Token supply and demand have a significant impact on token price trends, especially when the fundamental level is comparable. This article compares the token supply and demand of the three main derivative DEX protocols GMX, DYDX, and SNX, to gain a deeper understanding of the token economic models of the protocols, to assist with investment decisions.

1. Supply

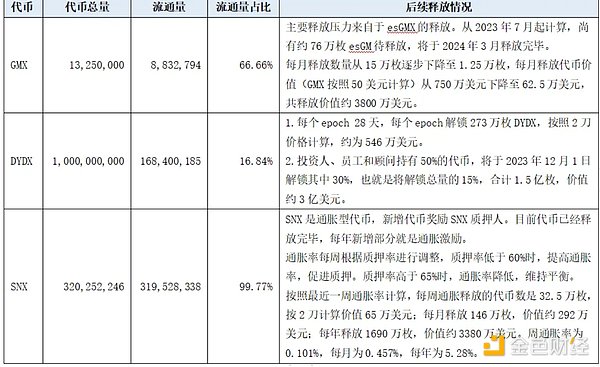

Source: LD Capital

Note: The token total and circulation volume are based on Coingecko’s data, and the “subsequent release situation” is determined based on project documents, community voting, and other documents, resulting in differences between the two data sets.

- Compound founder enters RWA track and tokenizes US Treasury bonds on Ethereum

- After a year of anticipation, the Ether with a similar art style to Azuki is about to be released. Will it be popular?

- MicroStrategy buys an additional 12,333 BTC at an average price of $28,136.

The token allocation of GMX is shown in the following figure:

Source: TokenUnlocks

Except for esGMX, contributor tokens are released linearly within two years after going online. GMX went online in August 2021, so contributor tokens are still being released, but the amount is relatively low, so they are not analyzed separately. All other tokens have been released.

According to the community vote decision, esGMX will stop being issued in March 2023. According to the release rules of esGMX, it has a one-year release period. Therefore, the specific release of esGMX is shown in the following table:

Source: LD Capital

The token allocation of DYDX is shown below:

Source: TokenUnlocks

Investors, employees and consultants, and future employees and consultants collectively hold 50% of the tokens, which should have been released in February 2023, but before its expiration, the community voted to extend it to December 1, 2023.

This part has a relatively large selling pressure, and the team is seeking new ways to lock these tokens. According to the plan, the DYDX chain will go online in the fourth quarter, and DYDX tokens need to be pledged as consensus nodes. Currently, the DYDX chain public testnet will go online on July 5, 2023.

Excluding these locked tokens, the main selling pressure at this stage comes from transaction incentives and liquidity provider incentives. Both incentives are unlocked every epoch (28 days), totaling about 2.73 million DYDX tokens.

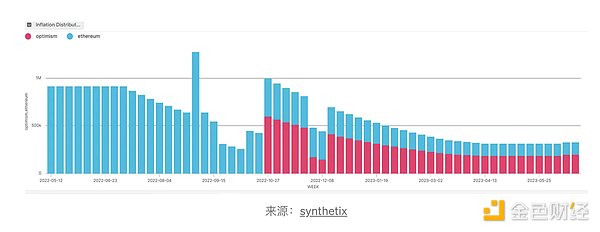

SNX’s tokens are almost all in circulation, with additional tokens coming from SNX issuance. SNX stakers can receive two types of incentives: fees and SNX issuance. The SNX inflation rate is adjusted weekly, mainly based on the SNX staking rate, to stimulate staking. The specific rules are as follows:

- Staking rate >70%: inflation rate reduced by 5%;

- Staking rate between 60-70%: inflation rate reduced by 2.5%;

- Staking rate <60%: inflation rate increased by 5%.

The following figure shows the amount of SNX tokens released each week:

Source: synthetix

Summary:

Comparing the three projects, GMX has the largest market value of tokens to be released in the next two months and is expected to be almost fully released in half a year, resulting in less selling pressure in the future. DYDX still has a large amount of selling pressure, which will significantly suppress the growth of its market value if there is no proper solution to lock up the tokens. SNX is an inflationary token that continuously adds new tokens, but its initial tokens have all been fully circulated, and it needs to digest the new tokens, at a rate of approximately 5% per year.

2. Demand

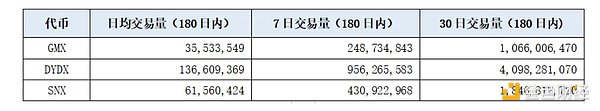

Source: LD Capital

Summary:

GMX provides many benefits for staking, which encourages a large number of tokens to be locked up, resulting in fewer circulating tokens on the market. After most of the tokens are staked, they will be converted to esGMX, and the release cycle of esGMX is one year, which encourages long-term locking of tokens. DYDX does not have a staking and locking mechanism, and the token has no direct yield utility. SNX’s model is similar to GMX’s, with a relatively high staking rate and has gone through a cycle of bull and bear markets, with many long-term stakers.

Overall, DYDX’s token is mainly for governance, with no actual utility. GMX and SNX are more closely integrated with their respective protocols, which is in line with their “real yield” narrative.

3. Liquidity

Source: LD Capital

Summary:

All three tokens are listed on mainstream exchanges such as Binance and OKX, and their liquidity is relatively sufficient. DYDX has the highest trading volume, followed by SNX, and GMX has the lowest.

4. Currency Holdings

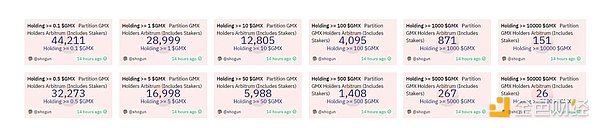

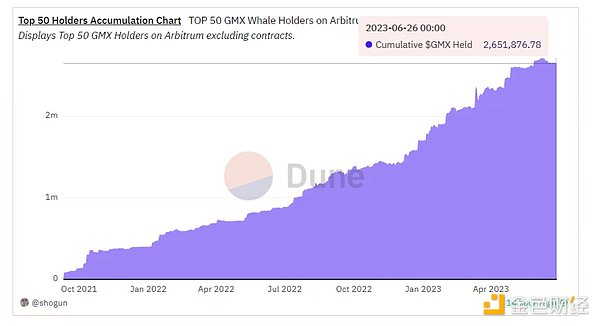

GMX

On-chain currency holdings distribution

The top 50 currency holding addresses have accumulated a total of 2.65 million GMX, accounting for approximately 30% of the circulation. It reached 2.71 million on June 7th.

Arthur Hayes is the largest individual holder of GMX, holding over 200,000 GMX and continuously staking it.

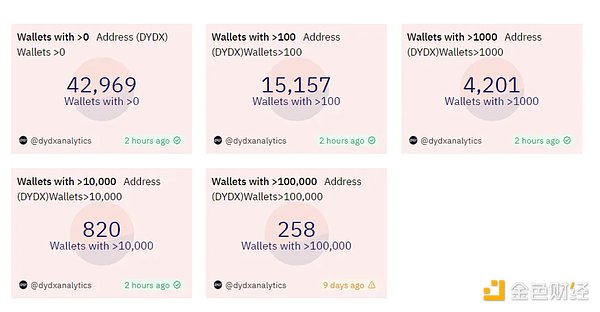

DYDX

Currency holdings distribution

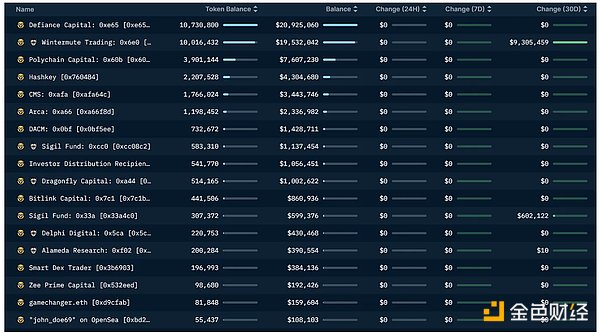

From the smart money holdings, we can see a large number of institutions, including Defiance Capital, Wintermute, Polychain, Hashkey, Arca, Dragonfly, Delphi Digital, Alameda, etc.

SNX

There are also many institutions in the smart money, including Wintermute, A16z, Jump Trading, DWF Labs, etc.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!