Today’s headlines:

HashKey’s Xiao Feng: Hong Kong’s Securities and Futures Commission may issue an STO regulatory circular by the end of this year

LianGuaiULY reveals that the founder of PEPE may be Zachary Testa, who has a criminal record and used PEPE earnings to buy a sports car

Tornado Cash co-founder Roman Storm has been released on bail

- a16z Why We Can’t Build Stateless Blockchains?

- Sui Kiosk A self-service machine for creators to create encrypted assets

- Decoding the New Public Chain PGN Supported by Gitcoin

Binance takes measures to increase liquidity for low-cap projects to address market manipulation concerns

ARK Invest and 21Shares resubmit two Ethereum futures ETF applications

Base and Optimism announce governance sharing and revenue sharing frameworks

Magnate Finance conducts a Rug Pull through oracle manipulation, resulting in losses of approximately $6.5 million

Uniswap’s spot trading volume in Q2 reaches $110 billion, surpassing Coinbase for two consecutive quarters

Regulatory News

Hong Kong Monetary Authority: Studying establishment of regulatory framework for digital Hong Kong Dollar or stablecoins, promoting tokenization of bank deposits

According to a report by Hong Kong Radio, the Hong Kong Monetary Authority stated today that it is studying the establishment of a regulatory framework for digital Hong Kong Dollar or stablecoins, as well as promoting the industry’s adoption of distributed ledger technology (DLT) to tokenize bank deposits. A seminar on DLT technology will be held with the industry next quarter.

Vincent Ruan, Deputy Chief Executive of the Monetary Authority, stated that there is no timeline for the tokenization of bank deposits and it will not be mandatory for all banks to adopt it. The progress is not related to the study of the digital Hong Kong Dollar, and both will proceed in parallel. Chan King-hung, Assistant Chief Executive of Banking Supervision, expressed hopes for wider adoption of DLT technology in the future, such as reducing bond transaction time to T+1. He also acknowledged that DLT platforms still face limitations in terms of technological maturity and stability, and further research is needed. However, once the technology matures, there will be opportunities to expand into the tokenization of securities, real estate, and mortgage products.

HashKey’s Xiao Feng: Hong Kong’s Securities and Futures Commission may issue an STO regulatory circular by the end of this year

Xiao Feng, Chairman of HashKey Group, stated at the Hong Kong Cryptofinance Summer Forum that there is still much room for improvement in Hong Kong’s existing regulatory rules and laws. He believes that there will be continuous improvements in the future, and many regulations, such as Security Token Offerings (STOs), have not been issued yet. By the end of this year, the Securities and Futures Commission may release a regulatory circular on STOs. Supporting Hong Kong’s real economy and technological innovation is crucial for the development of crypto finance (or virtual assets), and STOs play an important role in this. Promoting STO financing for technology companies allows crypto finance to have a relationship with the real economy and innovation in Hong Kong. The regulatory circular from the Securities and Futures Commission can provide clear rules, allowing the industry to know how to raise funds through tokenization.

NFT

Project Updates

LianGuaiULY revealed that the founder of PEPE may be Zachary Testa, who has a criminal record and used PEPE earnings to buy a sports car.

Jeremy Cahen, the founder of CryptoPhunks and NFT marketplace Not Larva Labs (known as LianGuaiULY on the X platform), claimed that the founder of PEPE is Zachary Testa, an American landscape photographer born in 1997. He graduated from Arizona State University in 2018 with a degree in marketing. He has a history of breaking the law in various wilderness areas, sacred indigenous areas, and other drone-restricted areas. Zachary is active on social media under the usernames z (@degenharambe) and Lord Kek (@LordKekLol).

LianGuaiULY has helped the PEPE team connect with the Binance listing team and Sushi team members. Zachary used PEPE earnings to purchase a purple Lamborghini worth $865,000, while his team did not pay any royalties to Matt_Furie, the original creator of Pepe the Frog.

Aave temporarily halted the minting of new GHOs to address integration issues, and related AIPs are being developed for the fix.

Aave stated on the X platform that a technical issue was discovered during the integration of GHOs with the Aave V3 GHO pool. To fix this issue, the minting of new GHOs has been temporarily stopped. The community is working on the fix and will propose it as an AIP soon. No funds are at risk, and all other markets are unaffected and operating normally.

Connext: Partial trades not included in airdrop have been corrected, and the community is rewarded for reporting witch addresses.

Layer2 interoperability protocol Connext stated on the X platform that, after carefully reviewing user feedback, the team confirmed that some trades were not included in the previous airdrop plan. The team has now corrected the airdrop distribution and increased the total size of the airdrop accordingly to ensure that the current distribution is not reduced.

In addition, Connext has invited the community to help the team identify witch addresses. If a witch hunter successfully reports a witch attacker/address, the reporter will receive a 25% reward in restored NEXT tokens.

Previously, Connext announced that it will airdrop its native token “Next” on September 5th.

Coinbase includes LianGuaiyLianGuail USD (PYUSD) in its listing roadmap.

Coinbase Assets tweeted that LianGuaiyLianGuail USD (PYUSD) has been included in its listing roadmap. The Ethereum network (ERC-20 token) contract address for LianGuaiyLianGuail USD (PYUSD) is 0x6c3ea9036406852006290770bedfcaba0e23a0e8.

Visa stops issuing new Binance cards in Europe, and Mastercard terminates its crypto card partnership with Binance in four countries.

According to LianGuaiNews on August 25th, Bloomberg reported that a Binance spokesperson stated that Visa has stopped issuing new co-branded cards with Binance in Europe since July. Meanwhile, Mastercard will completely terminate its credit card partnership with Binance in September in four countries. Mastercard has refused to disclose the reason for this decision. Visa has not responded to requests for comment.

Regarding the earlier report that “Mastercard and cryptocurrency exchange Binance will end their four crypto card projects in Argentina, Brazil, Colombia, and Bahrain on September 22nd”. Binance posted on the X platform stating that less than 1% of users in Latin America and the Middle East will be affected by this decision, and Binance accounts globally will not be affected. Mastercard stated that this will not have any impact on any other crypto card plans. The company stated that a grace period will allow cardholders to convert any assets in their Binance wallets.

The US Drug Enforcement Administration accidentally transferred around $50,000 worth of confiscated cryptocurrency to scammers

According to Forbes, earlier this year, the US Drug Enforcement Administration was deceived by a common cryptocurrency scam, resulting in the agency losing over $50,000 worth of digital currency during a three-year investigation into suspected drug proceeds laundered using digital currencies.

A search warrant reviewed by Forbes shows that in May of this year, the US Drug Enforcement Administration seized over $500,000 worth of USDT from two Binance accounts suspected of transferring illegal drug proceeds and stored them in a Trezor hardware wallet placed in a secure facility. Meanwhile, a scammer noticed that the Drug Enforcement Administration had sent a $45.36 USDT test amount to the Marshals Service as part of standard forfeiture processing. The scammer quickly set up a cryptocurrency address that matched the first five and last four characters of the Marshals account. The scammer “airdropped” the fake address into the Drug Enforcement Administration’s account and placed a token in the DEA account, making it appear as if it were a test payment to the Marshals. The Drug Enforcement Administration mistakenly sent over $50,000 worth of digital currency to the fake address by copying and pasting the cryptocurrency address, and afterwards contacted Tether, the operator of USDT, to freeze the fake account, but Tether stated that the money had already been spent. The identity of the user of the scam wallet has not yet been determined by investigators.

Victory Securities, a Hong Kong-listed company, launches the virtual asset trading application “VICSEC”

According to LianGuaiNews, Victory Securities (08540.HK), a Hong Kong-listed company, has launched the virtual asset trading application “VICSEC”, which is now officially online and available for download on Google Play Store and APK. The company stated that in the initial phase, the app will allow professional investors to experience the security and convenience provided by the virtual asset trading platform offered by licensed institutions, and in the future, there will be more features and the possibility of integrating securities trading.

Executive Director Chen Peiquan stated that the company has launched its first virtual asset trading app, allowing trading of various mainstream cryptocurrencies such as Bitcoin without limitations of time or location. The company hopes to soon launch compliant virtual asset trading for retail investors and play a role in the virtual asset field.

Previously, in March, Victory Securities obtained approval from the Hong Kong Securities and Futures Commission to manage investment portfolios of virtual assets.

Tornado Cash co-founder Roman Storm has been released on bail

Brian Klein, the lawyer for Tornado Cash co-founder Roman Storm, said on X platform: “My client Roman Storm has been released on bail, although I am still very disappointed that the prosecutor has charged him for helping develop software. Their novel legal theories have dangerous implications for all software developers.”

Earlier yesterday, the US Department of Justice accused Tornado Cash founder Roman Storm and Roman Semenov of conspiracy to commit money laundering, violating sanctions, and operating an unlicensed money transmitting business. Roman Storm has been arrested in Washington state, and Roman Semenov has been added to the US Treasury Department’s OFAC special investigation list.

Vessel Capital launches $55 million Web3 investment fund

According to TechCrunch, Web3 venture capital fund Vessel Capital has launched a $55 million fund focused on Web3 infrastructure and application investments. Vessel Capital was founded by Mirza Uddin, Eric Chen, and Anthony Anzalone. The company plans to invest approximately $10 million annually, with funds to be deployed over a five-year period. Uddin stated that while the fund will primarily invest in early-stage companies focused on specific application infrastructure, it is also open to exploring other areas. Vessel has previously invested in “dozens” of companies, including Injective, Burnt, and L1 blockchain Omni.

Prime Trust’s parent company loses $8 million due to investment in TerraUSD

According to Cointelegraph, the parent company of cryptocurrency custodian Prime Trust reported losses of approximately $8 million due to investment in TerraUSD. In a filing submitted to the US Bankruptcy Court for the District of Delaware on August 24th, Prime Core Technologies stated that it incurred losses of $6 million in customer funds and $2 million in treasury funds due to the investment in TerraUSD. This investment, along with increased expenditures incurred in October and November of last year, contributed to its bankruptcy. In June of this year, the regulatory agency in Nevada announced that it had applied to take over Prime Trust and had frozen all of its operations. It is reported that Prime Trust owes customers $85.67 million in fiat currency and $69.509 million in digital currency, but only holds $2.904 million in fiat currency and $68.648 million in cryptocurrency. In August of this year, Prime Trust filed for bankruptcy in Delaware, estimating liabilities of $100 million to $500 million and assets valued at $50 million to $100 million, with creditors numbering between 25,000 and 50,000.

Binance takes measures to increase liquidity for low-cap projects amid market manipulation concerns

According to The Block, Binance is pushing for crypto projects with low liquidity tokens to take measures to facilitate trading on its exchange. Excerpts from messages obtained by the media show that Binance staff contacted multiple projects over the past week to inquire about their relationship with market makers and whether they would consider providing funds for the exchange’s savings products. Specifically, Binance asked these projects if they would consider depositing 1-5% of their circulating token supply into its savings account to earn interest. Similar screenshots of such activities were also shared on Twitter. The messages indicate that if the projects in question have no relationship with market makers or do not wish to contribute to their savings products, Binance requires an explanation.

Binance spokesperson stated that this promotion is part of the “Continual Risk Management Program” and targets a small number of cryptocurrency institutions listed on the exchange. These institutions have low liquidity for their trading pairs or have a relatively small market capitalization compared to the broader market, which may expose users to risks, including potential market manipulation. The primary purpose of the risk management promotion is to encourage project teams to take recommended steps to enhance liquidity protection, and attracting support from market makers is one way to strengthen this protection. “Another possible risk mitigation measure is to donate to a liquidity pool, such as Binance Savings. Users can borrow tokens through margin or loans and engage in trading more actively to inject liquidity into the current market,” the spokesperson added, emphasizing that contributions are optional.

ARK Invest and 21Shares submit two Ethereum Futures ETF applications again

Bloomberg ETF analyst James Seyffart tweeted that ARK Invest and 21Shares have jointly submitted two Ethereum Futures ETF applications again, one ETF named “Ark 21Shares Active Ethereum Futures ETF (ARKZ)” and the other named “Ark 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY)”. According to previous reports, Ark Invest and 21Shares have submitted three Bitcoin Futures ETF applications to the U.S. Securities and Exchange Commission (SEC).

Base and Optimism announce Governance Sharing and Revenue Sharing Framework

According to Cointelegraph, Base and Optimism developers have jointly announced a revenue sharing and governance sharing agreement. According to a blog post by Optimism Collective, Base’s smart contracts can only be upgraded through a 2/2 multi-signature wallet account. One signature is controlled by Base and the other is controlled by the Optimism team (“Optimism Foundation”). This means that Base cannot be upgraded without the consent of the Optimism team. As more and more blockchains choose to use the OP Stack and become part of the “superchain,” governance will be transferred to a “security council.” The council consists of representatives from all the blockchains that make up this ecosystem.

Base will also pay 2.5% of its revenue or 15% of its profits to the Optimism Collective, whichever is higher. In return, it will receive “up to 118 million OP tokens,” giving it a voice in Optimism’s protocol governance. To maintain balance, this quantity will be limited to within 9% of the total supply. The team will also continue to develop real-time network monitoring tool Pessimism to detect network security threats as early as possible. In addition, Base will share revenue with Optimism Collective and eventually hand over the upgrade key to the Optimism Security Council.

According to previous reports, Coinbase, the parent company of Base, has also released the “Base Five Neutrality Principles” to prevent Base from becoming centralized.

Subsequently, dForce founder Yang Mindao stated that according to the agreement between Base Chain and Optimism, the valuation of Base Chain should be $1.18 billion.

Except for FTX, BlockFi’s claimant data was also leaked in the Kroll attack incident

BlockFi issued a statement today on the X platform stating that it has learned of a data incident involving its third-party supplier, the claims management platform Skroll. Kroll confirmed that an unauthorized third party obtained certain BlockFi client data from the Kroll platform. BlockFi’s internal systems and customer funds were not affected, and it can also confirm that BlockFi account passwords have never been stored on the Kroll platform.

BlockFi also stated: “Similar events have recently affected other bankrupt cryptocurrency platforms. In the coming weeks, you should expect an increase in phishing and spam calls. BlockFi and Kroll will never call, email, or text you asking for your personal information. You should directly visit our website and not click on any links in emails to log in. We are swiftly conducting a thorough investigation, and more information will be sent via email to all affected customers.”

Earlier today, it was reported that Kroll, the bankruptcy claims agent for FTX, was attacked, and non-sensitive customer data of some claimants was leaked.

Magnate Finance manipulated through an oracle and executed a rug pull, resulting in a loss of approximately $6.5 million.

ShieldDAO released an update on the Magnate Finance incident, stating that Magnate Finance executed a rug pull through direct manipulation of the price oracle, resulting in a loss of approximately $6.5 million. Subsequently, the Magnate Finance scammers transferred over 1.34 million DAI to a new address starting with 0x0664.

Previously, blockchain investigator ZachXBT stated that the deployer address of Magnate Finance is associated with the exit scams Solfire and Kokomo Finance. The website and social media platforms of Magnate Finance are currently inaccessible, and its Telegram group has been deleted.

Funding News

Cryptocurrency exchange BitOasis completes a new round of funding with participation from CoinDCX

According to Bloomberg, Dubai-based cryptocurrency exchange BitOasis has completed a new round of funding, with no disclosed terms and valuation. Indian cryptocurrency exchange CoinDCX, existing investors Wamda Capital and Jump Capital participated. BitOasis completed a $30 million Series B funding in 2021, led by venture capital firms Jump Capital and Wamda, with participation from Alameda Research, Global Founders Capital, LianGuaintera Capital, Digital Currency Group, NXMH, and others.

Important Data

PEPE multi-signature wallet threshold reduced to 2/8, and 1.6 million PEPE tokens transferred to CEX

According to on-chain analyst Yu Jin, the PEPE team’s multi-signature address transferred 1.6 million PEPE tokens (approximately $15.08 million) to four different CEX exchanges, including 85 trillion PEPE (approximately $7.99 million) to OKX, 67 trillion PEPE (approximately $6.29 million) to Binance, 445.1 billion PEPE (approximately $410,000) to Bybit, and 400 billion PEPE (approximately $370,000) to Kcoin.

In addition, blockchain investigator CryptoNoddy discovered that the PEPE multi-signature wallet changed the threshold from 5/8 to just 2/8, meaning that it no longer requires signatures from 5 out of the 8 wallets but only requires 2 out of the 8 wallets.

Meme token market sees a general decline, with PEPE and BITCOIN both experiencing nearly a 20% decrease in the past 24 hours

Coingecko data shows that Meme tokens are generally declining today, with Pepe (PEPE), HarryPotterObamaSonic10Inu (BITCOIN), and Mog Coin (MOG) having the highest 24-hour decreases of 20.9%, 19.7%, and 13.8% respectively. In addition, among other well-known Meme tokens, Dogecoin (DOGE), Shiba Inu (SHBI), and FLOKI have 24-hour decreases of 2.4%, 2.7%, and 4.2% respectively. However, Milady Meme Coin (LADYS) has seen a 9.1% increase in the past 24 hours.

Uniswap’s spot trading volume reached $110 billion in the second quarter, surpassing Coinbase for two consecutive quarters.

According to The Defiant, data shared by Ryan Rasmussen, a researcher at cryptocurrency asset management company Bitwise, shows that Uniswap processed approximately $110 billion in transactions in the second quarter of this year, once again surpassing Coinbase, which processed approximately $90 billion in transactions in the second quarter. Previously, Uniswap’s spot trading volume in the first quarter of this year was $155 billion, surpassing Coinbase’s $145 billion for the first time.

Coinbase’s spot trading activity during the bear market has declined significantly, dropping 83% from approximately $540 billion in the fourth quarter of 2021; during the same period, Uniswap’s trading volume decreased by half from $235 billion.

Tether Reserve Report: Holding $3.3 billion in liquidity reserves, reserve ratio exceeds 100%.

According to Cointelegraph, the Tether reserve report as of August 24th shows that Tether currently has nearly $3.3 billion in liquidity reserves distributed across 15 blockchain ecosystems. In addition, as of August 24th, Tether’s total assets were $86.1 billion, total liabilities were $82.8 billion, and the reserve ratio exceeded 100%.

LianGuaiNews APP Points Mall Officially Launched

Hardcore prizes are available for free exchange: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, as well as hundreds of selected research report collections, first come, first served, experience now!

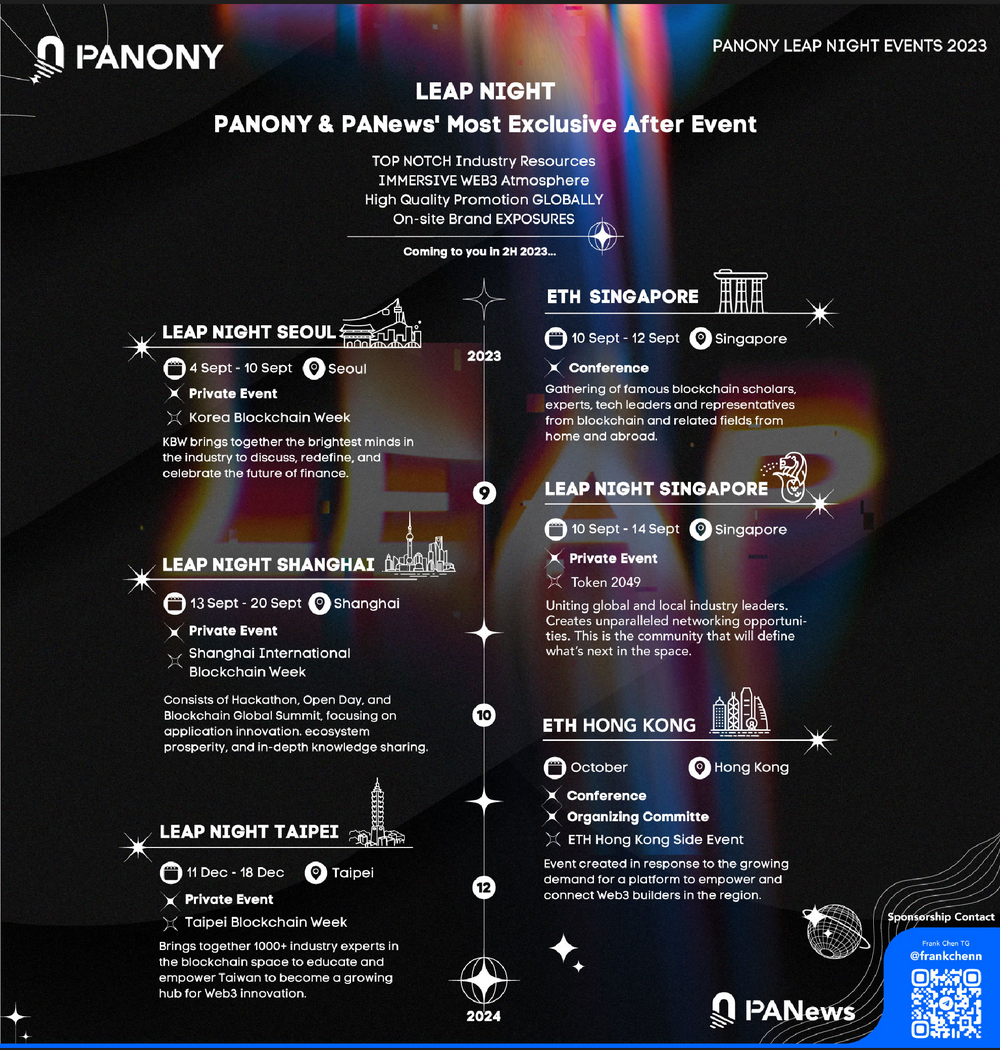

LianGuaiNews Launches the Global LEAP Tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple locations gather to witness a new chapter of globalization!

📥Multiple activities in progress, welcome to communicate!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!