Author: David Zareh Source: medium Compilation: Blocking, Shanouba

In the world of Ethereum staking, validators face various limitations and trade-offs when choosing a staking method. Self-staking, while providing control and participation in network consensus, also presents challenges such as immobility of staked funds and the minimum requirement of 32 ETH.

On the other hand, exchange staking offers flexibility but brings with it concentration risk and lower returns. However, a champion has emerged in the form of liquid staking.

Liquid staking helps bring liquidity back to the market. It can offer users an annual interest rate while maintaining the ability to utilize their collateralized assets, thus returning power to the user. You can now be your own bank instead of letting banks hold your assets and lend them out at higher percentages!

- Who are the four new AzukiDAO multi-signature managers who defeated Zagabond?

- Using Lens and dYdX as examples, why is 100% betting on Ethereum not a good idea?

- New phishing alert: Attackers on BNB Chain are using fake authorizations to deceive users into giving away Gas.

Self-Staking

Validators considering staking ETH face limitations including immobility of staked funds, a minimum participation requirement of 32 ETH, and personal responsibility associated with running validators.

However, users who deposit ETH into the Ethereum deposit contract for network security cannot withdraw their staked ETH until after activation of the upgrade. As the official date for this phase upgrade has not yet been determined, users may face a long waiting period, potentially years, before they can regain their staked ETH.

Exchange Staking – Competitor

Exchange staking refers to the process of staking tokens through centralized exchange services such as Binance, Gemini, Kraken, and Coinbase. This method allows users to stake and unstake their tokens at any time with minimal supervision and effort on the part of the user.

Collecting large amounts of ETH to run many validators by a centralized provider poses potential risks to the network and its users. Having such a centralized target makes the network more vulnerable to attacks or errors, which could be harmful.

Therefore, compared to self-staking or liquid staking, the rewards rate for exchange staking on Ethereum 2.0 is estimated to be much lower.

The chart below shows the average annual interest rate for staking ETH on Binance over the past 2 months.

Liquid Stake (LS) – Champion

LS provides an alternative way to lock up user rights, allowing them to collateralize any amount of Ethereum and efficiently cancel the ETH collateral without enabling transaction functionality.

This is achieved by creating a tokenized version of the collateral funds, similar to derivatives, which can be transferred, stored, spent or traded like regular tokens. Users deposit their ETH into a third-party application, which then represents the ETH on behalf of the user in the Ethereum deposit contract by running its own validator.

In return, these applications mint representative ETH tokens, such as stETH, allowing users to maintain the liquidity of their ETH while receiving Ethereum collateral rewards. For example, Lido offers users the ability to collateralize any amount of Ethereum and receive stETH as a reward.

This collateral token can be used for lending, collateral and other purposes, while accumulating collateral rewards every day. Lido’s approach also allows users to cancel collateral at any time through the stETH-ETH liquidity pool. After the Ethereum upgrade enables transaction functionality in the future, the representative ETH will be returned to the third-party issuer. The issuer then provides the user with an equal amount of ETH as their original collateral entitlement, plus rewards earned by protecting the network.

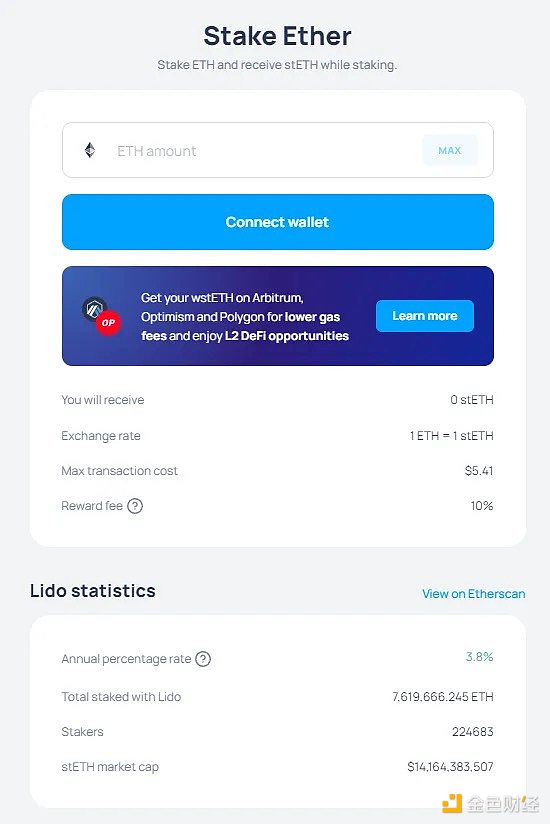

Lido liquidity staking statistics

Lido ETH statistics Snapshot

-

Lido is currently collateralizing approximately $14.2 billion in ETH

-

Approximately 225,000 wallets are collateralizing ETH on Lido

-

The average annual interest rate is 3.8% interest

The best part of blockchain is that you can verify this

stETH contract address:

https://etherscan.io/token/0xae7ab96520de3a18e5e111b5eaab095312d7fe84

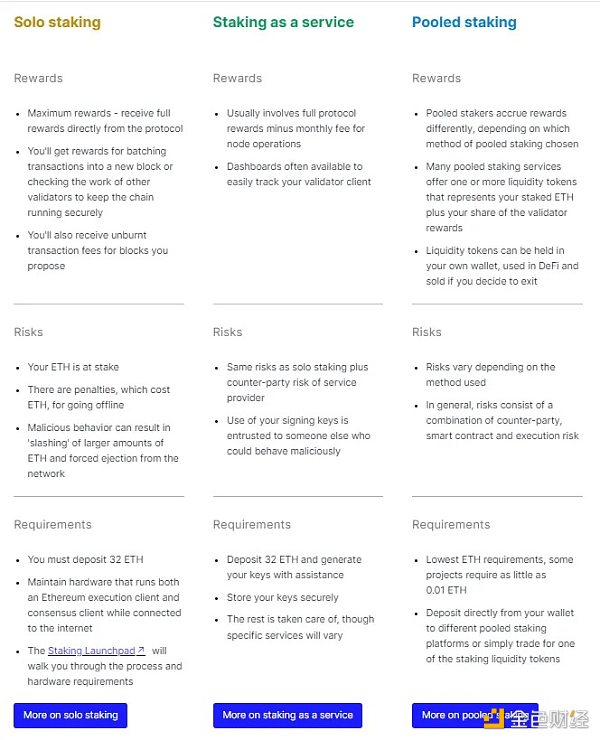

Review of Collateral Options

https://ethereum.org/en/staking/#comparison-of-options

The Future Pattern of Ethereum Collateral

Liquid equity offers all the benefits of user-initiated equity betting while reducing associated risks and complexities. It is a viable alternative to user-initiated equity betting and exchange-initiated equity betting, cleverly balancing risk, return, and convenience. Liquid equity services (such as Lido) meet the needs of Ethereum holders of all kinds.

For smaller wallets, Fluidity Equity allows them to bet any amount of Ethereum and have the flexibility to unlock their bets at any time. Larger holders can use Fluidity Equity services to hedge against Ethereum’s price volatility without having to maintain complex equity betting infrastructure.

Fluidity Equity is committed to the concept of decentralization, accessibility, and easy access to equity betting returns, and will develop in sync with the broader DeFi movement. It embodies the purest essence of DeFi.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!