Compiled by: BaiZe Research Institute

This week is destined to be a week worth remembering for the cryptocurrency industry.

On Monday, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance, the world’s largest cryptocurrency exchange, and its CEO, Changpeng Zhao. Binance and Zhao face 13 charges, including that the various tokens listed are “unregistered securities,” that customer assets were mixed with their own assets, that Binance Globe allowed U.S. customers to use it, and that virtual trading was used to intentionally inflate the platform trading volume of Binance.US.

Binance responded immediately, stating that the company has always been cooperating with the investigation and striving to negotiate a settlement, but the SEC chose to take enforcement action directly. Binance will vigorously defend its platform, fight against the SEC, and continue to make unremitting efforts to become a safe and trustworthy platform.

- After SEC sues Binance/Coinbase, BTC will be the only safe cryptocurrency

- Comprehensive guide to testnet faucets: How to quickly receive test coins?

- Seven Alleged Offenses of Binance.US and CZ in the Eyes of the US SEC During Investigation

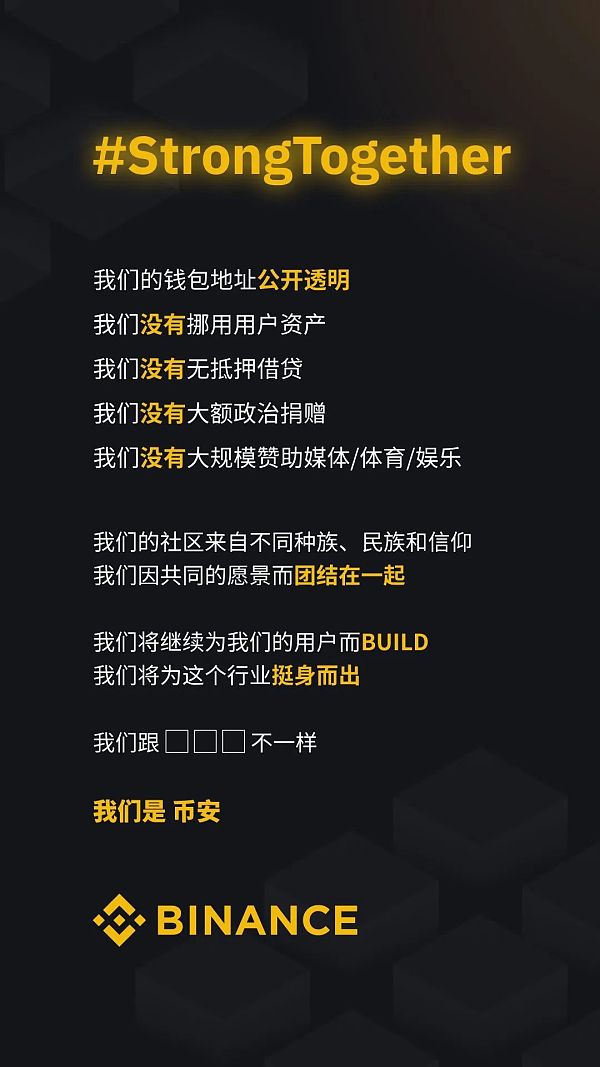

They then released the Strong Together statement again, stating that Binance does not have any misappropriation of user assets, that wallet addresses are transparently and publicly available, that it does not provide unsecured loans, that there are no large political donations or large-scale media/sports/entertainment sponsorships, and that it will continue to build for users and stand up for the cryptocurrency industry.

On Tuesday, the U.S. SEC filed a lawsuit against Coinbase, a U.S. compliant cryptocurrency trading platform, accusing it of failing to register with the SEC as an exchange, clearinghouse, and broker, and explicitly labeling Coinbase’s pledge service and a large number of tokens trading on the platform as “unregistered securities.”

Currently, ten states in the United States have taken legal action against Coinbase’s pledge service, including Illinois, Vermont, Alabama, Kentucky, California, Maryland, Wisconsin, Washington, New Jersey, and South Carolina.

Coinbase’s official Twitter account responded, “Cryptocurrency has come a long way. It still has a long way to go in the United States. We’re ready!”

Obviously, Coinbase is also ready to fight the SEC to the end.

Coinbase CEO Brain Armstrong questions the real purpose of the SEC’s lawsuit:

1. The SEC reviewed the business and allowed the company to go public in 2021.

2. Repeated attempts to register, but the conclusion drawn was that the SEC has not opened registration channels.

3. The SEC and the U.S. Commodity Futures Trading Commission (CFTC) have conflicting views on cryptocurrency regulation, and there is no consensus even on “what is a security and what is a commodity.”

4. The U.S. Congress is still introducing legislation to formally establish regulatory laws, but other crypto-friendly countries have already directly established clear laws. The SEC has not issued a clear rulebook, but has regulated through enforcement.

Why approve Coinbase’s IPO in 2021 and then sue to ban the same service 2 years later?

Therefore, compared with FTX, the true purpose behind the SEC’s heavy-handed crackdown on two crypto giants within two days is questionable.

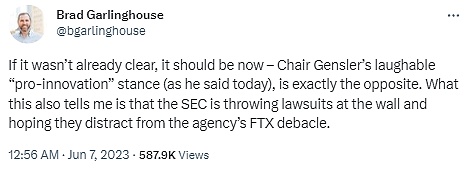

Ripple CEO Brad Garlinghouse joked that this was the SEC’s attempt to “shift” public attention away from the “FTX collapse.” SBF was the second-largest donor to Biden’s presidential campaign, and Biden appointed Gary Gensler as the current chairman of the SEC.

Some noteworthy differences between the two lawsuits:

1. The SEC seems to be intentionally “crushing” Binance

– Coinbase needs to repay all the “ill-gotten gains” related to the SEC’s alleged violations, as well as civil fines and other forms of investor relief. When Kraken settled with the SEC over its staking product-related issues in February, it was forced to pay a $30 million fine.

– Binance not only needs to pay similar fines, but also is ordered to permanently cease securities and crypto trading activities.

2. Coinbase is a “life-or-death battle”

On the other hand, compared with Binance, Coinbase’s struggle with the SEC is a “life-or-death battle.” Coinbase is more focused on the U.S. market, with over 80% of its revenue coming from the U.S. Although Coinbase may continue to operate normally in the short term, the SEC’s accusations may damage Coinbase’s reputation and lead to users withdrawing funds from the platform.

In addition, what is the cost if Coinbase settles with the SEC? If regulators want to promote innovation goals through litigation rather than carefully crafted rules, then how is this any different from standing idly by?

It’s a good thing to remove the “wild west” hat from the crypto industry in order to protect investors, but the SEC may have gone too far in taking enforcement action without clear legal guidance. This provides an opportunity for other countries to become safe havens for cryptocurrencies. Places like South America and the Caribbean are becoming more and more popular with crypto companies because they embrace cryptocurrencies more friendly and openly than the United States.

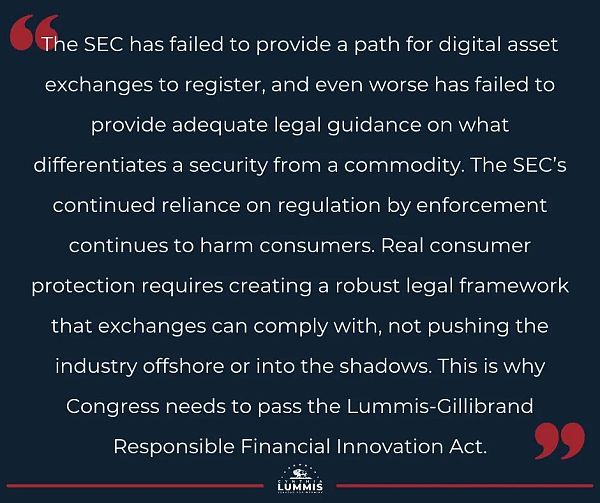

Senator Cynthia Lummis, who has long been dedicated to introducing cryptocurrency regulation bills to the United States, said in a statement that the SEC has failed to provide a registration path for digital asset exchanges, and worse, has not provided enough legal guidance to explain the difference between securities and commodities. The SEC continues to rely on law enforcement supervision and harm the interests of investors. Real investor protection requires a sound legal framework that exchanges can comply with, not pushing the industry away from the United States. The US Congress needs to pass cryptocurrency regulation bills as soon as possible.

This is by no means alarmist. Recently, Derek Boirun, founder of the Realio tokenization project of Real World Assets (RWA), complained in a blog post that unfriendly regulators forced him to leave the United States. The following is a compilation by Baize Research Institute, with slight deletions and modifications:

This summer, that is, in 2023, I will leave the United States indefinitely. As an American citizen born and raised, I am 42 years old. The only purpose of my doing this is to protect my constitutional rights, family, and company from excessive government intervention. This is like a plot in a surreal novel, but this is my story.

I am the founder of Realio, a blockchain company that focuses on building digital infrastructure that aims to put real-world assets (such as real estate) on the chain. We started building this company full-time in 2018 and invested a lot of time and money in its development. From the beginning, our core focus has been on compliance, because investing in real-world assets, whether on the blockchain or not, usually requires compliance with securities laws. After all, investing in real estate is not new, and neither is securities law, so doing it “on the blockchain” sounds very feasible.

Fast forward to 2022, and we’re growing, feeling optimistic about companies issuing compliant, safe tokens on our platform (tokens issued publicly under a legal and regulatory framework). Because we believe compliance can be achieved, we generally ignore most of the narratives that occur in the crypto industry, which happens to be where most of the money goes. Many people have become very wealthy by chasing “fast money,” whether or not they are anonymous, but we are sticking to our guns. We even chose to “tokenize” our own company through compliant security token offerings. Luckily, we managed to raise enough funds to sustain our development and construction for a few years. We are very grateful for the support provided by companies like Algorand, who invested in us through their token, ALGO (just today, I had to hear Gary Gensler refer to ALGO as an unregistered illegal security). If it weren’t for Algorand’s generous investment, as well as the rise in the price of ALGO, our financial situation might be very different.

From 2020 to 2023, most of our time was spent on compliance.

We launched a “tokenization” fund and spent a lot of money hiring top lawyers to register the fund with the SEC under the 40 Act. We spent more money on this than the entire operating budget of many start-ups. By the end of 2022, after multiple conversations with SEC staff explaining the structure, we were ready to submit registration documents. Then the FTX bankruptcy happened. Shortly thereafter, through discussions with lawyers, I learned that the SEC was shutting down registration of all “tokenization” funds seeking permission. However, this was the only way we wanted to register or comply.

At the same time, we also applied for a Regulation CF portal license from the Financial Industry Regulatory Authority (FINRA), which was also a very expensive process… Like the SEC, we had multiple conversations with staff to resolve all issues. However, after the FTX bankruptcy, FINRA asked to speak with us to review our details again. We were prepared and answered all questions honestly. However, we couldn’t help feeling that this telephone call was just a “formality,” with the staff repeating basic questions over and over again, with the goal of making us give up or getting us entangled in some technical problem. After the call, we received a follow-up list of questions from them, which were very broad and even beyond the scope of our application. We were aware that FINRA might delay it for several years, so we decided to put the application on hold until the new government took office.

Most blockchain-based asset issuers do not actually have a way to register, not because of a lack of trying or lack of compliance. From experience, regulators are not fair or friendly to the crypto industry. I am not a stranger to the various strategies regulators have employed against us, typical “bureaucratic” tactics.

However, the talented people in the crypto industry are working to build a better world financial system. This is not a game for us, nor is it political. Many of us have left traditional fields to do this. Now, we have to leave the U.S. too.

Money is the last battle for freedom. We will not stand idly by as you continue to control and manipulate us. Although you hold positions, you do not have this power. You have no right to tell us what the market needs and what it doesn’t need. This is the same kind of overreach that we fought for independence in building this country. The capital markets are suffocating because of regulation that actually doesn’t protect anyone except the wealthiest.

Leaving the U.S. is not easy either. I have a family who loves New York, etc. But I have an obligation to protect everything we’ve built, which means seeking out a country that will support us in continuing to build.

We will not stop, we will continue to build the digital new world we have been working to build.

Realio Founder’s Blog:

https://medium.com/@dboirun/why-im-leaving-the-u-s-233bf2d41f77

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!