Author: Nancy, LianGuaiNews

After 12 years of establishment, the veteran cryptocurrency exchange Kraken is about to venture into businesses outside the cryptocurrency field for the first time. According to sources cited by Bloomberg on September 28th, Kraken plans to launch US stock and ETF trading services in 2024, and has obtained regulatory approval in the UK and applied in the US. At the same time, Kraken will also launch qualified custody services for institutional clients in the coming weeks. The expansion of Kraken’s business services may be related to regulatory pressure and the overall decrease in trading volume in the bear market of cryptocurrencies.

US stock trading functionality will be launched next year, accelerating the diversification of business layout

According to Bloomberg, sources revealed that Kraken plans to offer US-listed stocks and ETF trading in the US and UK next year through a new department called Kraken Securities. The platform has obtained regulatory approval in the UK and has applied for a broker-dealer license from the US Financial Industry Regulatory Authority.

It is reported that after the launch of Kraken’s stock trading, the system will prompt eligible customers to activate the service. People who do so will see their cryptocurrency, stocks, and ETF portfolios presented in a single balance.

- Artificial Intelligence and Social Integration Telegram Bot Creates New Path for Cryptocurrency Development

- Interpreting the calculation of Ethereum gas fees How to reduce transaction costs?

- The current situation of the once popular Clubhouse continuous layoffs, frenzied transformation.

This means that Kraken will compete with platforms such as Robinhood and Public.com. These traditional brokerages are also expanding their own businesses, including Public.com’s plan to expand its platform from the US to the global market, and Robinhood’s launch of brokerage services for retail investors.

In addition, sources said that Kraken is also building its bulk brokerage services and will launch qualified custody services for institutional clients in the coming weeks. This custody service will be independent of the exchange’s operations, and Kraken has applied for approval from Wyoming.

In response to this, a Kraken spokesperson said, “While we cannot comment on rumors or speculation, we are seeking to expand and enhance our products so that customers can continue to securely and seamlessly access Kraken’s full suite of products.”

In fact, in addition to the above functions, Kraken has been actively diversifying its business layout recently.

In June of this year, Kraken officially launched the NFT market “Kraken NFT” and does not charge gas fees for trading NFTs on the platform. It supports over 250 NFT series on the Ethereum, Solana, and Polygon networks.

In July, the independently operated Kraken subsidiary Crypto Facilities appointed hedge fund veteran and former Kraken executive Mark Jennings as its new CEO for the expansion of its services to custodian a wider range of client assets following negotiations with the UK Financial Conduct Authority. If Crypto Facilities’ scope of custodian crypto asset license expansion is approved, the company plans to offer crypto asset futures contracts to institutional investors.

In September, Kraken is gradually launching support for euro and pound deposits for users in the UK and Europe (excluding Hungary and Croatia) through LianGuaiyLianGuail. The EMI license obtained by Kraken’s Irish subsidiary allows it to collaborate with European banks to expand its euro fiat services and register as a Virtual Asset Service Provider (VASP) in Spain, enabling it to provide cryptocurrency exchange and custody wallet services to residents of Spain.

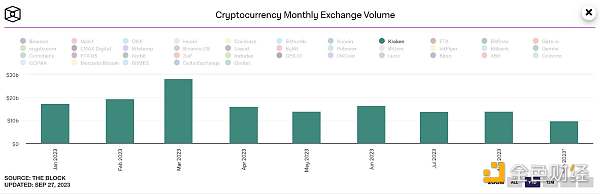

Under the multi-line layout, Kraken’s market share is also expanding. According to data from The Block, as of September 28th, Kraken’s monthly trading volume market share has grown by about 66.9% since the beginning of the year, currently at 3.69%.

Declining trading volume and regulatory pressure, cryptocurrency platforms seek new paths

From an external perspective, the expansion of Kraken’s business may be its response to regulatory risks and expanding revenue.

On one hand, under the prolonged bear market and unfavorable macroeconomic conditions, centralized exchanges (CEX) have seen a continuous decline in trading volume, resulting in sustained impact on profitability. According to data from The Block, as of September 28th, the monthly cryptocurrency trading volume of CEX plummeted to the lowest level since October 2020. The spot trading volume in September was lower than $264.58 billion, far below the monthly trading volume in May 2022 and May 2021, which were $1.4 trillion and $4.25 trillion respectively. Among them, Kraken’s monthly trading volume has fallen by about 43.3% since the beginning of this year.

On the other hand, as the United States and other countries tighten regulations on the cryptocurrency field, Kraken has faced tremendous regulatory pressure and even had to pay huge fines to mitigate risks.

In February of this year, Kraken was charged by the U.S. Securities and Exchange Commission (SEC) for offering unregistered securities, and had to end the pledge service provided to U.S. customers and pay a $30 million fine;

In March, under the new regulatory framework issued by Canada, which requires the segregation of custodial assets, Kraken submitted a pre-registration commitment to the Ontario Securities Commission of Canada and promised to comply with stricter regulations formulated by the country’s financial regulatory institution, the Canadian Securities Administrators (CSA);

In July, after Kraken refused to comply with a summons from the U.S. Internal Revenue Service (IRS), a judge ordered Kraken to provide certain information about its users. The IRS wanted Kraken to provide information such as names, dates of birth, actual addresses, phone numbers, and tax identification numbers for accounts that had cryptocurrency transactions exceeding $20,000 annually between 2016 and 2020. The aim was to determine the identities of U.S. citizens who conducted cryptocurrency transactions during the period of 2016-2020 and their federal income tax obligations;

In September, the Australian Securities and Investments Commission (ASIC) filed a civil penalty lawsuit against Bit Trade Pty Ltd, a local service provider of Kraken, accusing Bit Trade of failing to comply with its obligations in the design and distribution of margin trading products provided to Australian customers on the Kraken trading platform.

For Kraken, a diversified development strategy not only meets the needs of a wider range of users and obtains more sources of revenue, but also helps to some extent in diversifying regulatory risks.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!