Related topics: CZ and SBF entanglement and competition

1. I don’t know if the “CZ” technique will make it into business or financial history, but at least it will make it into encryption history, which the average person might not be able to read, but trader would be impressed. Looking back ten years from now, not only will it be a better business war than the movies, but it could be very meaningful.

2. Everything is deal, the richest man in China. Cz put up with it for two years and invested in FTX at the end of 2019, investing 20% in Alameda’s market-making capabilities, only to raise a formidable rival who not only stole his market, and laughed at his wild ways from a compliance point of view.

3. From the moment the FTX was found to have misappropriated funds, C-Z won outright. Exchange is the most important brand, is the user trust, from the beginning CZ to play the industry guardian image, as long as the commanding heights, no matter how Sam subsequent rescue, is futile.

- Read the recent FTX crash story, how did SBF fall overnight?

- CZ won FTX, but detonated the real Lehman of the encryption world

- Rug Pull: analyze DeFi scams in detail

Four. In fact, Sam gave up too early at first. CZ might have just wanted to test the pressure and give him a little push, but he didn’t expect his opponent to fall down immediately. It was no wonder that he was being pursued relentlessly from behind, after all, CZ is fighting in the Big Three. The exchange is the most pay attention to head effect, CZ does not care about the $2 billion FTT cash, otherwise would have TWAP slow delivery or OTC, he wants to eliminate the opponent.

5. To be precise, Alamada is no longer a hedge fund. It made 7,000 bitcoins at BitMEX and was a market maker at Binance. Thanks to the FTX Exchange, Sam has become a super Broker. After all, it’s easy to make money with money. However, in the face of the big trend, the giant’s weight is a burden. Sam has been doing so well these past two years that even though the media has been promoting him as“Sleeping on the office couch,” his efforts should not be used as an excuse for carelessness. Wind control should remain the No. 1 priority.

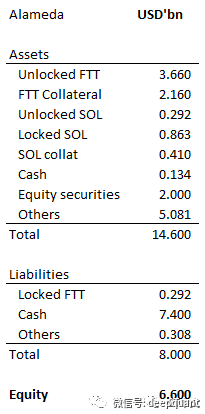

6. Where’s Alameda’s money? With assets of $14.6 billion, of which $8 billion is borrowed, it is probably insolvent, given the amount of water in the assets. Especially in the bear market, in the great panic, FTT and other cryptocurrencies have no liquidity, it is curious what is in this others?

Seven. Based on the FTX’s financing and fee income, it’s estimated that there’s $3 billion in cash on the books, but that’s shareholder money, not Sam’s. If Alameda had to be bailed out, those investors wouldn’t have agreed to it, so Sam is really passive.

8. Unlike Luna, the Luna crash was an arbitrage of divestment, where the fundamentals were rotten and the arbitrageurs were naturally short. Capital is profit-oriented, when there is a certainty of income, will be desperate to increase the leverage bet. However, FTX this time is a long knife slow cut, there are many variables.

9. Some people say that the FTX is the U. S. government’s own son, root is Miao Hong, it is too naive. The United States is at least a rule of law society in the process, do not use the Chinese relationship to understand, even if there is political contributions, it is under the condition that you guarantee clean. If you break the financial law, no matter who you are, you won’t be able to pass the hearing. Besides, the Department of Justice and the S.E.C. are not amateurs. Many of them will write the code themselves.

Ten. Is it possible that the script was already written? After all, the bear market to the end, are cut the last“Big”, “Fund”, and then re-narrative, the world unified, market concentration, IEO bull market opened? In the future, centralised exchanges will have to rely on CZ to be a good guy. Is this not a tragedy for the “Decentralised” blockchain fundamentalism?

Eleven. If UNISWAP had a master marketer like Moshe Sun, it would have been a big winner. In such a crisis, as the leader of the decentralized exchange, UNISWAP’s advantages of transparency are self-evident, and the value of WEB3 should be seen by more people.

Ba not only CZ, behind the strategy team is the real brains. According to CZ’s style of ripping sequoia by hand, there was still the second half to come. He continued to insert needles and gain fame and fortune during the ripping, but now it was only a half-time break.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!