Author: Bankless Team; Translator: LianGuaixiaozou

1. SBF Betrayed by Co-Founder

For SBF, this has been a difficult week as prosecutors took away some key witnesses who portrayed Sam as a bad person.

On Thursday, FTX co-founder Gary Wang testified that the cryptocurrency exchange gave privileges to Alameda Research, which is the biggest accusation by the prosecution so far.

- JPMorgan Chase The rise of Ethereum staking comes at the cost of increased centralization.

- Founder of Three Arrows Capital, Zhu Su, Arrested Scene Photos Exposed

- Toncoin Will Telegram Become the Admission Ticket for Super Apps and Mass Adoption?

“We allowed Alameda to withdraw funds without limitation,” Wang told the court. According to Decrypt, unlike other FTX accounts, Alameda was allowed to have a negative balance and by the time it collapsed, “Alameda had withdrawn $8 billion from the platform and obtained $65 billion in credit,” Wang mentioned in his testimony.

Wang testified that SBF committed telecommunication fraud, securities fraud, and commodity fraud. This is not surprising as Wang and Alameda’s Caroline Ellison admitted to conspiring to commit commodity, telecommunication, and securities fraud in December last year.

2. Michael Lewis’ SBF Biography Brings Confusion to the Crypto Field

Many people in the crypto field are eagerly awaiting the publication of famous financial writer Michael Lewis’ SBF biography, titled “Going Infinite.” However, early reviews of this book, which chronicles the rise and fall of SBF, suggest that Lewis may have wasted this precious opportunity by being too sympathetic to the young founder.

One of the many unreported details in the book is that SBF was losing $500,000 per day after the release of Alameda. Additionally, we learn why Kevin O’Leary still speaks highly of SBF after FTX’s collapse – he received $15.7 million in compensation from the company for “20 service hours, 20 social media posts, a virtual lunch, and 50 signatures.” Quite a lucrative deal.

3. SBF’s Fate Lies in the Hands of the Jury

Before the trial, the legal teams of the prosecution and defense were both concerned about the jury selection, which includes a librarian, a nurse, a special education teacher, and a prison guard.

At least three jurors were excused from appearing because they lost money in crypto investments.

The chosen 12 New Yorkers must reach a consensus and agree to convict SBF on each charge. On Twitter, amateur legal analysts have been speculating on who is most likely to be the defense’s target.

4. LianGuairadigm CEO Says VC Firm Was Misled

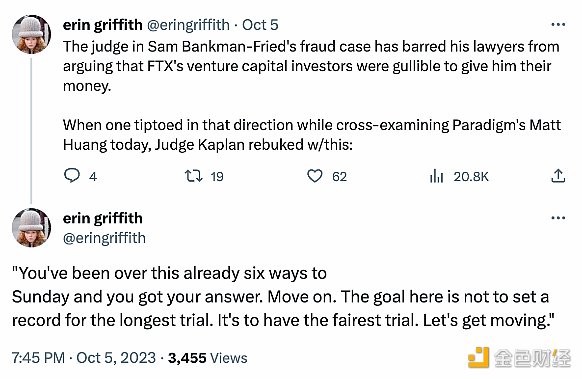

Wang provided the most intimate details about SBF’s misconduct, and another key witness who appeared in court this week is LianGuairadigm co-founder Matt Huang.

This elite venture capitalist testified that LianGuaridigm was kept in the dark about many key business decisions, including FTX’s decision to use customer funds to sustain Alameda Research’s operations.

As expected, Huang said the company has “zeroed out” its $278 million investment in FTX.

5. SBF may lose his private jet!

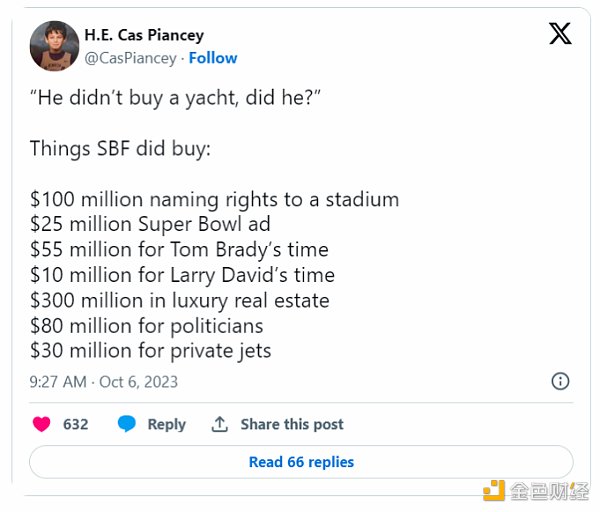

While SBF fights for his freedom in court, he is also fighting for his private jet.

U.S. prosecutors claim that in order to recover assets, the two private jets owned by SBF may be confiscated. Interestingly, these jets seem to only belong to the notorious founder in name, as they have never actually been used by him.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!