Original author: Poopman, Cryptocurrency Researcher Translated by: Leo, BlockBeats

crvUSD was launched a month and a half ago and has been the topic of many discussions and articles. This article by cryptocurrency researcher Poopman is one of the more comprehensive and detailed ones, covering topics such as crvUSD, LLAMMA, band, Uniswap V3 and LLAMMA, and the stability of crvUSD. The following is a translation of the article:

crvUSD is the most hardcore stablecoin ever. When borrowing from a CDP, there is no need to face full liquidation, and crvUSD introduces the LLAMMA mechanism, an algorithm that uses soft liquidation to reduce the impermanent loss during large liquidations. The following is a very in-depth introduction to crvUSD.

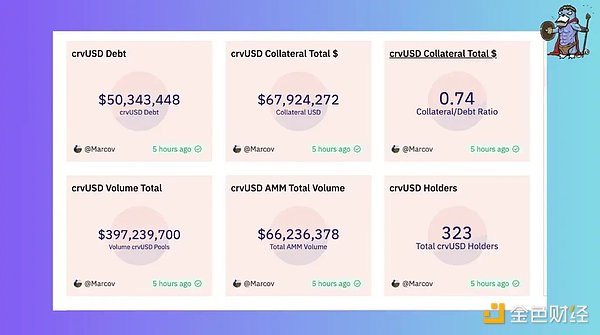

crvUSD stablecoin was launched about a month and a half ago. Among all the collateral, sfrxETH was the first to be accepted for minting crvUSD, followed by wstETH and WBTC. So far, crvUSD has attracted more than $67.9 million in TVL, and it is clear that users’ interest in stablecoins is growing.

- Evening Must-Read: Hong Kong should issue stablecoin backed by foreign exchange reserves

- After working on a Bitcoin NFT project for three months, I have some reflections on the industry

- Can I protect my rights after losing $1 million in a virtual currency exchange due to liquidation of contracts?

What is crvUSD?

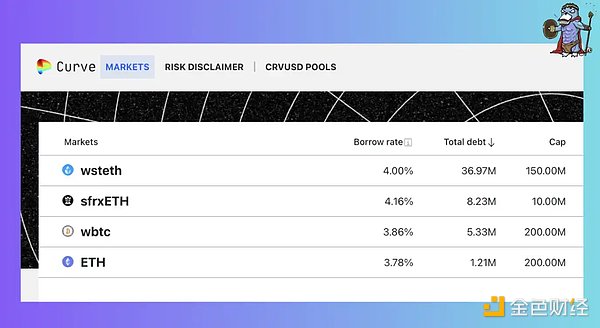

crvUSD is a CDP (Collateralized Debt Position, such as DAI), which allows users to deposit collateral and borrow crvUSD stable assets. So far, crvUSD has accepted four types of collateral, including sfrxETH, wstETH, wBTC, and wETH.

What is LLAMMA?

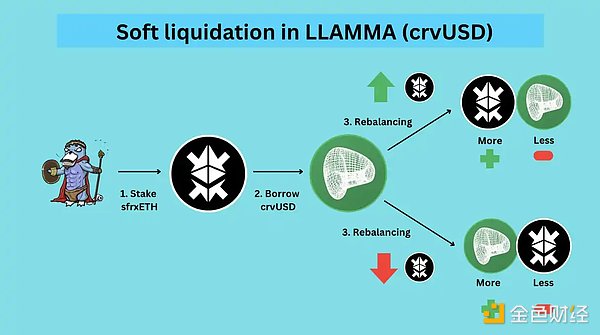

LLAMMA stands for Loan Liquidation AMM Algorithm. Simply put, the model itself functions like an AMM, allowing for gradual rebalancing of collateral portfolios through soft liquidation rather than liquidating positions completely.

To understand how crvUSD works, we need to understand the model and its uses. The following explains soft liquidation and LLAMMA.

Soft Liquidation

First, users deposit sfrxETH or other collateral and borrow crvUSD at an excess collateralization ratio (currently about 117%). Then, LLAMMA converts the user’s collateral into LP positions in a dedicated AMM. As prices fluctuate, the user’s crvUSD and sfrxETH ratio will change.

Use case 1: sfrxETH price drops

When users deposit sfrxETH to borrow crvUSD, the collateral is entirely sfrxETH. However, when the price of sfrxETH drops, LLAMMA converts part of the collateral into crvUSD, creating a collateral position that includes both sfrxETH and crvUSD.

Use case 2: sfrxETH price rises

When the price of sfrxETH enters a rising phase after a drop, LLAMMA buys back sfrxETH with crvUSD, restoring the collateral to a fully sfrxETH position.

This process is called soft liquidation, which temporarily rebalances a user’s collateral composition based on price fluctuations. So how is this “soft liquidation” actually implemented?

What is a Band?

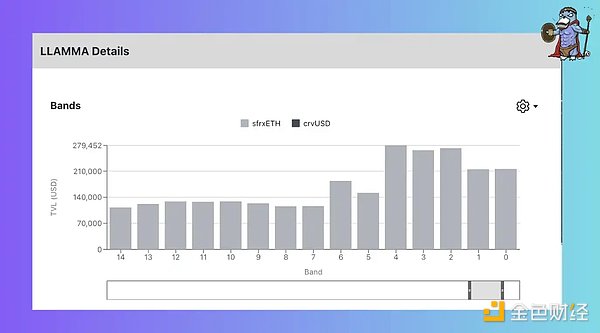

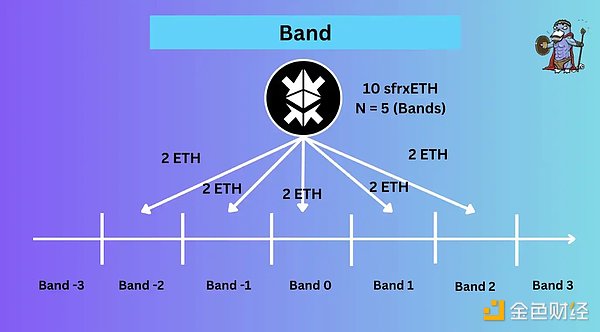

The “secret” to soft liquidation implementation lies in a specialized AMM in a price range called a “band”. A band is a price/liquidity portion, and the user can choose the number of bands to allocate their collateral within the selected range.

Within a band, there are upper and lower bounds. If a user’s collateral price goes beyond the range of a band, the user enters soft liquidation mode, and the assets in the band are temporarily converted into crvUSD.

Before a user mints/borrows crvUSD, they need to choose the number of bands they want to store their collateral in. For example, if the 10th sfrxETH collateral deposit has 5 bands, then each band stores 2 ETH collateral for liquidation at a specific price.

Dynamics:

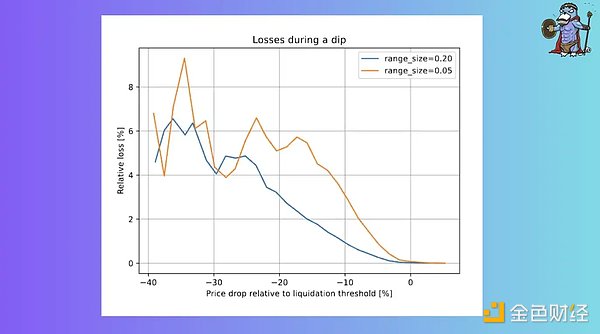

If you choose a higher range (e.g., N = 30), it means that your collateral will be liquidated shortly but more slowly. If you choose a shorter band range (e.g., N = 5), liquidation occurs more suddenly but later than with a higher band range.

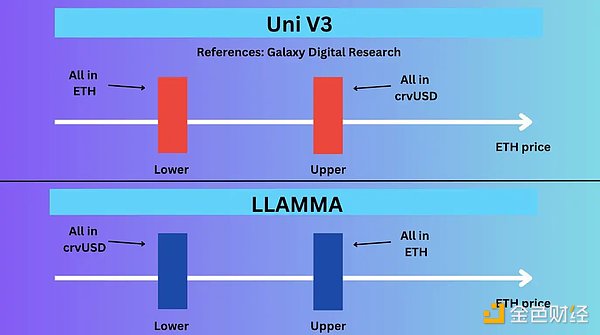

Uniswap V3 vs LLAMMA

So far, the entire AMM system may appear similar to Uniswap V3, but there are some key differences:

– Concentrated liquidity

– AMM Design

– Oracle Prices

Concentrated Liquidity

Uni V3: Users can customize their concentrated liquidity range.

Curve: Automatically concentrate liquidity around the internal price of the oracle.

Therefore, by sacrificing user customizability to deepen liquidity depth near the price.

AMM Design

Uni V3: When the price of sfrxETH goes out of range, your LP position becomes full ETH/crvUSD.

Curve: crvUSD follows the principle of “buying high and selling low.” If the price goes down, you will own more crvUSD. If the price goes up, you will have more ETH.

Through this pattern, crvUSD can reduce exposure to ETH in the event of a price drop, while also gaining upward potential for ETH in the event of a price rise. However, the rebalancing of crvUSD is carried out by external parties such as arbitrageurs, which requires:

– ETH/USD+ + + + + + + + + + + + + + External Price

– Arbitrage Incentives

ETH/USD External Price

The external price actually comes from 4 sources, which are:

Uniswap TWAP Oracle

Chainlink

TriCrypto

ETH/USD Index Moving Average (EMA)

This form of diversified data sources can reduce the manipulation risks that may occur with a single data source.

Arbitrage Incentives

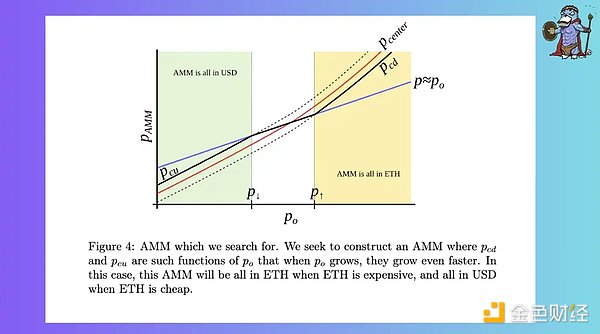

The blue line represents the oracle price. The red line represents the AMM price of LLAMMA. To attract arbitrageurs to rebalance the capital pool faster than others.

The design of LLAMMA’s AMM is that the price in the AMM (red) drops/rises faster than the price in Uniswap (blue). When the ETH price in Uniswap goes down, the AMM price in the AMM goes down faster, creating an opportunity for arbitrageurs to repay crvUSD and exchange ETH collateral.

Advantages: In the event of a large-scale liquidation, liquidation can cause market volatility and bring huge impermanent losses to LPs. Through soft liquidation, assets can be gradually sold, avoiding sudden liquidation and reducing impermanent losses.

Disadvantages: That being said, LPs may suffer losses in the continuous rebalancing process (because the deviation is greater). In addition, during periods of high gas fees, arbitrageurs may not be incentivized because gas costs may shrink their profit margins.

Pegging and Stability

LLAMMA is the first line of defense. However, to ensure the stability of the crvUSD peg, Curve Finance has also prepared two peg mechanisms:

– Pegkeeper

– Interest Rates

Pegkeeper

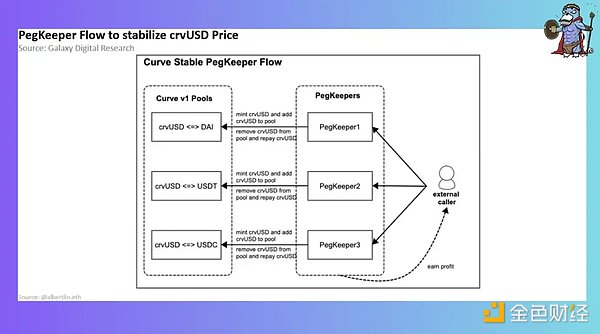

Pegkeeper: similar to Frax AMO:

When crvUSD > $1, Pegkeeper releases uncollateralized crvUSD to increase supply.

When crvUSD < $1, Pegkeeper destroys minted crvUSD to decrease supply.

Currently, there are 4 Pegkeepers helping to maintain price stability.

Interest Rates

When crvUSD deviates from around $1, it incentivizes/prevents users from borrowing. When crvUSD > $1, interest rates increase to incentivize users to repay loans. When crvUSD is less than $1, interest rates decrease to incentivize users to mint and borrow.

Above is the key content about crvUSD, and once you understand these, you will be quite familiar with crvUSD. LFG!!!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!