Recently, modular blockchain Celestia announced an airdrop plan, intending to distribute 60 million Celestia tokens TIA, including 7,579 developers and 576,653 active on-chain addresses. This airdrop accounts for 6% of the total supply of Celestia tokens.

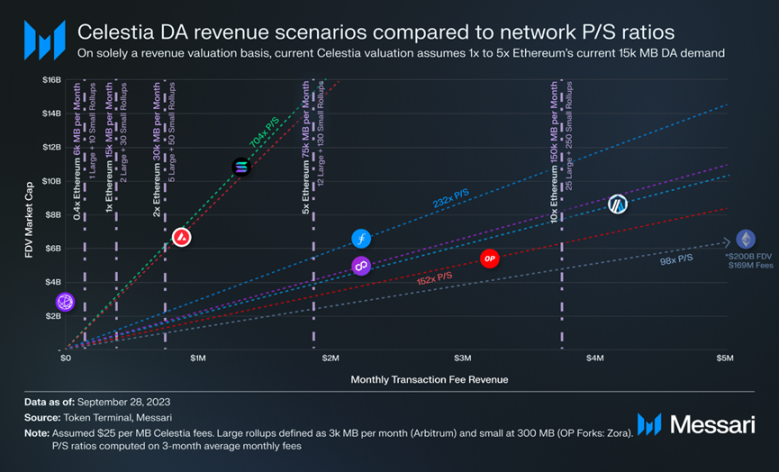

This valuation is calculated by Celestia’s market-to-sales ratio model, assuming that the second-layer network pays the cost of data availability to Celestia at a price of $25 per MB and can achieve twice the data availability of Ethereum on the second layer.

Celestia’s Value Capture

Celestia is a fundamental protocol that provides data availability. Its revenue comes from the fees paid by second-layer protocols for storing transaction receipts or proofs.

- Summary of the latest consensus meeting of Ethereum core developers Will re-discuss the timeline for the Cancun upgrade test.

- Messari Q3 Financing Report Public Chain Infrastructure Accounts for the Largest Proportion, Total Financing Amount Hits a Three-Year Low

- Weekly Preview | China Mobile’s first NFT will be sold on the Opensea platform; Aptos (APT) will unlock tokens worth over $20 million

Currently, second-layer protocols built on Ethereum write about 15,000 MB of data per month, with an average payment of $700 per MB (calculated based on the price of one Ethereum at $1600). According to Ethereum’s upgrade roadmap, EIP-4844 will introduce a new, cheaper data storage field called “blobs,” reducing Ethereum’s data availability cost by about 90%. This sets an upper limit on the unit revenue of data availability.

For Celestia, based on the revenue generated from gas fees, a valuation of $2.75 billion can be obtained, with storage costs per MB ranging from $10 to $25.

The vertical line represents Celestia’s different adoption levels, presented as multiples of the current cumulative Ethereum Rollup data demand (15,000 MB equivalent to 1x Ethereum). The diagonal lines represent the market-to-sales ratios of other fundamental protocols, and the intersection reflects Celestia’s FDV valuation within the selected revenue level and multiple range.

Like other L1 tokens (and to a lesser extent L2 tokens and L3 ecosystems), the value of the TIA token comes from current transaction demand (revenue) and all future expected transaction demand. As the adoption of the TIA token as a gas token increases in the Rollup built on top of it, the token captures more and more of the future economic activity value of the entire ecosystem. In addition to Celestia’s specific fee revenue for data availability, this pushes the valuation range towards levels similar to emerging L1s like Solana.

Celestia’s Customer Profile

Financial applications like DeFi tend to favor the high security and immense liquidity of the Ethereum ecosystem. Financial users have cash and have financial reasons (expected profits) for transactions, so they are willing to pay reasonable fees for transactions.

On the other hand, consumer applications like social networks or games involve a large number of low-value transactions. Lower transaction fee requirements mean less transaction fee revenue available to be shared with the DA layer.

The demand for Celestia’s DA is valued for its affordability and cheapness. The initial Rollup clients naturally seek lower transaction unit cost, such as focusing more on consumer applications or low-value financial applications.

Since the DA layer serves as the underlying security layer for the Rollup above, the value of the DA layer must grow proportionally to the aggregate value of the maximum Rollup and its associated applications in order to maintain an adequate level of security.

Celestia is undoubtedly an impressive technology, but the core challenge it faces is proving whether the independent DA network has enough value capture to demonstrate its long-term position in the market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!