Author: Xenia Soares, BeInCrypto Translation: Blocking, Shenouba

Decentralized finance (DeFi) has completely transformed the cryptocurrency market and left its mark on the global economy. There are many ways to earn passive income through various decentralized protocols. Most DeFi users believe that one of the most profitable ways to earn money is through staking. Proof-of-stake blockchains like Ethereum are secured through staking protocols, which allow network participants to use their staked funds to run validator nodes. However, the primary challenge of traditional staking is that staked tokens cannot be traded in other DeFi ecosystems or used as collateral to earn additional revenue. Liquidity staking aims to address this liquidity issue by providing additional tokens that represent the staked assets.

So how does this work? This article takes a deep dive into liquidity staking and its benefits for current DeFi users, as well as how it differs from other staking methods.

Table of Contents:

- How will Lucid Finance leverage diversified assets and the Pendle ecosystem to revitalize the LSD stablecoin space?

- Viewpoint: BlackRock Bitcoin ETF won’t be approved unless Binance goes bust

- Vitalic answers everything: AI Disaster, Zuzalu Experiment, Bitcoin Culture, and what he likes and dislikes the most?

-

What is Liquidity Staking?

-

How Does Liquidity Staking Work?

-

What Is the Difference Between Staking and Liquidity Staking?

-

The Benefits of Liquidity Staking

-

Pros and Cons of Liquidity Staking

-

Liquidity Staking Services

-

Is Liquidity Staking Risky?

-

The Future of Liquidity Staking and DeFi

-

FAQs

What is Liquidity Staking?

Liquidity staking is a staking solution that enables users to obtain liquidity while staking their tokens. This means that you can contribute to a proof-of-stake (PoS) blockchain, as with traditional staking. However, you are not limited by a lock-up period, but instead receive staking funds in the form of liquid staking tokens (LST) “receipts.” These LST receipts can be used in other DeFi systems to generate additional revenue and reward opportunities. In other words, this type of staking involves storing your funds in a DeFi custody account. Users can still access their funds during the staking period, which makes the protocol liquid or “liquidizable.”

So far, the liquidity collateral market and LSD (liquidity collateral derivatives) are on the rise. On June 16, 2023, Binance Research published a report that focused on the newer DeFi protocols built on LSD and older DeFi protocols.

Benefiting from the adoption of liquid collateral, the accumulated total value locked (TVL) of the top LSDfi protocols has grown rapidly in the past few months. As the story unfolds, the cumulative TVL of top LSDfi protocols has surpassed the $400 million mark, more than doubling in the past month.

How does liquidity collateral work?

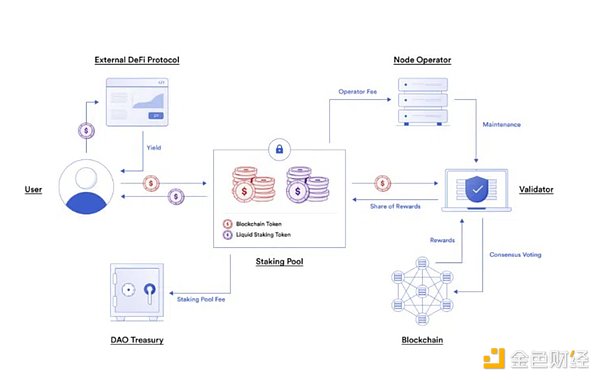

Just like traditional proof of stake protocols, the way liquidity collateral works is by depositing funds into a custodial account operated by a smart contract. The platform issues tokenized versions of the collateral funds as a reward. These tokenized versions have equivalent value in return.

Remember, you can still earn rewards from collateral funds, but now you can use these tokenized versions for other purposes in liquidity collateral. Then, these liquidity collateral tokens (LST) can be transferred out of the platform, stored elsewhere, traded, or spent without affecting the initial deposit. Now, in order to access your original holdings, you will need to exchange them for tokenized versions of equal value.

Below is a chart of liquidity collateral protocols, which also shows how LST can be used in external DeFi projects.

Liquidity collateral tokens and protocols: Chainlink

What is the difference between collateral and liquidity collateral?

Traditional collateral requires you to deposit funds into a custodial account operated by a smart contract for a period of time. Depending on the plan chosen, the lock-up period can range from a few days to several months. During this time, investors cannot access their funds.

On the other hand, when investors use liquidity collateral services to collateralize their funds, these funds are not locked up. Token holders receive receipt tokens as evidence of their equity. Therefore, the main difference is that with liquidity collateral, you can fully access your funds at any time and can cancel collateral at any time without any impact. Therefore, this equates to higher returns and greater market liquidity.

The benefits of liquidity collateral

The most obvious benefit of liquidity staking is the additional opportunity for rewards it provides to its users. This method allows you to earn staking rewards without locking up the rewards. However, to diversify earning opportunities, you can apply LST to various protocols (such as lending pools and prediction markets). Unlike tokens staked on the Ethereum network, liquidity tokens can be traded and used as collateral. Additionally, you can withdraw your staked tokens at any time.

Remember that liquidity staking is not without risk. Below we will discuss the common pros and cons of this type of investment.

Pros and Cons of Liquidity Staking

Pros

-

Unlocks liquidity: Liquidity staking does not lock up tokens that can be unlocked at any given time. Additionally, liquidity staking tokens can be used as collateral.

-

Liquidity mining: LST can be used on other DeFi protocols to participate in various liquidity mining opportunities. This increases the chances of earning more rewards.

-

Crypto-backed loans: Investors can use their existing crypto assets to obtain crypto-backed loans by locking up funds and receiving tokenized liquid versions of their assets.

Cons

-

Technical expertise required: Those who are new to DeFi (especially staking protocols) may not have the technical expertise to participate in the platform on their own.

-

Smart contract risk: Liquidity staking depends on the operability of smart contracts, but smart contracts always carry the risk of errors or attacks.

-

Price decoupling: The price of LST is not linked to the underlying asset it represents and may fall below the asset price due to unexpected market fluctuations.

Liquidity Staking Services

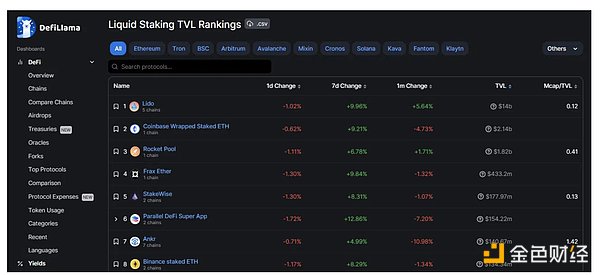

There are a variety of liquidity staking protocols available on the market, and the number is steadily increasing. For example, certain blockchains default to their own protocols. However, other blockchains such as Solana (SOL) and Polkadot (DOT) rely on third-party liquidity staking assistance. Below, you can see the TVL rankings of each platform.

Liquid Strike TVL: DefiLlama

Lido

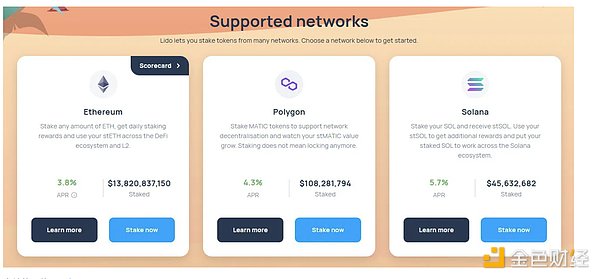

Lido Finance Protocol was launched in 2020 and is overall the best and most well-known liquid staking platform. The project was initially a viable staking solution specifically for the Ethereum network. Since then, it has expanded its functionality to other ecosystems such as Polygon, Solana, and Kusama (KSM).

After depositing staking funds, users receive derivatives in the form of “st” (e.g. stETH) and the name of the asset code. These funds can then be withdrawn for use in over 27 DeFi applications and crypto wallets. Lido’s staking rewards range from 4.8% to 15.5%, and Lido charges a fee of 10% for its liquid staking service.

Supported Networks: Lido

Rocket Pool

A good alternative to Lido is Rocket Pool, which is a decentralized platform for staking Ethereum. Launched in 2016, Rocket Pool allows users to stake and run permissionless nodes. However, this feature allows you to stake with less than 32 ETH while earning staking rewards of up to 8.98% per year, as well as using RPL collateral to protect the platform. Alternatively, you can use its liquid staking service to stake ETH and receive rETH liquidity tokens with an annual interest rate of up to 3.15% (based on a 7-day average).

How Rocket Pool Works

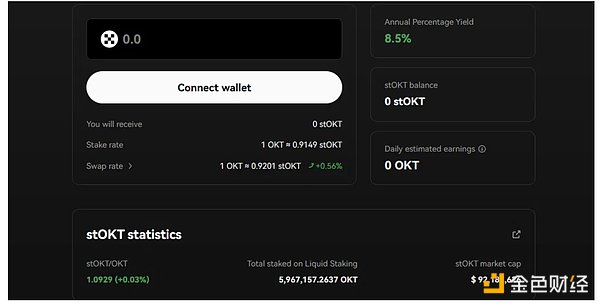

OKTC

The OKX platform offers a liquidity staking service to stake and earn OKT on the OKT chain. As a return for staking OKT, users receive staked OKT (stOKT). This is a multi-purpose KIP-20 token that can be traded and used within the OKTC protocol. The token’s value may vary over time because the staking funds received from staking OKT are not constant.

The OKT staking cycle is set at 14-day intervals, and staking OKT for OKT liquidity staking not only generates returns, but these returns also generate their own returns (compound interest). In addition, you can even earn swap fees by providing liquidity for the platform’s OKTC Swap feature.

Staking: OKTC

Hubble

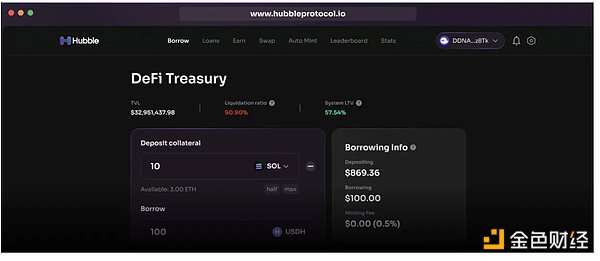

The Hubble protocol allows for the use of collateralized cryptocurrency assets for lending on its liquidity platform. It became popular after participating in the Solana hackathon, but what sets this platform apart is its lending service. The protocol allows investors to borrow against their cryptocurrency collateral and use the borrowed tokens as collateral elsewhere in the DeFi space.

The USDH stablecoin is used for the platform’s crypto lending services. You can mint USDH with a variety of collateral types and repay it at any time. This means that Hubble supports a variety of assets and allows you to deposit from different networks, providing up to 11x collateral leverage.

DeFi Treasury: Hubble Protocol

Is liquidity staking risky?

As with any financial protocol involving cryptocurrency, risk is always present. Liquidity mining carries liquidation risk. In the event of a market downturn, asset values may fall below collateral requirements. Another major risk associated with liquidity staking is smart contract security.

In general, smart contracts are vulnerable to attacks and errors. To mitigate this, protocols and smart contracts need to be audited regularly. There is also the risk of decoupling based on the token’s price. However, with good risk management and investment strategy, you can greatly reduce the chances of making mistakes or incurring losses.

The future of liquidity staking and DeFi

Compared to traditional staking protocols, liquidity staking offers more benefits to users. Investors no longer have to wait until the lock-up period ends to access their funds. In addition to being more convenient, rewards are also doubled. Users can still earn returns from their staked funds as normal; however, with the introduction of liquidity staking tokens, users can earn additional returns when these tokens are used on other DeFi networks. Because users can withdraw their stake at any time, this makes it attractive to a wider range of investors.

That being said, it is not surprising that the performance of liquidity staking protocols in the future will far exceed that of traditional staking services.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!