Author | defioasis

Editor | Colin Wu

Since its launch at the end of July, Base, a Layer 2 network based on Optimistic Rollup built by Coinbase, has accumulated $7 million in transaction fees, surpassing most other Layer 2 networks during the same period; its on-chain TVL exceeds $540 million, almost equal to the sum of zkSync Era and StarkNet, making it the third-largest Layer 2 network after Arbitrum and Optimism. As a public chain with minimal airdrop expectations, it has achieved greater success in a shorter period of time than public chains driven by potential airdrop farming. In this landscape of one-click chain deployment and reliance on potential airdrops, Base’s experience seems to show us another possibility for the development of public chains.

- LianGuai Morning News | UXD Sell all cryptocurrency assets except stablecoins and instead buy USDC and US Treasury Bonds.

- Weekly preview | Multiple Ethereum futures ETFs will be launched in the United States; Sui (SUI) will unlock approximately 34.62 million tokens worth over $16 million.

- LianGuai Daily | Bitwise launches two Ethereum futures ETFs; Brazil launches digital identity card based on private blockchain

Looking back at the past three months of development, Base has experienced at least four major events significant enough to be recorded in history.

No promotional hype, ignited social media through Memecoin

At the end of July, the Base mainnet quietly went live, but the public became aware of the news not through official media promotion, but through discussions about the huge price surge of Base’s first Memecoin, BALD, on different social media accounts and communities. On the evening of July 30th, the Base network received a total of about 25,000 ETH, with over 10,000 tokens flowing into the BALD/WETH liquidity pool. More than half of the funds in the entire network flowed into this Memecoin, demonstrating its strong ability to attract capital.

At that time, BALD’s market capitalization approached $100 million, with gains of tens of thousands of times. However, amidst the huge surge, the development team lost its way and withdrew a significant amount of liquidity on the second day, triggering a sharp decline in BALD, which was a challenge to the majority of users in this nascent network. This was followed by a massive search on social media for the identity behind the team deploying BALD, believing it was closely related to the bankrupt FTX/Alameda or even SBF himself. Although it ended in disappointment, BALD undoubtedly brought tremendous exposure to the newly born Base.

Venture capital support, surpassing public chains with super applications

The failure of BALD and the collapse of other Memecoins driven by BALD temporarily labeled Base as a network with questionable ecological quality, until the emergence of the super social application friend tech a week later. Integrated with Twitter and relying on novel personal social value trading relationships, as well as an invitation system that quickly became popular in major communities, it was once difficult to obtain. On August 10th, the Base network surpassed 100,000 daily active users for the first time, reaching 136,000, with 42,000 new users joining.

However, simple functionality and poor user experience caused users to quickly lose interest. Just when they thought they would quietly exit the stage of history, friend tech made a high-profile comeback with a seed round financing from the crypto venture capital LianGuairadigm, coupled with the initial round of point distribution for potential airdrops. This quickly brought back the previously exited users, who once again started a trend on social media, attracting more new users. The addition of celebrities such as Chen Jiaxing, President and CEO of famous startup incubator Y Combinator, and FaZe Banks, founder of the American esports club FaZe Clan, as well as the exponential growth of friend tech’s MEV robots, have brought more high-quality traffic and reputation to this young social network friend tech and its newborn public chain Base.

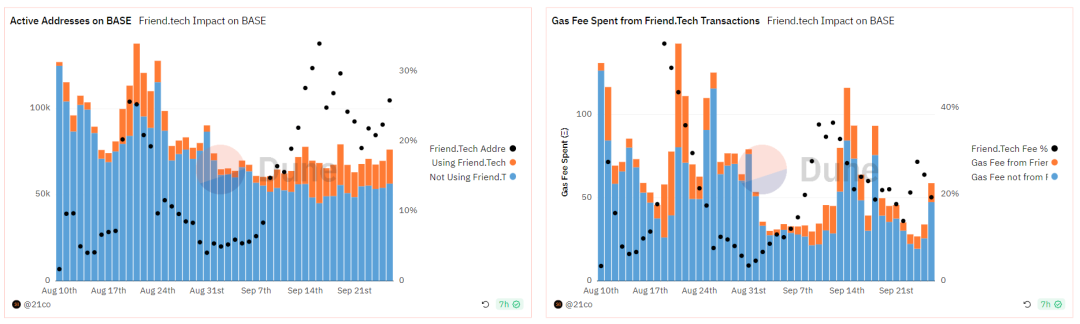

The achievements of Base in the L2 network are already outstanding, but the application of friend tech based on Base far exceeds the Base network itself. According to DeFiLlama data, as of September 27th, Base captured $1.93 million in September, with revenue reaching $1.06 million; while friend tech captured $21.74 million in fees and generated $10.87 million in revenue during the same period, ten times that of the Base network itself, making it a super application protocol comparable to Bitcoin and Uniswap. Currently, active users of friend tech account for about 25%-30% of the Base network, and Gas consumption in transactions accounts for about 20%-40% of the Base network, which is enough to demonstrate the influence of super applications on public chains.

Source: https://dune.com/21co/friendtech-analysis

Source: https://dune.com/21co/friendtech-analysis

DeFi Flywheel, Boosting TVL to a New Level

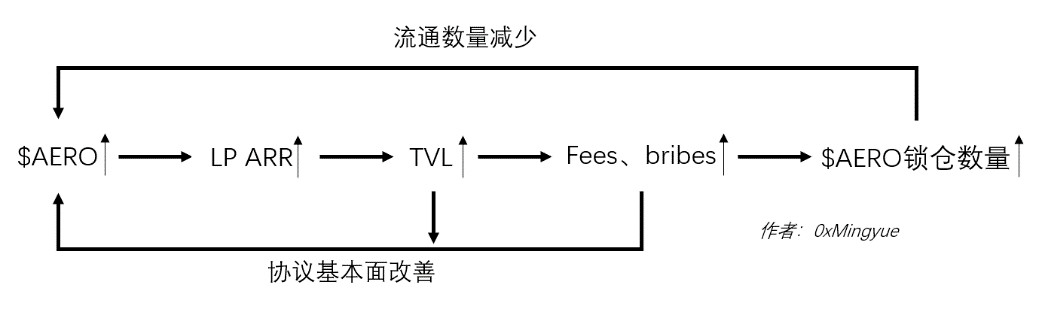

On August 31st, Velodrome, the largest DEX protocol on Optimism, deployed a new forked DEX called Aerodrome on the Base network. In less than 2 days after its launch, Aerodrome TVL reached $200 million, accounting for 50% of the entire Base TVL. Aerodrome inherits Velodrome V2 and improves the flaws of Solidly Ve(3,3).

The Aerodrome team provided nearly 7% emission incentives for veAERO to the AERO-USDC LP Pool, while the circulating supply of AERO was small and the overall size of the LP Pool was small. The high LP rewards attracted liquidity providers to buy a small amount of AERO on the market, further increasing its scarcity, which in turn drove up the price of AERO. The increase in price allowed liquidity providers to earn higher returns, creating a positive flywheel effect and attracting a large amount of external liquidity to the Aerodrome protocol and the Base network in a short period of time.

Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=47&id=17856

Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=47&id=17856

Despite falling more than 50% from its peak, AERO still has a locked value of $97 million, making it the largest DeFi protocol on the Base network, accounting for about 18%. The negative feedback spiral of Ve(3,3) on Optimism’s Velodrome has been addressed through the OP incentive provided by the Optimism Foundation to increase the lock-up rate. It remains to be seen whether this method can be applied on the Base network without token incentives.

Pioneering OP Stack Precedent, Sharing Revenue with Optimism Collective

In order to ensure sustainable funding for the open-source OP Stack and supporting Base’s public products, Base announced a deep collaboration with Optimism Collective on August 25th. Base will contribute 2.5% of the total revenue from Base Sorters to Optimism Collective, or 15% of the profits obtained from L2 transactions on Base after deducting the cost of data submission to L1, whichever is higher. Base will also actively participate in Optimism Collective governance as part of its contribution. Within the next 6 years, Base has the opportunity to earn up to 2.75% of OP supply and commits that its voting power within Optimism Collective will never exceed 9% of the total voting supply. This undoubtedly sets a precedent for the deep integration of OP Stack-based L2 networks and builder Optimism, and may accommodate more OP Stack-based networks sharing revenue with Optimism in the future, forming a large OP Stack ecosystem.

Reflections on the Development of Base

On-chain marketing will become the best marketing method in the future

Marketing methods need to guide users to the next stage and ultimately achieve conversion. The discovery of the Base mainnet did not come from official marketing, but from countless on-chain detectives in the community who tracked on-chain data and chased after on-chain wealth effects, radiating to more ordinary users through social influence. BALD is a typical example of on-chain marketing. The on-chain detectives first noticed the informal opening of the Base mainnet, the birth of the first on-chain token, and the FOMO of funds pouring into Memecoin. Through the community and social influence, they gradually attracted users’ attention and injected funds into the Base network, ultimately bringing players a grand rally in less than a day. It is unlikely that such a love-hate Memecoin would be born without on-chain marketing and the proliferation of L2. It is also unlikely to generate such a huge traffic boost for the network with just ordinary official marketing.

Building super applications for the network

Despite criticism of friend tech’s high fee cuts and value growth curve model, it is undeniable that friend tech has pioneered a unique social track by turning users’ social data into tradable social assets. With the support of this new model, friend tech attracted investment from LianGuairadigm, an innovative branch investment that specializes in betting on innovation, thereby further attracting the entry of social influencers and celebrities. Together with the points incentive system learned from Blur, another investment by LianGuairadigm, as well as continuous improvement of features, a sustainable positive growth has been achieved, benefiting the Base network itself. With the existence of super applications, Base will shift users’ pursuit of airdrops from the network to network applications, achieving a win-win situation for all three parties.

And the connection between friend tech and Base doesn’t seem to be accidental. As early as March this year, when Racer, the founder of friend tech, launched the social application Stealcam, he received praise from Jesse Pollak, the chief core developer of Base, on social media. This may have laid the groundwork for the birth of friend tech on the Base network.

From the competition between public chains to the collaboration between public chains

There seems to be a significant competitive relationship between most public chains, such as the dispute between EVM chains and non-EVM chains, the dispute over the scaling paths of rollups, Validiums, and Optimiums, and the dispute between Arbitrum and Optimism as L2 leaders. Unlike the public chains that are backed by luxury VCs and huge financing, Base has a much lower profile. Its cooperation with the Optimism ecosystem breaks the “hostile” prejudice between L2 solutions, and it has absorbed the Fork from the largest DEX of Optimism to become the largest TVL protocol of Base. It pioneeringly shares profits with Optimism and actively participates in governance. The collaboration between Base and Optimism may bring more synergistic effects in the future.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!