Authors: Helena L., Lin S., Eocene Research

Introduction

NFT has always been a highly anticipated track in Web 3, but it has long been plagued by many problems, one of which is market manipulation. Market manipulation refers to the act of using unfair means or information to influence market prices or trading volumes, thereby gaining unfair benefits. In NFT transactions, market manipulation mainly takes two forms:

Position manipulation: Holding manipulation refers to the situation where the project party (including public holdings and hidden holdings, of which hidden holdings are used for market manipulation) or market makers hold a large amount of NFT, creating scarcity and value, attracting more buyers to enter the market, driving up its price, and then selling at a high price, making huge profits. This behavior can lead to the formation and collapse of NFT price bubbles, damaging the interests of other investors.

Volume or price manipulation: Refers to certain individuals or organizations manipulating a large number of addresses to frequently trade NFT between different accounts, creating false trading volumes or raising prices, thereby misleading the judgment of other investors and inducing them to buy and sell, thus obtaining unfair profits. This behavior can undermine the authenticity and fairness of the NFT market, reduce its credibility and attractiveness.

Typical NFT market manipulation behaviors mainly include three stages:

First stage, fundraising: The main operation is to continuously absorb chips at a low price.

Second stage, brushing volume or pulling up: This stage mainly refers to trading volume. By manipulating multiple addresses to conduct false transactions to increase trading volume and raise prices.

Third stage, shipping stage: Further raise the price and recover funds while shipping.

Methodology

In order to find traces of holding or trading behind NFT projects, we used on-chain data analysis methods, and collected, cleaned, processed and excavated various transaction data in the NFT market using the traceable, unmodifiable, and publicly transparent characteristics provided by blockchain technology. We mainly focus on the following two aspects of data:

-

Funding relationships: We construct a fund flow chart by tracking the transfer records between addresses involved in NFT transactions, analyze the sources and destinations of funds, and identify addresses or address groups that may have manipulation intentions.

-

Similar behavior information: We construct features based on the behavioral information of addresses involved in NFT transactions, use clustering algorithms to find clusters of addresses with high similarity, and analyze whether they exhibit market manipulation behaviors.

Through the above two aspects of data analysis, we can preliminarily screen out some suspicious addresses or address clusters, and further analyze their transaction behavior to reveal their methods, motives and effects of manipulating the market.

Specific Case (Taking AKCB as an example)

AKCB (A KID CALLED BEAST) is an NFT project on Ethereum, consisting of ten thousand unique 3D and AR-ready digital beasts. Each beast belongs to one of 20 beast tribes, each with 500 members, representing different personalities and values. Users who own AKCB can enter the corresponding tribe community and interact and collaborate with other users who own the same beast tribe. AKCB began minting on January 15, 2023, with an initial mint price of 0.0777 ETH and a floor price of around 0.4 ETH as of June 20, 2023. AKCB has received a lot of attention and pursuit since its launch, but we have also found some suspicious behaviors, such as pumping and creating a sense of scarcity. We will demonstrate through two parts: holding and price manipulation.

I. Holding

1. Public holding

The project party minted 1000 tokens (about 10%) through contract address 0x263f8b4a146E85d8fd2BB42bE7fac5aaB0Ba3b7F. The project party generally retains some tokens for future community development or market value management. This part of public holdings generally does not belong to malicious manipulation behavior.

2. Hidden holdings

Since each user can only mint one token, there are a large number of addresses controlled by the same entity to mint, and several batches of such addresses have been found by detecting the same address deposit, fund collection, and fund transfer behaviors among all minters.

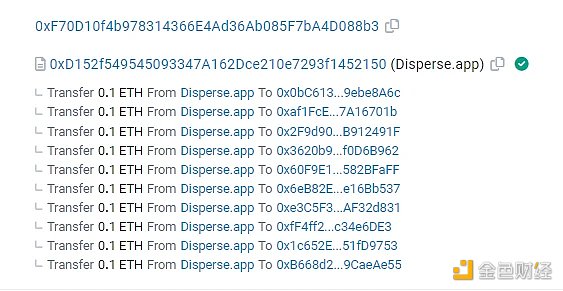

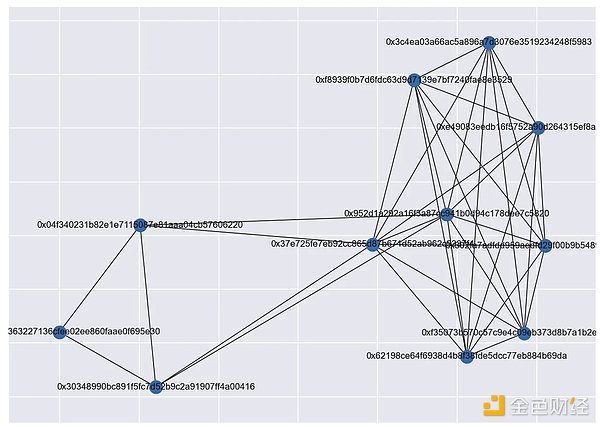

Address Cluster 1:

There are a total of 70 addresses, which were funded by two transactions through Disperse.app. The addresses have identical behavior information, and after completing the transaction, the funds were collected to a common address. Some of the addresses were sold on January 27th and February 8th after minting. Transaction hashes for funding:

0x0d673d7b25115bfef7eef59496f902b08b84a9b123951b01ed4107e9a4d1831f and

0x713c9bcd9f0c28c7d2fe5a833953d24b01e4d3d8472fd9832c1b602f73eb0f99

70 tokens were minted in total, 43 of which have been shipped, and 27 are still held in scattered addresses.

Figure 1: These addresses all received funding in one of two transactions through Disperse.app

Figure 2: These addresses all received funding in one of two transactions through Disperse.app

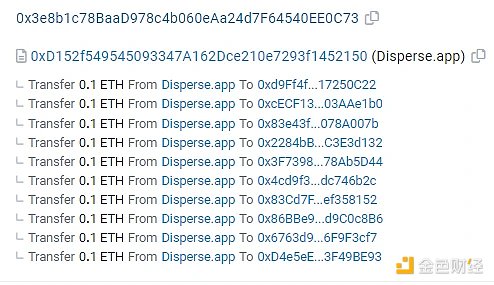

Address Cluster 2:

-

0x302fa7adfdd959aedfd29f00b9b5489d7072cd13

-

0x37e725fe7eb92cc865d87b671d52ab962c9337f4

-

0x3c4ea03a66ac5a896a7d3076e3519234248f5983

-

0x62198ce64f6938d4b8f38fde5dcc77eb884b69da

-

0x952d1a292a16f3a87cc941b0d94c178dee7c5820

-

0xe49083eedb16f5752a90d264315ef8a1041eac86

-

0xf8939f0b7d6fdc63d9d7139e7bf7240fae8e3529

-

0xf35073b570c57c9e4c09eb373d8b7a1b2e96dae6

-

0x04f340231b82e1e7115087e81aaa04cb57606220

-

0x30348990bc891f5fc7d52b9c2a91907ff4a00416

-

0x0127ead2363227136cfee02ee860faae0f695e30

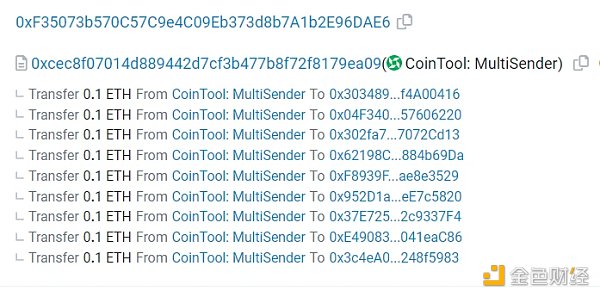

Relation: Addresses 1-9 deposited funds via CoinTool: MultiSender in the same transaction, with deposit tx_hash:

0x0086718d1b4242060b3ab5c7c4716bd26c75a4ded0cb8341d5ba801d7e2ec87a,

Addresses 9 and 10 are deposit addresses of address 11. Additionally, this batch of addresses has no historical transactions, and their behavior is completely similar.

Figure 3: Addresses deposited funds via CoinTool: MultiSender in the same transaction

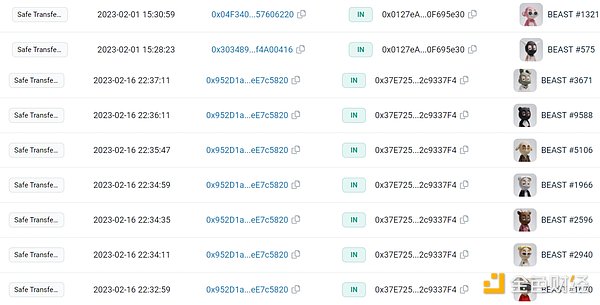

This batch of addresses minted a total of 11 tokens, which were then respectively collected into addresses 2 and 11. They were all sold in mid-February and March 10, and the prices were all above 1.2 ETH.

Figure 4: Tokens were transferred to address 2 or address 11

Figure 5: Fund correlation between addresses in cluster 2

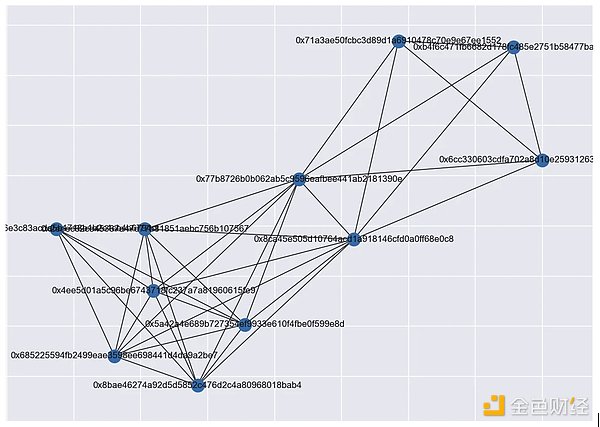

Address cluster 3:

-

0x8cA45E505d10764AcD1A918146cfd0A0FF68E0C8

-

0x5a42a4e689b727354ef9933e610f4fbe0f599e8d

-

0x8bae46274a92d5d5852C476d2c4A80968018Bab4

-

0x2eeEc62CE45367a47d77B81851aebC756B107567

-

0x685225594fb2499eae3598ee698441d4da9a2be7

-

0x71a3ae50fcbc3d89d1a6910478c70e9e67ee1552

-

0x77b8726b0b062ab5c9596eafbee441ab2181390e

-

0x6cC330603cDfa702a8D10E25931263DbA9a35458

-

0x4ee5d01a5c96be6743718fc237a7a81960615fe9

-

0xdcbe09d16e3c83acda5b1718b1b2c1cb4b6794cf

-

0xB4f6C471fb6682d178fC485E2751B58477BAe584

There are a total of 11 addresses in this batch of addresses, all of which have the same deposit address and final fund collection address, with no historical transactions and similar behavior. The specific source of funds is as follows:

-

Addresses 1-5: Source of funds is 0xFccf1C6A8C6978d76dF001699E02A2Ee88B8DEdA;

-

Addresses 6-7: Source of funds is 0x82B38c1636E98f0F7010cB00fcE9a24b649878Ab;

-

Addresses 8-11: Funds from address 1 are directly or indirectly deposited into these addresses.

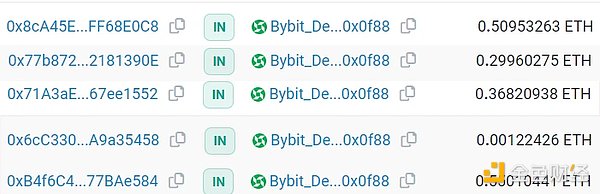

These addresses ultimately collect funds into the same Bybit deposit wallet:

Figure 6: These addresses ultimately send funds to the same Bybit deposit address

Figure 7: Correlation of funds between addresses in Cluster 3

After this batch of addresses opened its second mint on January 26, a total of 11 tokens were minted and immediately sold at a price around 0.5 ETH.

Conclusion:

Through our algorithm, we found that each address cluster is definitely manipulated by the same entity. The common characteristics of these addresses are:

-

They are all new addresses with no historical transactions

-

They are all manipulated by the same entity on a large scale

-

They sell at high prices after minting

This behavior is likely a way for the project party or market maker to increase popularity and recover funds.

II. Price Manipulation

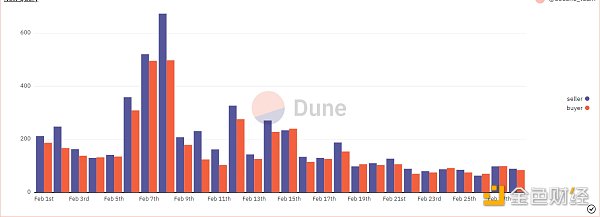

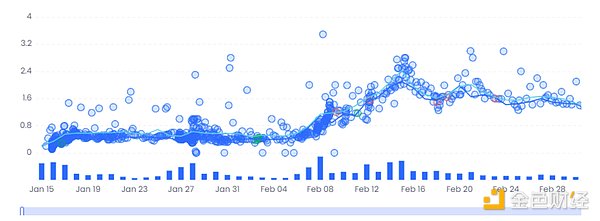

During our analysis of AKCB trading data, we found the following suspicious phenomena in the trading volume and floor price changes of the series from February 6 to February 15, and believe that the project party or market maker may have boosted the price during this period:

Suspicion 1: Starting from February 6, the number of buyers, sellers, trading volume, and floor price all sharply increased (contrary to other blue-chip NFTs during the same period).

Figure 8: Number of buyers and sellers sharply increased since February 6

Figure 9: Significant increase in trading volume and floor price starting on February 6th.

After this time period, the trading volume and floor price of this series have both maintained a relatively low level.

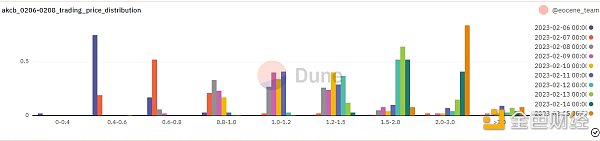

Suspicion 2: since February 6th, the distribution of trading prices has shown a uniform upward trend; the trading prices on that day are concentrated below the floor price of the next day.

Figure 10: The distribution of trading prices shows a uniform upward trend.

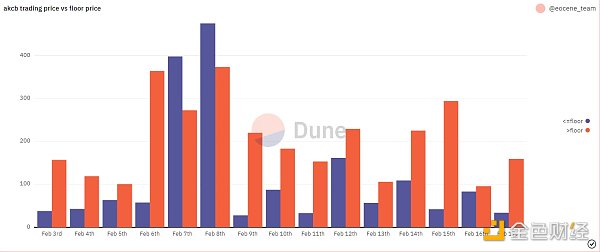

Since the easiest way to raise the floor price is to sweep all tokens below the target floor price, the distribution of trading prices will inevitably show a uniform upward trend, and the trading prices on that day will be concentrated below the floor price of the next day. On February 7th and 8th, when the trading volume surged, most of the trades were at prices below the next day’s floor price, which is different from other time periods. Such differences indicate the possibility of systematic manipulation of the floor price.

Figure 11: On February 7th and 8th, most trades were at prices below the next day’s floor price.

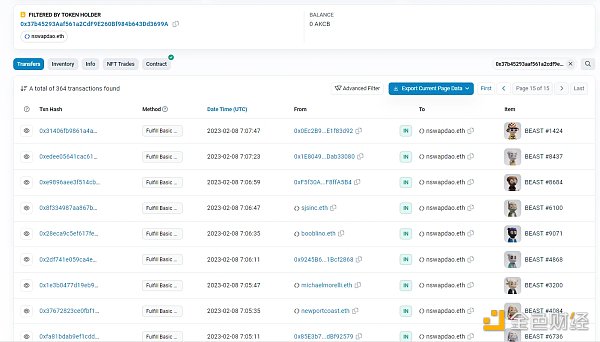

Suspicion 3: Market makers have bought a lot of AKCB.

Figure 12: NSwap sweeps a large amount of AKCB.

After NSwap made a large purchase, the floor price rose sharply. In addition to NSwap’s entry boosting the community’s confidence in AKCB, from a data perspective, we believe that there are also artificial manipulation factors behind the subsequent price increase.

Conclusion

From these abnormal trading data, we believe that there may be market makers manipulating AKCB’s floor price to rise significantly (up to 1.92 ETH) in mid-February.

Summary

The NFT market is a field full of innovation and vitality, but there are also some irregular and unfair phenomena, such as manipulating market prices, brushing trading volume, money laundering, etc. These behaviors not only harm the healthy development of the NFT market, but also affect the interests of ordinary users and investors. Therefore, analyzing these manipulative behaviors from a data perspective can allow players to have a deeper understanding of the market and make data-supported investment decisions. On the other hand, by exposing these market manipulation behaviors, we can improve the transparency and credibility of the NFT market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!