Article author: YANCEY STRICKLER Article translation: Block unicorn

Cryptocurrency is dead, and few people will feel sorry for it. Now, the bubble has burst and the real revolutionary work can begin.

In 2022, people witnessed the collapse of the cryptocurrency world.

- The Token that Disappeared from Data Analysis in the Last Decade: From Failed ICOs to Decreased Market Interest

- A Decade of Turbulent Development of Cryptocurrencies: Disappeared Tokens and Failed ICOs

- Conversation with Pendle Protocol: How to bring the interest rate derivatives market into DeFi?

Except for those who unfortunately lost a lot of money during the pandemic or had their Twitter avatars zapped by laser eyes, hardly anyone mourned the decline of cryptocurrency. Its excesses have become a costly, absurd living example of fraud and hollow money (assets without substantive support) in modern human history.

This period of mania cannot last forever, and it has not. The era of cryptocurrency is now coming to an end. Not because of SBF (although he has made contributions), but because of the accumulation of many things that we are all familiar with: the volatile price of cryptocurrency makes it almost unusable as a practical currency; overseas tax planning, regulatory evasion, and financial control; everything is securitized; and so on.

The end of the era of cryptocurrency marks another big event: the merger of a new, equity-proof version of Ethereum. This evolution creates cheaper, less energy-intensive infrastructure and opens a new chapter in the history of blockchain: the era of on-chain.

The Era of Cryptocurrency

The era of cryptocurrency began with the release of the Bitcoin white paper in 2008 and ended in September 2022 when Ethereum switched to the proof-of-stake validation model.

The characteristics of the era of cryptocurrency are the creation of the blockchain technology vision and its first application: cryptocurrency, especially Bitcoin and Ethereum.

The benefits of the era of cryptocurrency include the invention of blockchain and the widespread dissemination of ideas that support it; the establishment of new forms of digital value; and the power to reshape institutions and financial regulations.

The defining product of the era of cryptocurrency is cryptocurrency itself-cryptocurrency, cryptographic infrastructure, cryptographic investment, cryptographic organizations, and, finally, infrastructure derivatives such as non-fungible tokens (NFTs).

The downside of the cryptocurrency era is the amplification of human greed through cryptocurrency – Ponzi schemes, scammers, charlatans, and endless hype, resulting in the mass manufacture and inflation of assets, sometimes even using illegal means.

Except for those directly affected, almost no one will feel sad about the ultimate collapse of cryptocurrencies, and almost everyone else will cheer. Cryptocurrency era: 2008-2022 (rest in peace).

The On-Chain Era

In September 2022, Ethereum successfully transitioned to the Proof of Stake model, significantly reducing its energy and financial costs, making Ethereum for the first time practically usable (rather than just theoretically) as a world computer. With this merger, the On-Chain Era began.

The On-Chain Era will be defined as a period in which most of the world’s innovation and cultural output and sharing is established, stored, and accessed on-chain as a historical and information infrastructure.

The benefits of the On-Chain Era are that it empowers individual users and user groups to maintain digital sovereignty, allowing them to move freely between various markets and spaces without being trapped in a single platform, and to control their own works, data, and backgrounds. This enables various creators, consumers, and institutions to securely connect and obtain critical information in a far simpler and more powerful way than isolated systems of the past and present.

The defining product of the On-Chain Era will be the security, usefulness, and centralization of digital history and identity – but at the same time more decentralized than ever before, ending the true killer application of Web2: platform lock-in. A work or content forged on-chain will establish a provable origin of that information or work source; distribute the work through a shared ledger of the public blockchain; store and maintain it through a decentralized network of computers and code; and allow it to be useful throughout the network and in our daily lives.

The downside of the On-Chain Era will be the limitations of blockchain itself. How big can blockchains scale? How fast can they become? How cheap can they become? Can they handle larger amounts of information? How complex can decentralized applications become? What about zk proofs? And, as usual, there are onboarding issues.

For consumers, the convenience and sovereignty of the on-chain system are killer applications, not some currency that someone is hyping up, promising that it may be valuable someday if everything goes well. In the era of cryptocurrency, all the noise is about increasing the use of cryptocurrencies. In the era of on-chain, the goal will be more practical and useful: to make information more durable and permanently accessible.

The cryptocurrency era depends on sometimes deceptive promises of future utility to sustain itself, while the on-chain era will create practicality in the present and future.

Technological Revolutions and Financial Capital

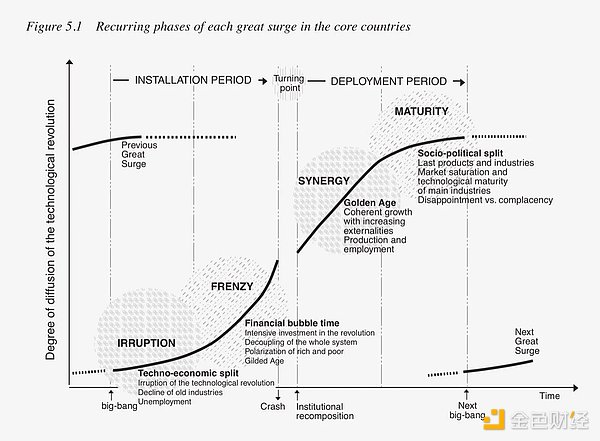

Image Source: Carlota Perez, “Technological Revolutions and Financial Capital” (UK: Edward Elgar, 2002)

The blockchain infrastructure may be going through different stages of thought and is not just a narrative tool. Similar patterns have occurred in past technological revolutions. In the book “Technological Revolutions and Financial Capital,” British-Venezuelan economist Carlota Perez observes an important evolution of technological change: they occur in stages, and bubbles often create practical applications in the later stages.

In the railway era of the 19th century, local crowdsourced funding to invest in regional railway lines based on their technological potential, accompanied by promises of enormous wealth. Almost all of these projects failed, leaving useless railway tracks on the terrain and leaving the true believers in the area bankrupt.

These entities eventually realized that building a railway line alone was not enough. There needed to be activity, commerce, and industry to support it. These were absent, and it was too early (and say it with me) then.

Perez observed that later generations of entrepreneurs and projects used the infrastructure built during the bubble period and began to use it. The core railway infrastructure became cheap enough, and there were enough railways that they began to have practical value. Perez found that bubbles often create markets, just not on the timeline imagined by the initial pushers, and certainly not within their false promises.

It is worth noting that Perez’s book was published in 2002, before the internet bubble burst and the subsequent resurgence of the internet, and the development stages of the internet itself are remarkably similar to the predictions of her model.

Railways and Blockchain

So, what does this mean for the end of cryptocurrencies? How is blockchain like railways? These are questions recently posed by Joe Wiesenthal of Odd Lots in a tweet and an excellent podcast episode. His own answer listed a number of things – all financial and all representative of the cryptocurrency era – but didn’t exactly exude persuasive power.

What infrastructure of the cryptocurrency era is actually useful for the new era of innovation? It’s not complicated: it’s the blockchain itself. The blockchain is a priceless and increasingly practical and available infrastructure for storing and transferring information, assets, and ideas.

Through on-chain storage, information gains a provable origin, establishing its source, collaborators and supporters, and its environment in a permanent and publicly accessible manner without the need for any institutional approval or maintenance. This system of independent verification and knowledge dissemination – whether it’s ideas, artworks or personal information – is truly revolutionary. Kids view the internet as a magical, unique thing that contains everything; the experience of the on-chain era is not far off.

Making information provable, infinite, and housed in a shared public database sounds a bit interesting, but most of the time it’s mundane – hardly worth waging cultural battles over. As the cryptocurrency era fades from memory and its excesses and frauds continue to be exposed, the on-chain era running in the background will grow.

In Web 2, publishing information and ideas generates content. In the on-chain era, publishing information and ideas will create history.

Today, a project I co-founded called Metalabel released a new product that shares our vision for creative work in the on-chain era: a new format called “Records”. Records are digital containers for creators to release and sell versions of their work, and can contain any creative media (art, writing, music, performance, video, design, games, ideas, etc.) and any form of creation (physical, digital, conceptual, ephemeral, live, exclusive, mass, niche). Once purchased, a Record lives permanently on the chain, so creators don’t lose their works (or supporters their collections) even if the platform disappears or changes hands. For us, this is what an on-chain product looks like.

Zora is not the only one working to bring culture onto the blockchain. The growth of Sound.xyz, the many creators who are beginning to catalog their work on-chain, and countless other projects are examples of a shift towards the on-chain era.

In the future, these projects won’t be talking about cryptocurrency. They’ll be talking about information, media, and other digital elements that are secure and portable because they’re on-chain. As a result, we’ll have greater control over our digital lives. Our identities will follow us in the way we want them to, not the way Facebook and Google want them to. We’ll pay for these services not just with cryptocurrency, but with credit cards and digital options as well. It may not be perfect, but it will be more convenient than the maze of usernames, passwords, and accounts that everyone is currently dealing with.

Finally, this new era will owe thanks to cryptocurrency for getting us here. The past decade led to a massive bubble that has now burst, but it also paved the way for an extraordinary future.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!