Author: Nancy, BlockingNews

The cryptocurrency market is also witnessing the drama of “barbarians at the gate.” On June 26th, DeFi yield aggregator Autofarm announced on Twitter that it had been maliciously acquired and would shut down the project. Although Autofarm did not disclose the specific acquirer, it mentioned in response to Twitter users that the acquirer was the same fraud group as the acquirer of Neblio and other projects.

BlockingNews found in its investigation of Neblio that the project’s acquirer and CEO had close ties to several controversial cryptocurrency projects, and the tokens of these projects were also delisted from exchanges.

Token delisted by Binance after new financing, investors undisclosed

Autofarm is an old DeFi project that functions similarly to Yearn Finance’s yield aggregator, aiming to optimize DeFi users’ yields when interacting with other DApps in the DeFi space. Autofarm was initially established on the BSC and gradually expanded to other chains such as Polygon, Avalanche, Fantom, and Celo.

- Compound founder enters RWA track, new company “Superstate” aims to tokenize US government bonds on Ethereum

- Interpreting Ethereum’s New Paradigms: PBS, ePBS, PEPC, and Optimistic Relaying

- MOVE Chain is a continuation of consortium chains: an informal response to criticism from the Move ecosystem

DefiLlama data shows that shortly after its launch, Autofarm’s TVL once exceeded 2 billion US dollars, but its locked-in volume began to plummet rapidly after May 2021 and is currently only about 12.63 million US dollars, a drop of over 99.5%. Meanwhile, the Autofarm token $AUTO’s price also fell from a high of about 13,000 US dollars to around 17 US dollars, a drop of 99.8%.

According to public information, Autofarm has undergone two rounds of financing. In addition to receiving initial funds from Platinum Capital, the project announced in January of this year that it had completed a $5 million private placement, but did not disclose the specific investors involved, only stating that this round of financing would be used for integrating advanced artificial intelligence (AI) and machine learning (ML) technologies and developing new products and features.

However, in less than half a year, Autofarm has been exposed to a malicious acquisition earlier this year and has been taken over for some time. It will now formally shut down its operations. Judging from Autofarm’s tweeting activity, it has not been active since March of this year, and many netizens have left messages asking about the team’s whereabouts.

In April of this year, Binance announced the delisting of Autofarm’s $AUTO token and explained in a notice that when the token no longer meets the listing standards or there are significant industry changes, it will conduct in-depth project reviews and may delist it.

Neblio and acquirer have close ties to several delisted projects

The crypto community is still shocked by Autofarm’s encounter, and the mysterious acquirer behind it has aroused market curiosity. Although Autofarm has not disclosed detailed information, perhaps we can find some clues from the blockchain platform Neblio mentioned.

Neblio is a blockchain platform founded in 2017 that focuses on distributed and high-performance. Public information shows that Neblio (token NEBL) has two investment institutions, ValueNet Capital and Dawnstar Capital. Among them, after blockingnews verified with ValueNet Capital CEO Sonic Zhang, he said that the institution did not participate in Neblio. Dawnstar Capital is the financing institution officially announced by Neblio, and it announced a 15 million US dollar financing led by the investment institution in October last year.

Dawnstar Capital claims to be a venture capital established in 2017 headquartered in Singapore. The fund has invested more than US$300 million in various assets and aims to provide a full set of financing, market-making, and marketing services for illiquid assets such as startups and early tokens, and major liquid assets listed on exchanges. Currently, the official website of Dawnstar Capital cannot be opened, and the Twitter account has no updates.

The cryptocurrency project publicly invested by Dawnstar Capital is the public chain QLC Chain (now renamed Kepple), and the institution led the investment of 15 million US dollars for the project in September 2021. Before the financing, QLC’s Twitter had not been updated for nearly half a year, and the project was questioned by the outside world for selling its shell to Dawnstar Capital with a market value of US$10 million but obtaining a financing of US$15 million, which was indirectly confirmed by CZ’s tweet, the founder of Binance.

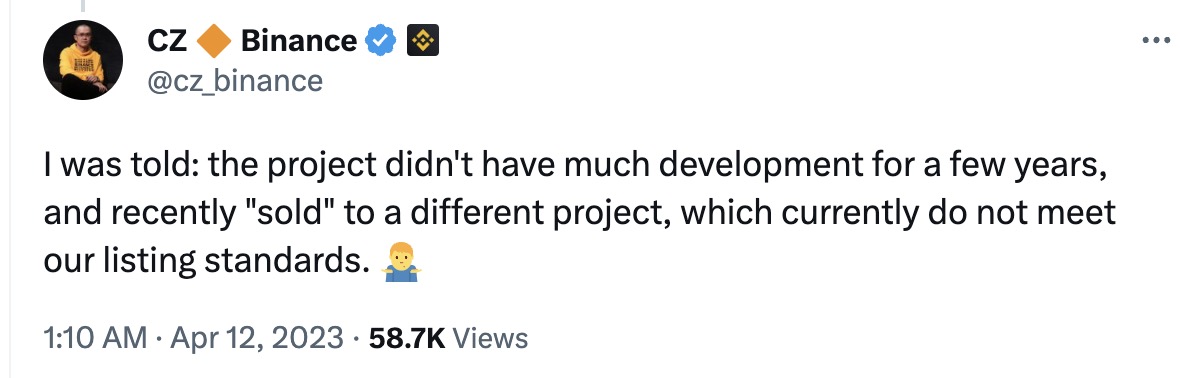

On April 2nd of this year, Kepple accused Binance of delisting QLC without prior notice in a tweet. In response, CZ replied, “Binance will not notify the project team in advance. The platform will regularly delist projects that are inactive, have no progress, and are below certain standards. QLC has not made much progress in recent years, and he himself was informed that the project was “sold” to another project, which does not meet Binance’s listing standards.”

It is worth mentioning that QLC, NEBL, and AUTO are the same batch of tokens delisted by Binance, perhaps Binance has long discovered that the institution used the purchase of projects listed on Binance for speculation.

In addition, Neblio CEO Dives Evgenii also has significant relations with cryptocurrency projects. According to Dives Evgenii’s introduction, he is not only a co-founder of a blockchain investment fund, but also an advisor to multiple projects. On the one hand, Dives Evgenii served as the Chief Operating Officer of the IC0 project TokenClub in 2017. Its token $TCT was delisted from Binance in October 2022 due to factors such as trading volume and liquidity, unethical/fraudulent behavior, and the level and quality of project advancement. Dives Evgenii also has close ties to the decentralized computing power market SONM. Neblio not only established a cooperative relationship with SONM, a decentralized fog computing platform, through the IC0 project, but also promoted its token $SNM’s surge in a tweet. However, Dives Evgenii himself tweeted that he had no relationship with SNM. According to the Ethereum browser, 76% of the total supply of $SNM is owned by the team. $SNM was also downgraded from a listed token to an innovative zone on Binance, a market with higher trading volatility and risk.

From various signs, there are indeed problems with Neblio and the acquirer mentioned by Autofarm. There are many cases of malicious acquisitions in the capital market, and the Autofarm incident may serve as a profound warning for cryptocurrency projects.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!