Recently, the anti-fraud propaganda film “All In” has become popular. The plot of the film involves overseas fraud groups using the persona of beautiful women to deceive victims into participating in cryptocurrency Ponzi schemes and scamming them out of their money. This, along with the exposure of the dark industry in Southeast Asia, has resonated with countless viewers.

Art comes from life. Cryptocurrency, as a new type of value carrier and transmission tool, has been widely adopted by criminal groups in Southeast Asia. It is involved in activities such as online gambling, fraud, and money laundering. Its anonymity, decentralization, and borderless nature make these illegal activities more concealed and the flow of illicit funds faster, posing challenges for law enforcement agencies.

Fortunately, blockchain ledger data is publicly transparent. With the extensive use of address labels and open-source network intelligence, Bitrace’s crypto analysts will be able to track the funds involved in illegal crypto activities through on-chain analysis. This article aims to illustrate the following points with data:

- Tether (referred to as USDT) is widely used in illegal activities and gambling in Southeast Asia. In the addresses monitored by Bitrace, the scale of USDT in 2022 exceeds 115 billion USDT;

- The return of USDT spreads the risk to more addresses and platforms, making them passive associates of illegal platforms. In 2022, more than 14.6 billion USDT flowed into trading platform accounts;

- USDT flows out of Southeast Asian illegal platform addresses, with major trading platforms passively bearing the majority share. However, Southeast Asian gray and black market operators and gamblers, mainly Chinese, have a preference for a few exchanges.

- Sitting at home, disaster strikes from above Why was my OpenSea account blocked due to US sanctions?

- What is the crime when hackers steal NFT digital collectibles?

- Review of Solidly’s development in the past year Did ve(3,3) thrive or spin in place?

Image | "All In"

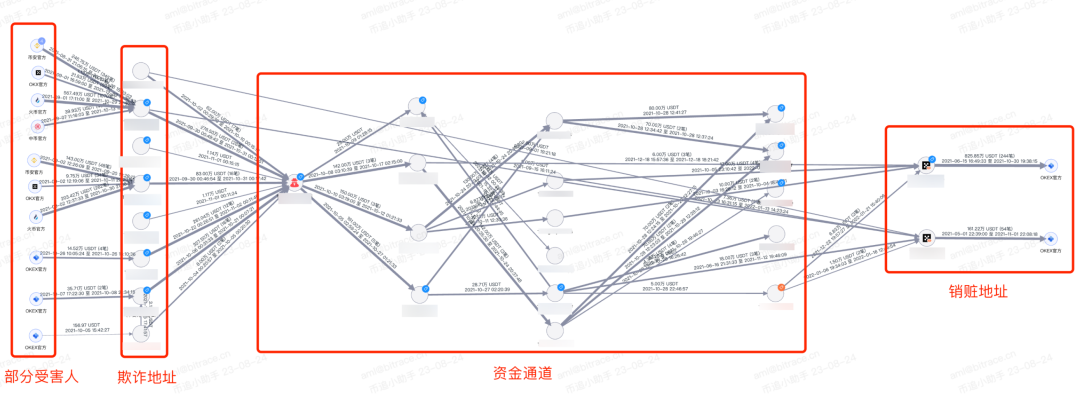

Example of a Cryptocurrency Ponzi Scheme

Telecom fraud is the most well-known type of illegal industry in Southeast Asia. As fraud groups expand their business into the field of new technologies, cryptocurrency Ponzi schemes have become increasingly common in recent years. These scams are often combined with investment fraud. Fraudsters search for targets in the online world, develop romantic relationships with them by creating attractive personas, and then induce them to participate in cryptocurrency investments. After victims invest a large amount of money, they often experience “losses,” are asked to pay “taxes,” or are simply unable to withdraw their principal.

Take the Ponzi scheme that occurred in Xiaoshan, Hangzhou in 2021 as an example. Victims were lured to participate in cryptocurrency investments on a platform called “Asia Pacific Exchange.” After victims purchased USDT on other trading platforms and transferred them to this platform, fraudsters manipulated the backend data to rapidly increase the victims’ “profits.” Throughout the process, they used persuasive language to continuously urge victims to add more funds. When victims applied for withdrawals, they were asked to pay taxes, or else their withdrawals would be denied. In this case, in order to obtain returns, the victims blindly borrowed money, mortgaged their properties, and invested a total of 12 million RMB worth of USDT, but ended up with nothing.

In fact, the person who develops a romantic relationship with the victim is fictional, the investment platform is fake, and the so-called “taxes” are baseless. In the post-fund analysis, we observed that more than one victim fell into this scam, and the deposited funds quickly flowed into a water house address located in Laos after simple consolidation.

There are countless cases of telecommunications fraud where the stolen money flows into Southeast Asian money laundering water houses in the form of cryptocurrencies.

In 2022, the scale of illegal activities involving cryptocurrencies in Southeast Asia exceeded 115 billion USDT

Based on a large amount of on-chain high-risk address data and automatic traceability analysis technology, Bitrace continuously monitors the inflow and outflow of funds to and from the addresses of some major black and gray market platforms in Southeast Asia, identifying cryptocurrency funds related to illegal activities such as online gambling, fraud, money laundering, theft, blackmail, and terrorism in a timely manner.

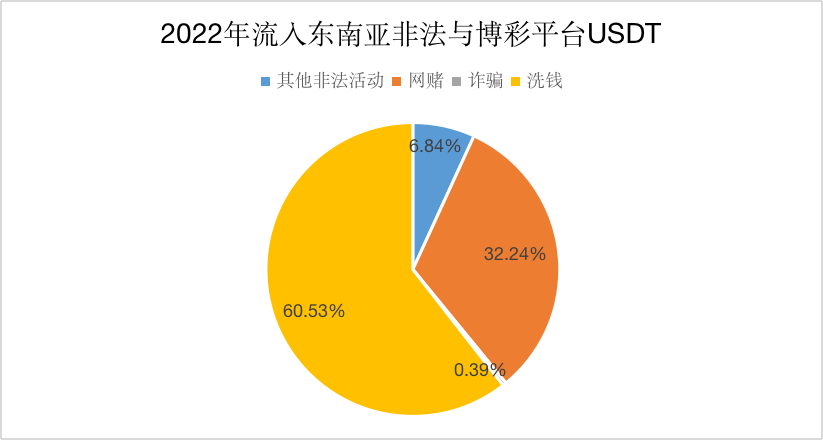

According to DeTrust, a risk data platform under Bitrace, “In 2022, more than 115 billion USDT flowed into certain Southeast Asian platform addresses,” including 37.16 billion USDT in online gambling funds and 69.78 billion USDT in money laundering funds. There were also 460 million USDT related to fraud (some of which were included and the stolen money was not cleaned).

In the monthly data, it is not difficult to see that the scale of funds throughout 2022 remained relatively stable. This indicates that such cryptocurrency-related activities were not affected by the fluctuations in the cryptocurrency market, to a certain extent achieving “crossing the bull and bear markets.” This may imply that participants or victims are not truly cryptocurrency investors in the true sense.

In 2022, 14.6 billion contaminated USDT flowed back from Southeast Asia

Earlier, Bitrace disclosed the pollution data of major centralized trading platforms in the Tron network involved in gambling incidents using USDT as a medium. With the continuous increase in the number of illegal entity address tags and the traceability analysis of relevant address funds, we have obtained more comprehensive pollution data using USDT as a medium by adding more network and trading platform addresses.

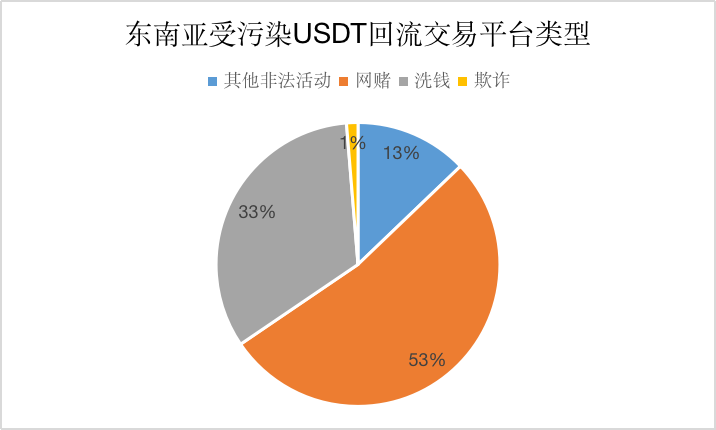

According to DeTrust, a risk data platform under Bitrace, in 2022, more than 14.64 billion contaminated USDT flowed directly or indirectly into centralized trading platforms from known Southeast Asian entity-associated addresses. This includes 7.71 billion USDT in online gambling funds, 4.86 billion USDT in money laundering funds, 1.88 billion USDT in other illegal activity funds, and a small amount of funds (190 million USDT) related to fraud.

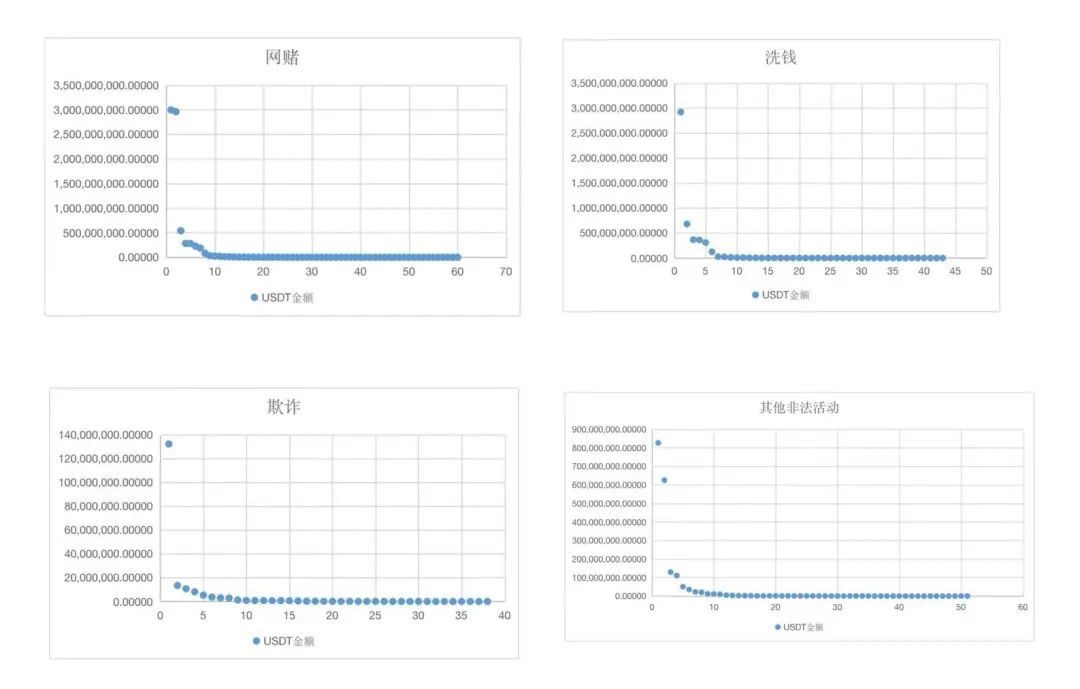

Figure | Scatter plot of risk capital data collected by various trading platforms (horizontal axis)

Risk capital pollution on cryptocurrency trading platforms also follows the Matthew Effect. Among them, a certain exchange with the largest volume of business income has received more USDT from Southeast Asia contaminated by 38.87% of online gambling funds, 60.02% of money laundering funds, 43.94% of other illegal activity funds, and 70.59% of fraudulent funds.

In addition to volume factors, certain types of contaminated USDT also show preferences for different trading platforms. Taking a certain exchange with a business volume of 12% and serving a large number of Chinese users, for example, in terms of other illegal activity funds and online gambling funds, the business addresses of this exchange have received 33.24% and 38.39% respectively, which is almost equivalent to the aforementioned exchange. This may be because most operators of gray and black production platforms in Southeast Asia, gamblers, casino agents, and the operators of four-party payment platforms that provide cryptocurrency fund settlement for casinos are Chinese, resulting in a disproportionate inflow of related funds relative to business volume.

Conclusion

Our industry is facing severe anti-money laundering challenges. Well-known mixing platform TornadoCash has been sanctioned by the U.S. Department of the Treasury for allegedly assisting in money laundering by certain hackers. Previously, multiple centralized or decentralized cryptocurrency institutions have been sued by government agencies for indirectly providing services to hackers. For other cryptocurrency entities, perhaps only compliant operations are the future.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!