Author: Understanding Finance

Investing in the right track is one of the best investment strategies. Finding the track before dawn can bring great excess returns, as seen in the case of new energy a few years ago. Now that the new energy wave has passed, the opportunity for humanoid robots has arrived.

Since the beginning of this year, concept stocks of humanoid robots such as Dahua Technology have risen by more than 104%, and Far East Transmission has risen by more than 82%. The entire robot index has also risen by more than 40%. It is worth noting that the AI sector, which was hot in the first half of the year, only rose by 20% during the same period.

The core reason for the surge in humanoid robots is the level of industrialization exceeding expectations. A few days ago, Tesla showcased the latest progress of the humanoid robot Optimus in a video, which greatly increased the possibility of industrial landing due to its excellent performance, directly leading to the daily limit of robot concept stocks such as Keliwise and Dahua Technology in the A-share market. In China, on September 26, Fuliye Intelligent General-Purpose Humanoid Robot GR-1 has already started pre-sales.

- What are Dispute Games? Modular games designed for the OP Stack fault-tolerant mechanism.

- A Quick Overview of Friend.tech Design Mechanisms and Potential Risks

- Delphi Digital What are intent-based applications?

It can be foreseen that mass production of humanoid robots is imminent, bringing performance support to concept stocks of humanoid robots.

This article holds the following views:

1. Humanoid robots are transitioning from conceptualization to performance. Leading companies in the industry such as Tesla have already set clear dates for mass production, and suppliers of parts for humanoid robots have also provided positive guidance on the pace of parts production. From the perspective of the production schedule of the entire industry chain, companies in the industry chain are about to reap revenue from humanoid robots.

2. AI has broken through the bottleneck of industrialization of humanoid robots. Humanoid robots need to integrate motion modules, sensing modules, and artificial intelligence modules. Previously, due to technological bottlenecks, it was difficult to efficiently integrate these three modules. However, large AI models have changed this situation, enabling effective integration of perception, decision-making, and motion control of humanoid robots, greatly improving both the progress and performance of the products.

3. The investment opportunity in humanoid robots can be focused on core components. Humanoid robot manufacturers, as the companies with the highest value in the industry chain, have great investment value. In addition, core control systems, motors, reducers, and other core components also have high added value and barriers, which are also worthy of attention.

Industrialization of humanoid robots exceeds expectations

Under the trend of population aging, robots that can replace humans to reduce costs and increase efficiency are a certain investment opportunity. This can be seen from the performance of concept stocks of humanoid robots, which have risen by more than 75% since the beginning of this year.

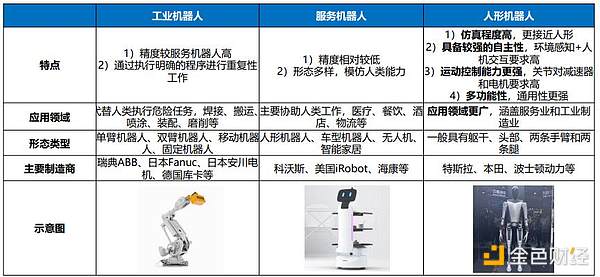

Concept stocks of humanoid robots are highly favored. To talk about the entire robot industry chain, robots are mainly divided into three categories: industrial robots, service robots, and humanoid robots. Among them, industrial robots mainly perform high-precision repetitive work through clear programs. A representative enterprise in the field of automotive assembly is KUKA from Germany. Service robots imitate human abilities and perform lower-level tasks, such as robotic vacuum cleaners. A representative enterprise is Ecovacs Robotics.

Compared to the previous two categories, humanoid robots are the most promising investment category in the current robot industry. Although as early as 1973, Waseda University in Japan developed the world’s first life-sized humanoid intelligent robot – WABOT-1. However, for the past half century, humanoid robots have been unable to industrialize. The reason is not difficult to understand. Humanoid robots are the most technically challenging category in the robot industry. They are closer to human form, have high simulation levels, not only require high-precision work, but also need to have stronger versatility and be applicable in various scenarios.

But this year, humanoid robots have reached a turning point, and their industrialization process has exceeded expectations. A typical example is that a few days ago, Tesla showcased the latest progress of its humanoid robot Optimus on social media. Through the video demonstration, the industry believes that Optimus has made advancements in visual perception and motion control.

In terms of visual perception, Optimus can accurately achieve limb position calibration and motion control, achieve color difference object classification and grasping, and have the ability to eliminate interference and automatically correct errors (not affected by external personnel’s intervention in actions, automatically righting inverted objects). In terms of motion control ability, Optimus has strong control over the strength of grasping and placing objects, and the whole motion exhibits delicate and flexible hand-like movements. In addition, Optimus can perform stretching movements in yoga and maintain balance, requiring high center of gravity distribution and motion positioning and adjustment abilities.

With the upgrade of visual perception and motion control abilities, Optimus can be applied in various fields such as industry, medical care, and daily life. Influenced by the better-than-expected progress of Optimus’ industrialization, after the release of the Optimus video, robot concept stocks such as Keyi Intelligent, Dahua Technology, Yuandong Transmission, and Shengtong Shares all hit the daily limit on the A-share market the next day.

So how did the humanoid robot sector exceed expectations?

From Concept to Performance

In recent years, sectors such as metaverse, AI, and humanoid robots have all experienced significant increases in a short period of time. But unlike most hot concepts, the humanoid robot sector has maintained an upward trend for a considerable period of time.

Compared to the popular AI sector in the first half of the year, AI, driven by AIGC, saw the entire sector rise by over 50% in just a few months, but then began to decline and has risen by over 15% so far this year. In contrast, the robot sector has not experienced a significant decline and has continued to rise, with an increase of over 40% this year.

The trend of humanoid robots is stronger than other concepts because it is almost certain that humanoid robots will reach the point of mass production, and companies in the industrial chain will substantially profit, no longer being just illusions. In other words, the concept stocks of humanoid robots have completed the transition from concept to performance.

Specifically, the mass production of humanoid robots is already on schedule. As the leader in the field, Tesla’s robot is currently in the B-sample stage and is expected to start small-scale production by the end of 2024. In China, on September 26th, Fourier Intelligence announced that its intelligent general-purpose humanoid robot GR-1 has started pre-sales.

The mass production of humanoid robots will also drive the performance of upstream suppliers. Core companies in the supply chain have provided positive guidance on the production pace of humanoid robots. For example, Top Group said, “The company’s developed linear and rotational actuators for robots have been sent to customers multiple times and have been recognized and praised by customers. The project requires entering the mass production ramp-up phase from the first quarter of 2024 with an initial order of 100 units per week. In order to meet customer requirements, the company needs to complete the installation and commissioning of four production lines this year to form an initial production capacity of 100,000 units per year, and then increase the annual production capacity to one million units.”

From concept to implementation, the breakthrough of the core pain points of humanoid robots has been achieved. Specifically, robots are composed of three key technology modules: motion module, sensing module, and artificial intelligence module. For general traditional robots, only one of these technologies is often needed to have value. For example, industrial robots mainly focus on motion control technology, while robotic vacuum cleaners focus on navigation and sensing technology.

However, humanoid robots are different. They must have universality in application scenarios, rather than performing a single task in a specific scenario. This means that humanoid robots require higher technology integration and fusion, need to model larger data sets, and also need a stronger understanding of language and instructions. However, previously, AI data and models were basically developed in isolation and iterated slowly, making it difficult for humanoid robots to achieve efficient integration of perception, decision-making, and motion control.

But the emergence of large-scale models has changed this situation. Large-scale models are evolving from single-modal models such as text, speech, and vision to the direction of multi-modal fusion in general AI. This allows for the direct integration of various technologies such as language, vision, decision-making, and control with humanoid robots, comprehensively improving robot performance. Therefore, the perception, decision-making, and motion control of humanoid robots have been effectively combined.

So, as humanoid robots gradually land, which links in the industry chain are worth paying attention to?

What to invest in humanoid robots?

Referring to the rapid development of electric vehicles since 2019, whole vehicle manufacturers have frequently become the top stocks in the industry chain with the highest value. However, in addition to whole vehicle manufacturers, core automotive components with high barriers and good market structure, such as batteries, separators, and electrolytes, have also seen significant growth.

Returning to humanoid robot investment, humanoid robots have a high entry barrier and require strong integrated software and hardware capabilities. The industry has a large market space, with a market scale in the trillions, making humanoid robot manufacturers a key investment target.

At present, among humanoid robot manufacturers, Tesla has a clear advantage. It not only has mechanical hardware capabilities but also leads in software aspects such as visual perception, algorithms, and virtual simulation. Moreover, Tesla’s car factory also provides application scenarios for humanoid robots.

Compared to Tesla, which is a “leading player” in this field, the core components with high added value and high barriers in the humanoid robot industry chain may offer more opportunities for information asymmetry.

According to Dongwu Securities’ estimation, the proportion of the value of humanoid robot components is as follows: 39% for the core control system, 19% for the motor, 14% for the reducer, 9% for the planetary roller screw, and around 3% for sensors.

From the perspective of the value chain of components, the core control system seems to be the most promising investment segment, but its competitive landscape is not friendly to component companies. The core control system is equivalent to the “brain” of humanoid robots and is one of the highest technological barriers. Currently, Tesla’s humanoid robots mainly use self-developed control systems, which consist of the self-developed FSD system and D1 supercomputer chip. In terms of performance comparison, Tesla’s self-developed Dojo D1 supercomputing chip has achieved a 4x performance improvement compared to other products in the industry at the same cost, a 1.3x performance improvement at the same power consumption, and a 5x reduction in space occupation.

In contrast, the added value of components such as motors and reducers may not be as high as that of the core control system, but the investment opportunities may be more certain. For example, the motor accounts for 19% of the cost of humanoid robots, second only to the control system, and most robot manufacturers rely on procurement. Moreover, motors can also create certain performance differences in humanoid robots. For example, servo motors are known as the “heart” of industrial robots and are generally installed at the “joints” of robots to provide precise control effects. Head manufacturers can rely on precise control effects to gain a competitive advantage and achieve significant performance growth.

Overall, as the flower of tomorrow that is about to bloom, humanoid robots need to be tracked and paid attention to in the long term. Finding those key companies and waiting for great opportunities to come is crucial.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!