Introduction: Since its inception, public chains have made significant progress and attracted high attention and investment from the global industry and countries. Its decentralized nature and transparent framework make it an ideal tool to promote secure and efficient transactions, paving the way for new business models and use cases. In addition, the growth of the public chain market is remarkable and is expected to continue to accelerate in the foreseeable future.

Curtain One: Market Distribution

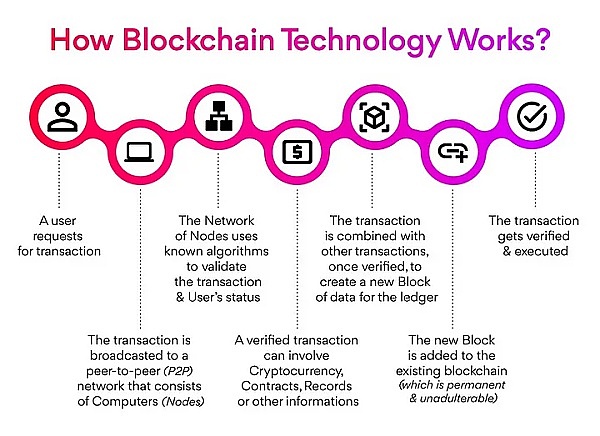

Generally, the market types of public chains include pseudo-anonymous addresses, which allow users to hide their real identity behind unique addresses; PGP encryption, which provides secure communication between parties involved in transactions; cryptocurrency, which provides an additional layer of security through encryption algorithms; and distributed consensus, which ensures that all nodes on the network reach consensus on the validity of transactions.

At the same time, public chains are also widely used in the market, including financial services (using blockchain for secure and transparent transactions, eliminating the need for intermediary institutions) and non-financial sectors (such as supply chain management, medical record management, and voting systems, etc.). Both markets benefit from the security and transparency provided by blockchain, enabling more efficient and trustworthy transactions.

According to relevant data, it is expected that public chains will achieve significant growth in the next few years, especially in North America, Asia-Pacific, Europe, the United States, and China. As the adoption of blockchain technology in industries such as banking, finance, healthcare, and supply chain management in the early stages, the United States is expected to occupy an important market share in the public chain technology market. As emerging economies such as China and India increasingly adopt blockchain technology, the growth rate in the Asia-Pacific region cannot be ignored. In addition, the number of blockchain startups in the European region is increasing, and the demand for blockchain solutions in various industries is also increasing.

- Social app Primal, based on the Nostr protocol, raises $1 million in funding with participation from Hivemind Ventures.

- Blockchain + Artificial Intelligence? Beware the red line of pyramid schemes

- Circle has made small layoffs and terminated investment in non-core activities.

Overall, driven by the continuous adoption of blockchain solutions in various industries and the increasing awareness of the advantages of blockchain technology, the public chain technology market is expected to achieve significant growth in the next few years.

Curtain Two: Development Potential of Public Chains

According to the market research report on public chain technology, the global market size of public chain technology will have a compound annual growth rate of 4.7% during the forecast period. At the same time, the survey results from the report show that various industries such as finance, healthcare, and supply chain management are increasingly adopting blockchain technology, which is driving market growth. The report recommends that companies invest in research and development to enhance the security and scalability of public chain solutions to ensure their future successful implementation.

On the one hand, in the unprecedented digital age, public chain technology has become a promising solution for secure and transparent transactions. With the advancement of various technologies such as pseudonymous addresses, PGP encryption, cryptocurrency, and distributed consensus, the market for this decentralized technology has grown significantly.

Pseudonymous addresses allow users to maintain privacy on the blockchain while ensuring transparency and accountability. PGP encryption adds an extra layer of security by encrypting sensitive data, preventing unauthorized access. In addition, mainstream cryptocurrencies such as Bitcoin and Ethereum have gained widespread acceptance, providing users with a secure and efficient medium of exchange.

On the other hand, the distributed consensus mechanism in public chains eliminates the need for central authority, ensuring trust and reliability. These features not only completely change the financial services industry, but also apply to non-financial fields, including supply chain management, healthcare, and voting systems.

However, the adoption of public chain technology is not without its challenges. Regulatory and legal factors play a crucial role in shaping the market conditions for these technologies. Governments around the world have been working to strike a balance between promoting innovation and preventing potential risks such as money laundering and fraud. Therefore, different regions have enacted different regulations to ensure compliance with the legal framework, leading to a decentralized regulatory landscape.

Despite these challenges, the public chain technology market still shows tremendous potential. With technological advancements and the development of regulatory frameworks, companies and organizations can harness the power of blockchain to streamline operations, enhance security, and drive innovation in both financial and non-financial fields, ensuring a prosperous digital future.

Veil Three: Value Capture of Public Chains

During the last bull market, Ethereum played a crucial role in the development of public chains. For many public chains at that time, in order to achieve benign development of their ecosystem, they needed to capture value from ETH, which means attracting large funds to migrate while ensuring high availability and full coverage of their ecosystem, especially since most public chains want to start with DeFi and compete with ETH on TPS.

If we regard an ecosystem as a small financial circle, then more ecosystems will have many ecological niches, and each ecosystem will occupy a unique position according to this ecological niche. Of course, the ecological construction of some public chains is voted by users with their feet. Products that are not used by users will gradually be eliminated from this ecosystem, and this public chain naturally has its ecological niche and its own positioning.

The previous funds flowed from the real world to the chain world. This interface is currently mainly solved by CEX, and some DEXs are trying to solve this part of the problem. In fact, it is quite difficult to solve the problem of offline funds going to the chain through DEX, and traditional institutions cannot be avoided. The method of introducing various national currencies and stocks by Terra is one solution, although it finally fell out of favor due to the collapse of Luna. Although the current players in this track are mainly CEX, the trend is definitely towards DEX, and the final form should be DEX+CEX.

Most of the on-chain DeFi is currently competing with Layer2 built on Ethereum or other public chains. Due to the limitations of Ethereum’s TPS and high GAS fees, many low-value users have to give up participating in the GAS war and look for lower consumption. This is also inevitable in the development of things. Early value profit-makers must find ways to maintain profits, and later value miners also need to increase their income. This inevitably makes a large number of value miners move to other ecosystems to mine more value.

Except for Solana, Cosmos, Polkadot and other public chains that have decided to solve specific problems only in certain specific directions due to their initial design, the other public chains are actually looking for their own positioning in the process of on-chain DeFi, and with the market explosion, some public chains will use the early ecological construction to occupy the ecological position, bend overtaking in the two subdivided areas of prophecy machine and cross-chain, and start a new round of public chain wave.

Conclusion: As the infrastructure and underlying technology of the Web3 world, public chains are the cornerstone of Dapps and the gathering place of ecology and community. Although there are still many shortcomings in the current public chain projects, such as high user access thresholds, high development difficulties, insufficient network throughput, gas fees, etc., the serious problems are exacerbated by the emergence of good and bad projects in the start-up period. It is undeniable that many public chains will usher in a reshuffle in the near future, and public chain projects that are based on technology and are committed to network value realization can develop in the long run!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!