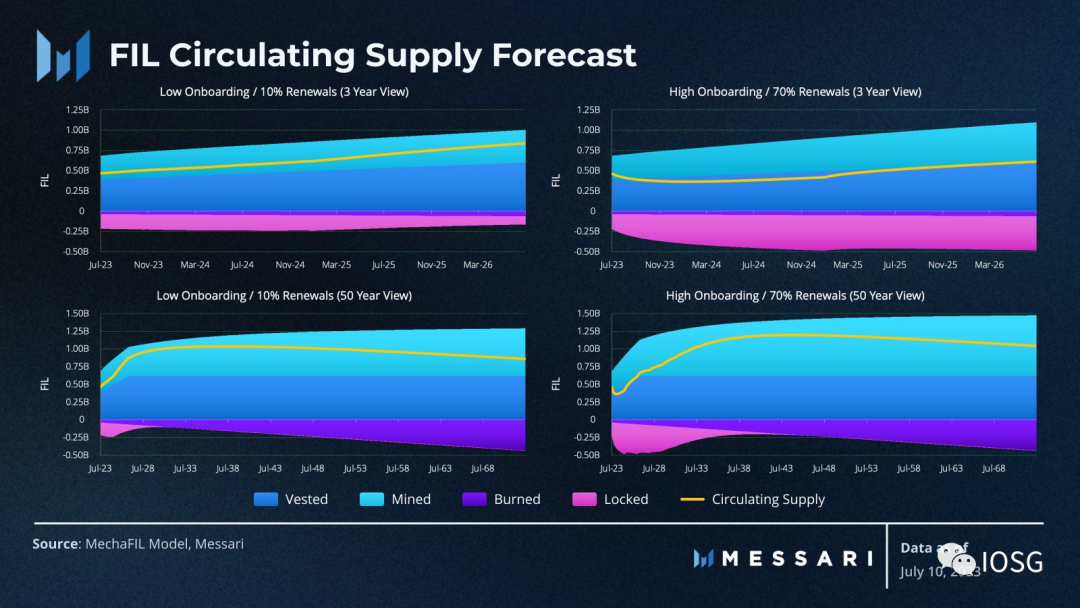

Messari’s professionals have simulated the circulating supply of FIL for 3 and 50 years using different scenarios.

Source: Messari

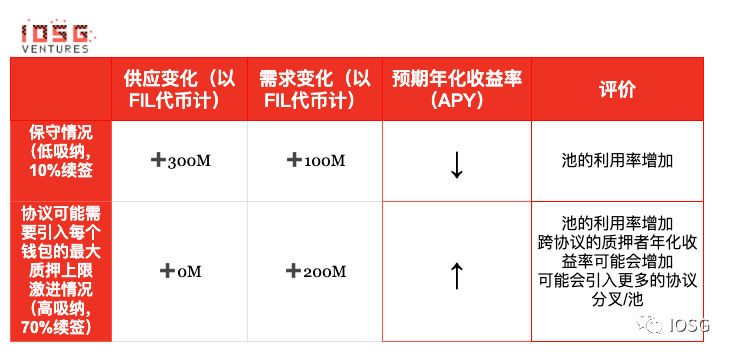

According to the chart in the upper left corner, in the conservative scenario where the addition of data is low and only 10% of total transactions are renewed, the additional reward output in the next 3 years will be close to 100 million FIL tokens. In the aggressive scenario, if the addition of data is high and 70% of existing transactions are renewed, the additional reward output will reach approximately 200 million FIL tokens.

Therefore, it can be expected that the market size in the next 3 years will be between 100 million and 200 million FIL tokens. Calculating based on the current FIL token price ($4.16 as of August 6), the total available market for borrowing (TAM) could be between $400 million and $800 million. This can be considered as the TAM for the borrowing side of the product.

In terms of supply, in the conservative estimate, approximately 300 million FIL tokens will be generated, while in the more aggressive scenario, the circulating supply is simulated to be similar to today. Why is that? Because if more transactions are absorbed and renewed, more FIL tokens will be locked in collateral for storage blocks.

In the more aggressive scenario, demand will exceed supply, and in this competitive market, the interest charged may be higher.

If the demand for adding more data exceeds the growth of circulating supply, the price of FIL tokens will rise, thereby creating more borrowing demand in FIL tokens.

Possible Future Directions for this Model

In different designs, there is no need to adopt a winner-takes-all approach. Intuitively, in the long run (based on Total Value Locked, TVL), the protocol that is usually built to be the safest wins, just like Lido in the Ethereum ecosystem. Rather than optimizing for a 2-3% yield, I am more inclined towards a more secure structure. I believe FIL token holders would also prioritize the safety of their capital over slightly higher returns.

This is considering the penalties miners pay for not being able to prove storage time.

From the perspective of borrowers (miners), they can borrow from different protocols to fulfill different purposes. If a miner already has a lot of collateral and does not need to pay operational costs through leverage, then a safer over-collateralization model would work better because it is safer. However, if I am a new miner and need to pledge a large amount of storage blocks, I might borrow from an under-collateralized pool.

By studying the above model, we can see:

In Filecoin, collateral is crucial for bridging the supply-demand gap of FIL tokens in the ecosystem. FVM has recently been released, allowing the existence of lending markets. Although the problem is real, the release of FVM may have come too late for most FIL collateral/lending protocols, as mining rewards have gradually decreased, making it a niche market.

However, there may be some intriguing use cases built on top of these collateral protocols. After introducing stablecoins, rewards can be seen as cash flow forward contracts. Similar to the model built by Alkimiya on Ethereum. This can inject new capital into the Filecoin ecosystem and increase the Total Value Locked (TVL) of these protocols.

Ethereum and Filecoin have different technologies, miners, developers, and applications, and therefore, different communities. Especially for collateral, as each miner is “non-fungible”, demand-side driving requires business expansion, and its success is directly proportional to the reputation of the protocol in the community.

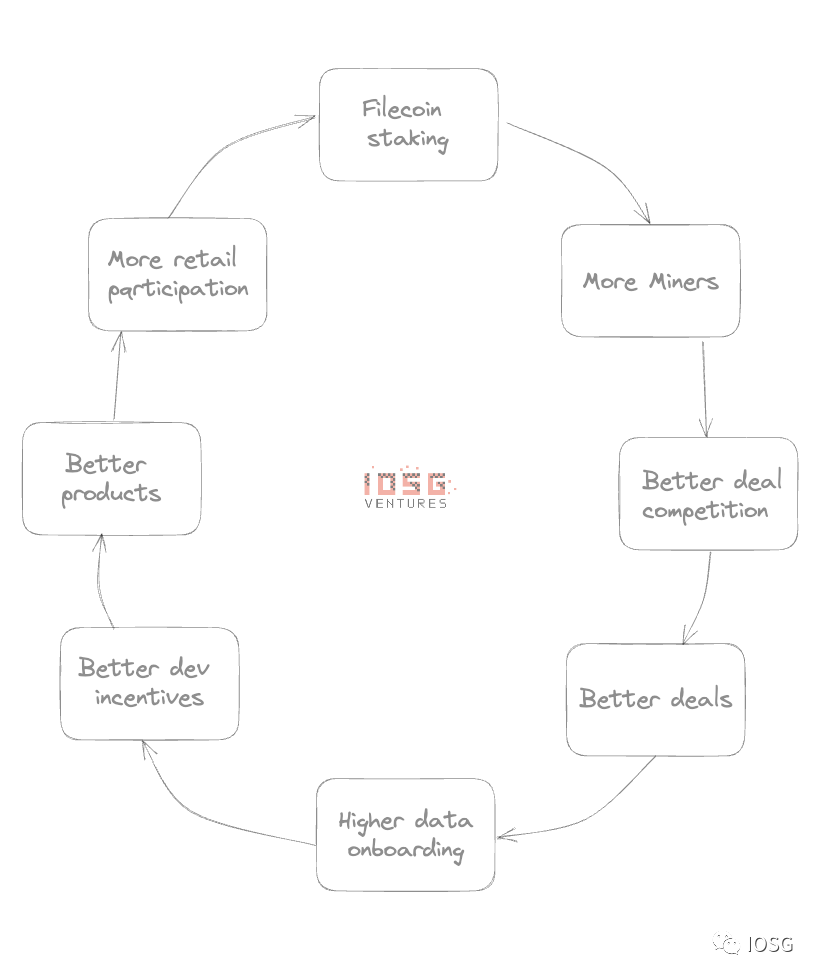

Collateral in Filecoin is a critical solution that needs to bring more miners into the system, allocate scattered funds for operations, create greater economic incentives, attract more developers to build useful products, and establish a positive feedback loop. To learn more about collateral and the importance of FVM in the Filecoin ecosystem, you can read our previously published article.

Summary

In the Filecoin ecosystem, there are still many unresolved issues, but we believe that the Protocol Labs team is working towards the right direction to achieve their vision of storing human data in an efficient system.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!