Author: Renato Martinez, GCR Research Translation: Deep Tide TechFlow

According to forecasts by the Activity Industry Committee and the Oxford Economic Research Institute, the projected revenue of the ticketing industry will exceed $16 trillion by 2028, making it a highly profitable industry. However, it faces significant unresolved issues. Despite the continuous hosting of events and the gradual improvement of its systems, existing platforms still fail to completely eliminate their inefficiencies, affecting global consumers and organizers.

Firstly, according to SeatGeek’s data, the secondary market sales in the United States reached a market size of $12 billion, which is almost equivalent to 20% of the total ticket volume. Neither ticketing companies nor producers profit from these sales in this market. In addition, it is estimated that about one in every five ticket buyers acts as a reseller.

On the other hand, reports from CNBC and Aventus indicate that at least one out of every ten tickets purchased for events in the United States is counterfeit. Last year, more than 10,000 people in Peru were scammed at a Bad Bunny concert, and there have also been numerous fraud incidents at recent Taylor Swift concerts in Mexico, causing harm to users and consumers.

- LianGuai Daily | Coinbase to offer perpetual futures to non-US retail investors; US government notifies employees government may shut down soon

- LianGuaintera Capital 2023 Cryptocurrency Industry Salary Survey Report

- Project Research | Botanix protocol A Bitcoin Layer 2 Network Compatible with EVM Smart Contracts

However, emerging technologies such as blockchain are expected to revolutionize the industry and create benefits for all stakeholders: ticketing companies, event organizers, artists, and fans.

Advantages of Blockchain and NFTs

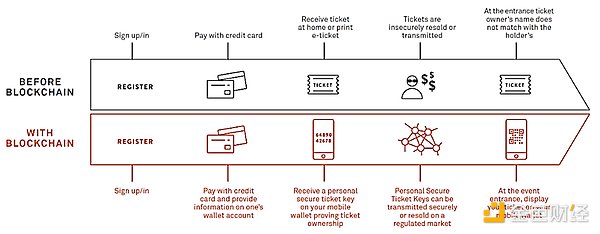

NFTs are tokens that represent unique digital assets, giving us the ability to tokenize digital and physical assets such as artworks, collectibles, and even properties. Stored on blockchain networks, they serve as verifiable proofs of authenticity and ownership. Furthermore, only one official owner can possess an NFT at any given time, unaffected by modifications or counterfeits.

NFT tickets are digital assets stored on the blockchain, significantly reducing the risks of ticket loss, theft, or damage. Additionally, NFT tickets allow for transparent tracking of transactions with complete visibility into real-time flow history. This revolutionary feature empowers organizers with unprecedented control over primary and secondary sales. This traceability also provides the necessary insights for implementing various related initiatives.

Similarly, leveraging smart contracts, event organizers and artists can set various conditions as needed, creating more diverse business models. This includes aesthetic customization, quantity, verification methods, and different sales methods such as auctions or fixed prices.

They can also establish specific rules for distributing royalties in the secondary market, such as automatically paying royalties each time a ticket is resold, creating new sources of revenue for creators and fans after sales. Additionally, this approach can help mitigate excessive reselling by invalidating tickets or imposing maximum prices in the secondary market.

These mechanisms even continue to exist after the event ends, enhancing data visibility and enabling future actions throughout the process, including attendance tracking, loyalty rewards, price adjustments for future events, and resale tracking.

Main participants: From traditional ticketing companies to Web3 native organizations

a) Traditional participants

-

Ticketmaster: Currently the leader in ticket sales in the United States, with over 70% market share and more than 113.6 million monthly active users. It highlights how NFTs are gradually revolutionizing large-scale ticket sales. Ticketmaster has been involved in previous events with the band Avenged Sevenfold, the first web-supported tour with Binance and The Weeknd, and other events including the NFL and commemorative tickets. The company’s collaboration with Dapper Labs allows event organizers and artists to issue NFT tickets before, during, and after live events. At the time of writing this article, over 5 million non-fungible tokens have been minted on the Flow blockchain. Ticketmaster has issued 700,000 NFTs to attendees of Super Bowl 56, immortalizing them with unique seat numbers. In other cases, Ticketmaster’s NFTs unlock rewards and VIP additional benefits for fans after the event.

-

SI Tickets: The ticketing sales division of Sports Illustrated launched its “Ticket Office” platform on May 2, 2022. Since 2021, SI Tickets has sold over 50 million tickets for over 250,000 events. Ticket Office is a self-service event management and ticketing sales system operating on the Polygon blockchain in partnership with ConsenSys. Ticket Office will allow organizers to provide highlights, memories, exclusive offers, and loyalty benefits to attendees through NFT technology.

-

TIXR: This Santa Monica-based ticketing app was established as a modern alternative to the previously rooted ticketing platforms. The company aims to attract users by offering exclusive access to events not listed on Ticketmaster. TIXR has been involved in events such as NFT Arizona and Aku World, the latter founded by former MLB player and artist Micah Johnson. Additionally, they are diving into the NFT world to enrich user experiences, with a focus on integrating these digital assets into the metaverse.

b) New entrants

-

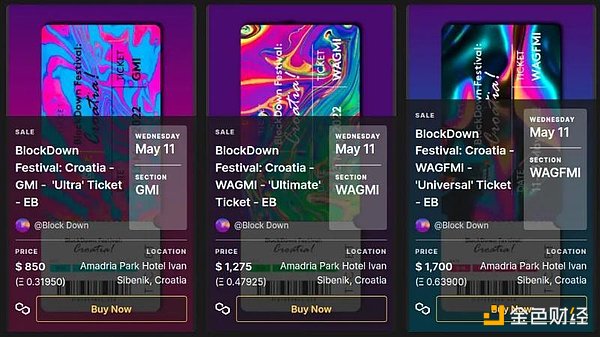

YellowHeart | Headquarters: New York, USA | Funding: $7 million | Funding date: April 2022

YellowHeart can be considered the most important NFT ticket marketplace for top music celebrities and brand events. Its business model focuses on resale royalties. Additionally, it has its own wallet and emphasizes the combination of NFTs with physical items. The company has provided NFT ticketing services for several renowned artists, including Kings of Leon and Maroon 5.

-

Bam.Fan | Headquarters: Vienna, Austria | Financing: $2.1 million | Financing Date: November 2021

Bam provides a comprehensive white-label ticketing and event management system, or a simplified API-driven NFT-as-a-Service (NFTaaS) model. Users can sell tickets and customize the appearance directly on their website. This is a good solution for brands seeking a specific look and feel.

-

Get Protocol | Headquarters: Amsterdam, Netherlands | Financing: $4.5 million | Financing Date: July 2023

This is a solution that provides decentralized financial tools for events and has regained momentum in the ecosystem. It has issued over 4 million blockchain-based tickets for well-known artists. In its recent funding round, it saw participation from famous investors such as Flow Ventures, Animoca Brands, and the Tezos Foundation, as well as individuals like Sebastien Borget, co-founder of The Sandbox.

-

TravelX | Headquarters: Miami, Florida, USA | Financing: $10 million | Financing Date: March 2022

Argentine low-cost airline Flybondi has expanded its collaboration with NFT flight ticketing company TravelX and launched the “3rd Edition Ticket”. This innovation allows passengers to independently change their names, transfer, or sell their “NFT tickets”, providing flexibility in the travel experience. Customers can purchase tickets without committing to travel plans or passenger details. This reduces customer service costs and generates revenue through transaction fees. In addition, Flybondi has included a 2% royalty in the NFT smart contract to ensure fees in secondary market resales.

There are other participants emerging in this industry worldwide, such as NFT TiX (New Jersey), SeatlabNFT (London), Relic Tickets (Florida), etc.

c) Emerging Markets

-

Toket (Buenos Aires, Argentina): Toket provides developers with user-friendly tools to seamlessly issue and manage NFTs on EVM-compatible blockchains. The API simplifies NFT creation across different fields such as art, music, physical assets, and ticketing. With a single API call or deploying custom contracts, Toket can easily generate NFT tickets for events to ensure a secure and traceable entry management system.

-

MentaTickets (Buenos Aires, Argentina): Menta serves as the infrastructure for ticket management, catering to entertainment ticketing platforms. It enables these platforms to enhance their ticket sales and resale through comprehensive traceability of inventory and control over distribution. Menta’s solution is customized for each enterprise to ensure optimal performance.

-

Fanz (Buenos Aires, Argentina): Fanz provides security, authenticity, and transferability for tickets, enhancing the experience for event organizers and attendees. The Fanz application features a control panel specifically designed for event organizers, empowering them to efficiently manage attendee databases.

Increasing Adoption

Various activities around the world are adopting NFT:

-

Binance and The Weekend have set milestones for supporting tours through Ticketmaster, enabling collectible NFTs.

-

Coachella has created its own NFT marketplace, selling 10 lifetime tickets for an astonishing $1.5 million, with one ticket selling for over $250,000.

-

Coinbase sold NFTs with VIP access for the Governors Ball Festival.

-

SXSW sold collectible NFTs for exclusive access to specific events.

-

Wimbledon sold NFTs of Andy Murray’s 2013 victory, including a VIP experience.

-

The NFL and Ticketmaster issued 70,000 digital commemorative tickets for Super Bowl 56.

-

The Olympics hosted an NFT art and music festival in Las Vegas with AfterLianGuairty.

Conclusion

We are in an interesting phase of ticket issuance evolution. NFT ticket startups bring bold and innovative approaches that challenge traditional methods non-competitively. While the leaders in NFT ticket issuance are still unclear, Ticketmaster is in a leading position by leveraging its powerful entertainment infrastructure. The practicality, security, and advantages of NFTs as tickets are undeniable, and well-known brands can benefit from them.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!