Author: Heimi, Baize Research Institute

If BlackRock’s Bitcoin spot ETF application is approved, it may trigger a new wave of cryptocurrency frenzy, with trillions of dollars of institutional funds pouring into the market and greatly increasing the prices of BTC and altcoins.

This article will introduce some projects that may directly benefit from BlackRock’s Bitcoin spot ETF.

Note: This article is for information sharing only, and the author has no interest in the mentioned projects and does not endorse them. DYOR

- “Double Kill” of Funds and Faith: How Can Azuki Regain Community Trust?

- What is liquidity mining in cryptocurrency?

- How will Lucid Finance leverage diversified assets and the Pendle ecosystem to revitalize the LSD stablecoin space?

Why can BlackRock exert such huge power?

BlackRock is the world’s largest asset management company, currently managing about $9 trillion in assets.

This month, BlackRock’s move to apply for a Bitcoin spot ETF is seen as proof that “institutions are once again entering the cryptocurrency market”.

Simply put, suppose you want to invest in Bitcoin. You don’t have to register with a cryptocurrency exchange, deposit money to buy Bitcoin, and pay taxes for each transaction. Instead, you can buy BlackRock’s Bitcoin spot ETF, and they will help you do these things. You will receive a receipt to prove your ownership of the ETF, and then track the value and performance of Bitcoin. In addition to using Coinbase to manage these Bitcoins, BlackRock cannot use your Bitcoins for evil, and all they can do is provide you with better value-for-money services.

However, what is really interesting is BlackRock’s relationship with the US government and the Federal Reserve.

In 2008, who did the Federal Reserve choose to manage the problem assets they took over from Bear Stearns?

The answer is BlackRock.

In 2020, when the Federal Reserve wanted to buy some corporate bonds to help support the economy, who did they turn to?

The answer is BlackRock.

In 2023, who did the Federal Deposit Insurance Corporation (FDIC) turn to for help in inventorying the assets of Signature and Silicon Valley Bank?

2. Project Mentioned by BlackRock: Energy Web

Energy Web is an organization committed to accelerating global decarbonization through open-source software and blockchain solutions, primarily addressing two key challenges: leveraging distributed assets such as solar systems, batteries, electric vehicles, and charging stations to achieve more efficient and sustainable grid balance; and bringing transparency to the supply chain of emerging green products such as sustainable aviation fuel. Over the years, the organization has signed deals with multiple large energy producers and fossil fuel companies, including the listed Shell and Volkswagen.

Its mainnet Energy Web Chain went live in 2019 and is an EVM enterprise-level public chain that uses the Proof of Authority (PoA) consensus mechanism. Blocks and transactions are verified by pre-approved participants (usually partner companies) who act as managers of the system. However, both enterprise and individual developers can deploy dApps on the network, such as DeFi with energy trading as the main theme, and any user can use it. But its native token EWT only serves as the most basic validator reward and gas token, and has not been given more utility.

This month, the organization announced that it will launch a Polkadot parallel chain called Energy Web X. The simplest way to understand it is that two blockchains share one token. The idea of Energy Web X is simple, it adds another utility to EWT – anyone can become a working node and earn token rewards for running compute workloads for energy companies by pledging tokens to trusted nodes.

It is worth noting that when BlackRock launched its Bitcoin private trust last year, it mentioned that Energy Web is helping to increase transparency in Bitcoin green mining. After the press release, the price of the EWT token rose by 24%. Therefore, if BlackRock’s Bitcoin spot ETF is approved, it may have a positive effect on Energy Web, the largest decentralized energy ecosystem, and the adoption of more energy companies may further drive the price of EWT.

3. RWAs Track that BlackRock is Interested in: Polymesh, Realio Network

As mentioned in the first part of this article, BlackRock is interested in tokenizing RWA.

Polymesh is an institutional-grade L1 network designed specifically for regulated assets such as security tokens. Inspired by the ERC-1400 standard, it offers more functionality and security to facilitate the issuance and management of on-chain assets. Transparency and compliance are among the network’s highlights, and all issuers, investors, stakers, and node operators are required to complete identity verification.

POLYX is the native token of Polymesh and is classified as a utility token according to Swiss financial regulatory guidance and the laws of the country. POLYX has multiple utilities such as staking, governance, and the creation and management of security tokens.

Realio Network was formerly a P2P digital asset issuance and trading platform focused on real estate private equity investment. It has now established an interoperable and scalable L1 network based on Cosmos SDK, focusing on the issuance and management of RWA tokens, and also provides tools for KYC/AML compliance and investor authentication to meet compliance requirements.

Currently, its flagship product, the Realio.fund investment platform, has been launched, providing multi-chain token issuance tools, fully automated compliance processes, and other functions, allowing users to invest in cryptocurrencies more securely.

Realio Network adopts a dual-token Proof-of-Stake model, RIO and RST, with multiple utilities such as staking, governance, and key management.

Polymesh and Realio Network, as the two most powerful projects in the RWA track, are bound to benefit from the wave brought by BlackRock’s approval of Bitcoin spot ETFs.

4. Stronger Together: Render and GMX

If BlackRock’s Bitcoin spot ETF application is approved, it may trigger a new round of cryptocurrency boom, and projects that have performed well this year may benefit, such as Render and GMX.

Render Network is a blockchain-based GPU rendering network designed to connect idle GPUs with creators who need extra GPUs to maximize resource utilization. As an infrastructure, rendering has huge business scalability, and it is also part of artificial intelligence and metaverse narrative, making it one of the benchmarks in the Depin (distributed physical infrastructure network) track.

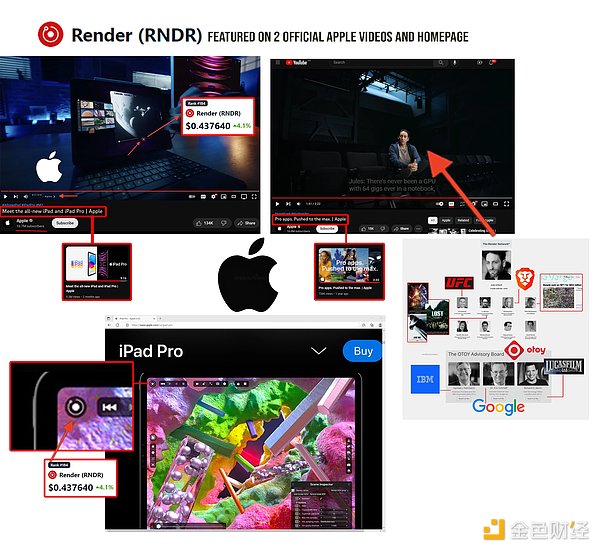

One of the strongest performing tokens this year, RNDR, has made a good rebound in the bear market, possibly due to its parent company OTOY’s partnership with Apple. Render Network’s logo has appeared multiple times in Apple’s official product promotion videos. Recently, RNDR has adopted a new token economics model called “burn and mint” (BME), making it a highly deflationary token, which could serve as a catalyst for its future price increases.

With the US SEC’s lawsuit against centralized cryptocurrency exchanges Coinbase and Binance this month, perpetual DEXs are gaining more users. Traders trying to get rid of CEX and KYC are looking for a “new home” in the perpetual DEX arena.

GMX, a leading project with a total trading volume of over 133 billion US dollars, is likely to continue to grow as a result.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!