Author: Nancy, BlockingNews

The NFT market is entering a dark period. On the one hand, with the overall market entering a downturn, the NFT market has also experienced a “shutdown trend”, with several NFT projects announcing their closure one after another. On the other hand, the failure of Azuki’s new work has triggered a sharp drop in blue-chip NFTs, and lending platforms are facing a “big test” with the risk of bad debts and a run on the platform.

Under the bear market, the NFT market has initiated a “shutdown trend”

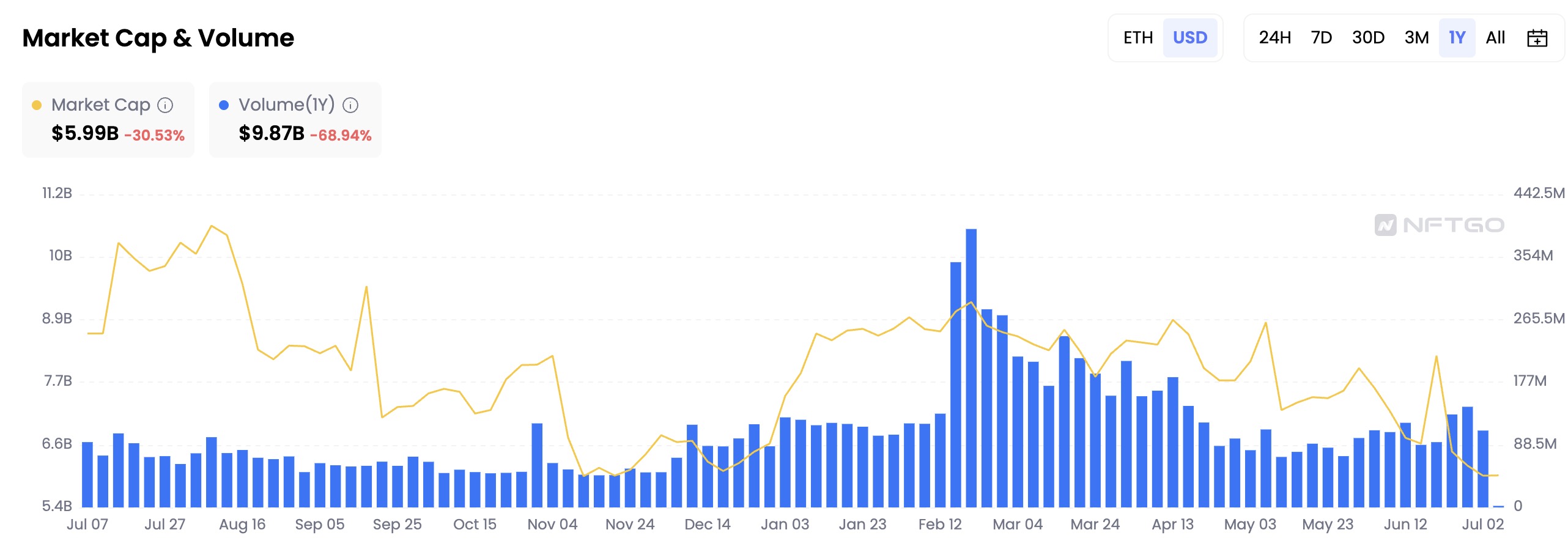

The NFT ecosystem is facing significant shrinkage. According to NFTGO data, as of July 6th, the total market value of NFTs (only Ethereum) reached 5.95 billion U.S. dollars, a decrease of more than 30.5% in the past year; the total transaction volume was 9.87 billion U.S. dollars, a decrease of more than 68.9%; and the number of traders exceeded 1.418 million, a decrease of 17.5%. From the data, the large-scale shrinkage of market value has also resulted in a continuous loss of popularity and capital for NFTs.

- The long-standing DeFi projects COMP and MKR have been rising in recent days. This article explores the possible logic behind this.

- Comparison of NFT lending protocol mechanisms: price drop ≠ automatic liquidation

- Report on the Japanese Cryptocurrency Market: Industry Trends and Future Prospects Research

In the NFT market, where the head effect is significant, the bear market pressure undoubtedly exacerbates the trend of “wolves are more than meat”. Bankruptcy has become a high-frequency vocabulary in the current NFT field. In recent months, Cardinal, Rentable, Tessera, Abacus, FormFunction, Mint Square, and NFT Trader have announced their closures, involving NFTfi, trading markets, and infrastructure.

Although these NFT projects have received millions or even tens of millions of dollars in financing, such as Tessera, which has received 20 million dollars in financing from Blockingradigm, Formfunction, which has received 4.7 million dollars in financing from Variant Fund, etc., they have been forced to close due to macroeconomic downturns, poor business models, difficulty in profitability, malicious attacks, and other reasons.

For example, Tessera founder Andy Chorlian once tweeted that the team spent a long time carefully analyzing the possible market situation, company structure, and financial situation, and believed that this was the best choice for the team and investors, and said, “When we really studied Escher’s economic model, we found that the profit target we needed to achieve (compared to the time and resource cost of scaling up there) or had no good business sense.”

Cardinal once wrote, “Since we began building 18 months ago, we have done our best to navigate an extremely difficult macroeconomic environment where good products are still hard to find. The reality is that members of our team are eager to explore other pursuits. While we have seen some real utility for our staking, renting, and identity products, we still feel they are trapped in the context of the cryptocurrency maximalist community. We had hoped that other industries around the world would begin adopting blockchain technology on a larger scale, but so far that still feels far away.”

Platform as a bad debt “backstop”, Azuki and BAYC series become liquidation “hard-hit areas”

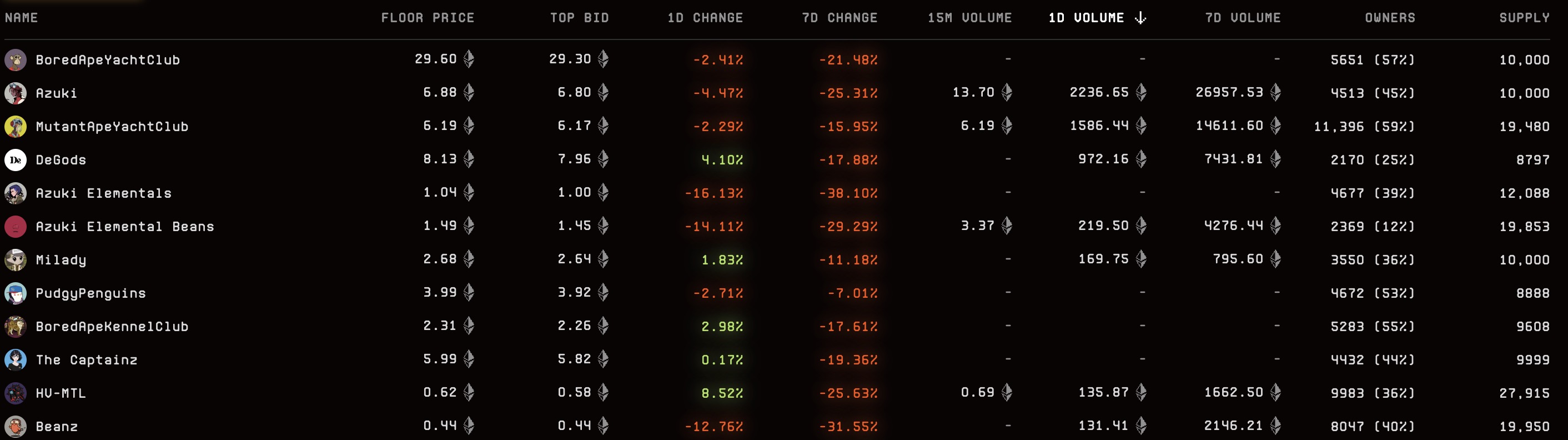

Recently, as a representative blue chip project, Azuki’s unhappiness undoubtedly dealt a heavy blow to NFT’s confidence. NFTGO data shows that the blue chip project index has fallen by about 11.2% in the past 7 days. According to Blur market data, popular projects such as BAYC, Azuki, MAYC, DeGods, Milady, and Pudgy Penguins have all experienced double-digit declines in the past week, especially the Azuki series.

In the general downturn market, a large number of blue chip NFTs are caught in a liquidation spiral. Due to insufficient market liquidity, many mainstream lending platforms have experienced bad debts to varying degrees, and funds have panicked and fled. However, most official lending platform officials have stated that they can cover the range of bad debts.

BendDAO

BendDAO is a point-to-pool NFT mortgage lending protocol that uses a conventional auction liquidation mechanism. BendDAO data shows that as of July 6th, the platform has a floating loss bad debt of 12.8 ETH, mainly due to 8 Azuki with unpaid debts higher than the floor price. At the same time, according to DeFiLlama data, as of July 6th, BendDAO Lending TVL reached 32.2 million US dollars, a drop of more than 69.6% in the past 7 days.

Therefore, the BendDAO community initiated a proposal to “use treasury funds to participate in protocol NFT auctions”, intending to use its DAO treasury to participate in protocol NFT auctions to enhance user confidence and help maintain market stability. Currently, this proposal has received a high vote of 97.11%. As of July 6th, the BendDAO treasury contains assets such as 52 ETH and 327,000 USDT, which are sufficient to cover potential floating losses.

BlockingrasBlockingce

BlockingraSBlockingce is also a point-to-pool NFT lending protocol that uses a hybrid Dutch auction liquidation mechanism. Recently, BlockingrasBlockingce announced the suspension of Azuki loan liquidation services, stating that this is intended to give users more time to supplement liquidity, repay loans, and improve health, and BlockingraSBlockingce has sufficient reserve funds to deal with sudden situations. The current bad debts are about 100,000 US dollars, and BlockingraSBlockingce’s reserve funds can fully cover them. The BlockingrasBlockingce official website shows that there are currently 13 NFTs in the platform in a suspended liquidation state, all of which are from Azuki.

According to DeFiLlama data, as of July 6, the BlockingraSBlockingce Lending TVL reached $55.55 million, a decrease of over 19.8% in the past week.

Blend

Blend is a peer-to-peer lending model. As the largest lending platform, Blend includes projects such as BAYC, Azuki, MAYC, Otherdeeed and Beanz, all of which have bad debts. Beanz (29), Remilio (18), and BAYC (12) are particularly noticeable. According to DeFiLlama data, as of July 6, Blur Lending TVL was $24.85 million, a decrease of over 43.2% in the past week.

Currently, Blur has the most obvious bad debt level, and Azuki and BAYC series NFTs, which have recently suffered heavy price declines, have the most liquidations.

In short, under the liquidity crisis, the current NFT market is facing a new round of stress tests and survival tests.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!