Compiled by: W3CDAO

Bitcoin (BTC) is a decentralized digital currency with a limited total supply, not controlled by any government or institution. The issuance of Bitcoin is achieved through a process called mining, where miners use computational power to verify transactions on the blockchain and receive Bitcoin as a reward. However, the issuance of Bitcoin is not constant, but rather decreases periodically, a process known as Bitcoin halving.

Bitcoin halving refers to the halving of the number of Bitcoins issued in each block on the blockchain whenever 210,000 blocks are generated (approximately every four years). The purpose of this is to control Bitcoin’s inflation and maintain its scarcity and value. The total supply of Bitcoin is limited to 21 million, which is expected to be mined by 2140. Currently, nearly 90% of Bitcoin has been mined, with approximately 900 new Bitcoins generated daily.

Zhao Changpeng: Multiple historical highs may be reached in a year

- Two giants monopolize 88% of the blockchain transaction fees. How can other blockchains break through?

- Exploring Fully Homomorphic Encryption Part II Lattice Cryptography and LWE Problem

- How will the design centered around intent affect the blockchain system?

Recently, Zhao Changpeng gave his opinion on the impact of the next halving on Bitcoin’s price. The translation of the full text is as follows:

Binance has added a Bitcoin halving countdown on our homepage.

What will happen during Bitcoin halving? I cannot predict the future. This is based on my experience from the past three halvings.

-

In the months leading up to the halving, there will be more and more discussions, news, anxiety, expectations, speculation, and hopes.

-

Usually, the price of Bitcoin does not rise on the second day after the halving.

-

In the year following the halving, the price of Bitcoin reaches multiple ATH (all-time highs). People ask why? Because people have short memories.

-

This does not mean there is a confirmed cause and effect relationship, as history cannot predict the future.

Historical Halving Data

Bitcoin halving has a significant impact on the price of Bitcoin, as it changes the supply and demand relationship and affects market sentiment and miner behavior. Historically, each halving has pushed the price of Bitcoin up to some extent, especially in the two years after the halving. For example, after the first halving in 2012, the price of Bitcoin rose from $12 to $1031.95 (over 8500%).

Data on Bitcoin’s price after the 2012 halving

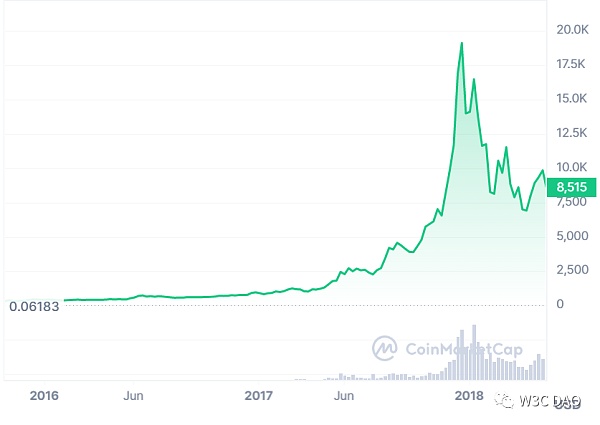

After the second halving in 2016, the price of Bitcoin rose from $650 to $19,798.68 (over 2900%).

Bitcoin Price Data After Halving in 2016

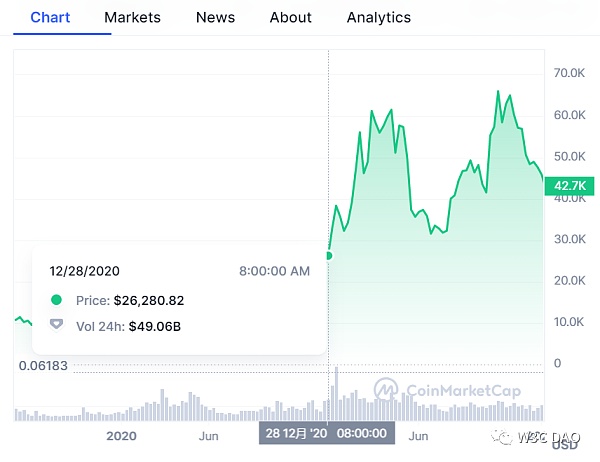

The most recent halving occurred on May 12, 2020, when the number of bitcoins issued per block decreased from 12.5 to 6.25. At that time, the price of Bitcoin was around $8,810. Since then, the price of Bitcoin has experienced multiple fluctuations and adjustments but has shown an overall upward trend. In November 2021, Bitcoin reached a new all-time high of around $69,000.

Bitcoin Price Data After Halving in 2020

So, how will the price of Bitcoin change before and after the next halving? This is a question that concerns many investors and miners. Based on the current block generation rate, the next halving is expected to occur on April 21, 2024, at block height 840,000. At that time, the number of bitcoins issued per block will further decrease to 3.125.

Interpretation by W3C DAO

-

Bitcoin halving is an important event that attracts widespread attention and discussion in the market, but it also comes with uncertainties and expectations.

-

The impact of Bitcoin halving on Bitcoin price is not immediately apparent but takes some time to manifest.

-

Within a year after Bitcoin halving, the price of Bitcoin usually creates multiple new all-time highs, possibly due to factors such as reduced supply, increased demand, and improved confidence.

-

However, Zhao Changpeng cautiously stated that history does not guarantee the future, and Bitcoin halving does not guarantee that the price of Bitcoin will definitely rise. It could also be influenced by other factors, so risk control should be taken into account.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!