Author: Terry; Plain Language Blockchain

With the continuous changes in the “atypical bear market”, the narrative of “halving” in the crypto world, which never fades, is gradually approaching – currently, there are about 9 months left until the fourth Bitcoin halving, which is expected to be on April 26, 2024. At that time, the block reward will be reduced from 6.25 BTC to 3.125 BTC.

What has passed is just a prologue. As one of the most important narratives in the crypto industry, “Bitcoin halving” has always been a good medicine to boost market confidence. Now that the bear market is faintly audible and the footsteps of the bull are uncertain, will this halving cycle follow the same rhyme as before?

- SEC Chairman Requests $2.4 Billion Budget to Address Improper Conduct in the Cryptocurrency Market

- Behind the soaring prices of multiple community tokens on Reddit Redesigning the existing reward system to clarify that avatars and points are tradable.

- After the airdrop of $15 million worth of tokens, what actions do the applicants of ARKM need to take?

01 Historical Cycle of Halving

For the crypto industry, each halving is a grand event, especially the first two halving cycles of Bitcoin, which saw astonishing gains of tens of times. (In the short term, after the first two halvings, there were short-term declines accompanied by exhausted positives, but later, after the adjustment was completed, a long-term upward trend emerged.)

However, since the start of the third halving in 2020, due to the significant increase in the number of industry practitioners, market attention, and the improvement of supporting infrastructure, Bitcoin is no longer a niche product limited to the geek community. It has started to interact with more external factors.

Summarized briefly:

Before the first two halvings (2012, from 50 BTC to 25 BTC; 2016, from 25 BTC to 12.5 BTC), geeks in the industry were more concerned about the possibility of Bitcoin as electronic cash;

In the third halving cycle (2020, from 12.5 BTC to 6.25 BTC), the focus on Bitcoin shifted to its role as a payment tool, which also sparked a series of debates (the subsequent BCH fork was almost the mainstream in the industry);

In the fourth halving cycle (2024, from 6.25 BTC to 3.125 BTC), Bitcoin has already become an alternative asset, and the focus has shifted to the layout of traditional institutions and capital;

Therefore, compared to the first two halvings, the heat of the third halving of Bitcoin was unprecedented. At the same time, the overall global political and economic environment also affected its performance during the third halving:

Under the influence of macro factors, from March 12th to March 13th, two months before the halving on May 11th, Bitcoin started to decline from $7,600, first falling to $5,500 and then further breaking through support levels, reaching a low of $3,600. The overall market value evaporated by $55 billion in an instant, and over 20 billion RMB was liquidated throughout the network, accurately achieving “halving of price”.

However, after the halving in May, DeFi Summer ushered in a new bull market cycle, and Bitcoin surged to $60,000, nearly 20 times higher than the lowest point before the halving.

Overall, according to the historical halving cycles, from a traditional perspective, the price of Bitcoin will return to half of the previous bull market price during the halving – that is, by April 2024, the price of Bitcoin may be around $30,000.

After the halving, it is highly likely to start a new bull market cycle. The current volume may be difficult to achieve a 10-fold increase, but surpassing the previous bull market high of $60,000 is still worth looking forward to.

02 Different New Variables

However, at the same time, with Bitcoin having gone through three halvings, the block reward reduced to 6.25, and the total mined amount exceeding 19 million, many situations and things have also come to a new perspective for rethinking.

In particular, apart from this round of Bitcoin halving, there have been some new variables worth noting in the entire industry and Bitcoin itself.

(1) Ethereum’s Transition from PoW to PoS

Firstly, Ethereum completed its transition from a PoW mechanism to a PoS mechanism last year. As the two largest cryptocurrencies by market capitalization, Bitcoin and Ethereum have become the leading cryptocurrencies representing PoW and PoS, respectively, bringing their competition and debate into a new era.

After transitioning to PoS, the newly added Ethereum will only be produced through PoS staking. According to current estimates, after the Ethereum upgrade to The Merge and the transition to PoS, the theoretically newly added Ethereum through PoS will be approximately 660,000 per year.

However, according to the data shown in the above ultrasound.money chart, since The Merge, the circulating supply of Ethereum has not increased, but has decreased by nearly 300,000, entering a deflationary era, with the current annual deflation rate at 0.289%.

This is not only due to the support from the on-chain burning after Ethereum’s London upgrade in 2021, but more importantly, it is because the new Ethereum output under the PoS mechanism is much less than under the PoW mechanism:

Under the PoW mechanism, nearly 5 million ETH are newly produced each year, which is approximately 8 times that of the PoS mechanism (660,000). If calculated based on this data, Ethereum will still be in an inflationary state, with an annual inflation rate as high as 3.26%.

Therefore, the transition of Ethereum from PoW to PoS, combined with the support of on-chain burning, has successfully entered the deflationary era. Compared to the impact of Bitcoin halving, the supply-side impact is undoubtedly more direct and will to some extent weaken the attractiveness of Bitcoin halving. This is also one of the biggest variables in this halving compared to previous ones.

(2) Transaction Fee Revenue

According to the halving rule of Bitcoin, the block reward starts at 50 bitcoins, and the rule is to halve every four years. It has already halved three times, resulting in 6.25 bitcoins. The next halving will occur in 2024. This process will continue until there are no more block rewards for Bitcoin in 2140;

However, transaction fees will always exist. Therefore, after each round of halving, the block reward will gradually decrease and even approach zero. In the future, miners’ income will become very singular, consisting only of transaction fee rewards.

This year, the prosperity of the Bitcoin ecosystem, especially BRC20, has sparked a new wave of “BitcoinFi”. The activity of internal transactions within the Bitcoin ecosystem has reached a new peak, thereby boosting the increase in Bitcoin’s transaction fee revenue.

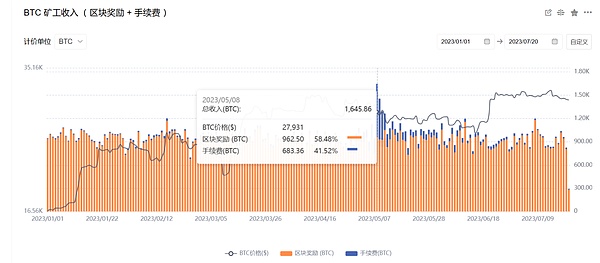

Image Source: https://www.oklink.com

Image Source: https://www.oklink.com

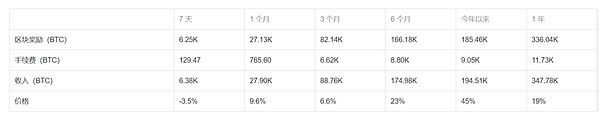

On May 8th, the BTC mining transaction fee income reached a new high in nearly 5 years, reaching 683.36 BTC (approximately $19.08 million), accounting for 40% of the miners’ total income that day.

Historically, the average data for miner’s transaction fee income is only about 2%. However, the average data for the past three months has reached about 8%, setting a new record (although the proportion of transaction fee income has recently fallen back to the previous level of about 2%).

Image Source: https://www.oklink.com

Image Source: https://www.oklink.com

But as the subsequent block rewards gradually decrease to zero, the importance of transaction fees will become higher and higher, until it eventually becomes the only source of income.

BRC20 in the first half of this year can be regarded as a rehearsal in advance. Regardless of its success, it will inevitably attract more attention along the way with the subsequent halving of Bitcoin.

03. How does this halving affect?

In fact, in addition to the halving of Bitcoin, old-timer tokens that adopt the PoW mechanism and are now transitioning to PoS also face their own “halving” nodes:

Litecoin’s halving is approaching, and it is expected to take place on August 3rd this year – the block reward will be reduced from 12.5 coins to 6.25 coins. Recently, Litecoin’s secondary market performance has also experienced significant volatility, but overall, it has performed better than most other assets.

BCH, similar to Bitcoin, is expected to halve on April 5th, 2024, reducing the block reward from 6.25 coins to 3.125 coins. Recently, BCH has also experienced a wave of significant increases.

All of this provides sufficient imagination for the halving of Bitcoin in 2024, and the capital in the industry has always liked to collectively gamble on the “halving event”. Factors such as growing computing power, new hardware, and the upcoming halving of rewards will determine the overall growth of the industry and Bitcoin, especially now.

As of the latest mining difficulty adjustment of Bitcoin at block height 798336, the mining difficulty has been significantly increased by 6.45% to 53.91T, reaching a new historical high and nearly doubling compared to a year ago.

However, against the backdrop of the carbon neutrality issue and the skyrocketing global energy prices this year, the biggest narrative difference between PoS and PoW is that PoS networks consume less energy and are “more environmentally friendly”.

Of course, PoW has unique advantages in the face of increasingly tightening regulations – so far, cryptocurrencies based on PoW have been classified as commodities and comply with existing regulatory rules, while PoS tokens face regulatory risks of being classified as securities.

04 Summary

Overall, we are currently in the middle of a new halving cycle – with a window period of over half a year before the Bitcoin halving event, and a market reaction period of one to two years after the halving.

This may also be the first (or second) time that the majority of practitioners and investors in this cycle have witnessed and experienced the “grand event” of Bitcoin halving. The future direction of Bitcoin and this cycle after halving is still unknown.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!