1. Introduction to Blockchain and Cryptocurrency Wealth Management

1.1 Background and Significance

The development of blockchain technology since 2008 has greatly changed our world, especially in the financial sector, where blockchain technology and cryptocurrencies have had a profound impact on the global economy. The most prominent aspect is that they provide new investment and wealth management opportunities for financial market participants.

The emergence of cryptocurrency wealth management products is one of the latest achievements of applying blockchain technology in the financial services industry. For investors, cryptocurrency wealth management products provide a new and effective way to maintain the liquidity of their assets while also achieving competitive returns. For the global financial market, the development of cryptocurrency wealth management products expands the depth and breadth of the market, provides new risk management tools, and enriches the supply of products and services in the market.

Therefore, understanding the definition, types, background, and significance of cryptocurrency wealth management products is of great value to investors, market participants, policy makers, and regulators. In the following sections, this article will delve into this topic, hoping to provide valuable insights and cryptocurrency asset strategy recommendations for readers.

1.2 Definition and Types of Cryptocurrency Wealth Management Products

Cryptocurrency wealth management products can be seen as innovative financial services that apply blockchain technology. These wealth management products provide investors with opportunities to store and appreciate their digital assets. In essence, cryptocurrency wealth management products can also be divided into two categories: fixed-term and current. Fixed-term products require investors to lock their funds for a specified period of time to obtain predetermined returns, while current products allow investors to deposit and withdraw their funds at any time, but the yield may vary. Both of these products provide effective supplements to traditional bank savings accounts and open up new revenue opportunities for investors.

- Changtui Dogecoin being cut internally within the plate— the market has finally entered the deep bearish zone.

- Comparison of Ordinals trading markets Magic Eden, UniSat, Ordinals Wallet

- Weekly Preview | The Federal Open Market Committee of the Federal Reserve holds a monetary policy meeting; Token unlocks for OP, YGG, AGIX, and others.

2. Current Situation and Development Trends of Cryptocurrency Wealth Management Market

2.1 Market Size and Growth of Cryptocurrency Wealth Management

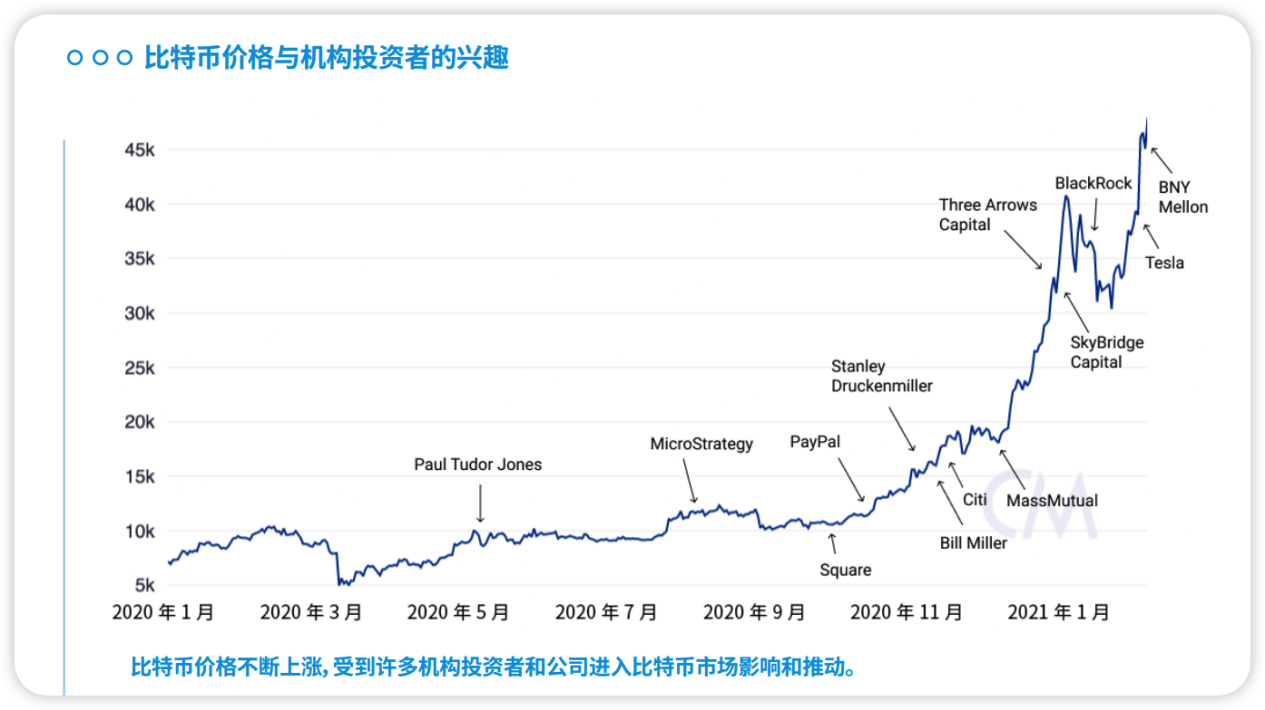

According to datos.com statistics, the global cryptocurrency wealth management market has reached $292 billion as early as 2021, with a year-on-year growth of over 600%. It is expected to exceed $5 billion by this year (2023), indicating the continuous growth of interest and confidence among investors in digital assets. Cryptocurrency wealth management forms involve digital currencies and their derivatives. Bitcoin is widely regarded as an investment target, and the wave of its transactions has also spawned more wealth management tools.

The most popular forms currently are direct investment in Bitcoin, investment in new types of digital currencies (such as NFTs), and various lending services. Holding Bitcoin directly has always been a popular investment method. In addition, with the continuous issuance of new tokens, investors have shown interest in other digital assets. Many custodian institutions are expanding their trust business by absorbing assets and also providing lending services for cryptocurrencies such as Bitcoin, lending out digital tokens to earn interest.

The rapid growth of the cryptocurrency wealth management market is due to the high risk and high return that digital currencies can provide, while users prefer decentralized and transparent currency attributes. It is predicted that with more recognition of the value of cryptocurrencies by investors in the future, the entire cryptocurrency wealth management market is expected to continue to expand rapidly in light of world extreme events (changes in the local geopolitical landscape under the influence of trade competition and the Russia-Ukraine conflict).

Source: Coin Metrics

2.2 The main investors and their behaviors in cryptocurrency wealth management products

The main investors are young and wealthy technology enthusiasts. This group of people is curious and confident about digital assets and pursues high returns on investment. They mostly learn about and participate in investments through online social networks and forums. This group of people is mainly concentrated in the age group of 30 to 45 years old.

In addition, middle and high-end individuals have also become investors. The high returns offered by cryptocurrency wealth management products attract their participation. These investors often have a higher investment ability and willingness to take risks.

The common characteristics of cryptocurrency wealth management investors are: high risk tolerance, high recognition of digital currencies, and willingness to participate in emerging markets. Most of them pay attention to the latest news and data of popular tokens and make investment decisions quickly. However, it is necessary to pay special attention to high-risk factors such as large fluctuations in cryptocurrency prices.

Their investment behavior tends to be short-term and medium-term, and long-term holdings are not common. They mainly focus on potential returns rather than long-term asset appreciation.

III. Detailed Explanation and Risk Analysis of Cryptocurrency Wealth Management Products

3.1 Introduction to Cryptocurrency Wealth Management Products

Specifically, cryptocurrency wealth management products are financial activities conducted using cryptocurrencies, and their product forms and investment returns vary greatly. They are mainly divided into two categories: decentralized finance (DeFi) wealth management products and centralized finance (CeFi) wealth management products. These two categories of products have their own characteristics, as well as different risks and returns. When investing, users need to have a clear understanding of them, understand their operating principles and possible risks, and make wise investment decisions.

Before delving into these two types of products, we need to clarify one thing first: cryptocurrency wealth management products are different from traditional financial wealth management products. They are not based on government currency but on cryptocurrencies. This means that they are not constrained by the traditional financial system, but also bring some new challenges and risks, such as market volatility and technical risks.

In the following chapters, we will provide a detailed introduction to DeFi and CeFi cryptocurrency wealth management products, hoping to help readers better understand these two types of products and make wiser investment choices.

3.1.1 DeFi Financial Products

- 3.4.1.1 Curve

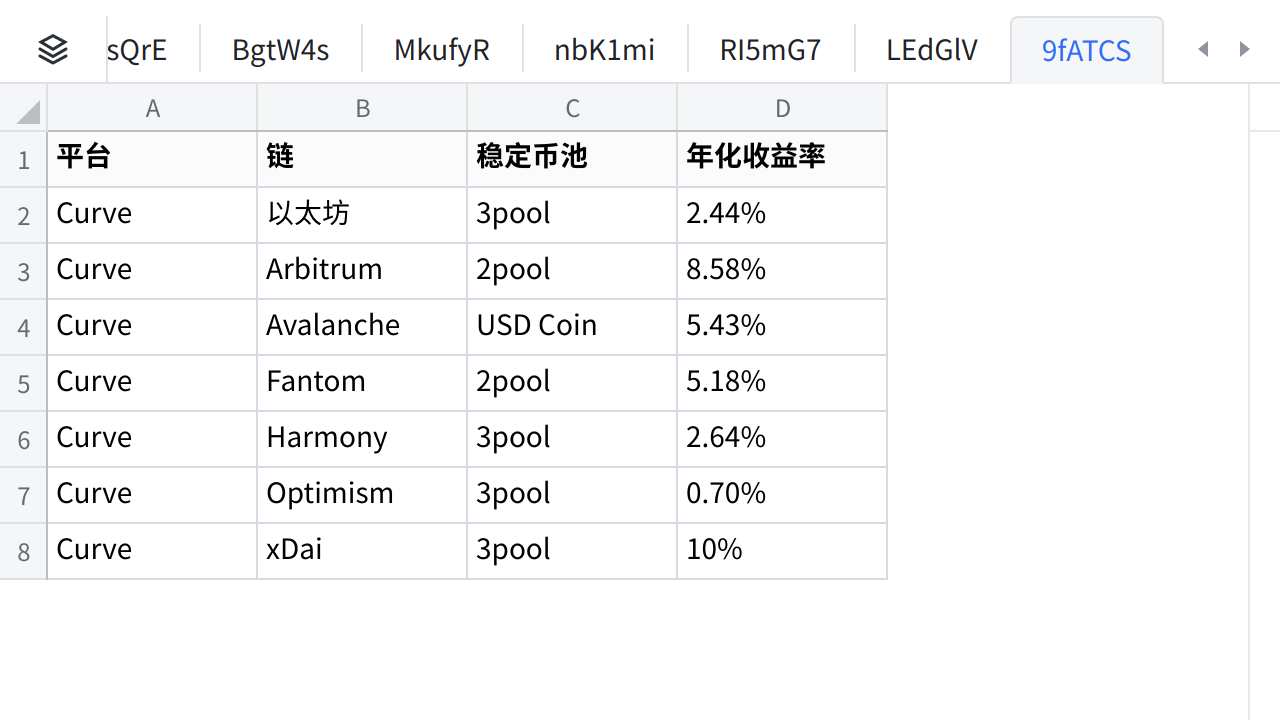

Curve is one of the earliest Automated Market Makers (AMMs) and initially focused on trading stablecoins (V2 version expanded to non-stablecoin trading) by employing innovative algorithms to provide large-scale and low-slippage stablecoin trading.

The main stablecoin pool on Ethereum for Curve is 3pool, which facilitates trading between DAI, USDC, and USDT stablecoins, with a maximum yield of 2.44%.

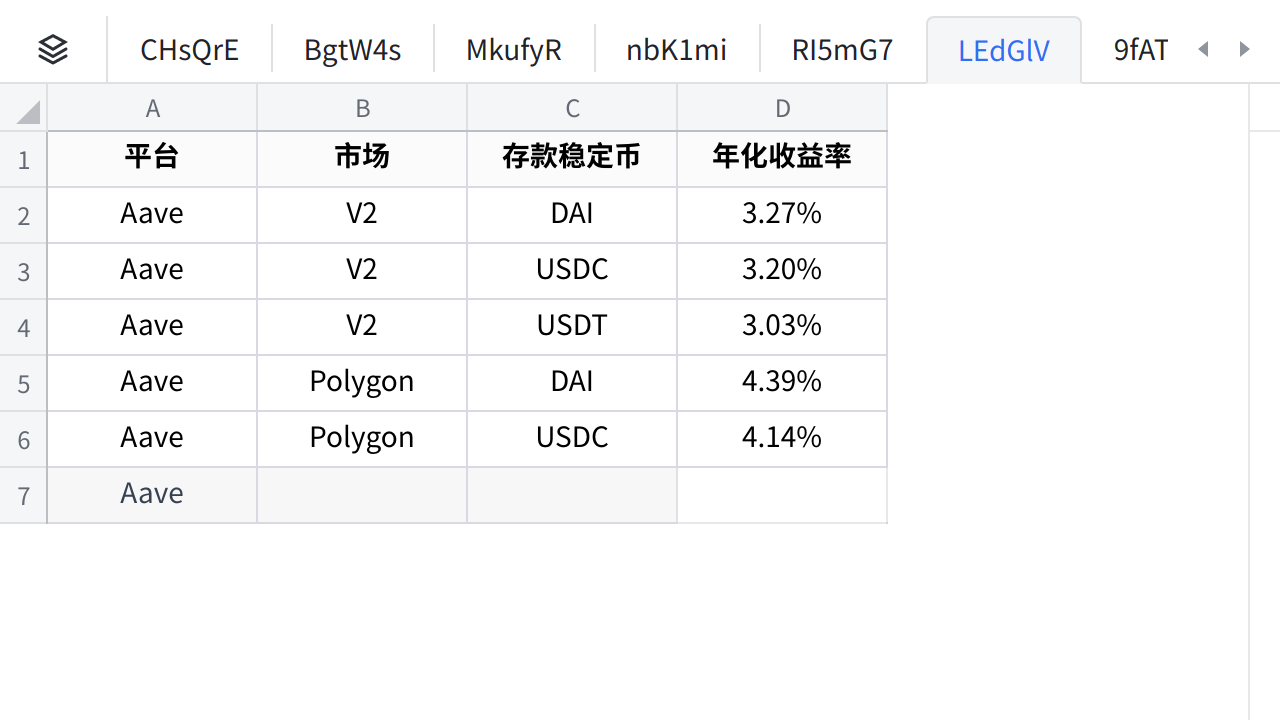

- 3.4.1.2 Aave

Aave is one of the leading DeFi lending platforms. Aave offers five markets including V1, V2, AMM, Polygon, and Avalanche. The highest annual yield is on the USDT lending pool in the AMM market, with an interest rate of 7.66%.

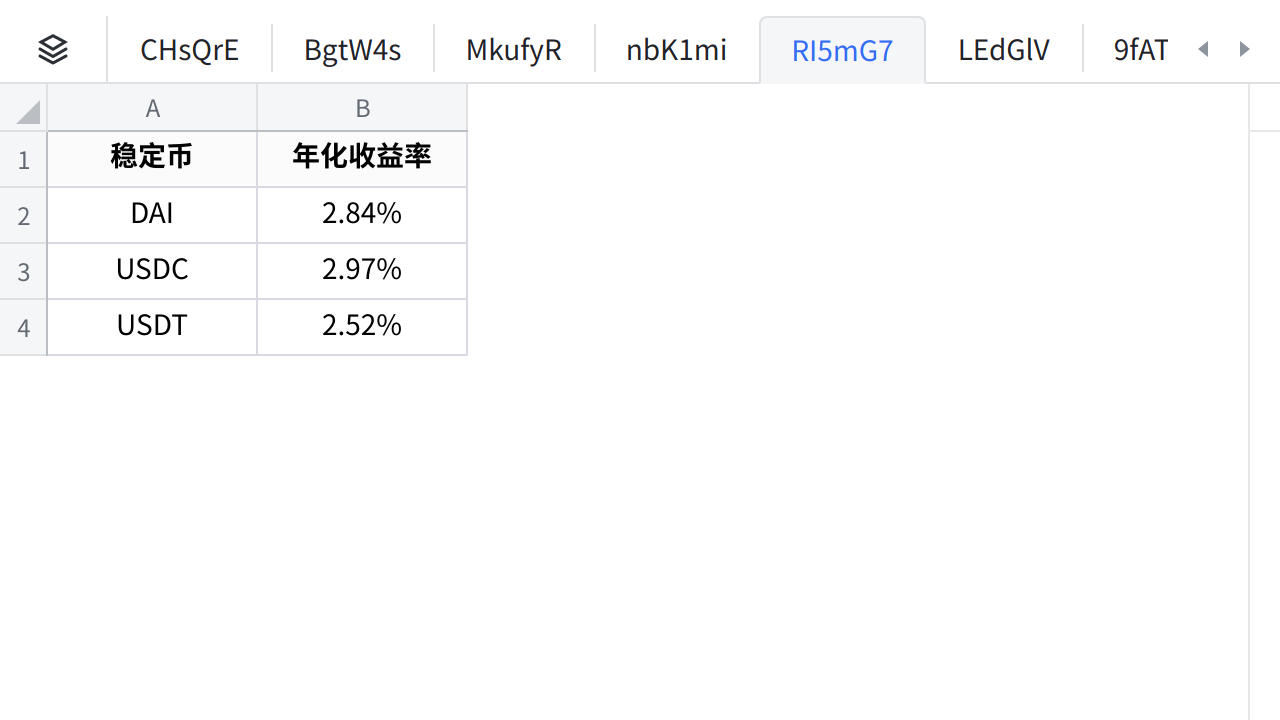

- 3.4.1.3 Compound

Compound is another major DeFi lending platform currently deployed on the Ethereum network. It supports lending and borrowing of DAI, USDC, and USDT. According to the latest data, its Total Value Locked (TVL) is $13.2 billion. On Compound, the annual yields for DAI, USDC, and USDT deposits are 2.84%, 2.97%, and 2.52% respectively, with USDC having the highest yield at 2.97%.

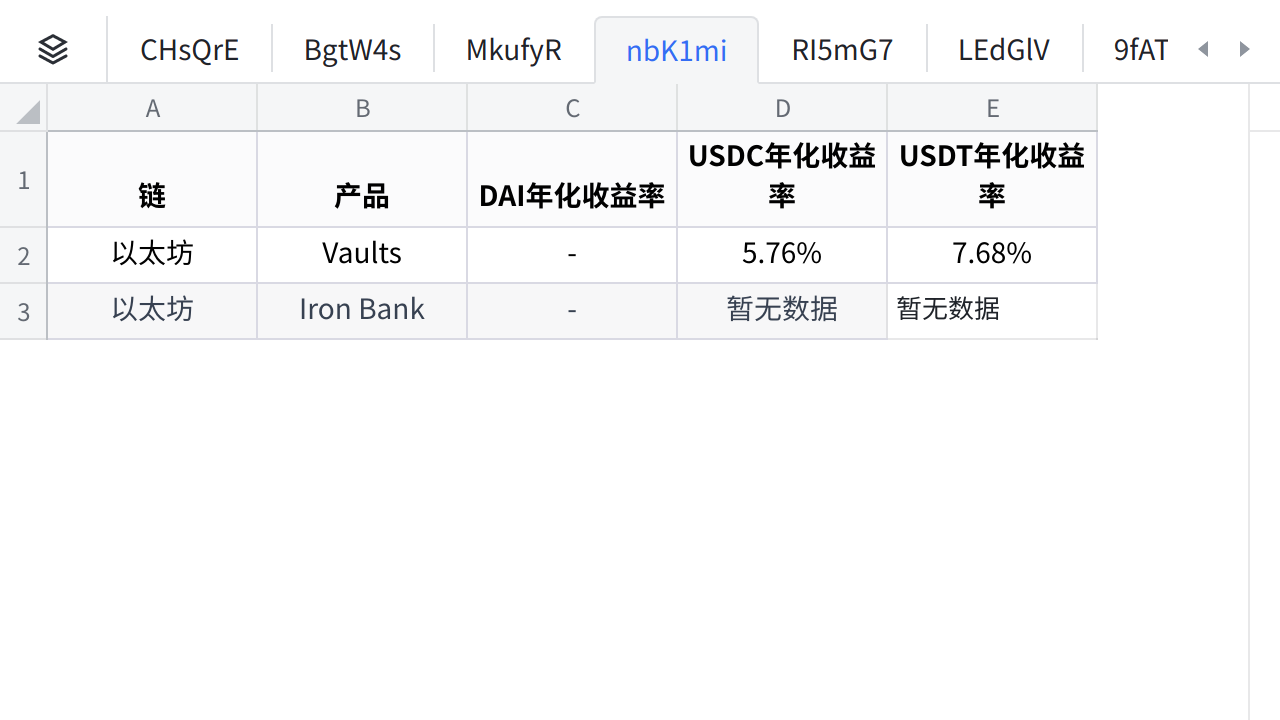

- 3.4.1.4 Yearn

Yearn is a DeFi yield aggregator with a current Total Value Locked of $4.23 billion. Yearn automatically allocates users’ funds to other protocols to maximize their returns. Yearn currently supports both Ethereum and Fantom chains and offers two types of yield-generating products: Vaults and Iron Bank. Vaults are yield aggregation products, while Iron Bank is a collateralized lending product. The highest annual yield is on the DAI Vaults on Fantom, with an interest rate of 24.96%.

Among them, the highest yield for Ethereum-Vaults USDT is 7.68%, followed by USDC with a yield of 5.76%.

3.1.2 CeFi Crypto Financial Products

- 3.4.2.1 CeFi Stablecoin Financial Products

Although Decentralized Finance (DeFi) is rapidly developing, Centralized Finance (CeFi) remains an important part of the crypto finance ecosystem. In the field of stablecoin financial products, CeFi mainly focuses on major exchanges. With their large user base and abundant capital reserves, exchanges have unique advantages for their financial services.

The stablecoin wealth management products of exchanges are more like traditional bank wealth management products, combined with the characteristics of blockchain, and have launched a series of new products. Mainly including: current wealth management, fixed-term wealth management, regular investment plan, high-interest current, dual-currency investment, node staking, ETH2.0, etc. Below, we will introduce the stablecoin wealth management products of four exchanges: Huobi, Binance, OKX, and Gate.io.

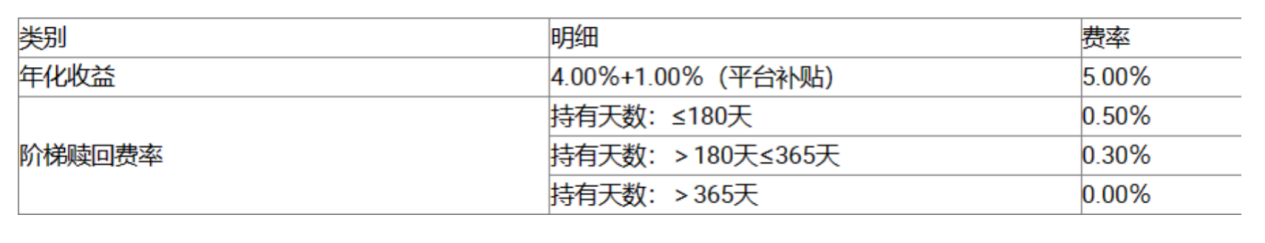

The most typical stablecoin wealth management product of Huobi is the high-interest current product. This product supports on-demand withdrawal and has relatively stable returns and high asset security. The currently supported currencies are USDT, DOT, FIL, TUSD, USDC, ETH (other currencies will be gradually opened). The annualized returns and redemption fees for USDT can be referred to as follows:

Huobi’s high-interest current product is suitable for:

- High-net-worth individual investors: If you have accumulated a considerable amount of wealth and are seeking high-return investment opportunities, this product is suitable for you as a long-term and stable asset allocation, requiring you to bear the cost of short-term redemption.

- Professional investors: If you are an institutional investor, fund manager, or other professional investor. With market insight and investment experience, you can select high-quality wealth management products. This product is also suitable for stable and high-return investments.

- Long-term investors: If you have a sum of money that can be invested for a long time, such as retirement reserves, children’s education funds, etc., and are willing to invest the funds in wealth management products for a long time, this product is also suitable for you. It can help you resist short-term market fluctuations and lock in stable returns.

Binance, OKX, and Gate.io, as well-known cryptocurrency trading platforms, provide various forms of stablecoin wealth management products. Among them, Binance is one of the largest trading platforms. According to Coingecko data, its spot trading volume in the past 24 hours reached 12.5 billion US dollars. It provides products such as Binance Earn and liquidity mining. OKX and Gate.io, as experienced exchanges, also have diversified stablecoin wealth management products, including current, fixed-term, lending, DeFi mining, etc.

- 3.4.2.2 CeFi non-stablecoin wealth management

The above is the content of the stablecoin wealth management products of major exchanges. Next, we will introduce some non-stablecoin wealth management products. Here, we mainly use Huobi as an example.

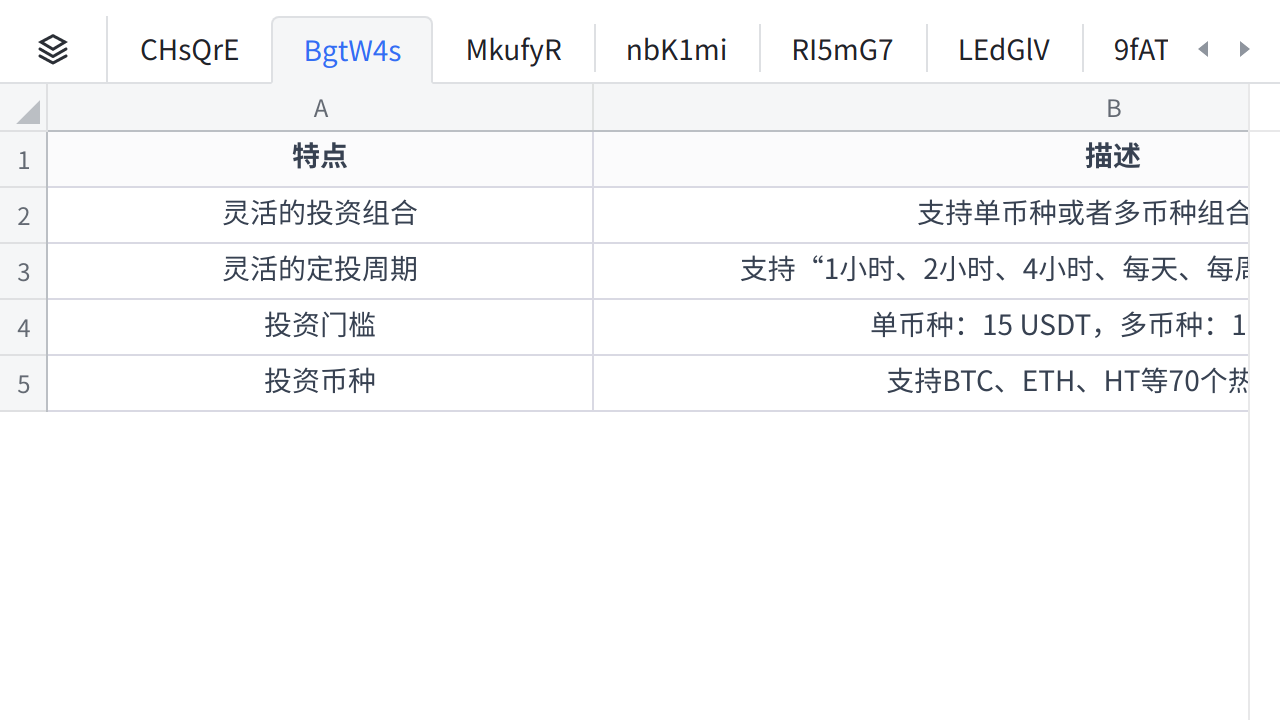

- “Regular Investment Plan” product

The “Regular Investment Plan” is a product designed for long-term investors, especially suitable for investors with limited time, lack of investment experience, but seeking long-term growth and risk diversification. This plan allows investors to regularly invest funds, enabling them to average down investment costs, reduce the impact of market volatility, and achieve the effects of accumulating small amounts over time and enjoying compound growth.

This plan is particularly suitable for investors who make good use of the average cost method, busy professionals, long-term investors, and small investors.

- Spot Balance Automatic Wealth Management

Spot balance automatic wealth management is a convenient way of wealth management. It can be activated with one click and help investors easily invest in all cryptocurrencies that support current account wealth management. Through this method, investors can achieve automatic compound investment of assets while enjoying flexible subscription and redemption.

3.2 Main types of risks for cryptocurrency wealth management products

Although cryptocurrency wealth management products bring potential high returns to investors, like any investment, they also have certain risks. Based on the characteristics of cryptocurrencies, the related risks may be higher. These risks mainly include the following aspects:

3.2.1 Market risk

The cryptocurrency market is a highly volatile market. Price fluctuations can be very drastic and are usually caused by various uncertainties, including technological changes, policy or regulatory changes, and changes in market participants’ sentiment. For example, the release of a new technology or policy that may be favorable to a certain cryptocurrency may cause its price to rise. Conversely, unfavorable news or events may lead to price drops. In some cases, these fluctuations can be very drastic, and prices may experience significant increases or decreases in the short term.

3.2.2 Liquidity risk

Liquidity risk involves whether investors can buy or sell assets quickly at reasonable prices when needed. For cryptocurrencies with low liquidity, if there is a shortage of buyers in the market, investors may need to sell their cryptocurrencies at prices lower than the market price, resulting in losses. Similarly, if there is a shortage of sellers in the market, investors may need to buy cryptocurrencies at prices higher than the market price. In addition, cryptocurrencies with low liquidity may be more susceptible to the impact of large transactions, leading to price fluctuations.

3.2.3 Technical risk

The infrastructure of cryptocurrencies, including blockchain and smart contracts, relies on complex technologies. These technologies may have undiscovered vulnerabilities that can be exploited for attacks, resulting in asset losses for investors. In addition, due to the anonymity and irreversibility of cryptocurrencies, once a technical failure or operational mistake occurs, investors may be unable to recover their assets.

3.2.4 Regulatory risk

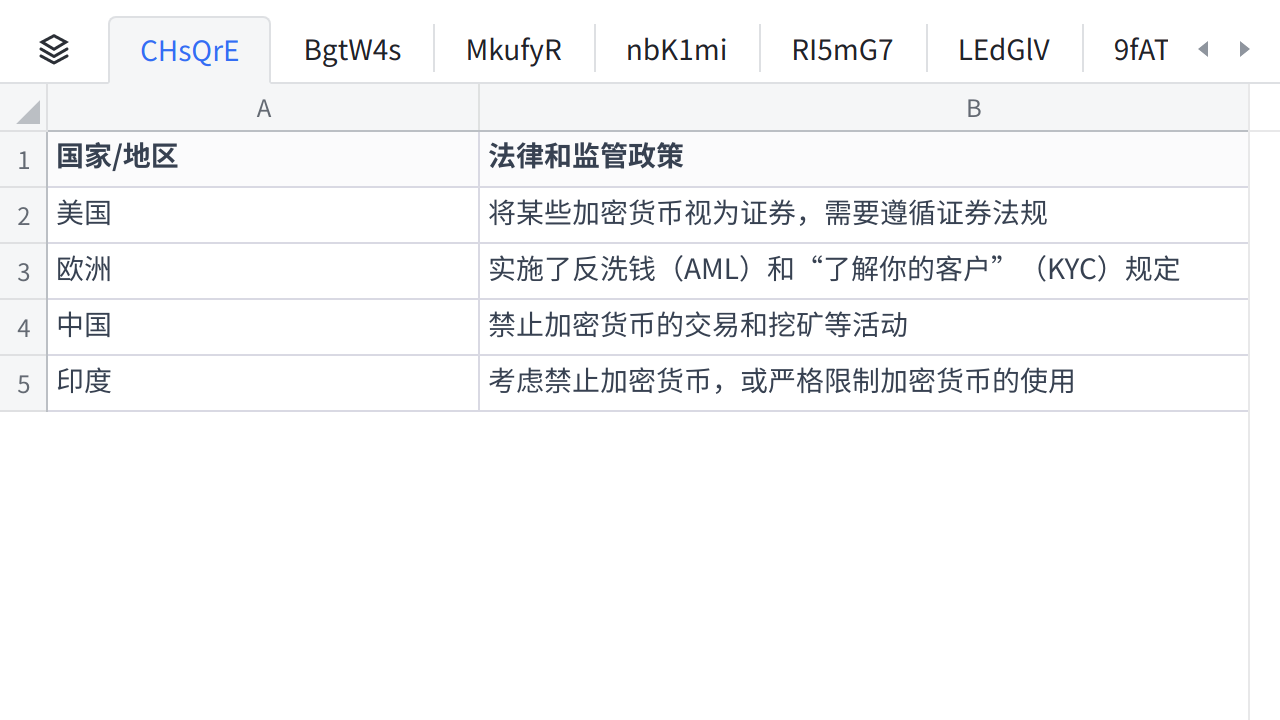

The attitudes and policies of countries around the world towards cryptocurrencies vary. Some countries or regions may have a welcoming attitude towards cryptocurrencies and have policies that encourage their development. However, there are also countries or regions that may have a cautious or even negative attitude towards cryptocurrencies and have strict regulatory policies. Changes in these policies may directly affect the value and availability of cryptocurrencies.

IV. Legal and Regulatory Environment of Cryptocurrency Wealth Management Products

4.1 Overview of the Legal and Regulatory Environment for Cryptocurrency Financial Products Worldwide

The legal and regulatory environment for cryptocurrency financial products varies greatly worldwide. For example, the U.S. Securities and Exchange Commission (SEC) has established certain regulations for cryptocurrencies, treating some cryptocurrencies as securities, which means that related cryptocurrency financial products need to comply with securities regulations. In Europe, there are anti-money laundering (AML) and know-your-customer (KYC) regulations for cryptocurrency exchanges. However, countries like China and India have adopted strict control policies on cryptocurrencies, prohibiting activities such as cryptocurrency trading and mining.

4.2 Impact of Regulatory Attitudes and Policies of Different Countries

The regulatory attitudes and policies of different countries have a significant impact on the market development of cryptocurrency financial products. For example, countries like Switzerland and Singapore, which have an open attitude towards cryptocurrencies, have active cryptocurrency markets and have attracted a large number of cryptocurrency companies and investors. On the other hand, countries like China and India, which have strict policies on cryptocurrencies, have limited development in their domestic cryptocurrency markets.

4.3 Impact of Regulatory Environment on Market Development

A clear and stable regulatory environment can help improve market transparency, protect investor interests, and attract more investment. However, excessive or unclear regulation may have negative effects on the market. For example, in 2017, the Chinese government banned initial coin offerings (ICOs) of cryptocurrencies, which led to many cryptocurrency projects and investors leaving China. On the other hand, the regulation of cryptocurrencies by the U.S. SEC, although putting pressure on certain cryptocurrency companies, also helps maintain market order and protect investor interests.

Chapter 5: Future Development and Strategic Recommendations for Cryptocurrency Financial Products

5.1 Development Potential and Challenges of Cryptocurrency Financial Products

5.1.1 Enormous Future Development Potential of Cryptocurrency Financial Products

Cryptocurrency financial products have enormous development potential in the future. With the advancement of technology, cryptocurrencies are gradually being accepted by the public and applied in various scenarios, including cross-border remittances, insurance, supply chain finance, etc. As a type of financial service, financial products contribute to the development of cryptocurrencies and meet users’ investment and financial management needs.

According to a report by Markets and Markets, the global cryptocurrency asset management market is expected to grow at a compound annual growth rate (CAGR) of 21.5% between 2021 and 2026. Research And Markets is even more optimistic, predicting a CAGR of 82.4% for the global blockchain market between 2021 and 2028, with the market size reaching $39.46 billion by 2028.

Increasing Demand for Cryptocurrency Wealth Management in Family Offices

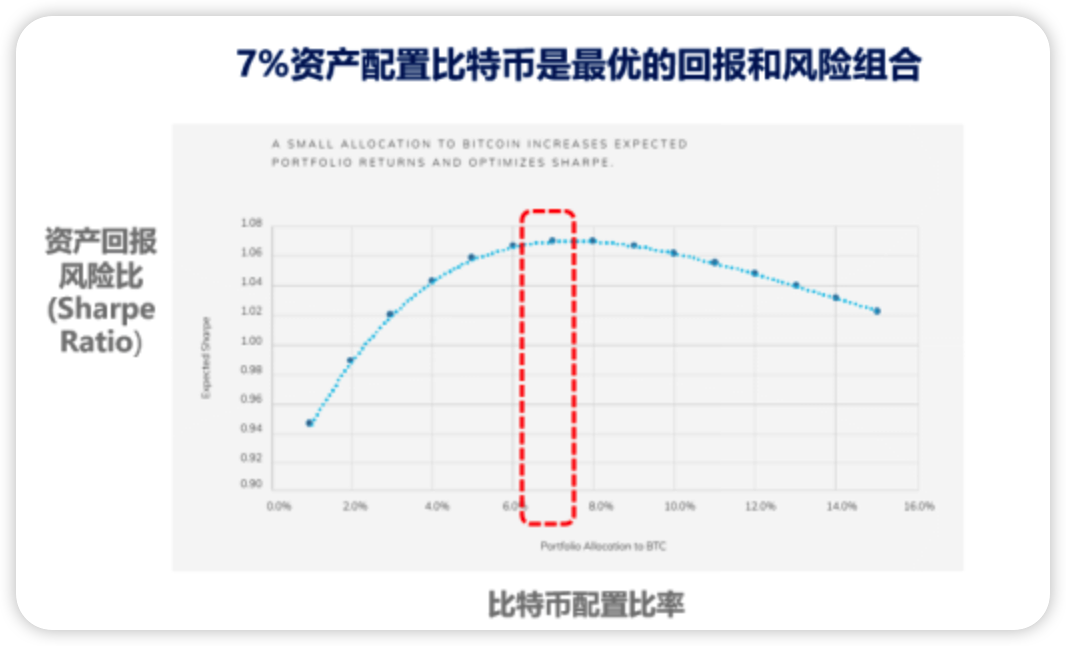

For long-term funds such as high-net-worth clients, family offices, and university endowments, allocating appropriate assets such as Bitcoin can effectively hedge against inflation, increase asset returns, and reduce overall asset volatility. According to a research report by Galaxy Digital Research in November 2020, allocating 7% of total assets to Bitcoin maximizes the risk-adjusted return, known as the Sharpe Ratio. A research report by Coinshares in November 2021 pointed out that institutional-managed assets currently allocate only about 1% to cryptocurrency assets. Considering the trillions of dollars in assets managed by institutions, increasing the allocation from the current 1% to 7% would bring a market worth trillions of dollars to the cryptocurrency asset management market.

However, confidence in the future growth of cryptocurrency asset management has been shaken after the Bitcoin crash in May. The main cause of the bear market for cryptocurrency assets is the global economy and macro environment, with the direct trigger being the decline in prices of various assets worldwide due to the Federal Reserve’s interest rate hikes and balance sheet tightening. Since May and June 2022, the entire cryptocurrency market has entered a rapid decline, with a slight recovery around June 2023 (at the time of writing this article).

Although the market is currently recovering from the bear market, the popularity of wealth management has not reached its peak. However, in the long run, cryptocurrency assets represented by Bitcoin are still in a stage of rapid development.

5.1.2 Challenges of Cryptocurrency Wealth Management

- Valuation Challenges and Volatility of Cryptocurrency Assets

The valuation of cryptocurrency assets faces significant challenges due to the lack of a recognized valuation system, which leads to frequent market speculation and price volatility. This not only increases the difficulty for fund managers in investment decisions and risk control but also makes regulatory agencies and institutional investors cautious about cryptocurrency assets. These factors collectively hinder the long-term development of the cryptocurrency wealth management industry.

- Fragmentation of Global Regulatory Frameworks

Although some countries have issued fund management licenses for cryptocurrency asset management or incorporated them into existing fund management systems, global regulation still exhibits fragmentation. This does not align with the cross-border flow and globalization characteristics of cryptocurrency assets. Cryptocurrency asset management companies face high compliance costs when dealing with the impacts of different countries, regulatory systems, and policies on their global operations. Especially after the collapse of Terra/UST stablecoin, regulatory agencies have increased their focus on stablecoins. Due to the lack of a mature stablecoin regulatory system globally, the cryptocurrency asset management industry faces significant risks arising from stablecoin regulatory uncertainties.

- Imperfections of Cryptocurrency Asset Management Systems

Compared to traditional fund management systems, cryptocurrency asset management systems are still in a stage of rapid development. Traditional system service providers have yet to extensively enter this field, and the unique characteristics of cryptocurrency assets make it difficult and costly to build asset management systems.

Some well-established cryptocurrency asset management companies, such as BBshares, Amber Group, or asset management companies under exchanges, have to invest significant resources in developing dedicated cryptocurrency asset management systems. These systems need to provide comprehensive services, including front-end trading, middle-end fund management and risk management, back-end reporting and reconciliation, API key cryptocurrency multi-signature management, etc. Independently developing and maintaining a brand new cryptocurrency asset management system is a heavy burden for fund companies, hindering the industry’s rapid development towards greater specialization.

- Security and Network Attack Risks

The decentralized and online nature of cryptocurrencies makes them vulnerable to network attacks and security vulnerabilities. Hackers may exploit technical means to steal cryptocurrency assets, causing significant losses to investors and management companies. Therefore, cryptocurrency wealth management companies need to invest significant resources in ensuring security protection, enhancing system security, and mitigating potential security risks.

- Lack of Market Transparency

Compared to traditional financial markets, the cryptocurrency market has lower transparency. There may be insider trading, market manipulation, and other behaviors by exchanges and project parties, which bring additional risks to cryptocurrency wealth management. In addition, the anonymity of cryptocurrencies may lead to some investors exploiting market loopholes for illegal activities, negatively impacting the entire industry.

- Liquidity Issues between Fiat and Cryptocurrencies

Although liquidity in the cryptocurrency market is gradually increasing, there are still challenges in the exchange between cryptocurrencies and fiat currencies in many cases. Exchanges and financial institutions may impose limits on exchange amounts or charge high fees, which impose additional burdens and risks on cryptocurrency wealth management.

- Education and Trust Issues for Retail Investors

Many retail investors have a lack of understanding about cryptocurrencies and related financial products, which may lead to misunderstandings and panic about cryptocurrency finance. Therefore, cryptocurrency financial companies need to increase education and publicity efforts to help investors understand the risks and returns of cryptocurrencies and establish trust.

In summary, the challenges faced by the cryptocurrency finance industry include valuation system, regulatory system, asset management system, security, market transparency, technological development, liquidity issues, and education and trust of retail investors. To address these challenges, the industry needs to work together to promote the prosperous development of the cryptocurrency finance market.

5.2 Recommendations for Investors

For investors, the cryptocurrency market is a new type of market, where risk management has not yet been established, the classification of financial products and the regulation in various regions are also not perfect. Investors are advised to pay attention to the following points:

- Manage risks well: Due to the high price volatility of cryptocurrencies, investors should clearly understand their risk tolerance and allocate investment funds accordingly.

- Understand investment products: Investors should have a deep understanding of the products they invest in, including the operation mode and the source of returns.

- Pay attention to regulatory dynamics: Investors should closely monitor the regulatory dynamics of cryptocurrencies worldwide in order to adjust their investment strategies in a timely manner.

5.3 Recommendations for Policy Makers and Regulatory Agencies

For policy makers and regulatory agencies, the following are some suggestions:

- Develop clear regulatory policies: Policy makers and regulatory agencies should formulate clear regulatory policies for cryptocurrency financial products to provide clear rules for the market.

- Enhance investor education: Policy makers and regulatory agencies should strengthen investors’ financial knowledge and risk awareness through various means of education.

- Establish reasonable risk prevention and control mechanisms: Regulatory agencies should establish reasonable risk prevention and control mechanisms, such as formulating anti-money laundering and anti-terrorism financing rules, and improving cryptocurrency trading

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!