Blocking journalist Jessy

A revolution in traditional banking is taking place.

When all the functions of traditional banking, such as payment, clearing, and settlement, are put on the public chain and connected to cryptocurrencies, an imaginative application appears. This is a Dapp called Fiat24, which is built on Arbitrum and links crypto wallets with traditional banks. Through this Dapp, users can register and own their own Visa card and also have an NFT account, which can partially replace a user’s traditional bank account.

Because this Dapp integrates a series of Web3 services and is governed by Swiss banking law, it can operate some banking functions. On this account, users can complete the exchange of cryptocurrencies to fiat currencies, complete deposits and withdrawals, complete forex exchange for fiat currencies, bind their Visa cards to some payment platforms for consumption, and withdraw cash from NFC-enabled ATMs, which can basically be used as a normal Visa card. Some of these actions occur or are recorded on the chain through the execution of smart contracts and require gas fees.

- What are the key mistakes in understanding Arweave, and how can they be avoided?

- The US Internal Revenue Service is investigating cryptocurrency traders who are taking advantage of tax benefits in Puerto Rico.

- An Explanation of Liquidity-Weighted Collateral Tokens (LRT) and EigenETH

We can also see this Dapp as a core banking system that is completely built on the blockchain and driven by smart contracts. Its revolutionary role is to break down the wall between the banking and crypto industries. In traditional electronic banking, users access their bank accounts using usernames and passwords and usually receive SMS messages to obtain transaction confirmation codes to complete payment instructions. All customer data and transaction records are stored in the bank’s backend databases, which are subject to single points of failure. On the Fiat24 platform, each customer holds a unique NFT to represent their identity and accesses their cash account through this NFT, completely abandoning traditional accounts and passwords. For the traditional banking industry, this is undoubtedly revolutionary.

What can people do with Fiat24?

Currently, Chinese and American users are not allowed to use this Dapp. Only 24 countries are allowed to use the service. The process of opening a Visa card account on the platform is the same as opening an account with a traditional bank and requires strict KYC.

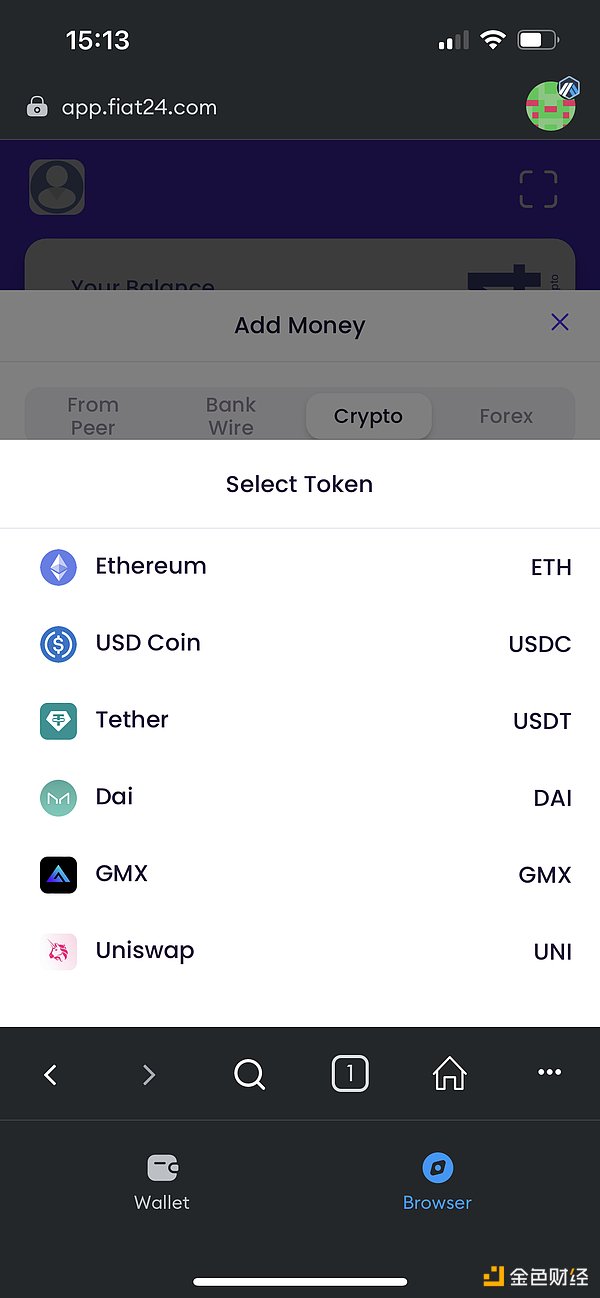

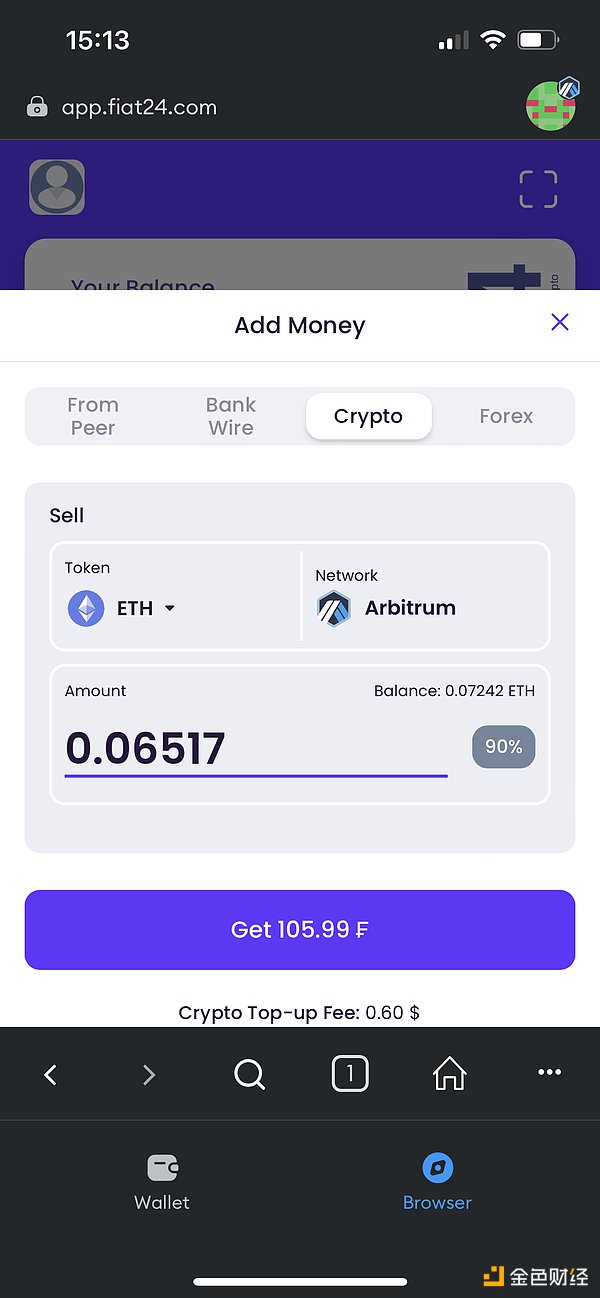

According to its official website, users can directly convert their crypto assets into fiat currencies and deposit them into their accounts through this Dapp. According to tracking the exchange address on the chain, we can see that this step depends on converting various cryptocurrencies into USDC in Uniswap first, and then exchanging USDC for US dollars in Centre. On the user side, when a user clicks to sell their virtual currency, they will soon find that their Visa card account shows that cash has been credited. This is achieved by executing the well-written smart contract.

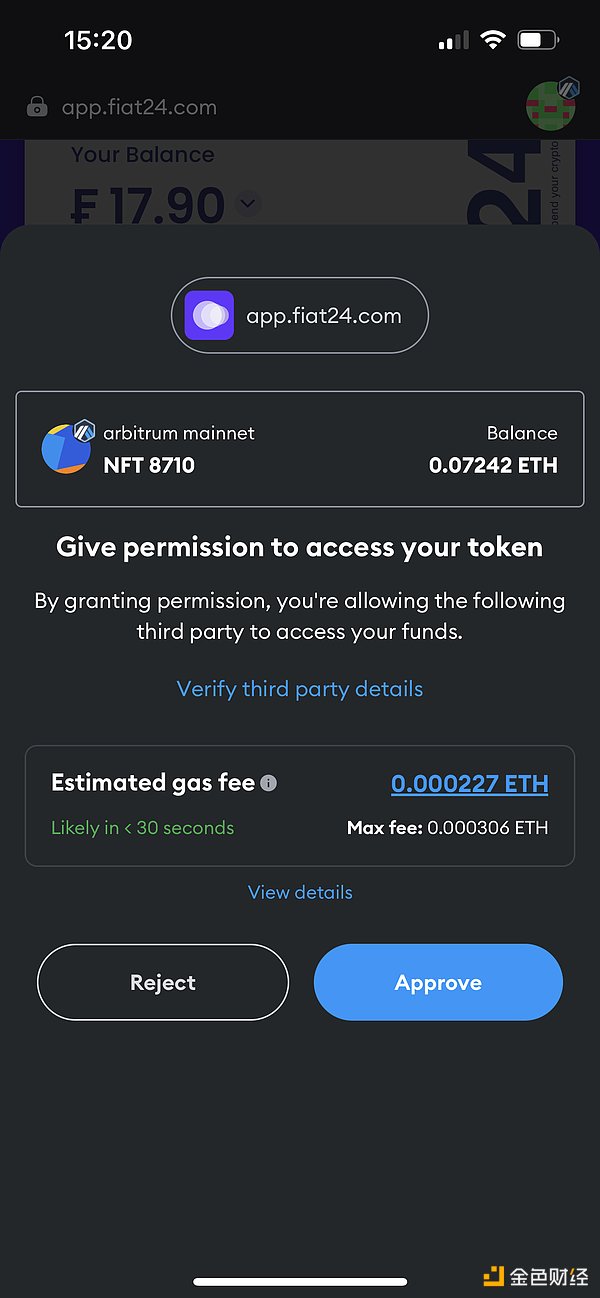

This process is also called recharging your account with cryptocurrency. During the process, the user needs to authorize Fiat24 to access USDC in the Ethereum wallet linked to the account and sign and confirm the transaction through the wallet’s signature request.

Sell virtual currency/recharge cryptocurrency to account

In terms of withdrawals, you can use this Visa card to consume directly, or bind another bank card of your own account, and this withdrawal card is required to have IBAN functionality as required. However, it is only necessary to withdraw from the Fiat24 account to an account with IBAN, and there is no such requirement to directly recharge the account with fiat currency.

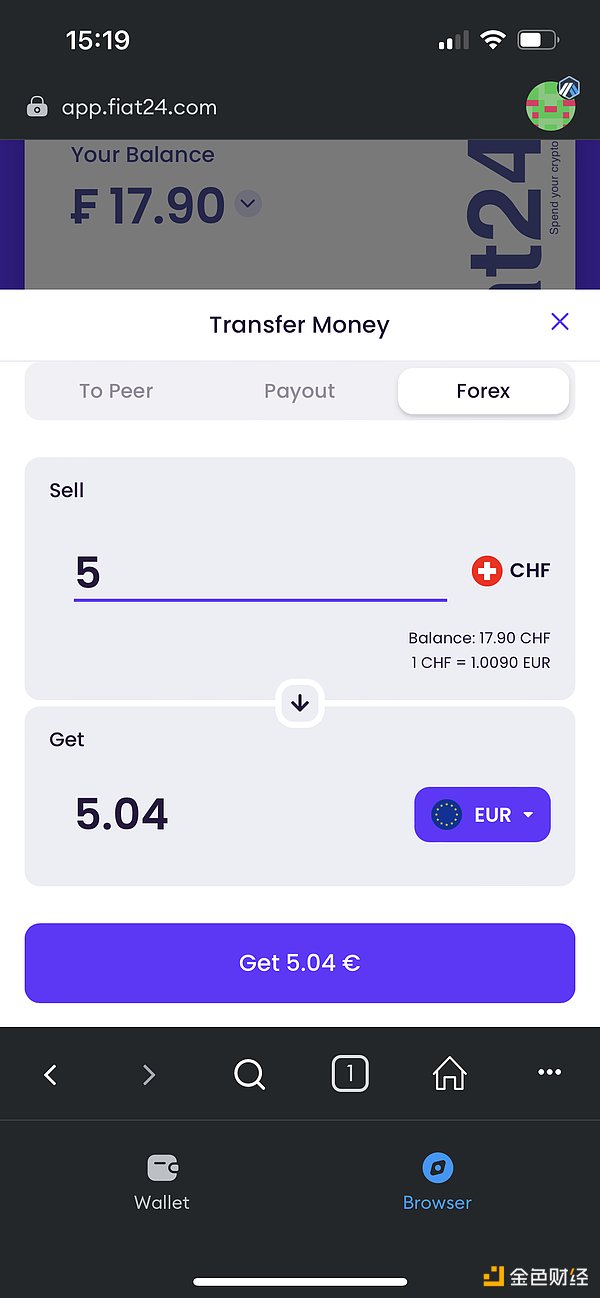

The logic of traditional banks in electronic payments is to first account for the transaction and then settle it. The same is true for this Visa card, except that the accounting process occurs on the chain. For example, in the exchange of foreign exchange, Fiat24 also maps the process of exchanging US dollars for other currencies to the chain, so the gas fee consumed by the accounting consumed in the currency exchange.

Fiat exchange page

Gas consumed in foreign exchange

According to the demo provided by Fiat24, we can see that with this Visa card, we can directly complete transfers, consumption, and a limited variety of foreign currency exchange.

According to the project team, they have met the same anti-money laundering requirements as traditional financial institutions, and compliance infrastructure and processes have been audited by BDO Switzerland.

“Bank” driven by smart contracts

This is a change to traditional banks. Switzerland allows a fintech company to do some of the things that traditional banks do. And the core business processes are driven by smart contracts. For example, the process of recharging cryptocurrency to fiat currency in this account, although integrated with multiple services, these processes are written into smart contracts and executed according to smart contracts.

For the traditional financial industry, the clearing system is very complex, and funds need to be transferred through multiple clearing systems of banks, central banks and international organizations to arrive, while using blockchain can realize point-to-point instant payment, transfer electronic currency on the blockchain, carry out cross-border payments, greatly reduce the arrival time, reduce cross-border payment costs, and improve efficiency.

For the banking industry, blockchain, as a highly digital and secure ledger, can be used to achieve the core functions of banks: as a secure center for storing and transferring value.

Fiat24 can be said to be an iteration of banking business, because it integrates multiple services, such as currency exchange of Uniswap, U exchange of Centre and so on, and connects the whole process, and integrates the functions of banks, which are all written into smart contracts, so it can achieve a relatively smooth exchange experience from cryptocurrency to fiat currency.

Compared with Visa and Mastercard launched by Onekey and DeBlockingy, the biggest difference is that Fiat24 is allowed to have some banking functions and accept supervision. While Onekey and DeBlockingy need to find crypto-friendly banks for cooperation.

However, risks also exist. Fiat24 inevitably precipitates the fund pool. But on-chain makes all processes open and transparent, and risks are not black boxes, which can be quickly discovered. Moreover, when these processes are executed according to smart contracts, they cannot be tampered with.

In addition to building a bridge between Web2 and Web3, Fiat24 has also added some very Web3 gameplay, such as the sale of meta-universe land and the issuance of project tokens.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!