Compound founder Robert Leshner has announced the creation of a new company, Superstate, which will use Ethereum blockchain as a supplemental record-keeping tool to create a short-term government bond fund, creating regulated financial products that connect traditional markets and the blockchain ecosystem. The Compound token COMP has recently performed strongly as a result of this news, while MakerDAO (MKR) and Aave (AAVE) have also had good performances recently.

Although the concept of RWA (real world assets) has existed for a long time, the narrative and price have a feedback relationship, and enthusiastic users have been looking for logic for this round.

Unlike the previous asset-chaining of RWA, the narrative of this round of RWA is mainly due to the fact that the yield of US Treasury bonds has been at a high level (to be verified), which has caused serious impact on the already declining cryptocurrency market, and the bearish DeFi, which is difficult to resist the siphoning effect of US Treasury bonds for institutional-level stable baseline returns. Even the total supply of stablecoins has declined. According to data from DefiLlama, the total supply of stablecoins has dropped from a bull market high of USD 187 billion to USD 127 billion on July 3.

Look at how the market views this round of gains.

- Comparison of NFT lending protocol mechanisms: price drop ≠ automatic liquidation

- Report on the Japanese Cryptocurrency Market: Industry Trends and Future Prospects Research

- Top 10 Cryptocurrency Market Events of the First Half of 2023

Logic 1: RWA

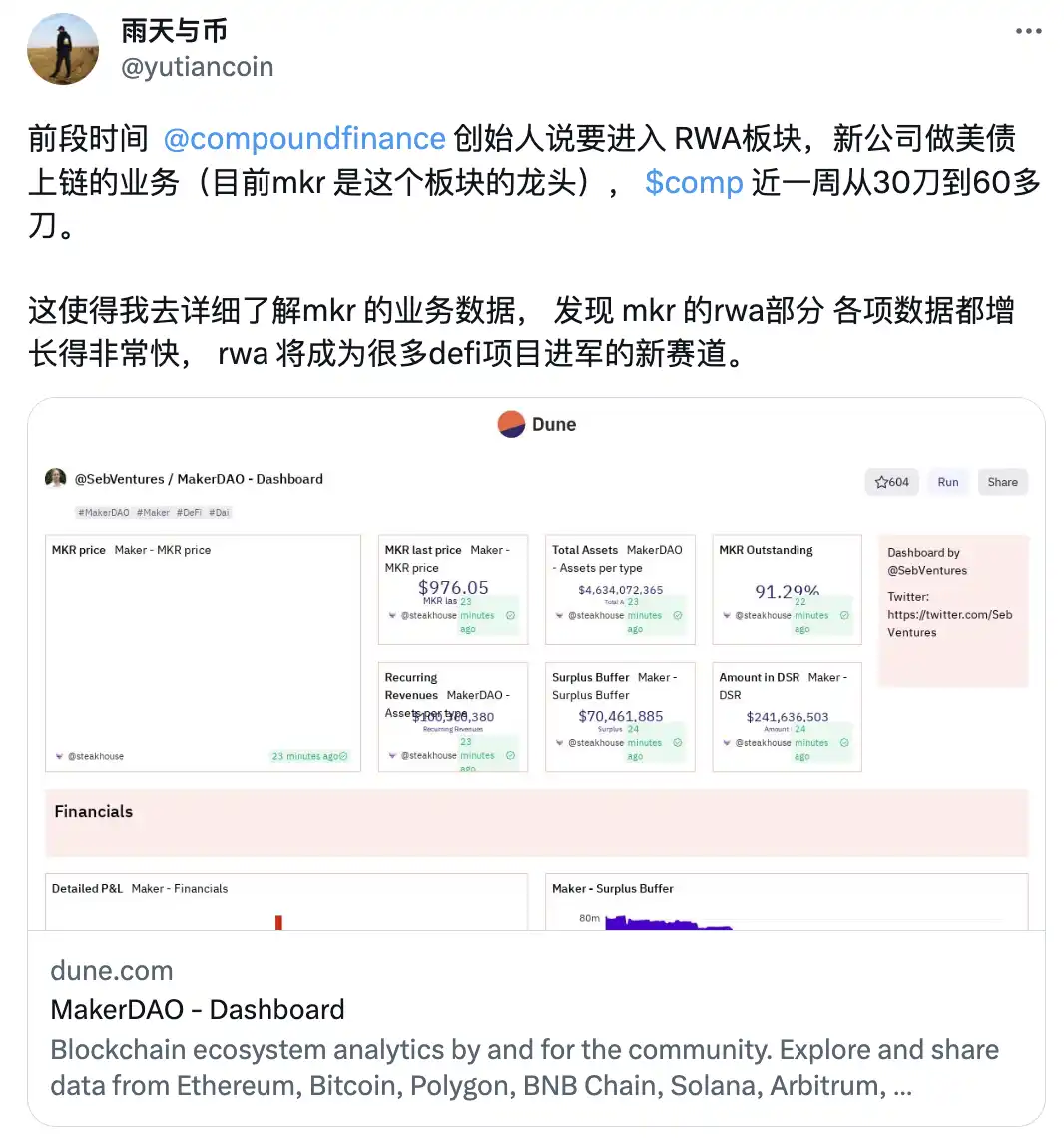

Since the Compound project has not announced any progress recently, the market attributes COMP’s strength to RWA. MakerDAO’s use of its vault for financial management of DAI deposit rates (DAI Savings Rate) has a long history. As early as 2019, DAI launched DSR. It’s just that at that time, DeFi still had such a wide user base and tens of billions of TVL (Total Value Locked).

As for Aave, some users have expressed that, as a larger lending platform than Compound, Aave can not only obtain Compound’s traffic, but also may have new narratives of its own.

Logic 2: “Dino coin”

This round of stronger tokens not only includes these RWA tokens, but also tokens such as Bitcoin Cash (BCH), Litecoin (LTC), and Bitcoin SV (BSV). BCH’s strength may come from its inclusion on the US trading platform EDX. Under the influence of such tokens, some Twitter users have attributed the narrative of these tokens to “Dino coin,” referring to coins left over from the dinosaur era.

Comment: The first three are closely related to the BCH, COMP, and ADA projects.

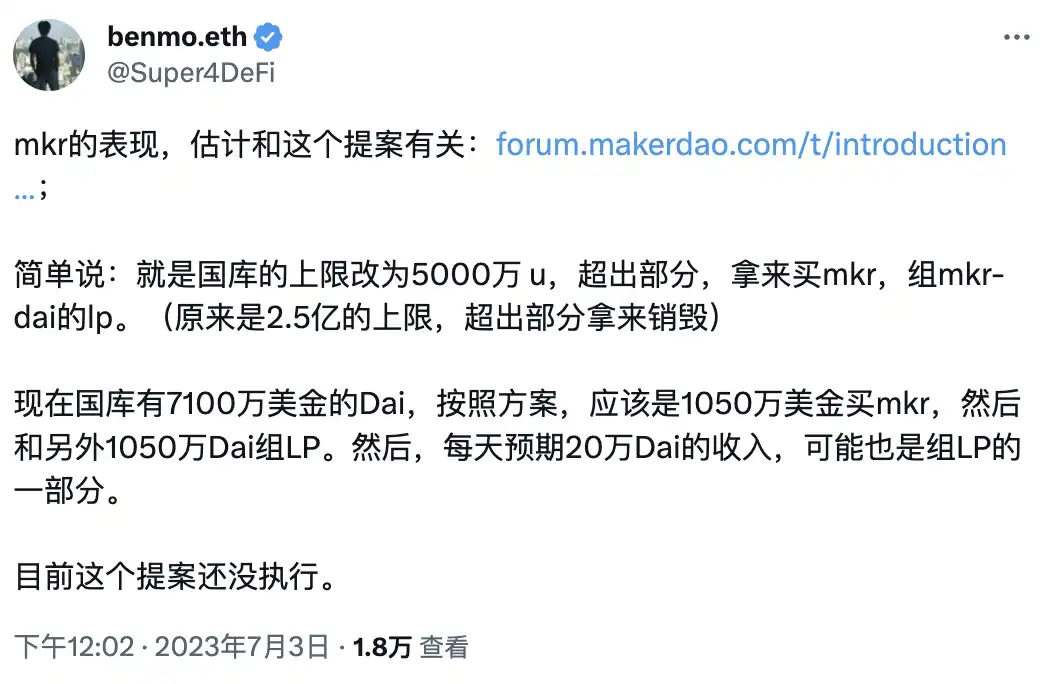

Logic 3: Expected Buyback by Project Party and Whale Purchase

With the advancement of the new MakerDAO proposal to introduce an intelligent destruction mechanism, the market’s expectation for MakerDAO to buy back MKR is growing stronger, which may be the reason why the market is bullish on MKR. At the same time, Rune Christensen, founder of MakerDAO, also bought a large amount of MKR starting at the end of 2022, spending tens of millions of dollars. It is worth noting that as an early investor in Lido, his main source of funds at that time was the sale of his token LDO.

Not only that, there are also a large number of whales buying COMP. According to Twitter user Andrew T (@Blockanalia), a whale collected about $11 million worth of COPM in 11 days, all obtained from Binance. The associated address of the address has been related to IOSG, but Andrew also said that the address is likely to be an OTC address.

As for BCH, many Twitter users are discussing that the dominant force behind it is Bitmain. But it is worth noting that Wu Jihan, the co-founder of Bitmain who strongly advocated for BCH, has left Bitmain. His mining company Bitdeer was listed on Nasdaq on April 14, 2023, and on June 16, Bitdeer announced a $1 million stock buyback plan. Since June 9, the stock price of Bitdeer has more than doubled.

Note: The yellow line shows the price increase of BCH

Is it really working or is it a “dead cat bounce”?

Whether it is Compound, MakerDAO, the old-fashioned DeFi or RWA, the narrative that is hot until it’s too hot has been repeatedly stirred and reheated many times. In this industry where everything is accelerating, most hotspots follow the same path of rapid rotation in months, weeks, or even days. In the cryptocurrency industry, many people judge whether a product has “worked” based on its token price. “Working” here no longer refers to whether the project can make money, but rather “do I want to continue telling the story for it?”

Many people believe that the rise of MKR and COMP is due to changes in the revenue structure of the protocol or modifications to proposals, and thus it can influence the coin price. However, following this logic, UNI should be the leader of this wave of gains. Of course, you can also say that UNI is not RWA, but when we observe the MKR price after the deployment of the buyback proposal, RWA or favorable proposal modifications do not seem to have brought the expected sustained rise.

As some calm users have commented, regardless of how the market narrative “fits” the coin price, users need to make their own judgments. “Buy the rumor, sell the news.” No matter what market, a good story is the endless source of people’s continuous recharging for their beliefs.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!