Author: Ryan Selkis, Founder and CEO of Messari; Compiled by Blockingcryptonaitive

Recently, Ryan Selkis, Founder and CEO of Messari, summarized the macroeconomic and crypto industry conditions for the first half of 2023 on Twitter. He said that he has never been more bullish on cryptocurrencies, and the second half of 2023 will be a grand one. He also pointed out 10 people and 9 products worth paying attention to in the second half of 2023.

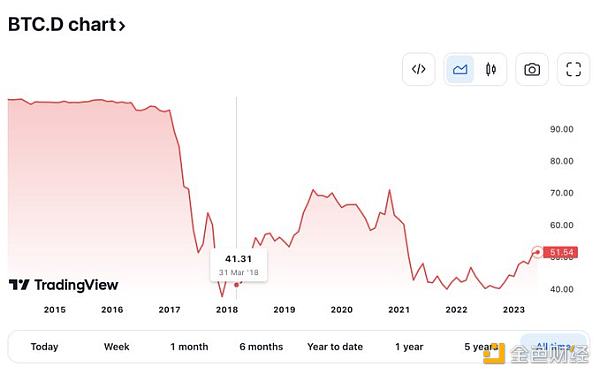

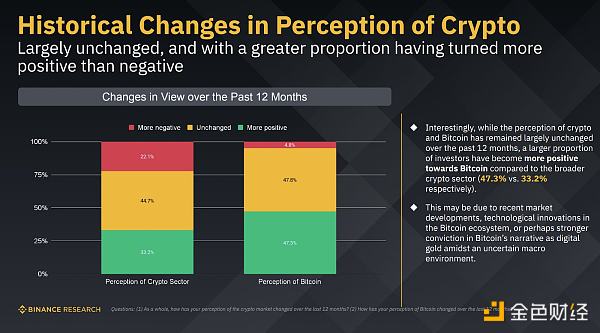

1. Everything is about macro (Bitcoin, ETH), not “cryptocurrencies” (DeFi, L2, NFT). This is not surprising unless this is your first cycle. The good news is that Bitcoin’s dominance often leads the recovery, and we are at a high point in recent years.

- Alluvial, a developer of enterprise-level LSD protocols, has raised $12 million in Series A funding. What makes them unique?

- Viewpoint: The profitability of the full-chain game is insufficient, and blockchain games need to attract more external users.

- Rollup for Specific Applications: Balancing the Tradeoff between Connection and Control

2. ETH has successfully “merged” and completed the “Shapella” upgrade, ushering in a new era of ETH as a hard currency and net deflationary asset.

Nevertheless, I still place more emphasis on a historical high signal indicator, the market value-to-realized value ratio, which is still slightly lower for BTC than for ETH.

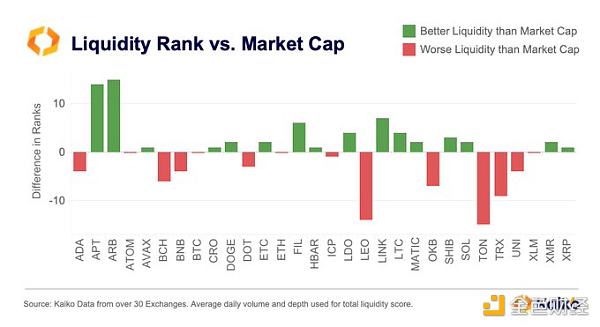

3. Kaiko created a liquidity ranking that combines market depth (price slippage) and exchange trading volume. The difference between their liquidity ranking and market capitalization reflects my personal “buy/sell” list for other major assets. (Not financial advice)

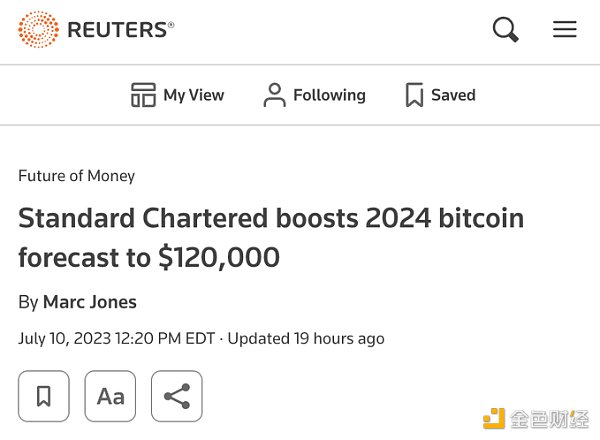

4. The Bitcoin spot ETF itself is not important, or at least its impact is easily priced in advance: Retail investors can front-run the ETF approval because the structural shift in demand will come from new institutional credibility (BlackRock), not ETF flows. Look at the forecast below:

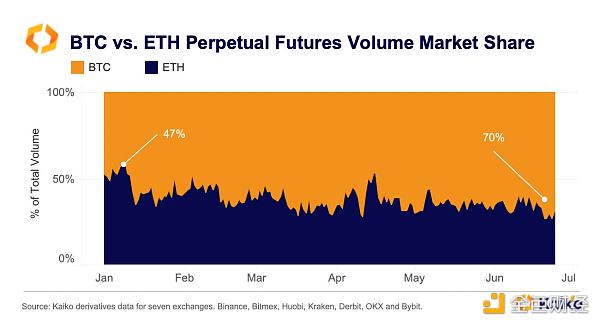

5. In terms of market liquidity, Bitcoin is unique, especially in the perpetual contract market. The king is still the king. Bitcoin’s “net preference” is growing rapidly: from 3:2 to 10:1.

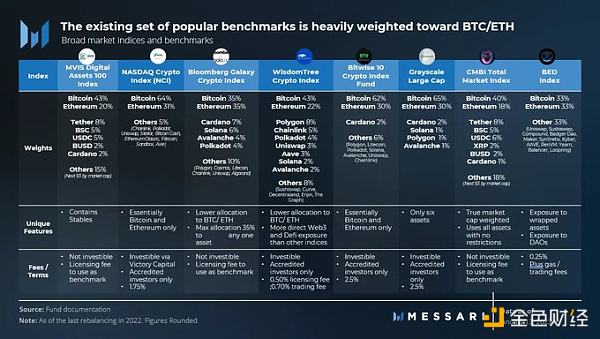

6. U.S. SEC Chairman Gensler is right: BTC and ETH account for 75% of the market share. But his practice of limiting other investments is wrong. Of the 26,000 stocks traded since 1926, 86 account for 50% of the rise in the U.S. market. Indexes can help investors achieve balanced investments:

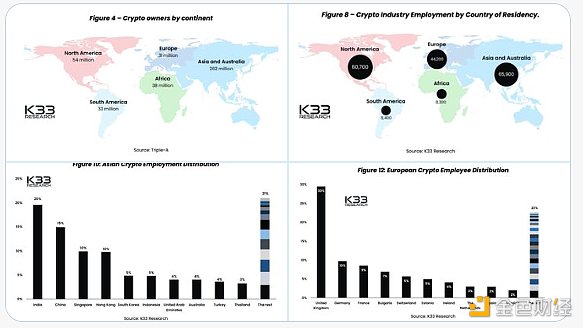

7. An unelected corrupt bureaucrat should not be allowed to prevent participation in a trillion-dollar market with 190,000 employees (including 60,000 Americans). The cumulative valuation of global cryptocurrency companies has reached $180 billion. The United States should win this market. Long US, India, UK.

Narrative Impetus

Cryptocurrencies must be placed in a macro backdrop, and only become important when it comes to important major medium-term trends (lack of confidence in central banks; their role in an AI-driven world; the global economic balkanization in “Great Power Conflict”).

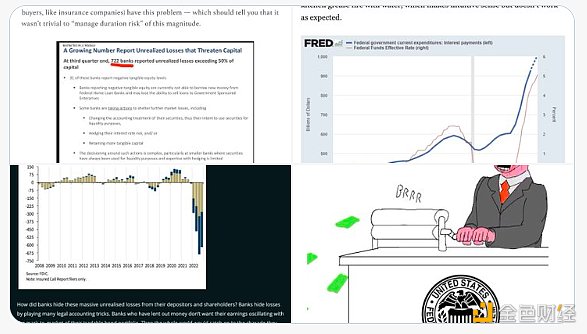

8. Macro: The most likely scenario is that the Fed will yield and change monetary policy, otherwise the retail and commercial real estate debt markets, as well as bank solvency, will come under too much pressure. Apart from the Fed, no one can buy government bonds. The printing press will come back.

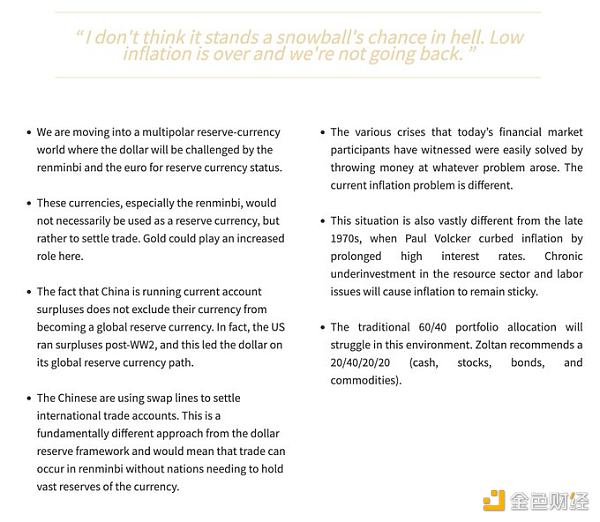

9. Geopolitics: “Non-aligned countries” (independent countries or countries competing with the United States) will turn to “external currencies” such as gold and cryptocurrencies for reserve diversification.

Certain genies (sanctions abuse) cannot be put back in the bottle. Long live Lord Zoltan:

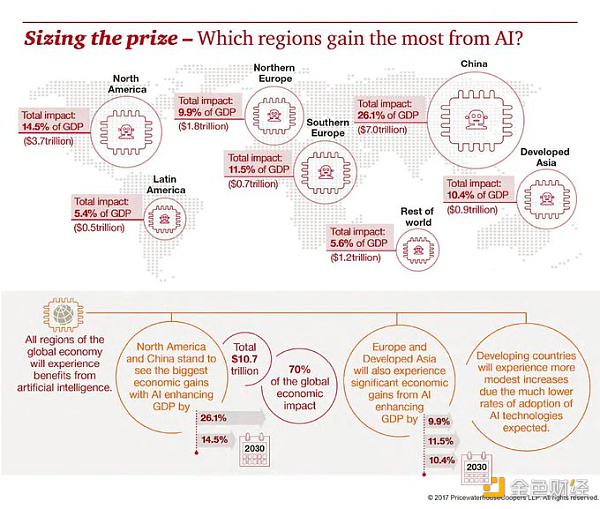

10. Artificial Intelligence: In the era of immense digital richness, it is crucial to provide technology that is reliable, global, and mathematically guaranteed scarcity. In addition, AI will be the ultimate driving force behind the adoption of cryptocurrencies, as they are the perfect machine-to-machine currency. If cryptocurrencies grow in parallel with AI… watch out.

10 people to watch in the second half of the year

11. Blockingul Grewal leads Coinbase’s fight against the US government on cryptocurrency. Coinbase can keep cryptocurrency’s status in the United States until the 2024 election. After that, our prospects depend on the courts and Congress.

12. The third person to watch is Dante DisBlockingrte, the chief strategist of Circle. As for the stablecoin legislation we’ve seen from both parties this year, it will largely depend on Dante and his team.

13. The third person to watch is a leader of BlockingC (The American Blockchain Political Action Committee), who may ultimately help secure several key seats in swing state House and Senate races in the 2024 elections. BlockingC needs about $50 million.

14. If 2023 is the year for cryptocurrency lawsuits against the government, the most important lawyer won’t be Blockingul Grewal. It will be Stuart Alderoty. Ripple’s lawsuit against the SEC will have a huge impact on the future of non-bitcoin digital assets and their trading in the United States. The verdict is pending.

15. Winklevoss Twins + Barry Silbert: Genesis’ closure, Gemini Earn customer solutions, and fraud allegations against DCG will lead to a long and ugly legal battle. That said, this is just a sideshow: the fate of DCG depends on the GBTC ETF conversion.

16. The UK is taking cryptocurrency seriously. Perhaps that’s because they have a Prime Minister, Rishi Sunak. When he was Chancellor of the Exchequer, Rishi formed a UK CBDC Taskforce and oversaw comprehensive new laws regulating the UK cryptocurrency industry.

“Where are the builders?” You may wonder why 6 out of 10 of the observed are lawyers, politicians, or active litigants. That’s where we are in this market cycle. But there are four builders worth paying attention to:

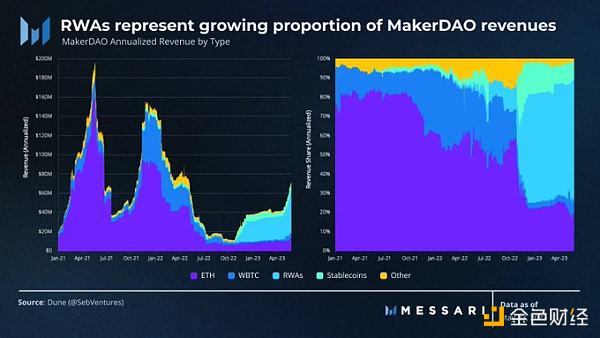

17. Rune from MakerDAO: In the summer of 2022, Rune proposed a decade-long plan called “Endgame” to simplify Maker’s core governance structure and reduce the protocol’s reliance on centralized collateral (dollar stablecoins and RWA ceilings).

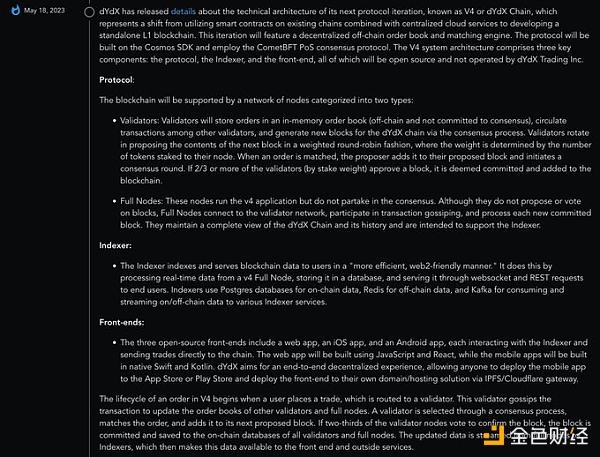

18. Antonio Juliano must also be included, considering dydx’s ambitious transition from an Ethereum Rollup to a Cosmos-supported application chain.

19. There are rumors of possible actions that the Ministry of Justice may take against Binance, especially after CFTC/SEC takes action and some executives leave. I am 44% confident that CZ (and his remaining team) can weather the storm in two ways: 1) record fines of over $1 billion and 2) further decentralization.

20. Larry Fink, CEO of BlackRock:

Changes his attitude towards cryptocurrencies in five years; CEO of the world’s largest asset management company; joins the BTC spot ETF competition with a score of 575-1; “digital gold”; “technology is great”

This is more significant than Tudor Jones’ endorsement in 2021.

9 Products Worth Watching in the Second Half of the Year

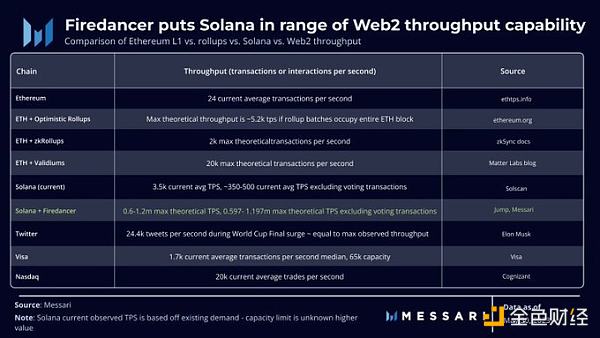

21. Firedancer is a Solana validator client developed by Jump Crypto, which can enhance Solana’s scalability, reduce latency, improve client diversity, and has amazing TPS potential. Betting “modularity” and “Rollup” against the trend.

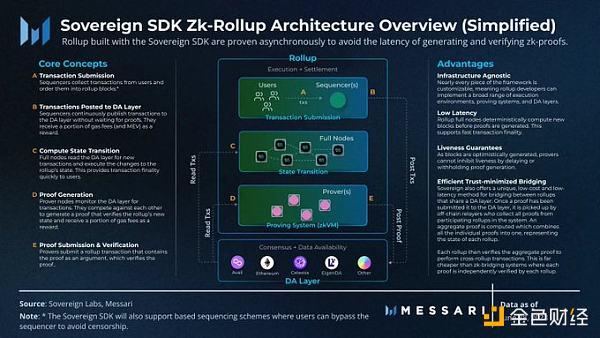

22. Sovereign SDK is a flexible, chain-agnostic Rollup development framework and the first major project dedicated to connecting different types of zk-rollups. Flexibility. Customization. Interoperability.

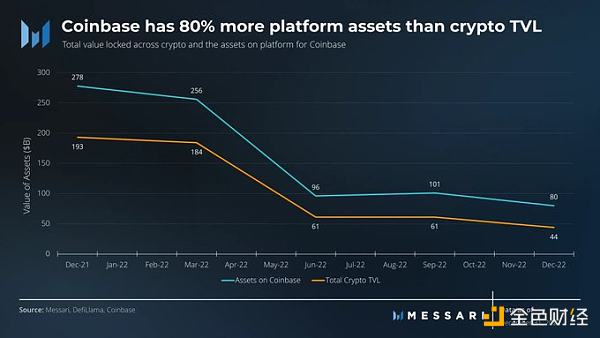

23. BASE from Coinbase, built on OP Stack. It has no tokens yet, but Coinbase (with 110 million users) entering the Layer2 ecosystem is a major event for on-chain finance.

Coinbase’s “TVL” is 80% higher than DeFi.

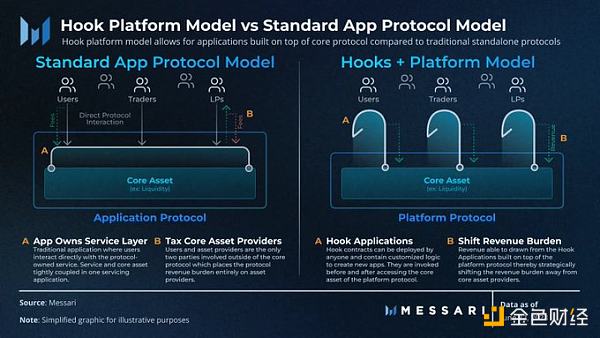

24. Hooks in Uniswap v4 are customizable smart contracts with specific integration rules for specific protocols. They help enhance network effects. For example, Uniswap v4 plans to use hooks to evolve from a DEX to a liquidity platform.

25. The ETH staking ecosystem is exploding. If the ETH staking rate reaches 50%, this will be a $3-5 billion revenue opportunity, and centralized services and liquidity staking services will compete. My observation list includes: Eigenlayer, Alluvial, Lybra.

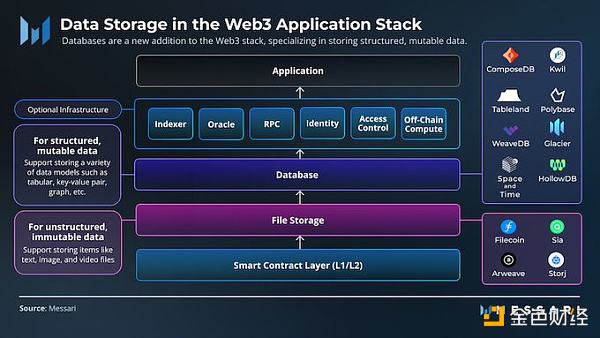

26. Decentralized database (Ceramic + SBlockingce & Time): supplement the smart contract platform and decentralized file storage network, and achieve better data composability, ownership and verifiability, as well as Web3-native access control.

27. Lens (and Farcaster): early leaders for decentralized social use; top-notch in composability and functional potential; may be the turning point for decentralized social as our social graph is split by Web2 giants (Twitter and Threads).

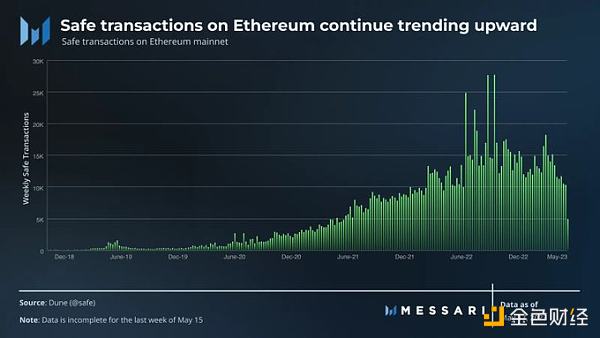

28. Safe (wallet) will benefit from ERC-4337 (account abstraction), which will impact the early wallet industry. These early smart contract wallets currently hold about $35 billion in value on the Ethereum mainnet alone and adoption rates are increasing every day.

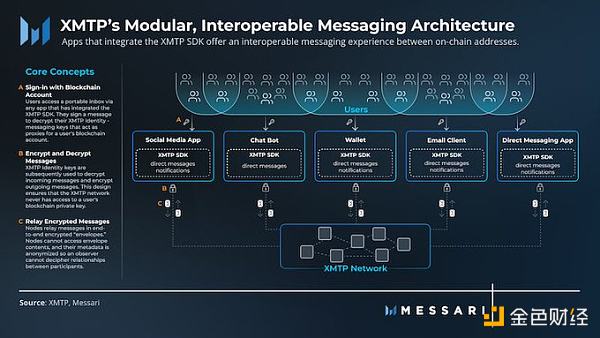

29. XMTP is building the messaging layer for Web3. The massive demand is for a universal messaging protocol and network that allows end-to-end encrypted messaging between cryptographic addresses. Nearly one million XMTP inboxes have been generated to date.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!