By June 2023, with another round of issuance, the issuance of TUSD (TrueUSD) has exceeded 3 billion, and the market value is approaching BUSD, becoming the fifth largest stablecoin. In 2023, the issuance of TUSD grew by more than 200%, making it the only stablecoin with rapid growth in circulation during the cryptocurrency bear market.

Due to different coordinate systems, the chart only represents trends, data source: glassnode

It seems that everyone in the industry knows that the reason why TUSD has prospered during the bear market is inseparable from Binance’s promotion. Looking back at the development history of TUSD, we can find that TUSD, which seems to be “getting up early and catching up with the late show,” has a different experience from most other centralized stablecoins, including the mysterious departure of TrustToken’s co-founder and CEO and the change of company ownership, and the original team made an unsecured lending agreement TrueFi and issued coins.

- Autofarm was forced to shut down after being “knocked on the door by barbarians”, and the malicious acquirer may have purchased Binance Smart Chain projects multiple times.

- Compound founder enters RWA track, new company “Superstate” aims to tokenize US government bonds on Ethereum

- Interpreting Ethereum’s New Paradigms: PBS, ePBS, PEPC, and Optimistic Relaying

It seems that TUSD has become a new “appointed” stablecoin for Binance. But why did Binance choose TUSD, and who is the actual controller and beneficiary of TUSD now? How will Binance prevent TUSD from becoming the next BUSD? With these questions, we have combed through the history of TUSD in detail, and restored the entire development history of TUSD through clues.

Who is Techteryx? The Secret of TUSD That Cannot Be Said

Looking back on the 6 years from 2018 to 2023, after experiencing the initial brilliance, the mid-term decline, the subsequent change of ownership, and following the trend, TUSD has finally become what it is today.

Born with a golden key

Although it has a weaker presence than USDC (USD Coin), USDP (Blockingx Dollar), and BUSD in DeFi Summer, TUSD (TrueUSD) issued by TrustToken is actually earlier than them. According to the official website, TUSD was launched in April 2018 and was the first regulator-operated US dollar stablecoin.

When it was established in 2018, TrustToken received a total of US$20 million in investment, including a16z and Founders Fund who have gone through bull and bear markets, the well-known Chinese institution GGV Capital, and market-making institutions Jump Trading Capital and BlockTower Capital, which are now well-known in the market, as well as the then red-hot Danhua Capital and ZhenFund in the currency circle.

As early as the year of its launch, its circulation exceeded $200 million. However, in January 2020, the circulation dropped to about $150 million, surpassed by USDC’s $500 million and USDP’s $200 million. Although born with a golden key and quickly landed on many mainstream trading platforms such as Binance, Bittrex, and Upbit, TUSD was not successful in terms of circulation, number of trading pairs, and trading volume in its early years.

The Mysterious Change of Ownership

According to LinkedIn, Jai An, co-founder and CEO of TrustToken, the issuing company of TUSD, resigned in July 2020. He has not updated his profile since then and is almost in a “retired state.” It is difficult to find information about the former CEO of TUSD on various online platforms since then.

Coincidentally, in July 2020, TUSD, which had not been increasing its circulation for a long time, began to increase its issuance intensively. Soon, its circulation broke the previous high and reached $500 million.

Data source: glassnode

TrustToken officially announced in December 2020 that it would transfer the ownership of TUSD to Asian consortium Techteryx. TUSD will have independent financial and operational resources separate from TrustToken Inc. The TrustToken team will continue to manage product operations, compliance, and banking relationships. TUSD will continue to exist on the Ethereum blockchain and support the Binance blockchain, and will soon be natively introduced to Tron and other chains.

This means that the official handover has been completed publicly.

Another co-founder and CTO, Rafael Cosman, became the CEO of TrustToken in the announcement and continued until the Archblock period. At the same time, TUSD’s official Medium moved to a new account, and all articles previously published by TUSD were kept in the TrueFi account. That’s why clicking on some early announcements now redirects to the TrueFi page.

It should be from this point that the mystery of who this Asian consortium Techteryx is and who the real owner of TUSD is became confusing.

After TUSD announced the change of ownership, it sparked intense discussion in the Makerdao community about the risks of TUSD, where we received “very detailed misinformation” from the official side. Techteryx is a large joint venture based in Hong Kong, Singapore, Guangzhou, Shenzhen, and Beijing, led by Jennifer Jiang (the largest owner), who has a deep background in traditional industries and has led the acquisition of more than a dozen companies…

This answer can easily be confusing. In further inquiries, community members stated that no information about Techteryx company was found in the area mentioned above. The only information found about Jennifer Jiang is that she was the CEO of a blockchain company in Boston and has published a paper on blockchain consensus mechanisms. However, the TUSD officials who released the above information did not provide any explanation for it.

Interestingly, for many players, the question of who owns TUSD has become an “open secret” in the cryptocurrency circle.

The reason why it is said to be public is that although Techteryx and the person behind it are good at hiding themselves, large-scale on-chain data cannot be faked. From the current on-chain data, the answer seems even more obvious.

1) Not only did TUSD’s use cases during DeFi Summer come mostly from Tron. According to official data, TUSD has a circulation of about $2.37 billion on Tron, accounting for about 76% of the total circulation, and about $730 million on Ethereum, accounting for about 23% of the total circulation.

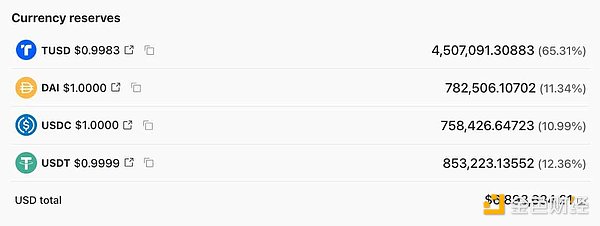

Main issuance data displayed on the TUSD official website as of June 2023

2) Moreover, when ZachXBT publicly raised funds due to the Huang Lizheng lawsuit, only three users donated TUSD, and Justin Sun was not only the first but also the largest donor among the three.

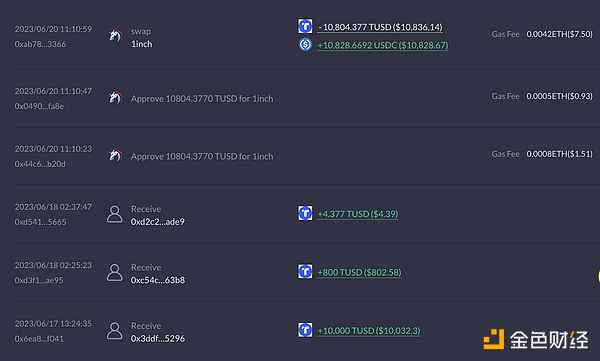

Justin Sun’s address donated 10,000 TUSD, source: DeBank

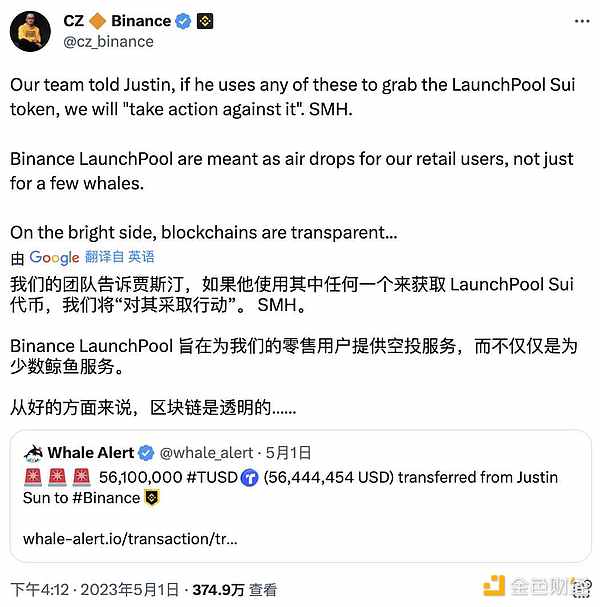

3) Combined with Justin Sun’s transfer of more than 56 million TUSD to Binance during the LaunchPool period of Binance SUI, which was warned by CZ.

Combined with the above or obvious or subtle clues, we seem to be able to find some answers to the question of who actually owns TUSD. And why is this called a secret?

First of all, TUSD has always belonged to Techteryx in name, and Jennifer Jiang did not come forward and explain this publicly. Nor did any Techteryx staff publicly state that TUSD is related to Sun.

Moreover, Adam Cochran (@adamscochran) previously summarized the actual situation about TUSD, “Justin Sun’s corporate group purchased TrueUSD, but still pays management fees to the original American owners. Then it was transferred to an offshore bank, and now with the increase in market value, control of the private key has also been transferred, but there is no real evidence to support it…”.

Adam is like the little boy in “The Emperor’s New Clothes” who said what many people wanted to say. However, the subsequent development of the situation is quite different from the fairy tale. He received a warning from the TUSD official:

1) TrueUSD never belonged to Justin Sun;

2) We reserve the right to seek legal remedies against your slander.

The “denial” from the official and the lawyer’s letter warning further clears Justin Sun’s relationship with TUSD from the public and legal perspectives. Let the ownership of TUSD continue to be a “secret that cannot be said”.

In response to a tweet about “but they just won’t admit it,” Adma said that in fact, when taking over businesses worth over $1 billion, most legitimate business groups want the public to know who they are, not hide it.

Crypto has always been the Wild West. Under various internal and external factors, many Chinese companies also use offshore companies, “white gloves”, outsourcing companies and other means. Just like now, Justin Sun is only a consultant for Huobi.

TUSD and TureFi, brothers of the same origin and different ownership

In fact, CZ has clarified that TrueFi has nothing to do with TUSD. But by clarifying the timeline of the development of events related to TrueFi, we can better understand the relationship between the original TUSD team, investors, and the acquiring party Techteryx:

In 2018, TrustToken received a total of $20 million in investment from institutions such as a16z, BlockTower, and Jump;

In July 2020, TrustToken allegedly conducted a transaction to transfer ownership, and the original CEO resigned;

On November 6, 2020, TrustToken launched the first unsecured loan agreement TrueFi, and the platform’s main loan use case is TUSD;

In December, TrustToken formally announced the transfer of TUSD ownership.

In August 2021, TrustToekn announced a $12.5 million financing completed by selling the TrueFi token TRU, with Blocktower leading and a16z and Alameda Research participating.

In March 2022, TrustToken added two senior executives, Wall Street veteran Bill Wolf and senior product manager Ryan Christensen, who respectively serve as Chief Investment Officer and Chief Product Officer;

In September of the same year, TrustToken was renamed Archblock, and Ryan Christensen, who joined the company, was promoted to CEO. Former CEO Rafael Cosman serves as a board member and advisor and founded AI company Protogon Research in 2023.

Combining the timeline above, we can clearly see that TUSD and TrueFi are of the same origin but different ownership. From the TrustToekn team selling the ownership of TUSD, to creating TureFi based on TUSD and financing and issuing coins, to creating a new company, to possibly introducing well-backed executives for the founder’s exit. A series of hidden and delicate chain operations are breathtaking. Without careful sorting, it is difficult to distinguish the relationship between the two parties. This is likely the reason why each TUSD issuance in the past has caused the TrueFi token TRU to skyrocket.

Coldness and ambiguity, why did Binance choose TUSD?

Binance is one of the earlier trading platforms that supports TUSD. In May 2018, it planned to go online with TUSD, and launched its trading pairs with BTC, ETH and BNB. But perhaps due to liquidity issues, Binance delayed the listing of TUSD by 4 days.

Later, for most of 2019, Binance gradually launched some TUSD trading pairs for projects with high market value and good liquidity. But at this time, Binance may still be in the stage of looking for a reliable stablecoin direction. In addition to TUSD, it also launched USDC and BlockingX. Although there are many mentions in the announcement, TUSD is not unique among many stablecoins.

In order to fully understand the changes in the relationship between Binance and TUSD, we collected the English announcements released by Binance related to TUSD.

TUSD’s “good days” on Binance temporarily ended in October 2019. Since then, Binance has almost no new TUSD trading pairs. From April to October 2020, TUSD was only announced to be removed from trading pairs on Binance for 7 months. In the following time, TUSD became the least visible stablecoin on Binance. Until 2022, Binance continued to delist TUSD trading pairs.

Binance USD (BUSD) is a stablecoin developed by Binance and crypto finance institution Blockingxos Trust Co. in September 2019. In contrast to TUSD, BUSD’s value has been on the rise. Its circulation exceeded that of TUSD early in 2020 and in September, it surpassed BlockingX’s USDP with the help of BSC (now BNB Chain). At its peak, Binance imitated FTX’s strategy and automatically converted USDC, USDP, and TUSD into BUSD to achieve compliance with stablecoins on Binance. At that time, people only recognized USDT, USDC, and BUSD as centralized stablecoins.

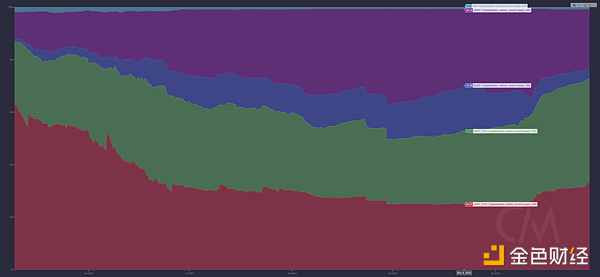

Starting in September 2020, the blue BUSD market share rose rapidly. Source: Coin Metrics

However, on February 13, 2023, the New York State Department of Financial Services (NYDFS) ordered Blockingxos to stop issuing more BUSD, and TUSD’s fate took a turn for the better.

The NYDFS emphasized that it had authorized Blockingxos to issue BUSD on the Ethereum blockchain, but the department had not authorized Binance-Peg BUSD on any blockchain. Blockingxos responded that it would stop issuing new BUSD tokens in accordance with NYDFS’s instructions and work closely with the department from February 21, and BUSD will continue to receive Blockingxos’s full support and can be redeemed until at least February 2024.

Subsequently, BUSD, which had a market capitalization of up to $22 billion, gradually exited the stage of history.

At that time, few people would have thought that Binance would choose TUSD because USDT had a market capitalization of $69 billion, USDC had a market capitalization of $41 billion, and MakerDAO’s DAI had $5 billion. TUSD’s market capitalization was only $900 million, even less than Frax Finance’s native stablecoin FRAX’s $1 billion.

However, the small circulation seemed to be the easiest problem to solve for Binance. Starting in September 2019, TUSD began to be “frozen” by Binance, and during the five months from September 2022 to March 2023, TUSD even disappeared completely from Binance’s announcements. Over the course of five years, Binance only issued 62 announcements for TUSD.

From March to June 2023, Binance released 41 announcements related to TUSD in just three months. Since then, TUSD’s circulating market value has increased by 220%.

What did Binance do after choosing TUSD?

To protect its own rights and the interests of BUSD holders, Binance first chose to increase stablecoin spot trading pairs, launched fee discounts, and stopped automatic conversion of stablecoins on March 11. At the same time, BNB, ETH, and TUSD trading pairs were offered without handling fees. One detail in the announcement is that the window for automatic conversion of BUSD to TUSD is nearly 2 weeks longer than that of USDC and USDP, which speaks for itself about the relationship between the closeness of the two.

In addition, Binance will add TUSD trading pairs to popular trading currencies and open some TUSD trading pairs for isolated margin. Taking RDNT, which was launched on Binance Innovation Zone on March 31st, as an example, the three trading pairs are BTC, USDT, and TUSD.

If the above-mentioned strategies are just appetizers, then Launchpool opening TUSD Pool and BTC/TUSD trading pairs without handling fees can be said to be the sumptuous feast prepared by Binance for TUSD. It is worth noting that prior to March, only BNB and BUSD were regulars on Binance’s Launchpool, but since March, all of Binance’s Launchpool offerings have only been BNB and TUSD. This shows TUSD’s position at Binance.

On March 15, Binance announced that it would stop the zero-handling fee promotion for BTC in all trading pairs, and only BTC/TUSD would have the promotion of zero handling fees for order placement and execution. This strong incentive has made BTC/TUSD trading pairs surpass BTC/USDT trading pairs and become the largest trading pair in terms of trading volume on Binance.

The Hidden Concerns of TUSD

Although Binance supports TUSD like BUSD, TUSD’s foundation is still somewhat unstable despite its runaway success.

When TUSD is not supported by Binance Launchpool, its exchange rate to USDT is negative in the long run. Moreover, it often goes off the anchor in the Curve pool and accounts for nearly 70% of the 3 Pool and TUSD liquidity pool.

TUSD’s proportion in the Curve 3 Pool/TUSD liquidity pool is severely skewed.

Except on Tron and Ethereum chains, TUSD has a very small circulation. Apart from its previous use on TruFi and USDD, there are now few use cases for TUSD, which is struggling even more after DeFi Summer.

Although Binance has launched a zero hanging order handling fee activity for TUSD, the trading volume of other trading pairs is dismal except for BTC. Even with the zero hanging order handling fee for ETH/TUSD, the trading volume is far behind that of USDT. Outside of Binance, there is even less support for TUSD trading pairs on other trading platforms. OKX does not have TUSD trading pairs, and Huobi has only listed USDT and USDD trading pairs.

It is not just the low usage that is a big problem for the TUSD’s more than 3 billion dollar reserve in the community’s view.

TUSD has always claimed that Chainlink provides proof of reserves for TUSD, but Chainlink’s displayed data is obtained from a company called The Network Firm, which regularly reviews TrustToken’s custody bank accounts. It is worth noting that some members of The Network Firm come from Armanino, which audited FTX in 2020 and 2021, and Armanino also audited TUSD’s reserve proof before.

Not only in terms of reserve data proof, Prime Trust, the custodian of TUSD’s reserves, is also plagued by bankruptcy crises. On June 28th, the Financial Institution Division of the Nevada Department of Business and Industry (FID) submitted a petition to the Eighth Judicial District Court of Nevada, requesting the appointment of a receiver to take over the daily operations of the cryptocurrency custodian Prime Trust and examine all of its financial conditions.

According to FID’s documents, Prime Trust had lost access to the old wallet as early as 2021 and used customer assets to repurchase cryptocurrencies. Even TUSD officials have repeatedly stated through various channels that they would suspend coin casting through Prime Trust.

Why TUSD?

Despite the many hidden dangers, why did Binance still choose TUSD?

Regulatory issues are a circle that cannot be bypassed. By reviewing the development history of BUSD, perhaps we can find some clues. In September 2019, Binance chose to cooperate with Blockingxos. Experienced Blockingxos played the role of BUSD’s issuing entity on Ethereum, and BUSD was the ERC-20 Token it issued on Ethereum, and BUSD’s reserve was held in Blockingxos’ US bank account.

But as BSC (now BNB Chain) rises, BUSD also falls. One reason BUSD is subject to regulatory charges is because of this. The issuance of BUSD by Blockingxos is authorized by NYDFS, but only for Ethereum, and the BUSD issued on the BSC chain is a completely different matter.

Although Binance’s partnership with Blockingxos is well-known for BUSD, Binance actually announced a partnership with TrustToken in June of the same year. At that time, CEO Jai An stated that Binance users could seamlessly mint and redeem TUSD. Working with Binance makes it easier for users to enter and exit the cryptocurrency market, taking into account factors such as age, interests, and play style.

It is worth noting that TUSD had a higher issuance than BlockingX in June 2019. Although it is unknown why Binance ultimately chose Blockingxos, it can be said that Binance’s relationship with TUSD began at that time. Not to mention the “Asian ancestry” that TUSD now has, which seems to be a perfect match for Binance.

As for Binance, which now sits firmly at the top of the industry, it did not choose to enter the market with a high-profile launch after the experience with BUSD.

Although there was once a joint challenge from USDC and Binance-supported BUSD, the past is like smoke and USDT continues to dominate the centralized stablecoin field. In terms of liquidity, trading volume, and trading pairs, USDT has a crushing advantage, with Tether’s parent company earning a net profit of $1.48 billion in the first quarter of 2023 alone.

USDT, which sits firmly in the center of the stage, not only does not need support, but has also been fined by regulatory agencies multiple times due to its long-standing opaque reserve issue. USDT, which has been plagued by regulatory issues, was unable to automatically exchange with compliant stablecoins on many trading platforms.

Thanks to FTX and DeFi, USDC (Circle) achieved full development during the previous bull market. Not only did it sit in the position of the second largest stablecoin, but it also received a total of $400 million in financing from traditional US financial giants such as BlackRock and Fidelity in 2021. But whether it is the close relationship between it and FTX, or Bloomberg’s previous report that Circle reported to the NYDFS in 2022 that “Binance’s reserves are insufficient to support assets such as BUSD,” combined with Binance US’s development being hindered in the United States, may make Binance hesitant to adopt USDC on a large scale.

Looking back at TUSD, it is a unique existence among the existing choices, whether it is from its “Asian ancestry”, long history, compliance level, or infrastructure construction. In addition, Binance’s relationship with Tron is not as bad as many people imagine. Not only did Tron conduct an ICO on Bianance, but in 2019, after experiencing regulatory issues, Binance restarted LaunchBlockingd, igniting the market with strong profit-making effects. Since the announcement of the restart of LaunchBlockingd, the price of BNB has risen from $6 to nearly $40, a surge of over 500% that year. BitTorrent was the first project of LaunchBlockingd at that time, which was acquired by Tron founder Justin Sun in 2018.

It is important that, under regulatory pressure, Binance is likely to need a trustworthy and ‘stable’ stablecoin partner from a reasonable and legal third-party perspective.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!