Author: John Blockingul Koning, host of the Moneyness blog; Translator: Blockingxiaozou

As early as 2018, I described the controversial topic of the US Securities and Exchange Commission (SEC) continuously rejecting Bitcoin ETF listing applications. My conclusion at the time was that “the SEC is likely to continue to reject more applications.” This year, my conclusion has not changed. Even if Blackrock, the giant of Wall Street, proposed the listing of iShares Bitcoin ETF on NASDAQ, there has been no change: Bitcoin ETF is unlikely to be approved.

The Financial Times reported that the biggest difference this time compared to in the past is that Blackrock will sign a monitoring sharing agreement with “a US Bitcoin spot trading platform operator.” It is clear that the operator will be Coinbase, the largest cryptocurrency market in the United States.

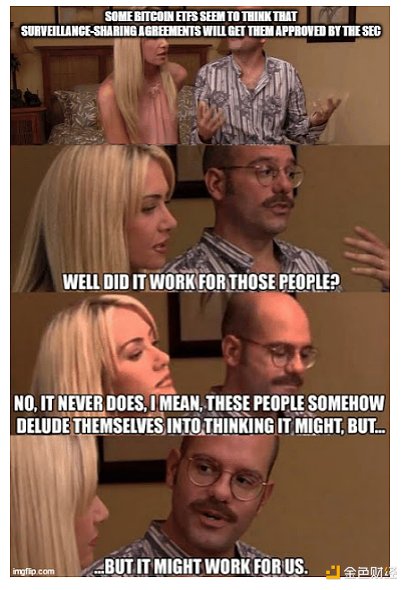

This sounds persuasive, but Blackrock is not the first potential Bitcoin ETF issuer to want to sign a monitoring sharing agreement with a US exchange. This is an ancient strategy that has not yet worked.

- Vitalic answers everything: AI Disaster, Zuzalu Experiment, Bitcoin Culture, and what he likes and dislikes the most?

- Azuki’s drama, questions about decentralization, and answers from mfers

- What projects will be the winners if BlackRock’s Bitcoin ETF is approved?

Years ago, the Winklevoss twins attempted to list their Bitcoin ETF on the Bats BZX exchange, and part of their (modified) proposal involved BZX and the US cryptocurrency exchange Gemini Exchange signing a monitoring sharing agreement. However, the SEC did not think it was feasible in 2018, so I don’t understand why it would be feasible now.

Let’s take a look back. Why sign a monitoring sharing agreement?

I discussed this issue in detail five years ago, and here I will give a brief explanation. When an exchange lists an ETF, especially a commodity ETF, the ETF is usually based on some commodity, such as wood or copper, which is traded on another exchange (or several exchanges). The SEC believes that the agreement to share information between the relevant exchanges is key to preventing fraud and manipulation. For example, if an exchange trades bananas, and another exchange wants to list a banana ETF, then the SEC will only approve the ETF under this premise: the listing exchange demonstrates that it can monitor the underlying spot banana exchange, detect manipulators, and ultimately protect investors.

The Winklevoss brothers previously tried to prevent manipulation by sharing monitoring with Gemini, but the SEC believed that this was not enough for two reasons. Gemini is not heavyweight enough (not large enough relative to the overall market), and it is not regulated as a national exchange.

Let’s fast forward to 2023. In this proposal, Blackrock actually swaps Gemini for Coinbase, enabling Nasdaq to share monitoring of the iShares bitcoin ETF with Coinbase. Unfortunately for Blackrock, nothing has changed. First, Coinbase is not a regulated exchange and is very similar to Gemini. Second, Coinbase is not as large globally, especially compared to offshore exchange giant Binance. Therefore, I am skeptical that the monitoring sharing agreement with Coinbase will allow Blackrock’s proposal to pass.

Blackrock’s second strategy to obtain SEC approval is to sign another monitoring sharing agreement with a regulated futures exchange that offers bitcoin contracts. As I described in an article in 2018, this is how the massive approval of the SPDR Gold ETF was obtained decades ago. When trading in a commodity is informal, such as through an over-the-counter trading market (like gold), and when the ETF listing exchange cannot sign a monitoring sharing agreement, then the SEC may accept an agreement reached with a futures exchange as a stopgap measure, as was the case with SPDR and the New York Mercantile Exchange (NYMEX).

In the case of Blackrock, it chooses to have Nasdaq, the exchange on which it is listed, share information with the Chicago Mercantile Exchange (CME), which lists bitcoin futures.

At first glance, Blackrock seems to be on the right track. Unlike Coinbase, CME meets the criterion of being “regulated”. So, is it “heavyweight” enough? CME’s open interest is about $1.5-2 billion, about half of Binance’s $3-4 billion in open interest in futures (just a small part of Binance and all other unregulated offshore exchanges totaling $10 billion), so I’m not sure if CME’s size is sufficient. In other words, if you want to manipulate the price of bitcoin through futures, you might do well with Binance’s futures market, so Blackrock’s monitoring sharing agreement with CME may not be as effective.

In any case, this strategy has been tried before and has not been successful. Many ETFs have tried to use a monitoring sharing agreement with CME as a passport to obtain SEC approval, and many ETFs have used deep data analysis to demonstrate why CME meets the “heavyweight” condition, but no ETF has been successful in convincing the SEC. So what makes Blackrock different?

If Blackrock’s iShares Bitcoin ETF cannot be approved, what does a Bitcoin ETF need to do to be approved?

In my view, unregulated offshore markets need to disappear. Price discovery for many cryptocurrencies (and potential manipulation) occurs in offshore markets, including spot markets and futures markets. Given the SEC’s consistent logic, a US Bitcoin ETF would need to wait until Binance goes bankrupt, because only then would most Bitcoin trading migrate to venues that meet the SEC’s “regulated” and “heavyweight” requirements.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!