Author: daniel@footprint.network

Data Source: Footprint GameFi Research

In April, the cryptocurrency market continued the trend of spring rebound, and the price of Bitcoin reached a high point in 11 months. The GameFi industry is also showing vitality. Although there are no eye-catching fluctuations, data indicators such as financing rounds and active users have rebounded.

Although there is no huge financing like CCP Games last month, the eye-catching Web3 karate combat game Karate Combat raised $18 million in funding, launched the Karate Combat “Up Only Gaming” application on Ethereum and Hedera networks, and will soon launch the KARATE token. Does this mean that ICOs (Initial Coin Offerings) are becoming popular again?

- How did Rook, which relied on dissolution, skyrocket four times? How did the “DAO Predator” hunt down DAO treasuries?

- Encryption Index Track: Which projects are worth paying attention to

- What happened to Multichain? Cross-chain asset delay causes token to plummet by 35%.

The data in this report comes from the GameFi Research page of Footprint Analytics. The page provides an easy-to-use data panel that includes the data indicators that GameFi industry needs to pay most attention to, and updates them in real time. You can find the latest information on GameFi-related prices, individual projects, financing rounds, etc. by clicking here.

Key Research Findings

GameFi Market Overview

-

The price of Bitcoin has remained above the support level of $27,000 and has reached a high point in 11 months, that is, $30,506.

-

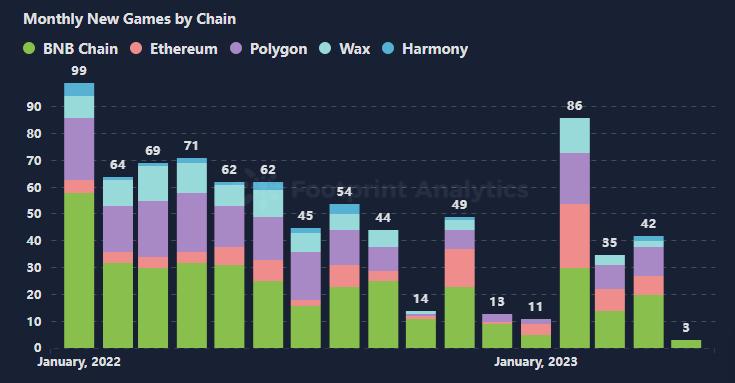

51 new GameFi projects were launched in April.

-

The average daily trading volume has been declining since the beginning of the month, and finally reached a monthly low of 19.3 million on April 23.

-

The monthly trading volume decreased by 8.2%.

GameFi User Analysis

-

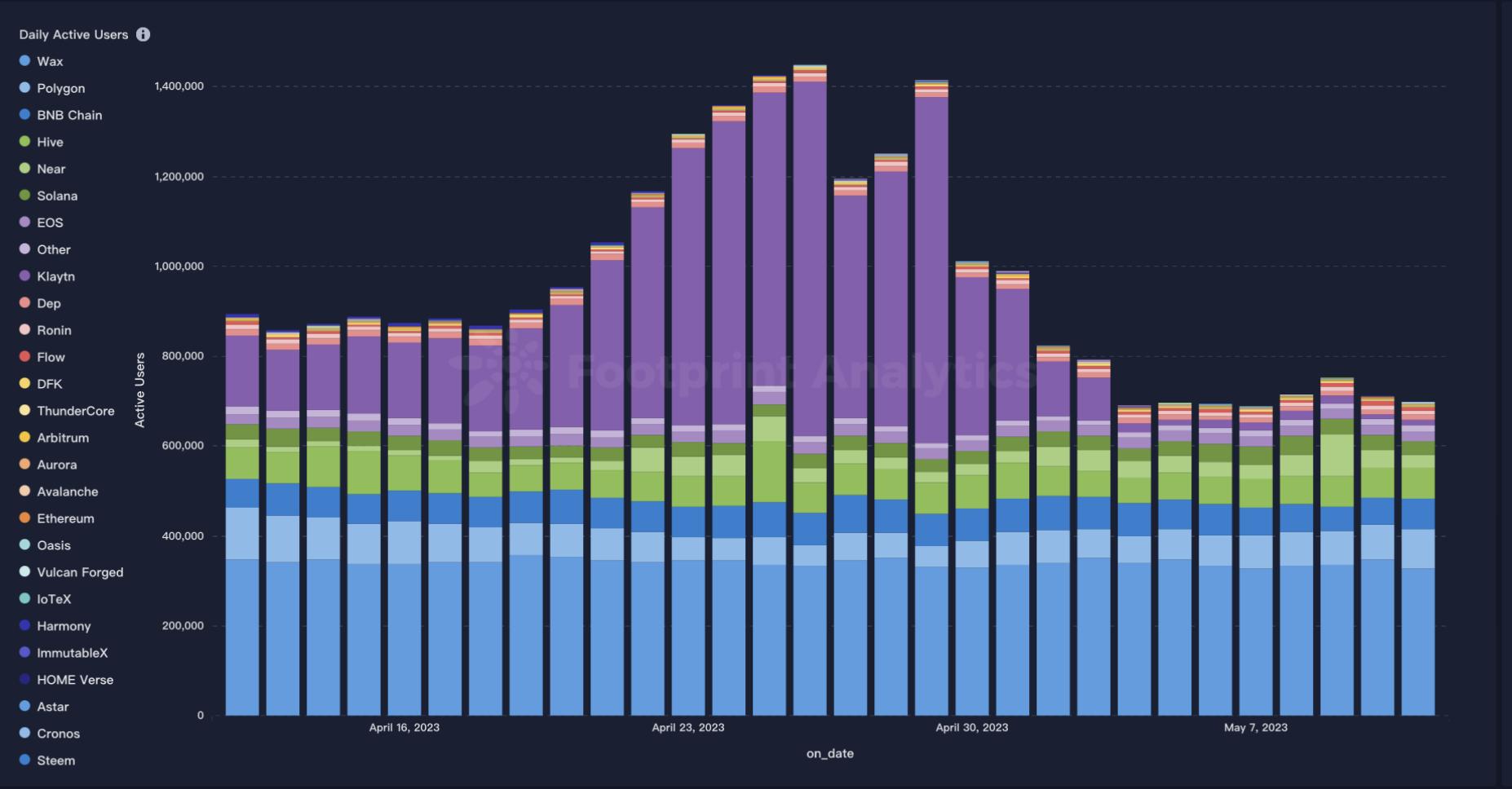

In April, the user acquisition and retention performance of GameFi was impressive. On April 26, the daily active users soared to 1.49 million, with a growth rate of 72.4%.

GameFi Public Chain Data

-

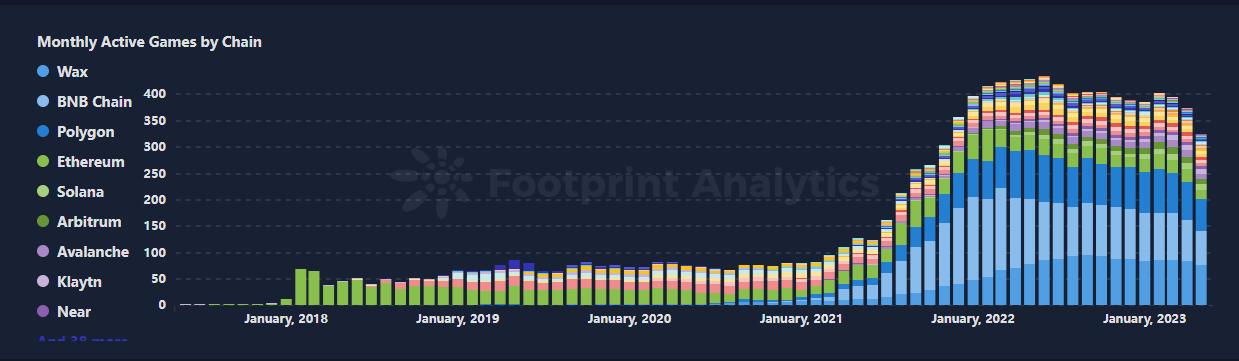

The distribution of active public chains of projects remains basically unchanged.

-

BNB has the most new games, with a total of 20.

-

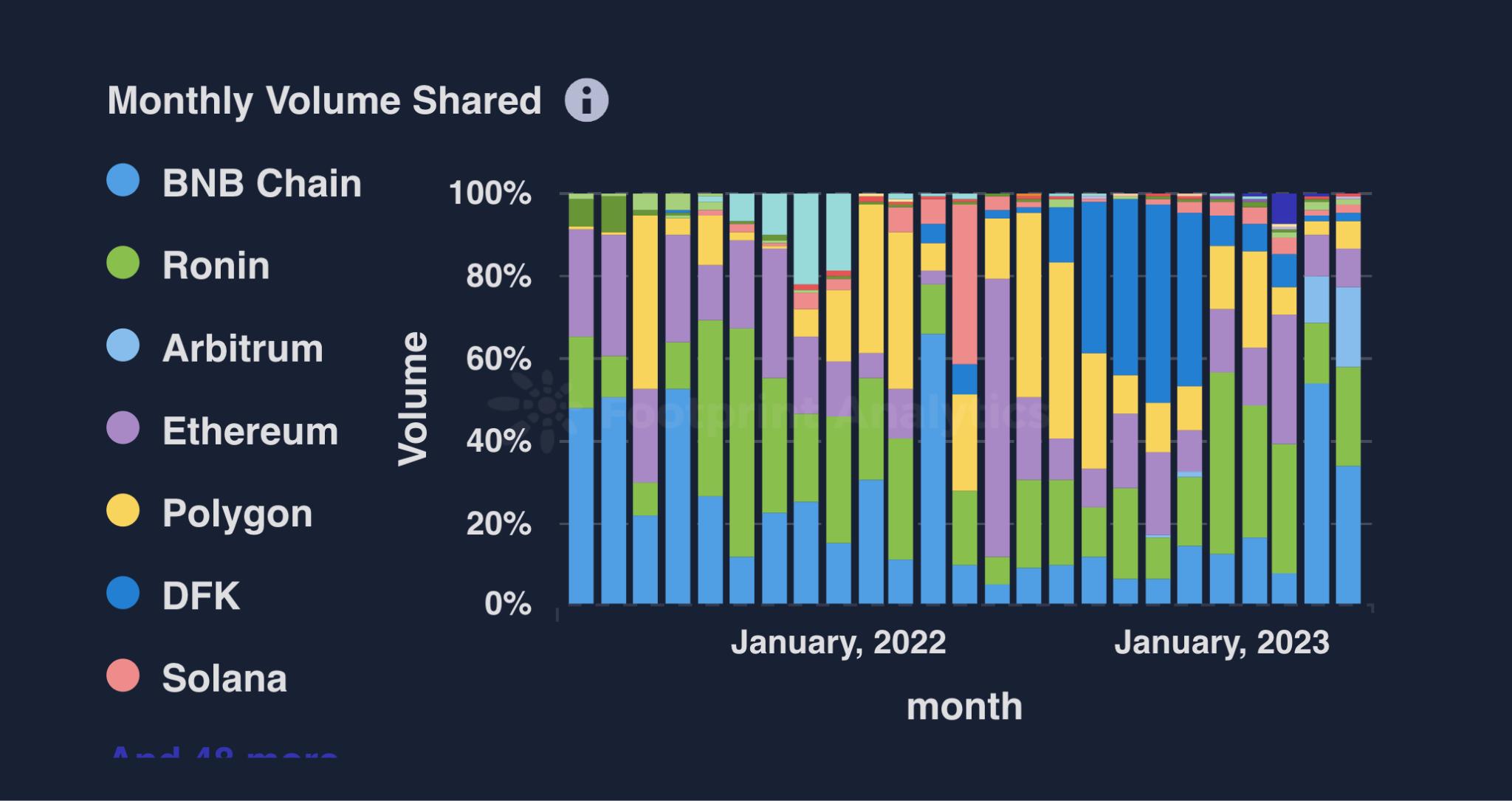

BNB chain accounts for 54% of the market in terms of trading volume.

GameFi Project Overview

-

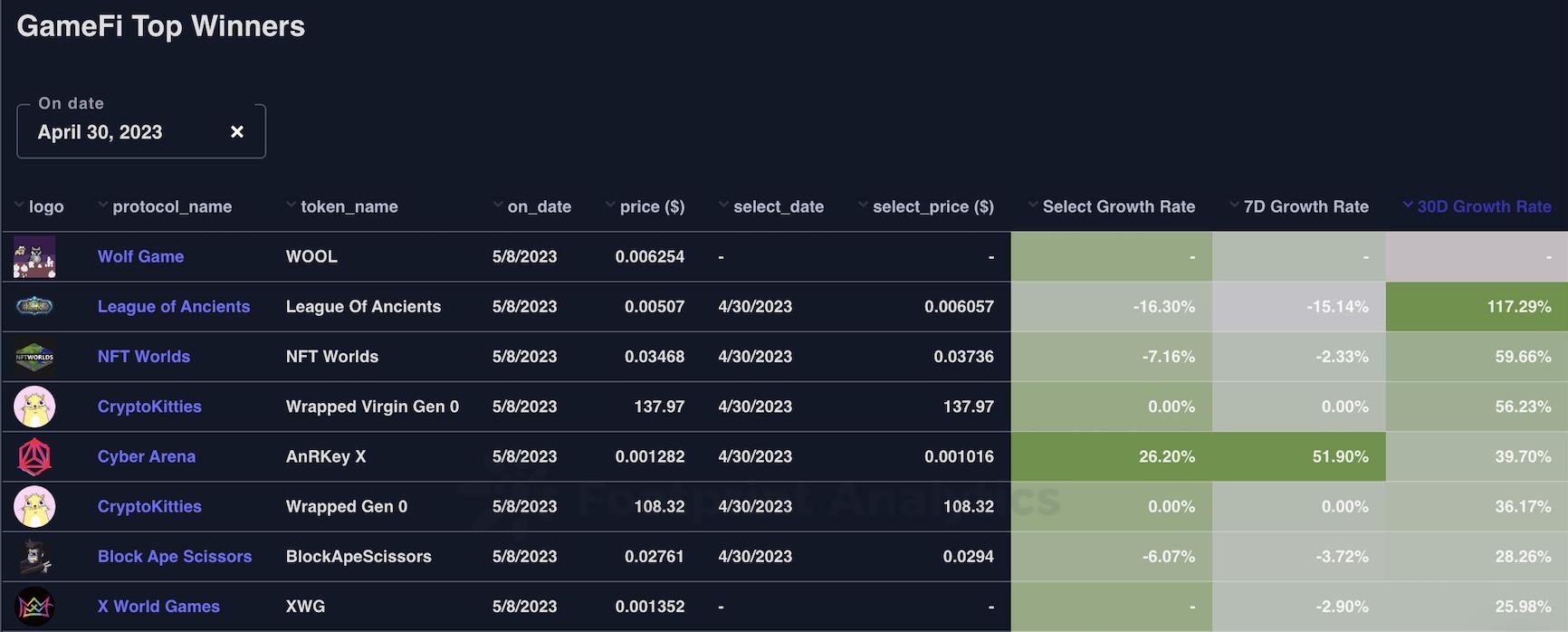

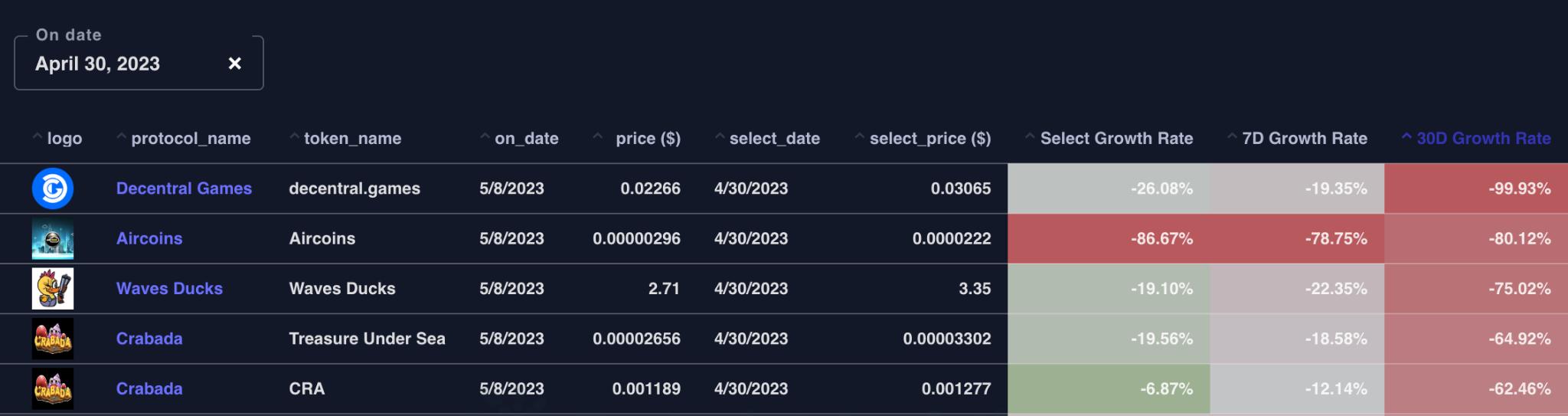

The projects with the largest price increase this month (excluding inactive games or very small projects) include League of Ancients, NFT Worlds, and Cryptokittes.

-

The once-promising Crabada has the highest percentage drop, with a token value drop of more than 60%.

Overview of GameFi Investment and Financing

-

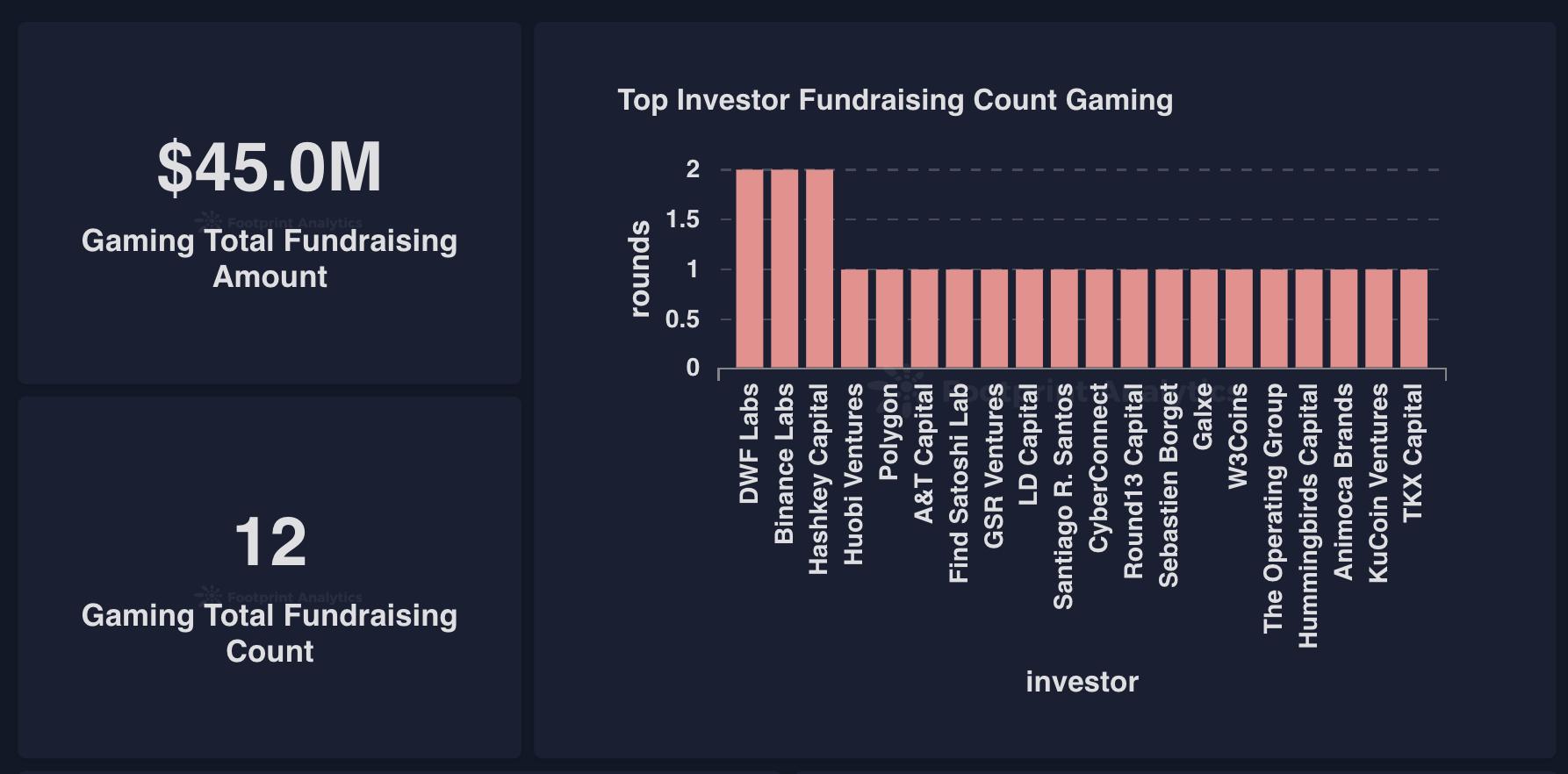

There were a total of 12 GameFi-related financing rounds in April, totaling $45 million, a decrease from previous months.

-

Web3 karate combat game Karate Combat raised $18 million.

-

Chain game RACA completed a $16 million financing round.

Market Overview of GameFi

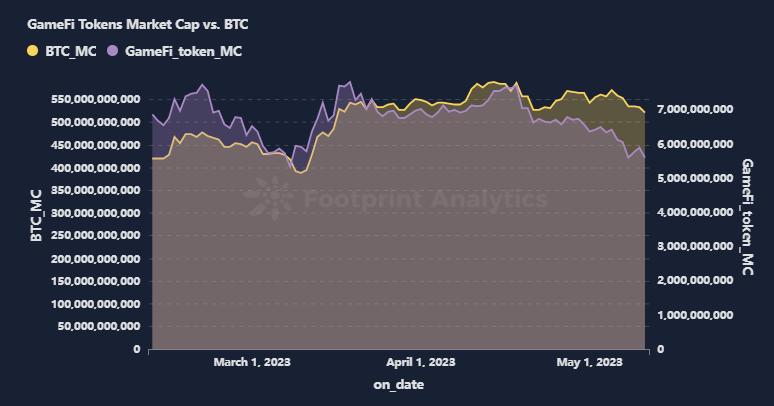

Bitcoin prices remained above the support level of $27,000 and reached a 11-month high of $30,506.

For most of April, the market value of GameFi tokens was closely related to Bitcoin, but in the second half of the month (from April 15th to May 1st), the market value of GameFi tokens fell more sharply.

In the second half of this month, Bitcoin’s market value fell by 7.2%, while GameFi tokens fell by 15.5%. This difference suggests that GameFi projects are inherently riskier and more susceptible to fluctuations in market funds during a downturn. As investors tend to withdraw from risky assets during periods of economic uncertainty, GameFi tokens are particularly vulnerable. However, this downturn also provides potential opportunities for those willing to take on extra risks.

Although the GameFi market has experienced significant declines, it also reminds investors to maintain a balanced investment portfolio, make diversified investment choices, and pay attention to managing potential risks.

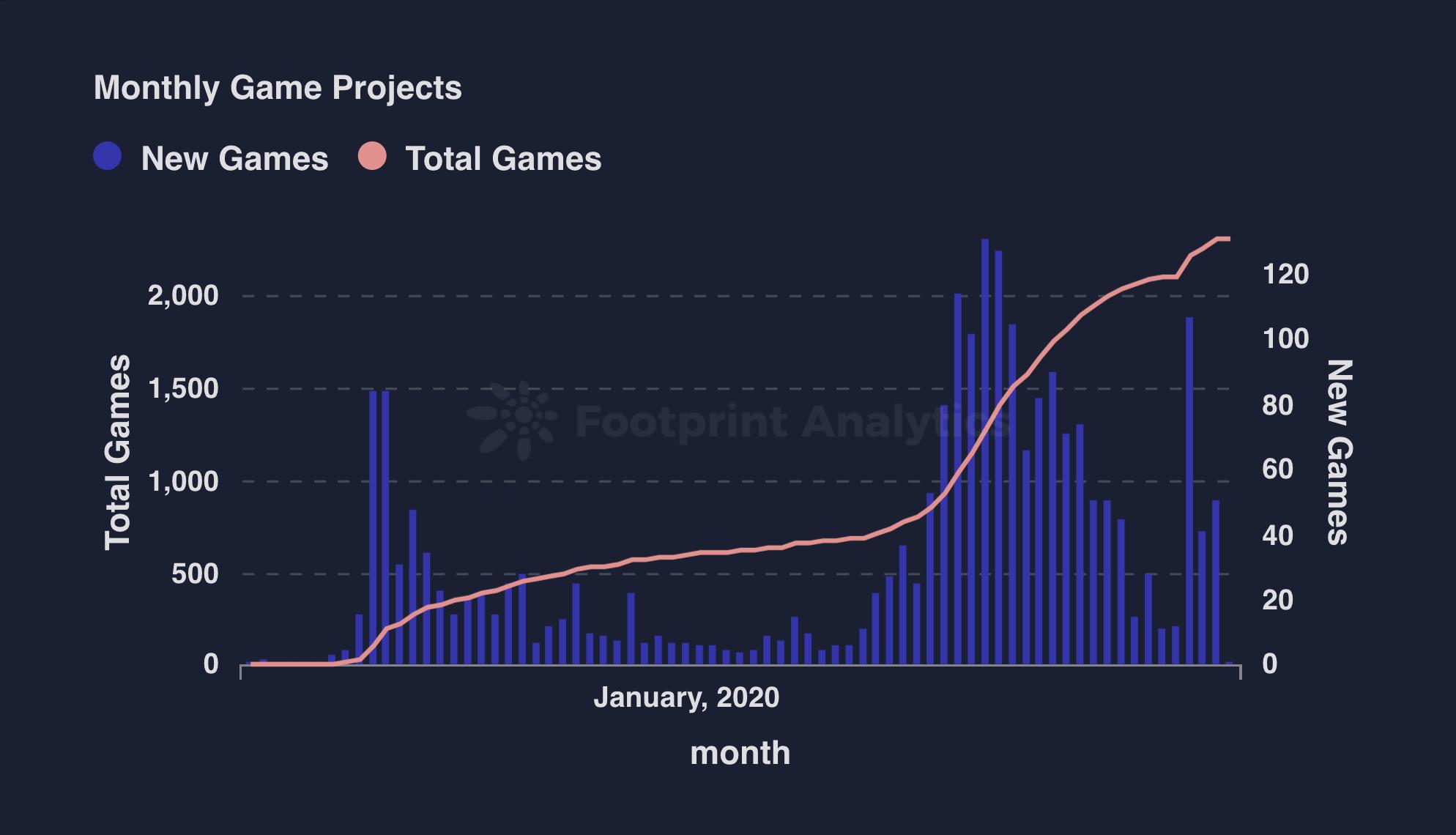

51 new GameFi projects were launched in April

In April, 51 new GameFi projects were launched, an increase of 10 from March, but still less than the amazing 107 in February. At the same time, the number of active games reached a historic high of 1,040 in April. Overall, this index has been on the rise for the past few months, but there have also been some small monthly fluctuations.

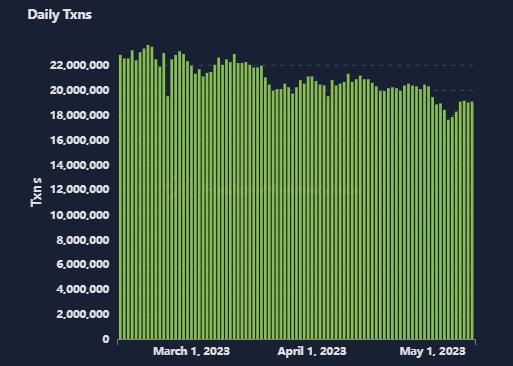

Starting from the beginning of the month, the average daily trading volume showed a downward trend, reaching a monthly low of only $19.3 million on April 23rd.

The overall monthly transaction volume in April decreased by 8.2% compared to March.

Through the analysis of monthly data in the previous article, we can see that the market value of Bitcoin and GameFi tokens have both decreased, and the market value of GameFi tokens has decreased significantly more than that of Bitcoin. This indicates that the decrease in user activity has led to a decrease in the frequency of transactions by active users, which in turn has led to a decrease in the overall transaction volume. Possible reasons include a decrease in user stickiness or a decrease in trading opportunities in the game.

Although the transaction data for April has declined, the decline is not significant, and the long-term fundamentals of the industry are not expected to be significantly affected.

GameFi User Analysis

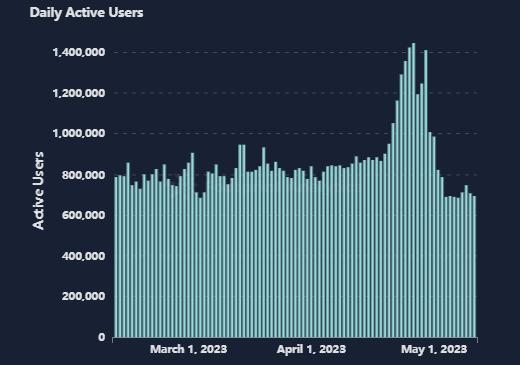

There were some fluctuations in GameFi’s user data in April, but the overall trend remained upward.

In April, GameFi’s user acquisition and retention performance was impressive. On April 26, the daily active users jumped to 1.49 million, with a growth rate of 72.4%.

Although the number of daily active users dropped to 1.01 million on April 30, it was still higher than the beginning of the month, indicating that the surge in active users on April 26 was not a one-time event, but rather new users were highly retained to a certain extent. This growth is a positive signal for GameFi projects.

GameFi Public Chain Data

The distribution of active public chains for the project remains basically unchanged.

Wax, BNB, Polygon, Ethereum, and Solana each have 84, 78, 73, 23, and 12 active games, respectively.

BNB has the most new games, with a total of 20.

In April, BNB performed well in the GameFi field, making it a potential leader in this field. Its openness, low Gas Fee, and strong liquidity support make it an ideal choice for game project development.

Meanwhile, Polygon performed well in April, having the second highest number of active games at 11.

BNB Chain accounted for 54% of the market in terms of trading volume.

But at the same time, Solana’s trading volume only accounted for 1.2% of the total trading volume.

GameFi Project Overview

The projects with the largest price growth this month (excluding inactive games or very small projects) include League of Ancients, NFT Worlds, and Cryptokittes.

The once-promising Crabada suffered the highest decline, with token values falling by over 60%.

The decline in token prices indicates that the project may have encountered problems or failed to meet market expectations. A significant drop in token prices may have a negative impact on the project, reducing community confidence and affecting subsequent fundraising and development.

A year ago, this crab-themed fighting game was one of the largest and most active GameFi projects on Avalanche.

GameFi Investment Overview

In April, there were a total of 12 rounds of GameFi-related financing, totaling $45 million.

The number of financing rounds increased from the 5 rounds in March, but the total amount did not reach the $77 million in March (in March, Icelandic developer CCP Games completed a round of financing of up to $40 million).

Web3 karate combat game Karate Combat raised $18 million for the launch of the Karate Combat “Up Only Gaming” app and KARATE tokens in April.

Chain game RACA also completed a $16 million financing round.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!