Author: Miles Deutscher, Crypto KOL; Translator: Blocking0xxz

The US SEC has classified 19 tokens as securities in its lawsuits against Binance and Coinbase. This could have a huge impact on these tokens as well as the entire crypto industry.

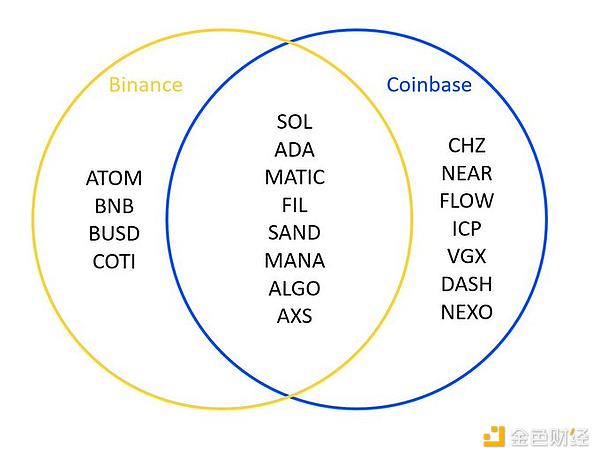

Here is the full list of tokens that the US SEC considers to be securities:

- Realio Founder: After three years of struggling to achieve compliance, I am now forced to leave the United States?

- Spent three years trying to comply with regulations for tokenized funds, but failed. Now I am forced to leave the United States?

- After SEC sues Binance/Coinbase, BTC will be the only safe cryptocurrency

Binance: ATOM, BNB, BUSD, COTI;

Coinbase: CHZ, NEAR, FLOW, ICP, VGX, DASH, NEXO.

Both: SOL, ADA, MATIC, FIL, SAND, MANA, ALGO, AXS, interestingly, ETH is excluded.

What do these tokens have in common?

1. There is an initial sale/fundraising activity; 2. Each project promises to improve the protocol through ongoing development (including business development/marketing expenses); 3. Social media is used to express the characteristics/advantages of the protocol.

This is where the Howey test comes into play. There are four criteria for determining whether something is an “investment contract” (security): 1. An investment of money; 2. In a common enterprise; 3. With an expectation of profits; 4. Derived from the efforts of others.

The US SEC argues that the above 19 tokens meet the requirements of the Howey Test because of the three common factors above, resulting in an “expectation of profit”.

What would be the impact if these tokens were deemed securities?

1. These tokens would not be able to trade on US exchanges; 2. They may be delisted from US exchanges like Coinbase and Robinhood during the transition period; 3. This would create regulatory challenges and set a startling precedent.

The main issue here is that the Howey test is an outdated and relatively limited framework created in 1946. Applying a precedent established in 1946 to a brand-new digital asset category poses challenges.

In my view, the rash approach taken by the US lacks nuanced insight or foresight. I hope other countries take a different approach. We have seen more proactive/thoughtful developments from other developed countries such as the UAE, and even the UK/Australia.

One thing is certain: we need clear regulation. For the sake of the entire industry, its current development, and future growth, we need clear guidelines on how cryptocurrencies can enter the financial system.

This will come with time. But before that, fasten your seatbelt and begin a bumpy journey.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!