Author | TaxDAO

In addition to income tax issues, cryptocurrency transactions may also involve turnover tax issues. This article will analyze the tax status and future of cryptocurrencies from the perspective of turnover tax, aiming to provide relevant reference information for cryptocurrency investors. This article believes that compared to turnover tax, more countries in the future will still tend to use income tax or other forms of taxation to collect cryptocurrencies.

1. Turnover Tax and its main tax types

1.1 Overview of Turnover Tax

Turnover tax is a tax levied on the turnover or quantity of goods or services. It is an indirect tax collected during the circulation of goods.

According to the method of collection, turnover tax can be divided into ad valorem tax and specific tax. Ad valorem tax is levied based on the value or price of goods or services, such as value-added tax and sales tax. Specific tax is levied based on the quantity or weight of goods or services, such as customs duties and resource taxes.

- LianGuai Morning News | Analysis Bitcoin’s halving in 2024 could push prices to $400,000

- A Look at Singapore’s 5 Billion Money Laundering Case Will the Domestic Payment Industry Undergo a Transformation?

- Looking at the latest developments of THORChain from the perspectives of optimism and pessimism liquidity exchange and lending.

1.2 Main turnover taxes

The main turnover taxes include the following five tax types: value-added tax, sales tax, consumption tax, business tax, and customs duties.

- Value-added tax (VAT) is a turnover tax that is levied on the value added to goods or services in the production, circulation, and consumption process, reflecting the real value added of goods or services.

- Sales tax is a turnover tax levied on the sales amount or price of goods or services. It is levied only at the final stage of sales and only involves the final consumers. The United States is a typical representative country that levies sales tax. In the United States, whether to levy sales tax and how to set the tax base and tax rate are determined by individual states and local governments.

- Consumption tax is a turnover tax levied on specific goods or services in the production, import, or sales process. Unlike value-added tax, consumption tax usually only applies to specific goods such as cigarettes and luxury goods. Its purpose is to regulate consumption structure and promote conservation and environmental protection.

- Business tax is a turnover tax levied on the turnover obtained from providing services, transferring intangible assets, or selling real estate. Business tax was an existing turnover tax in China and was replaced by value-added tax in 2015.

- Customs duties are turnover taxes levied on goods and articles imported or exported and are only collected during the entry or exit of goods.

Capital gains tax is not a turnover tax because it is not levied during the production, circulation, and consumption process of goods or services, but is levied when assets are transferred or traded.

2. Cryptocurrency turnover tax

2.1 Taxes that may be generated during the circulation of cryptocurrencies

Cryptocurrency turnover tax refers to the tax levied on transactions or activities using cryptocurrencies. Generally speaking, cryptocurrencies are not subject to consumption tax because they do not have the nature of luxury goods or “harmful goods”. They are also not subject to customs duties because they are digital assets rather than physical goods. The discussion on cryptocurrency turnover tax in the working paper “Taxing Cryptocurrencies” published by the IMF in July 2023 is also limited to this scope. Therefore, cryptocurrency turnover tax mainly includes value-added tax and sales tax. This article attempts to provide a brief analysis of the tax situation of cryptocurrency value-added tax and sales tax in major countries around the world.

Different countries or regions may have different definitions, classifications, and taxation methods for cryptocurrencies, so cryptocurrency investors need to consult the corresponding circulation tax regulations based on their jurisdiction.

2.2 Countries and regions that levy circulation tax on cryptocurrencies

Currently, most countries and regions do not levy circulation tax on cryptocurrencies, which is related to their legal definition of cryptocurrencies. Only when cryptocurrencies are defined as “commodities” or “assets” can circulation tax be levied. Countries and regions that consider cryptocurrencies as “currency” do not levy circulation tax on cryptocurrencies.

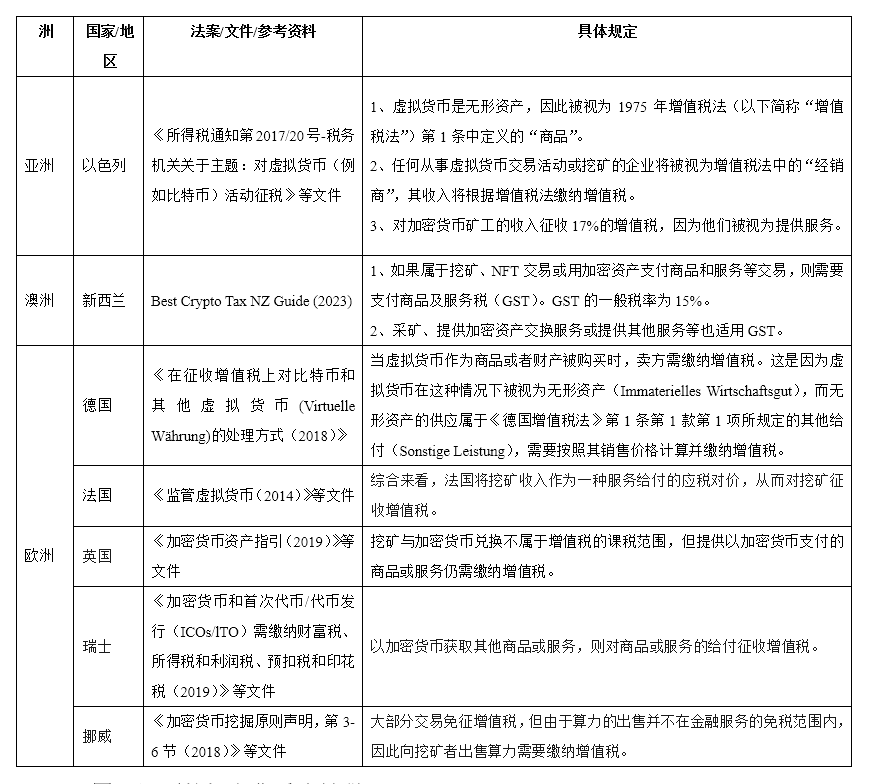

This article briefly summarizes the representative countries and regions that levy circulation tax on cryptocurrency-related transactions, as shown in the table below.

2.3.1 Cryptocurrency circulation tax in the European Union

The regulation of cryptocurrency circulation tax in the European Union is leading internationally. As early as the Hedqvist case in 2015, the European Court ruled that the exchange service between legal tender and Bitcoin constitutes a taxable service for value-added tax.

The general situation of the Hedqvist case is as follows: Swedish resident Hedqvist planned to provide exchange services between legal tender and Bitcoin. The Swedish administrative court submitted this case to the European Court to determine whether the value-added obtained by Hedqvist in this exchange service needs to pay value-added tax. The European Court believes that since Bitcoin is not a tangible asset, the exchange of legal tender and Bitcoin does not belong to the payment for goods, but the payment for services, and Hedqvist and the counterparty form a “consideration” in the transaction. Therefore, the European Court determined that the exchange service between legal tender and Bitcoin belongs to the taxable service under Article 2(1)(c) of the EU VAT Directive.

At the same time, the European Court believes that the spirit of Article 135(1)(e) of the VAT Directive applies to cryptocurrency exchanges, so it can be inferred that exchanging legal tender for cryptocurrency is exempt from value-added tax.

Therefore, in cryptocurrency exchanges, EU countries are influenced by this precedent and include the exchange between cryptocurrency and legal tender as well as the exchange between cryptocurrencies in the scope of value-added tax, but exemptions may apply. However, for mining operations, the situation is different: except for France, most countries (such as Germany, Ireland, Sweden, etc.) believe that mining operations are not subject to value-added tax.

2.3.2 General practices in other countries

European countries outside the European Union have basically adopted the relevant spirit of the European Court’s judgment on the Hedqvist case, such as the United Kingdom, Norway, etc. Countries outside Europe generally adopt a similar approach to Israel, excluding the exchange of virtual currencies from the scope of value-added tax; at the same time, these countries treat the act of purchasing goods or services with virtual currencies as taxable sales (i.e., subject to value-added tax). As for the value-added tax treatment of “mining,” it is more diversified and has not yet formed a mainstream policy opinion.

Another design concept for taxing cryptocurrencies is to completely exempt them from turnover taxes and instead regulate them from the perspective of income taxes, as is typical in countries such as Singapore, Japan, South Africa, and Hong Kong, China.

3 Future Prospects of Cryptocurrency Turnover Taxes

There is currently no unified standard or specification for cryptocurrency turnover taxes on a global scale. Different countries and regions have significant differences in the definition, classification, recognition, taxation basis, tax rates, and other aspects of cryptocurrencies, resulting in the complexity and uncertainty of cryptocurrency turnover taxes.

Currently, most countries and regions tend to include cryptocurrencies in the scope of income taxes and tax the income generated from activities such as buying, selling, exchanging, gifting, and donating cryptocurrencies. This article believes that, compared to turnover taxes, more countries in the future will still prefer to use income taxes or other forms of taxation to collect cryptocurrencies. This is because income taxes are more convenient in terms of collection and calculation compared to turnover taxes. They can not only adapt more flexibly to the fluctuations and innovations of the cryptocurrency market, avoiding tax losses or excessive taxation caused by price uncertainty or product diversity but also coordinate the differences in tax systems between different countries and regions, avoid international double taxation, and promote cross-border transactions. Therefore, income taxes, compared to turnover taxes, can better reflect the value changes of cryptocurrencies and the taxpayers’ ability to bear the burden. In comparison, turnover taxes have some problems and challenges in terms of collection costs, effectiveness, and fairness.

References

[1] Israeli Tax Authority. (2017). Income Tax Circular No. 2017/20 – Tax Authority’s Topic: Taxation of Activities with Virtual Currencies (such as Bitcoin)

[2] Divly. (2023). Best Crypto Tax NZ Guide (2023).

[3] German Federal Ministry of Finance. (2018). Treatment of Bitcoin and Other Virtual Currencies for VAT Purposes

[4] French Ministry of Finance. (2014). Regulation of Virtual Currencies

[5] HM Revenue & Customs. (2019). Cryptoassets Guidance

[6] Swiss Federal Tax Administration. (2019). Cryptocurrencies and Initial Coin Offerings (ICOs/ITO) Subject to Wealth Taxes, Income Taxes and Profit Taxes, Withholding Taxes and Stamp Duties

[7] Norwegian Tax Administration. (2018). Cryptocurrency Mining Principles Statement, Sections 3-6

[8] Hedqvist, D. (2015). Case C-264/14 Skatteverket v David Hedqvist. Court of Justice of the European Union.

[9] International Monetary Fund. (2023). Taxing Cryptocurrencies. IMF Working Paper No. 23/17.

[10] Jasmine Coleman, Liu Qichao, Wu Fangbei. (2021). Research on Value-Added Tax Issues of Cryptocurrencies in the European Union and Its Extensions.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!