Editor | Callum@Web3CN.Pro

Table of Contents

1. Project Introduction

2. Project Vision

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service

- From the perspective of developer services, how does Socket Protocol obtain funding and ecosystem support from Coinbase?

- What are the advantages and disadvantages of using Ethereum as a layer2 scalability solution?

3. Development History

4. Team Background

5. Financing Information

6. Project Architecture

- Mintlayer Wallet

- Tokenization Standards

- Decentralized Exchange (DEX)

7. Development Achievements

- Project Development

- Ecosystem Building

- Community Status

8. Economic Model

- Token Distribution

- Economic Model

9. Advantages and Risks

1. Project Introduction

Mintlayer is a Layer2 protocol similar to Proof of Stake (PoS), bringing smart contract programmability to the Bitcoin blockchain. It aims to address the scalability issue of Bitcoin and improve its functionality by enhancing decentralized finance (DeFi) applications, decentralized exchanges (DEX), stablecoins, and tokenization standards on the Bitcoin network. The two main elements Mintlayer brings to the Bitcoin ecosystem are asset tokenization and trading on DEX. It provides a more powerful blockchain environment for DeFi protocols with its scaling solutions: batch transactions and the Lightning Network, reducing transaction size and fees, creating a win-win situation for all parties involved.

Mintlayer is capable of creating Bitcoin-driven tokens and smart contracts, inheriting Bitcoin’s security and providing interoperability with Bitcoin. This enables DeFi use cases, currently found on Ethereum and other blockchains, to be possible and scalable for the first time in a true Bitcoin-native environment (using real Bitcoin without pegging or wrapping). Mintlayer also supports access control lists, which can create compliant tokens and NFTs, and features such as Lightning Network, transaction batching, and signature aggregation, as well as the first gas currency free market (transaction fees can be paid with any token issued on Mintlayer).

2. Project Vision

As a Bitcoin sidechain, Mintlayer aims to enable Bitcoin holders to access DeFi, stablecoins, NFTs, and other tokenized assets while fully inheriting the overall security of Bitcoin’s proof of work.

As the project name suggests, it hopes to become a new layer for casting various assets: stocks, bonds, stablecoins, asset-backed tokens, and more. But it is important that these assets are not issued on any random blockchain infrastructure network, but specifically issued on the Bitcoin layer. That is why Mintlayer is ultimately built on top of Bitcoin, as it envisions forming financial order around Bitcoin standards.

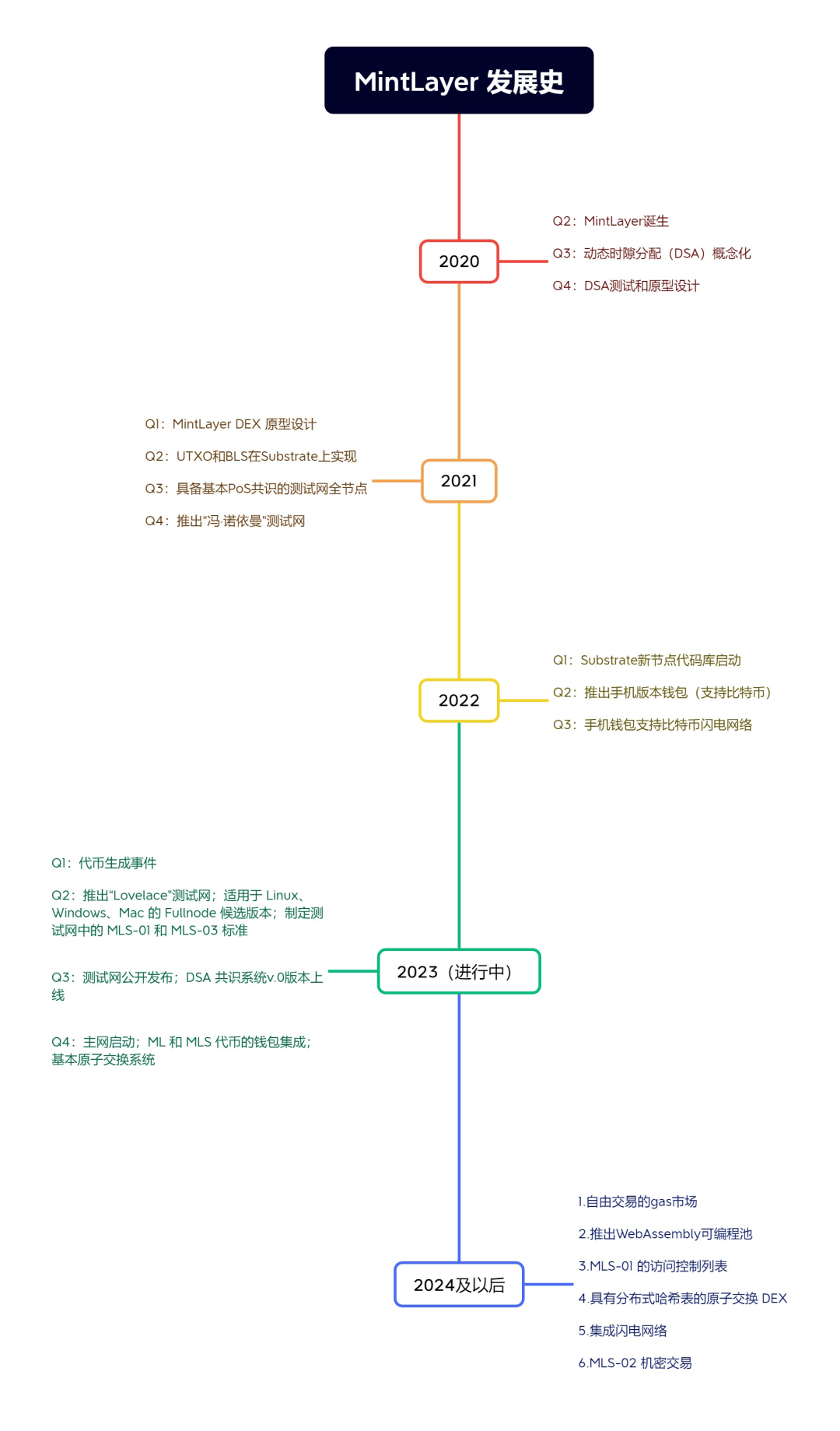

III. Development History

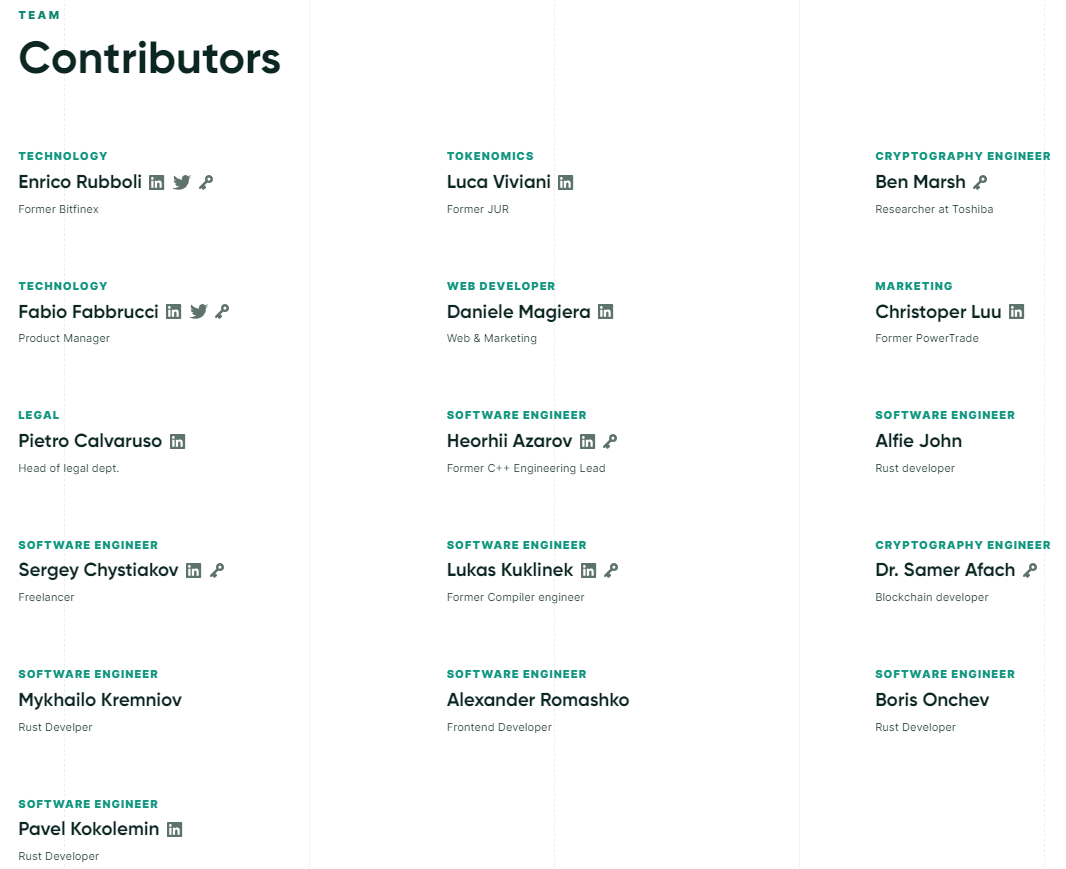

IV. Team Background

The team behind MintLayer is RBB Labs, a software company based in San Marino that provides fintech, financial, and trading solutions. It has 16 core contributors. CEO Enrico Rubboli is a software developer with 17 years of experience and a cryptocurrency expert. He was a former developer for Tether and Bitfinex and has a strong passion for Bitcoin, as well as an interest in new technologies, architecture, and design.

RBB Labs provides services to the public such as blockchain solutions, network security, software engineering, and consulting education. It is currently leading the development of multiple blockchain projects, including MintLayer and Stablecomp (Stablecomp is a DeFi platform that allows users to easily assess opportunities for earning stablecoin compounding, allocation, and interest on multiple chain dApps).

V. Financing Information

On May 24, 2021, MintLayer raised $5.2 million in seed funding. The investment institutions and other KOLs included Lotus Capital, Moonrock Capital, Jun Capital, EXnetwork, CryptoDormFund, Matrix Ventures, Black Dragon, Sky Ventures, BlockLianGuaict, MoonFounde, and others.

In this round of financing, Alphabit, Moonwhale, 4SV, X21, and Iconomy LianGuairtners also joined the project as advisors to MintLayer. These companies will directly or indirectly utilize their skills, expertise, and extensive networks to assist the MintLayer ecosystem and its user base, as well as provide guidance for the project’s rapid expansion into the market. In addition, it has established a strategic partnership with the San Marino Innovation Center.

Furthermore, according to the investment and financing data website Crunchbase, on October 1, 2021, MintLayer completed a Series A financing of $12 million. However, this round of financing has not been verified by the official MintLayer and the investment institutions have not been disclosed.

VI. Project Architecture

MintLayer Wallet

The MintLayer Wallet (Mojito Wallet) supports multiple tokens, including Bitcoin (BTC), MintLayer (ML), and all tokens issued or pegged on the chain (with the MLS token standard). It mainly consists of two types: lightweight wallet and full node wallet.

1. Lightweight Wallet

- Stores, sends, and receives Bitcoin like any other traditional Bitcoin wallet

- Stores, sends, and receives ML tokens and all MLS-01, MLS-02, MLS-03 standard tokens

- Batch transactions with other nodes before broadcasting to the network to pay lower fees, reduce the burden on the blockchain, and speed up transaction speed

- Uses the Lightning Network for transactions (BTC, ML, and MLS-01 standard tokens)

- Uses atomic swap DEX for peer-to-peer exchange of BTC, ML, and MLS-01 standard tokens

2. Full Node Wallet

Mintlayer full node is coupled with Bitcoin Core node. In addition, Mintlayer full node uses utreexo, which compresses the size of the UTXO set to 1 KB. Therefore, even in the long run, the processed node will not occupy more than about 3GB of space (approximately 3 days of blockchain space under maximum throughput).

Mintlayer full node provides all the functionalities of a light wallet, as well as the following functionalities:

- Stake ML tokens and become a “participant” in the network.

- As a “participant,” propose or sign blocks and earn transaction fees.

- Create MLS-01 tokens by executing Mintlayer on-chain transactions.

- Peg BTC to create MLS-01/02 tokens for faster transactions and lower fees (also enables private transactions).

- Create custom smart contracts and programmable pools, and build DeFi systems.

- Connect to multiple oracles to query DEX data or identity data, and also facilitate DEX transactions or decentralized identity applications. Provide a standard wallet API for programming oracles to assist in building smart contracts on Mintlayer.

Tokenization Standards

The abbreviation MLS-01 stands for Mintlayer Standard Version 0.1. It represents the basic standard specification for Mintlayer tokens, with a typical list of rules that must be implemented for Mintlayer wallets to handle them correctly. Due to this standard, each MLS-01 can be received, sent, or stored in any Mintlayer multi-token wallet.

Mintlayer uses the Bitcoin UTXO structure, which has three basic characteristics:

- Technically compatible with features already implemented in Bitcoin, such as atomic swaps and the Lightning Network.

- Emphasizes privacy.

- Payments can be batched and aggregated in a single transaction, saving a significant amount of space required for each payment in a single transaction.

MLS-01 standard tokens and ML are only transferred on the Mintlayer sidechain, without occupying Bitcoin blockchain resources. The MLS-01 standard allows tokens and ML to be transferred only on the Mintlayer sidechain, thus preventing congestion on the Bitcoin blockchain. One key feature of MLS-01 is the ability to implement Access Control List (ACL) conditions, similar to the functionality in Ethereum’s ERC-20. ACL provides transaction customizability, facilitating compliant token issuance or updating secure tokens to comply with company policies or legal requirements. Additionally, they consider conditions such as practical token expenditures, token non-fungibility, transaction thresholds, and time locks. Token issuers can update token conditions using new transactions that include revised rules. The flexibility of ACL governance depends on the original rule set for token creation.

MLS-02 standard adopts ring signature for anti-attack private transactions, ensuring privacy and anonymity. These privacy features increase the data requirements for transactions and add additional verification steps. Therefore, MLS-02 cannot benefit from transaction batching like MLS-01, resulting in higher transaction fees.

MLS-03 Standard is the iteration of Mintlayer on non-fungible tokens (NFTs).

Decentralized Exchange (DEX)

Mintlayer focuses on creating an atomic swap decentralized exchange (DEX) to achieve decentralized finance for Bitcoin. The Mintlayer DEX will allow for 1:1 atomic swaps with native Bitcoin to acquire other tokenized assets in the ecosystem. These atomic swaps on the network are unique compared to other competitors as they are without intermediaries, pegs, wrappers, or wrapped tokens. Since atomic swaps allow for native Bitcoin, it eliminates counterparty or custodial risks for users. Its Bitcoin-like UTXO architecture combined with Schnorr signatures enables more efficient transaction aggregation. This aggregation helps reduce payment scaling by up to 70% while enhancing privacy and increasing transaction throughput. It provides more privacy and a highly confidential native tokenization standard compared to account-based blockchains like Ethereum. Mintlayer has scalability options such as Lightning Network swaps or decentralized exchange (DEX) transactions from Bitcoin, which can prevent congestion and fee increases even with high transaction volumes.

Seven, Development Achievements

Project Development

As a sidechain with its own blockchain, Mintlayer stays close to the design principles of Bitcoin and only deviates when advanced features are absolutely necessary. One of the changes is the alternative consensus mechanism. Bitcoin is based on Proof of Work (PoW), while Mintlayer is a protocol similar to Proof of Stake (PoS). Mintlayer’s consensus mechanism is a new one called Dynamic Slot Allocation (DSA) consensus. Mintlayer is the first blockchain to use this mechanism, which has similarities to PoS. DSA uses Bitcoin hash values as a source of randomness to elect block signers. These are entities that validate chain activity and earn network fees as compensation.

Every 1008 Bitcoin blocks make up one round of block creation in Mintlayer, where block signers (also known as block creators) complete the task of creating new blocks. By acting as maintainers and creators of the Mintlayer consensus, block signers also establish a time-ordered transaction history to track time. Importantly, anyone on the Mintlayer system can record checkpoints on the Bitcoin blockchain. However, only block signers can “lock” them, meaning that full nodes must be run to enforce them. Mintlayer relies on these checkpoints as a crucial method to prevent remote attacks on its blockchain, anchoring Mintlayer transactions and blocks to the Bitcoin main chain through a built-in checkpoint system.

Ecosystem Development

The current ecosystem projects are in the development stage, and the Mintlayer ecosystem provides a range of opportunities for projects with the sole purpose of unlocking the full potential of Bitcoin. Therefore, projects at various stages can apply for support.

Below are the infrastructure and key aspects of building projects on Mintlayer:

– Ecosystem Fund: Select and fund the best DeFi projects with real use cases. This tool also connects project founders with angel investors and venture capitalists on the Mintlayer network.

– Incubator Program: Nurture early-stage projects to get them off the ground and assist with business strategy, software development, token economics, funding, legal obstacles, etc.

– Accelerator Program: For established projects that wish to port (or migrate) to the Mintlayer protocol, this program provides funding and consulting to accelerate their growth.

– Grants: Provide grant opportunities for open-source developers to build on Mintlayer.

**Community Overview**

– Twitter: 88,000 followers, moderate fan engagement

– Discord: 30,000 members

– Telegram: 35,000 members

– Active community members account for about 10%.

**8. Economic Model**

The Mintlayer token (ML) powers the Mintlayer network and maintains security on the blockchain. Its purpose is to support staking, governance, and ecosystem tools.

**Token Allocation**

The total supply of ML is 600,000,000. At the launch of the mainnet, 400,000,000 ML will be created. Each Mintlayer block will generate block rewards for block creators until the total supply reaches the hard cap of 600,000,000 ML. It is expected to be fully distributed approximately 10 years after the genesis block.

The initial allocation of 400 million tokens is as follows:

[Image: Token Allocation]

The initial unlocked token supply is set at 15,820,000 ML. The token allocation details are as follows:

[Image: Token Allocation Details]

ML token holder address analysis:

[Image: ML Token Holder Addresses]

According to Etherscan data as of September 11, 2023, there are currently 4,402 ML holder addresses. The top 100 holders account for 98.14% of the total holdings, and the top 10 holders account for 96.03%.

Among the top 10 addresses, 4 are contract/exchange/LP addresses, accounting for 94.13%. After excluding this portion, the top 100 addresses account for a total of 4.01%. It can be seen that the current concentration of ML holder addresses is high, with tokens mainly concentrated in the hands of the team and market makers.

**Economic Model**

**1. Staking**

The main purpose of ML token is to pay transaction fees and cover additional costs associated with specific transactions (e.g., token creation transactions) and allow users to stake and join the network as block producers through a consensus protocol.

Mintlayer’s consensus protocol relies on a liquidity pool to act as block producers in the network. The main benefit of doing this is that it allows an arbitrary number of users to become an active part of the network and receive rewards. To create a pool, a minimum of 40,000 ML tokens, which is exactly 0.01% of the initial total supply, must be staked. Any user can stake tokens to the liquidity pool to receive rewards in the future.

In the first 10 years of operation on the network, each block generated had a block reward. The block reward was paid in $ML. The amount of reward received is proportional to the stake owned by the mining pool, meaning that if the delegated mining pool owns 10% of the stake, it can expect to receive 10% of the block reward.

Block producers also collect transaction fees from the blocks they create, and network users can use any MLS-01 token (including ML) transmitted through Mintlayer to pay fees.

2. Community Participation

Mintlayer is an open-source project. To encourage community-driven protocols, $ML tokens allow their holders to express their views on network development. Users can help determine the development order of roadmap events, suggest features, and more.

3. Ecosystem Tools

ML tokens can be used to pay for network fees as well as token issuance fees paid by users when issuing tokens on Mintlayer. RBB LAB’s services can be purchased with ML tokens:

- Mintlayer smart contract development

- Security audits of Mintlayer smart contracts

- Software engineering for decentralized applications on Mintlayer

9. Advantages and Risks

Advantages

Mintlayer is a unique project that can act as a sidechain when isolating its native functionality because it has its own independent blockchain, PoS consensus, checkpoint system, and the ability to peg native BTC to wrapped Bitcoin equivalents using its MLS-01 or MLS-02 token standards. With Mintlayer inheriting L2 functionality due to its integration with the Lightning Network, users can also benefit from off-chain transaction efficiency using BTC, ML, or MLS-01 tokens.

MintLayer allows participants to achieve more use cases with BTC without relying on centralized exchanges. By leveraging the security of the world’s largest cryptocurrency and integrating the Lightning Network, Mintlayer provides a platform for developers to build applications with real-world financial use cases.

Risks

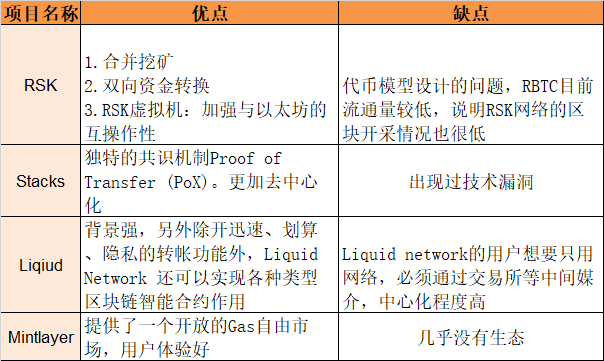

First, projects related to Bitcoin Layer 2 and sidechains are gradually starting. In addition to MintLayer, there are some early projects like RSK, Stacks, Liquid Network, etc. It remains to be seen whether MintLayer can stand out among these competitors.

Second, the current Bitcoin ecosystem is still far behind Ethereum in terms of scale. First, there are fewer well-known projects compared to Ethereum, and second, the user base is also smaller than Ethereum. The Bitcoin Layer 2 ecosystem is still in the construction stage and needs market validation.

In conclusion, as Bitcoin’s scaling solutions continue to develop and more people explore the Bitcoin ecosystem and expand the functionality of blockchain, Mintlayer is worth continuous attention.

References

https://docs.mintlayer.org/

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!