Introduction

Ethereum, as an open, programmable blockchain platform, is not only the infrastructure for digital currency, but also provides an environment for developers to build decentralized applications (DAPPs) and smart contracts. Due to its flexibility and scalability, Ethereum has become a key player in the cryptocurrency ecosystem, attracting developers and users from around the world.

In the previous issue of Cregis Research, we discussed the value of account abstraction (AA), which led to a complex topic: in June, Ethereum’s founder Vitalik Buterin pointed out in his blog that Ethereum currently faces some important challenges and problems that need to be solved in order to further its development. Otherwise, Ethereum will fail. The three directions for transformation are smart contract wallets, privacy protection, and Layer 2 scalability. After a successful transformation, Ethereum will improve in terms of performance, user experience, privacy protection and other aspects.

Of course, these changes will also bring new challenges. Regarding the problems and significance of smart contract (CA) wallets, as analyzed clearly in the previous issue, Cregis Research summarizes the remaining issues and selects several key points that are closely related to daily experience to review Vitalik Buterin’s views from more than half a month ago.

- The modular war of Layer2 begins: OP Stack VS ZK Stack, who will be the ultimate winner?

- Long Push: Binance’s latest IEO project ArkhamIntel interactive tutorial

- Different Perspectives on Interpreting the On-Chain Intelligence Trading Platform Arkham

Challenges brought by the three transformations of Ethereum

Why does Ethereum need to transform?

The main reason why Ethereum needs to transform lies in the challenges of scalability, security, and privacy protection.

First, let us review the discussion in the previous issue of Cregis Research: Ethereum Account Construction Archaeology and the Value of Account Abstraction. It pointed out that Ethereum operating in a decentralized environment still faces the biggest pain point: linear environment cannot execute high-concurrency transactions and complex code compilation, which is the challenge of scalability.

Due to Ethereum’s limited transaction processing capabilities, transaction costs become high when network traffic increases. This high transaction cost hinders Ethereum’s popularity in the mainstream market. Therefore, Ethereum needs to improve its processing power and reduce transaction costs through L2 expansion such as rollups.

Secondly, the issue of wallet security is also an important issue. The theft of simple EOA wallets (represented by various plug-in wallets) generated by seed phrases to generate public-private key pairs is endless, from the massive leakage of ARB airdrop addresses to KOL crying out on Twitter that their wallets have been hacked and cleared. The demand of individual users for asset security is increasingly intensifying, but they are unwilling to sacrifice user experience (enterprise users will choose a fully self-managed MPC scheme for asset security and are willing to sacrifice the convenience of on-chain interaction), which requires Ethereum to transform wallet security, promote industry security standards for smart contract wallets (such as EIP-4337), and provide individual users with stronger security and convenience.

Finally, privacy protection is another key challenge. All transactions on Ethereum L1 are public, because EOA is bound to assets; whether it is ordinary individual users, whales or corporate institutions, they may currently suffer from the distress of having their asset addresses marked and tracked. Therefore, Ethereum needs to further improve to implement non-malicious privacy computing, ensure that in the future not only on-chain assets, but also on-chain identity, credit systems and other DID information can be protected; at the same time, it needs to ensure that when malicious events occur, there are response mechanisms to ensure that wrongdoers cannot escape tracking and cash out smoothly.

Three most important issues (Cregis Research summary and added opinions)

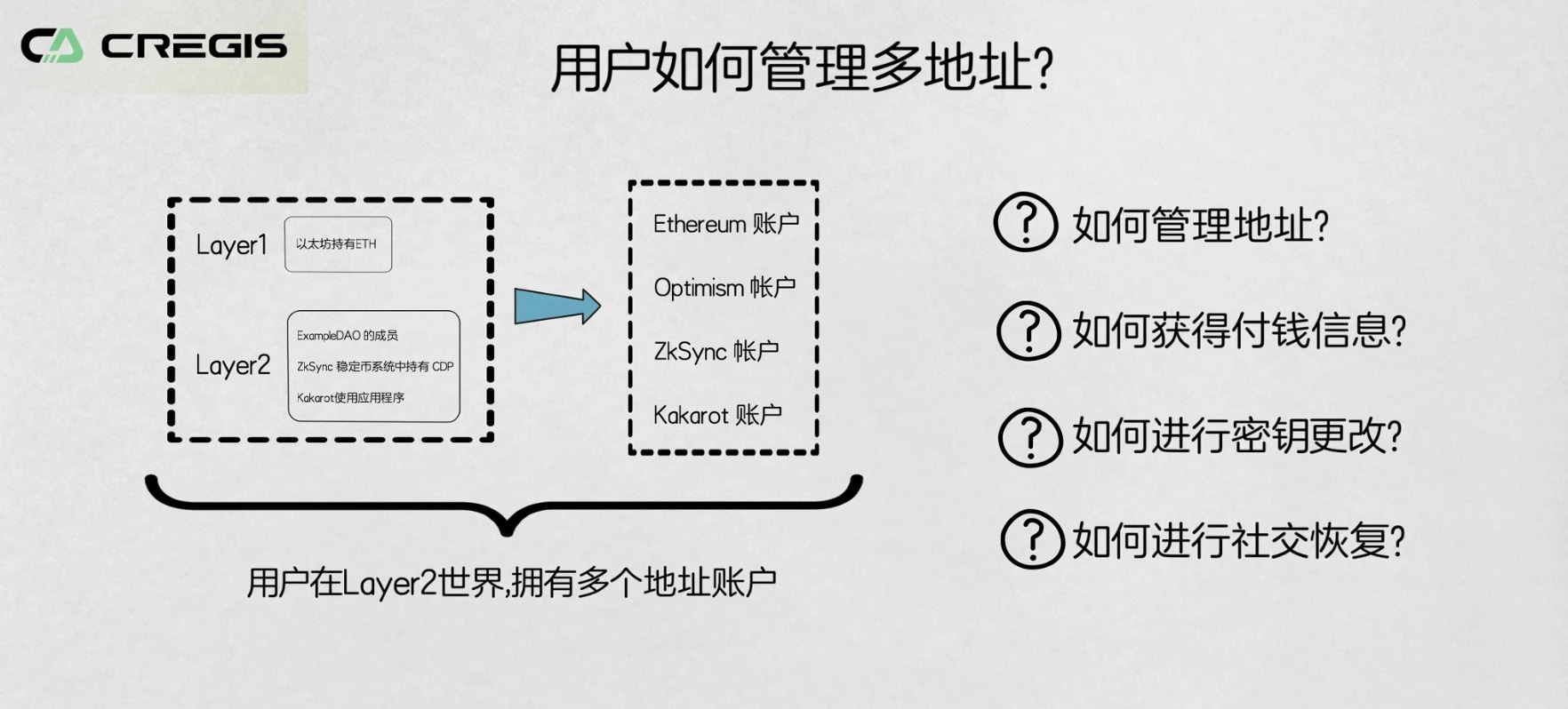

- How do users manage multiple wallet addresses

Compared with Web 2.0, Web 3.0 still maintains one advantage: users can create different application accounts with one social feature (e-mail, mobile phone number, etc.). Although in the Web 3.0 world, public chain addresses with the same consensus mechanism can be universal (such as BSC, ERC-20, TRC-20), with the advent of L2 expansion plans, users will have multiple completely different L2 addresses, different Layer 1 and Layer 2 networks may use different programming languages and intermediate components, which leads to problems in address retention; and in the multi-chain bridging environment represented by Polkadot or the multi-chain universal L2 environment mentioned in Cregis’ future vision, users may also need to manage the addresses of several heterogeneous chains, which increases the complexity of address management.

Finally, the proposal for invisible addresses for privacy protection, if widely used, will enable users to have more addresses to enhance their privacy protection. Therefore, retaining an address becomes more difficult.

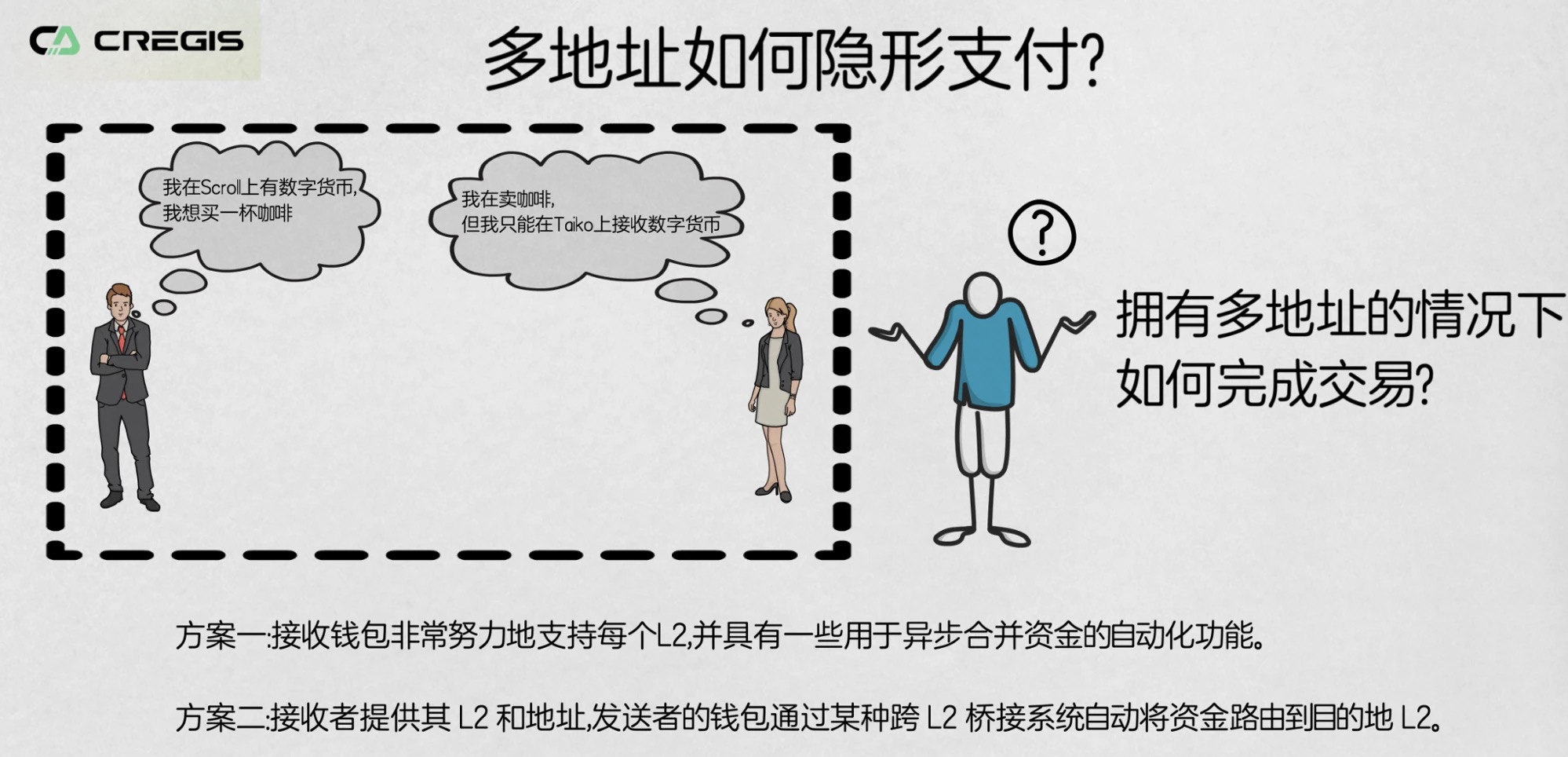

- How do users achieve invisible payments? (Especially in a multi-address environment)

Assuming that the L2 in the future Ethereum ecosystem will develop as expected, even if most of the native assets are ERC-20 tokens, users may have multiple L2 addresses, making it more difficult to choose the correct address to send assets or pay. Traditionally, users only need to know the recipient’s address to send payments, but now they need to know the Layer 2 network that the recipient accepts and the corresponding address, and need additional steps to ensure that funds are sent to the correct target.

Multiple account invisible payment problem in L2 environment

Although contract accounts (CA) built using smart contracts can easily solve addressing problems, they cannot provide privacy protection functions directly.

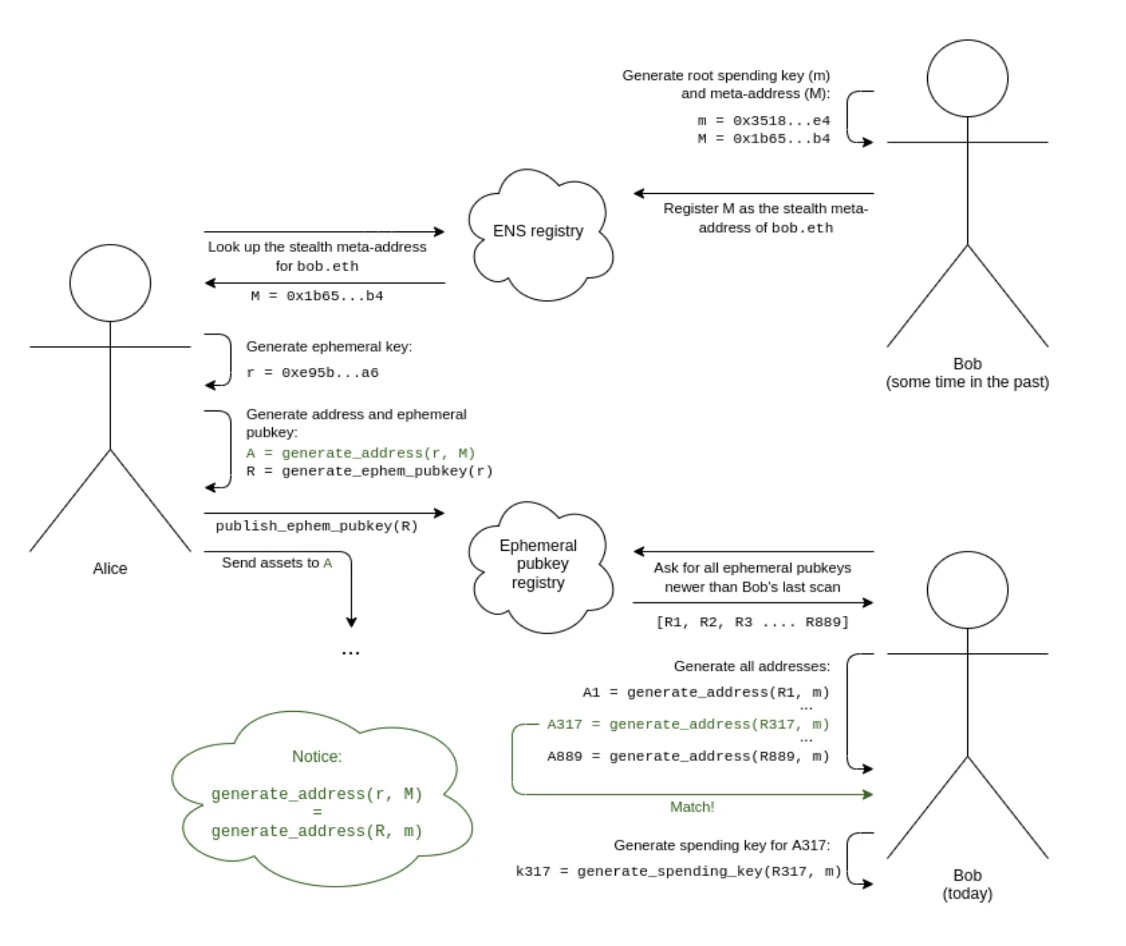

V God’s privacy protection solution proposed in the early days of Ethereum: Invisible Address. Invisible Address can help you maintain privacy when conducting digital currency transactions without being tracked by others. Cregis will share some steps to solve privacy issues:

The invisible address is an address that can be generated by the payer or payee, but can only be controlled by the payee. This address can improve the privacy of Ethereum in multiple scenarios. In this mode, Bob (the payee) generates a consumption key and uses this key to generate an invisible meta-address: B, h = hash(x). He passes this meta-address to Alice (the payer). Alice can perform a calculation on this meta-address to generate an invisible address belonging to Alice to Bob: b-1. Then, she can send any assets she wants to this address, and Bob will have complete control over them.

The generation process of the invisible address requires operating elliptic curve functions: Bob generates a key m and calculates M = G * m, where G is a public generating point of the elliptic curve. Alice generates a temporary key r and publishes a temporary public key R = G * r. Alice can calculate a shared secret S = M * r, and Bob can also calculate the same shared secret S = m * R.

After Bob’s invisible address b-1 is generated and needs to be traded with Alice, Alice generates a value: c, and publishes an encrypted data of c that only Bob can decrypt; when the transaction is executed, it is verified by zero knowledge proof: the value x provided by Bob and the value c provided by Alice can make k=hash(hash(x), c), and the transaction is completed after the verification is correct. During this process, Bob’s original address is not exposed, only the encrypted value x is provided, and the zero knowledge proof is only responsible for verifying the content of k and will not display the correlation between B and b-1.

- How can wallet products protect users’ assets and privacy at the same time?

In the traditional chain environment, wallets mainly focus on the protection of private keys, but in the ZKP (zero-knowledge proof) world, wallets need to protect identity verification credentials and user data at the same time. An example is the identity system ZKBlockingss based on ZK-SNARK and MPC, which allows users to generate basic proof of identity verification while making the process of verifying identity unnecessary to provide any real information through MPC.

However, since the encrypted data label (key fragment) itself replaces the EOA’s private key, the issue of custody of the encrypted data label becomes more important, as users need to balance between local storage of data or relying on third-party hold encrypted copies. At the same time, wallets that support social recovery need to manage asset recovery and encrypted key recovery to ensure a balance between security and availability. So in the visible future, the security strategies of enterprise wallets and personal wallets will take radically different directions. Taking enterprise wallets as an example, because the most stringent security environment is needed to protect funds, users of enterprise wallets are likely to abandon: 1. Contract wallets with human vulnerabilities; 2. Mixed custody MPC wallets with third-party risks, and choose private deployment MPC wallets with the same level of security as hardware wallets; while personal users in scenarios other than asset custody, because they always hope to get the best user experience, may choose products with some centralized operation.

In addition, blockchain addresses cannot meet the identity verification needs in the ecosystem, so solutions such as ENS (Blockchain Domain Name) and SBT (Soul Binding Token) are gradually being accepted by the public, but there are still problems that have not been solved: the former is difficult to solve the problem of homonymy brought by the traditional world, while the latter, although there is no homonymy problem, still lacks enough ecological applications to fully play the DID function it carries, and even the current application scenarios can be said to be very thin.

There is a lot more to the original text, and those interested can also visit: “The Three Transitions”, by Vitalik Buterin.

Four, Summary

I believe you already know that in the nearly three-month-long global currency circle controversy over the [Ethereum Transformation] topic, the wallet is only one important component. V God’s ambition is not only to realize the ambition of “Ethereum making up for Bitcoin’s shortcomings”, but also to truly create a world where everyone can enter, highly integrated with the real world, and at the same time retain the concept of decentralization.

Next quarter preview: Cregis Research will return to cryptography and analyze the differences between the ECDSA elliptic curve function algorithm and the BLS algorithm.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!