Author: Joyce, BlockBeats

Editor: Jaleel, BlockBeats

New L2 and Rollup solutions continue to emerge in the cryptocurrency ecosystem, accompanied by increasing fragmentation of liquidity. In the multi-chain world, cross-chain solutions are essential.

- What are the advantages and disadvantages of using Ethereum as a layer2 scalability solution?

- Overview of the story behind Pendle War How did we push Pendle to new heights?

- LayerZero The Future Path and Star Projects of Cross-chain Innovation

In the fierce and homogenizing competition of the cross-chain track, focusing on interoperability and providing more personalized cross-chain services may be a direction worth paying attention to. For example, Poly Network, a veteran cross-chain protocol, provides a comprehensive cross-chain solution similar to Cosmos Hub, connecting multiple blockchain networks. Its current transaction volume has exceeded $1.67 billion, with a TVL of over $81.31 million.

In addition, Socket, which has received $5 million in funding and has been invested by Coinbase Ventures and Framework Ventures, provides a new approach for the cross-chain track. Socket does not choose to be a bridge or a cross-chain application, but instead serves as the infrastructure for service developers to build cross-chain applications.

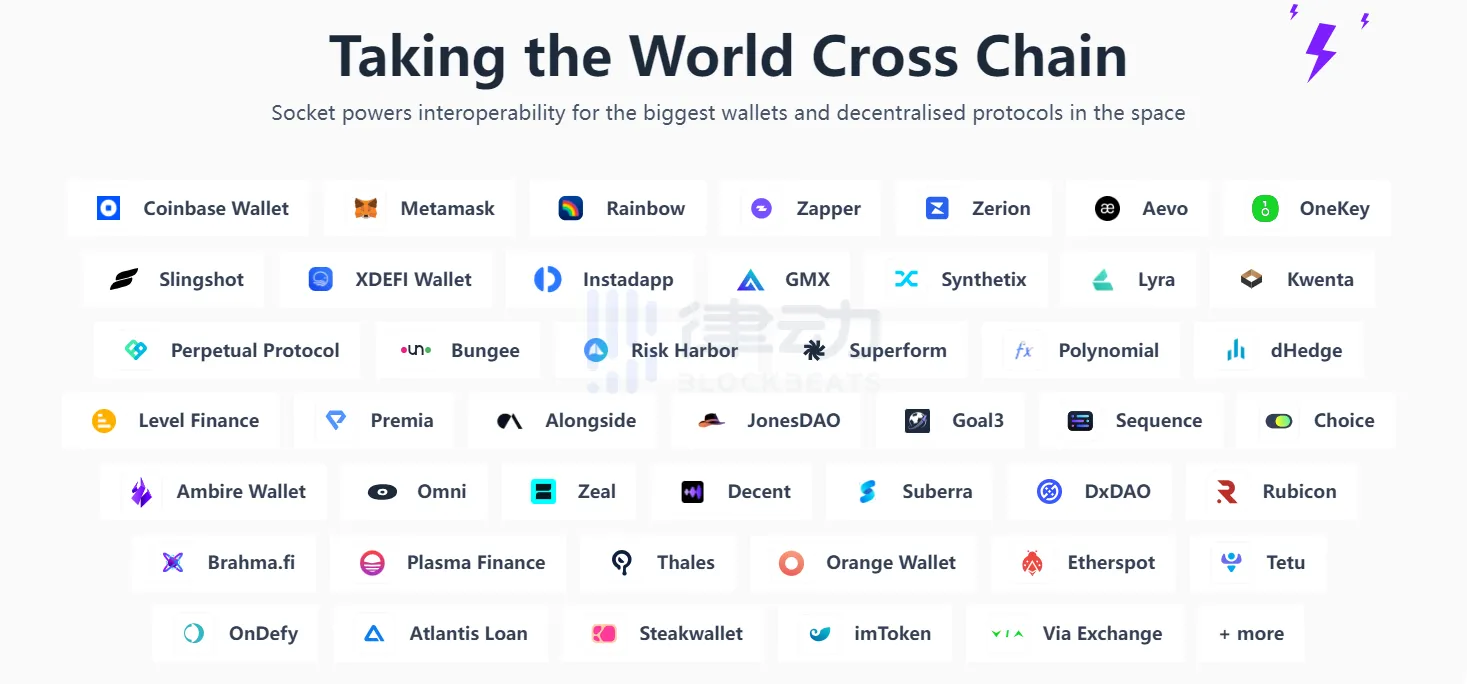

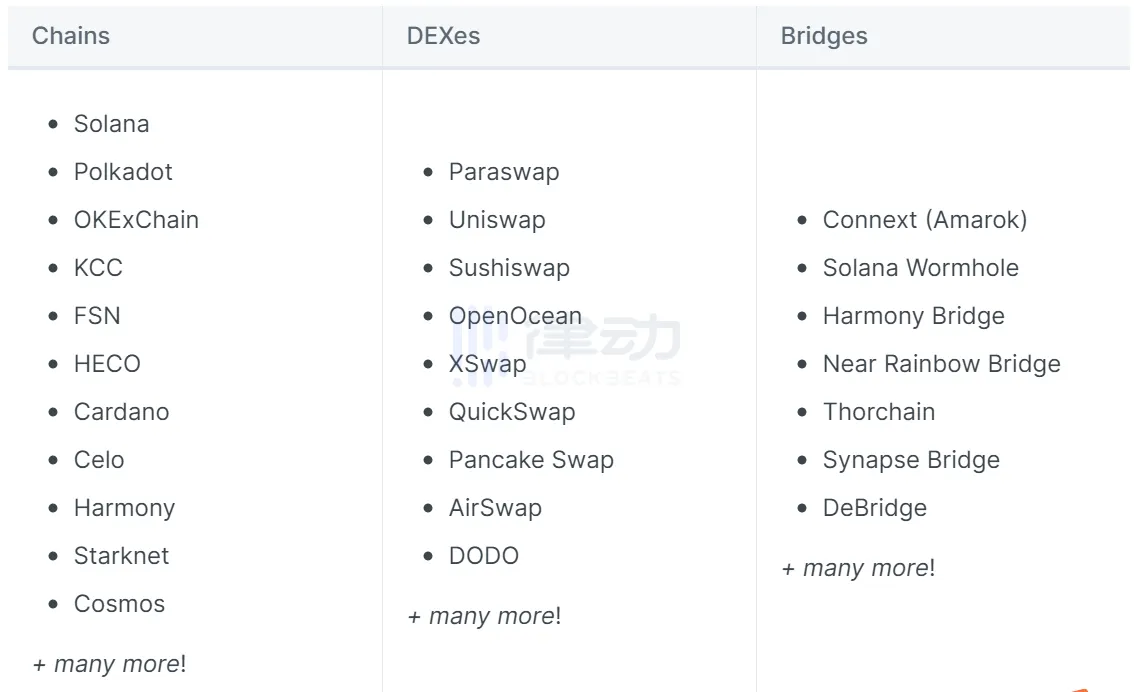

Since its launch in November 2021, Socket has facilitated over 2.5 million cross-chain transactions on 15 chains, serving over 80 protocols and dApps, with a total transaction volume of $3.5 billion. It covers areas such as software and hardware wallets, browsers, and DeFi, including mainstream wallets like Coinbase Wallet, Coinbase, and MetaMask. What is the architecture of Socket? What advantages contribute to its smooth development? Besides developers, does Socket have other strategic layouts? Blockbeats has summarized these in this article.

Socket Protocol: Developer-friendly interoperable infrastructure

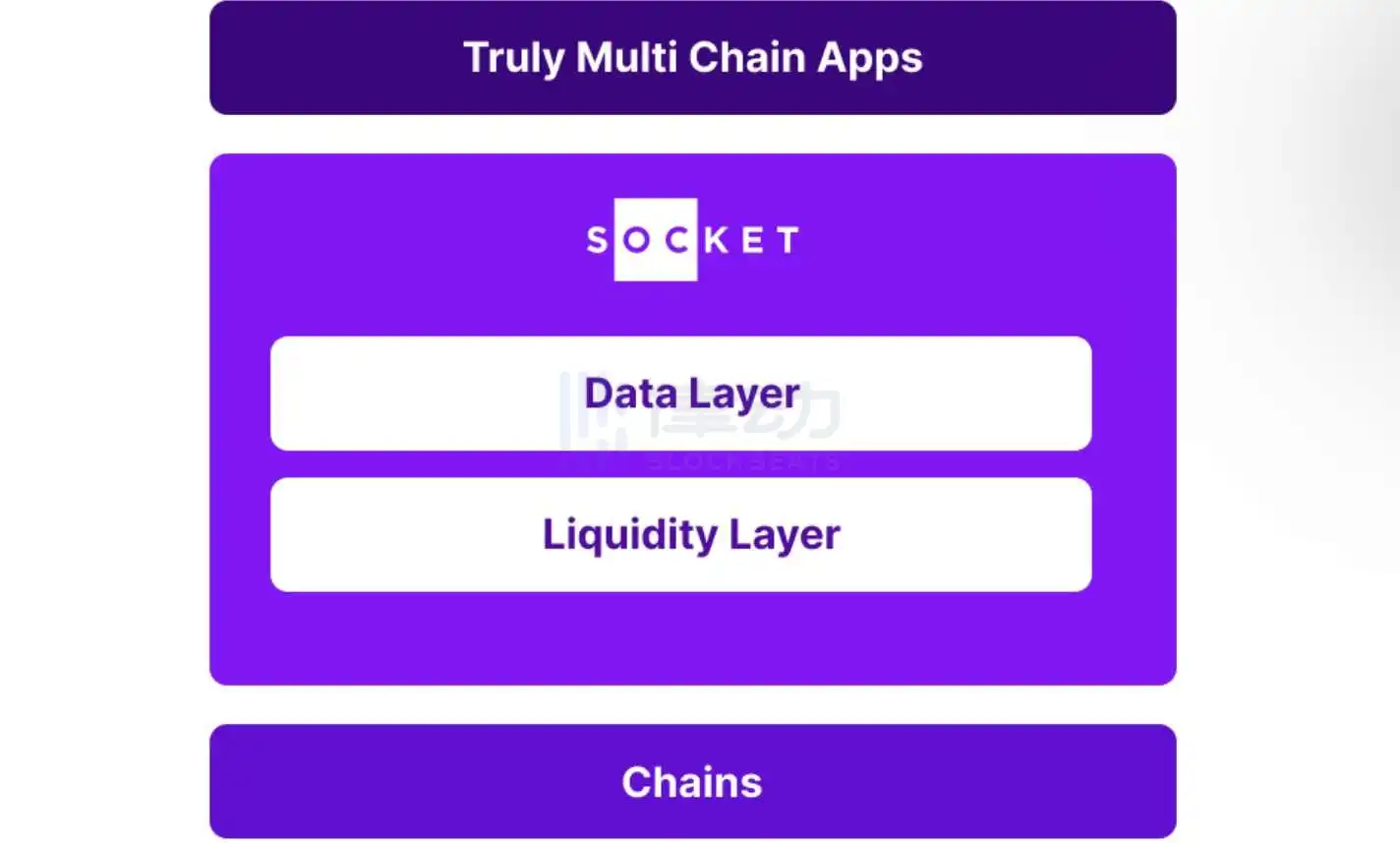

Socket is an interoperable protocol infrastructure for cross-chain data and asset transfer, aiming to provide secure, efficient, and seamless asset and data transfer for cross-blockchain protocols and dApps.

Its feature is that developers can use Socket to build interoperable products with different targets and trade-offs, providing users of applications with a seamless multi-chain experience. Developers can add cross-chain asset transfer and data transfer functionality to their applications by calling APIs or directly using pre-packaged cross-chain functional modules and tools.

According to the official documentation, the seamless transfer of cross-chain data and assets is achieved through two key components of Socket: SocketLL (Liquidity Layer) and SocketDL (Data Layer).

Key Components: SocketLL and SocketDL

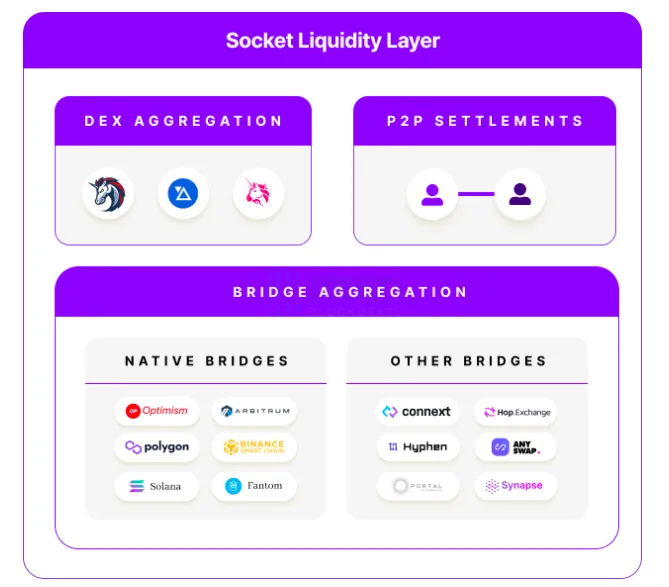

SocketLL unifies cross-chain liquidity by aggregating asset bridges and DEX, and dynamically selects the optimal bridge path mechanism for developers’ preferences, such as cost, latency, or security, to achieve seamless and efficient cross-chain asset transfer.

Socket’s on-chain contracts and optional off-chain backend quote engine and API together support the token bridging process for users. The backend quote engine determines the best possible route between given token chains by using DEX and bridge liquidity data, and the Socket LL API supports the data flow for the frontend, generating bridging routes and transaction data for bridging. SocketLL’s smart contract aggregates all DEXs and bridges into a single function call route. Users can swap + bridge tokens with just one click.

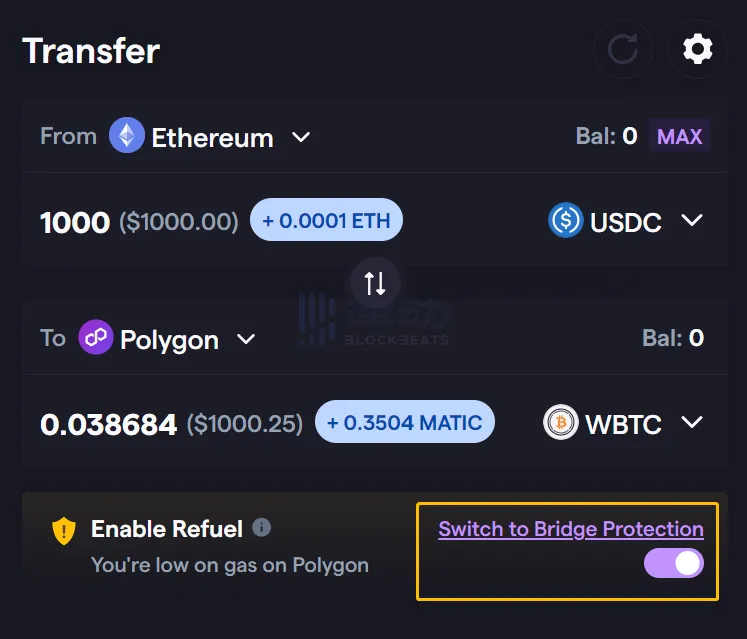

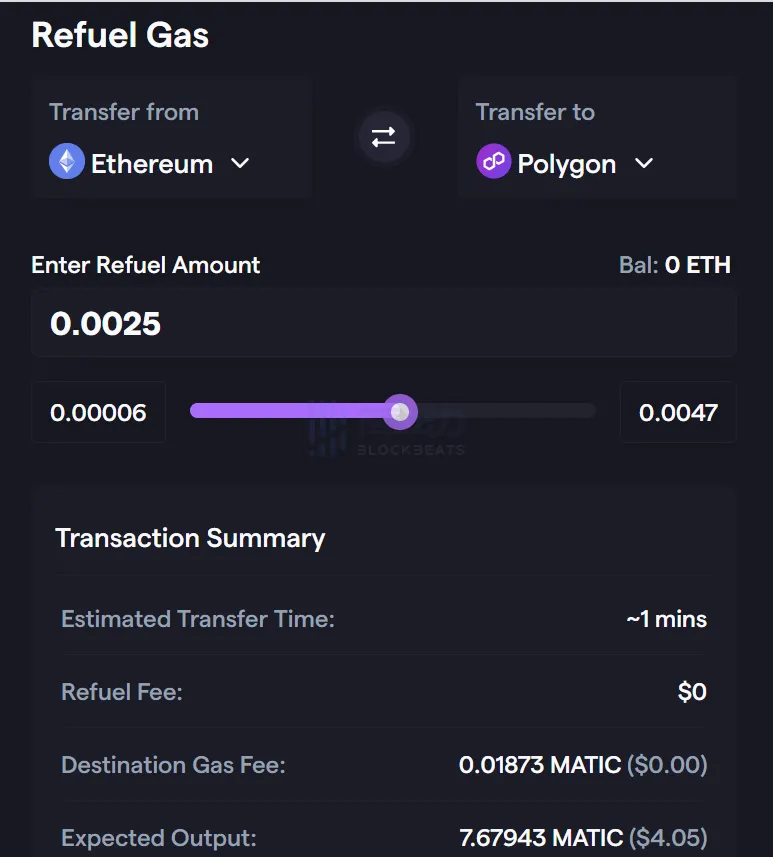

In addition, Socket has developed a centralized solution called Refuel to ensure that users can always get gas on any chain they need, avoiding the problem of not having native tokens to execute transactions when transferring tokens across chains. Refuel can be used in the bridging process itself to allow users to receive native tokens as well as bridged assets on the target chain, or as a bridge for moving small amounts of native tokens.

In addition to SocketLL, there is another key component called SocketDL.

SocketDL unifies chains by connecting all smart contracts on the chains, allowing them to perform read and write operations on each other. This supports secure cross-chain data transfer. Through SocketDL, smart contracts are able to read states and communicate arbitrarily with other contracts on different chains. For example, a protocol on Polygon can read the APY of Aave on Arbitrum, or a protocol on Fantom can deposit funds into Aave on Optimism through Socket.

Team Operation Mechanism: Security Expert Community and OP Rush Program

It is worth mentioning that Socket has established a security expert community called SocketSentinels, with community members divided into three levels based on their abilities and contributions to Socket, and different levels will receive different rights. Socket states on its official website that “members who play a key role in Socket governance and all security work will receive 5% of any future Socket tokens allocated to this and other similar security programs.”

In May, Socket held “SOCKET SURGE” to recruit hackers to conduct security audits on the SocketDL testnet. Socket implanted “Easter eggs” to identify potential collaborators and stated that “people in the blockchain security community who have obvious security intentions will be airdropped SurgeLianGuaiss NFTs”, and outstanding participants will be invited to join SocketSentinels. Contributions in the event were scored in SurgePoints, and Socket invested $77,000 in Lootbox over the course of 4 weeks, with 14,000 people participating in registration and discovering 15 system bugs.

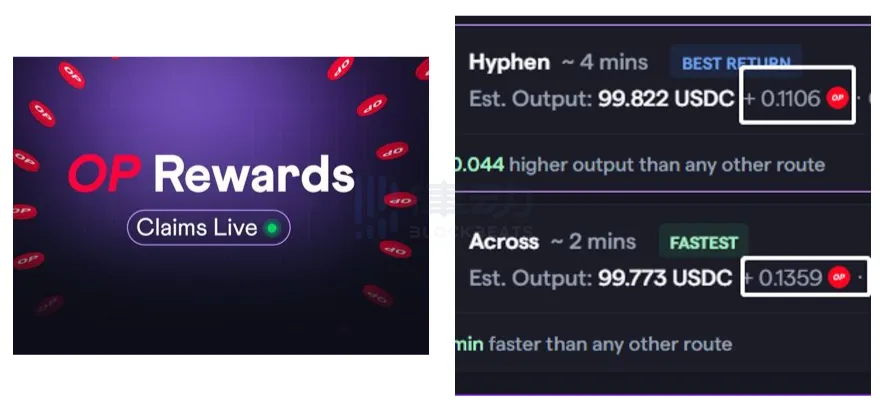

Part of Socket’s current popularity also comes from its well-developed operating strategy. On August 2nd, Socket launched the OP Rush program, where users who use Bungee and other dApps/wallets supported by Socket will be eligible to receive 90% of the bridge fee in the form of OP tokens when bridging to Optimism. The program lasts for 4 months, with a total distribution of 300k OP tokens.

The calculation formula for the reward is Commission Amount = 90% Bridge Fee + USD Source Gas Fee (based on the current OP price), where the bridge fee = Source Amount (USD) – Target Amount (USD), and the maximum OP limit per transaction is 20. The rewards obtained will be displayed on Bungee.

Within one month after the start of the event, users injected $150 million in liquidity into Optimism through Socket.

How to Use the Socket Bridge Aggregator Bungee

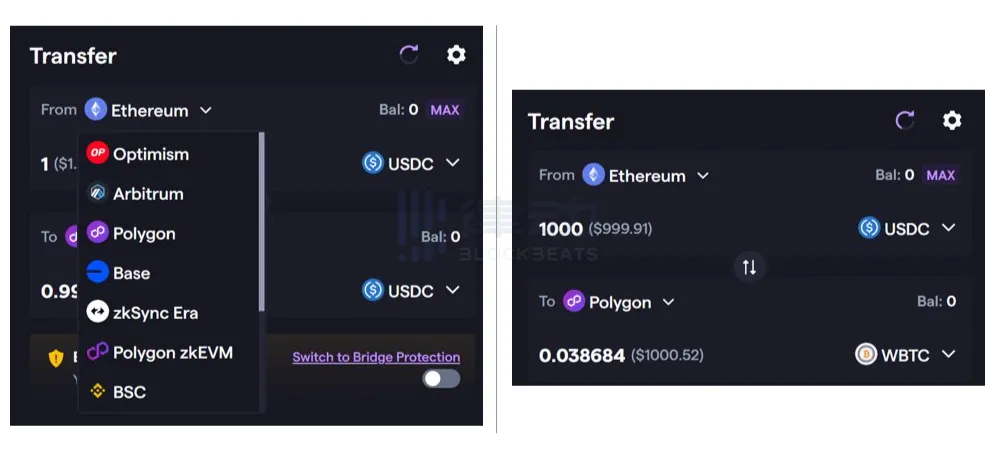

For ordinary users, Bungee, the bridge aggregator built by the Socket team, can be directly used for single transaction bridging (support for multi-transaction Multi Txn Bungee is still in the testing phase). Bungee currently supports asset transactions between most mainstream chains, such as Arbitrum, Avalanche, Ethereum, Optimism, etc.

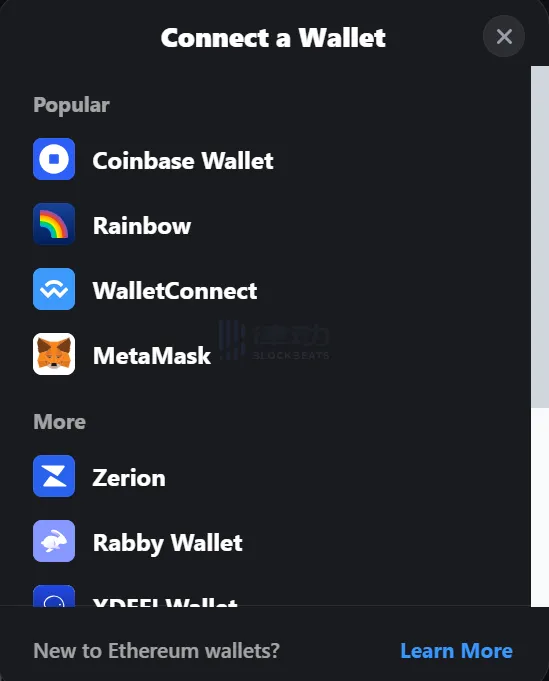

Enter Bungee and connect your wallet. Bungee supports mainstream wallets such as Metamask, Wallet Connect, Rainbow, and Coinbase.

Select the source chain and target chain, choose the assets to be bridged, and enter the amount.

After entering the amount, available routes will be displayed, showing the cost and required transaction time for each route. Choose the appropriate route to proceed with the cross-chain asset transfer.

About Refuel

If there is not enough native token on the target chain to be used as gas fees, you can use the Refuel function to exchange a small amount of bridged token on the source chain for the native token on the target chain. The amount of token serving as gas fees will be displayed in the interface.

For users who want to move a small amount of native tokens across chains, Refuel can also be used as an independent bridge. After selecting the source chain and target chain, Bungee will highlight the minimum and maximum limits of Refuel on the slider below.

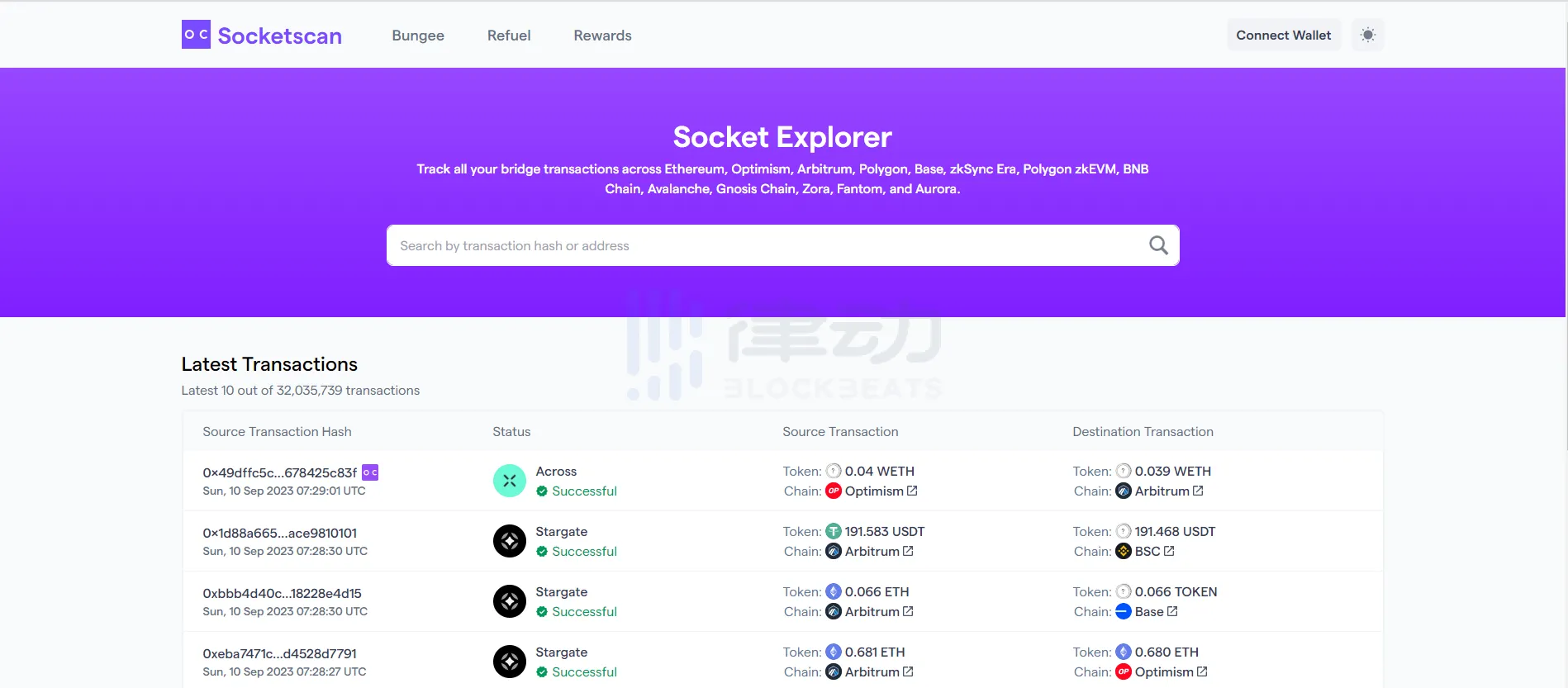

After submitting the request for cross-chain asset transfer, confirm the transaction in your wallet and wait for the transaction to be confirmed on the source chain. Users can track the transaction status by searching for the source transaction hash or target transaction hash on Socketscan. When the transaction is marked as successful, users will be able to find the corresponding assets in the target address.

Expansion of Cooperation with Coinbase After Financing

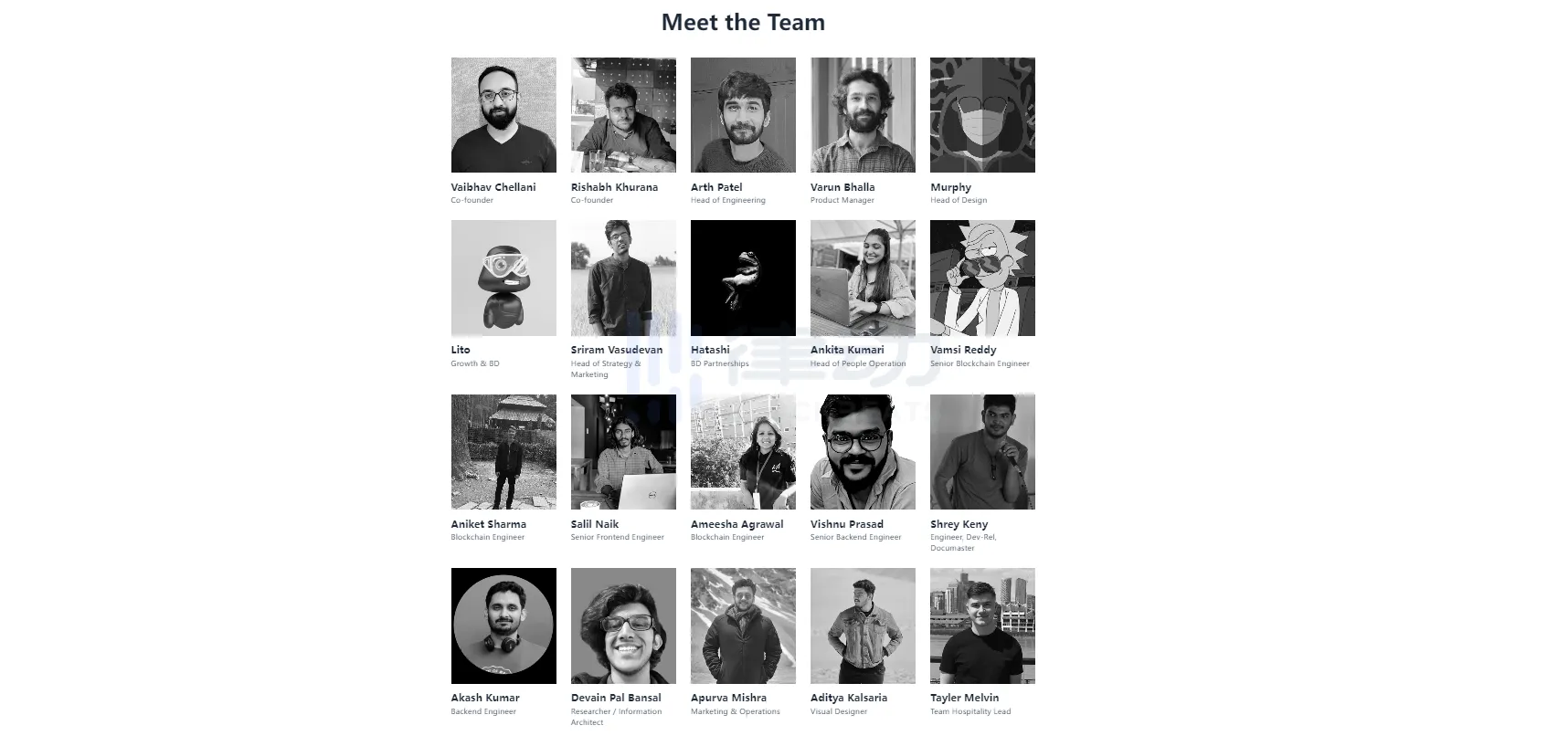

The Socket team is composed of programmers and cross-chain enthusiasts. The official website shows that there are 20 members, and the co-founders are Vaibhav Chellani (formerly an engineer at Matic Network) and Rishabh Khurana.

Socket was formerly known as Movr Network. After changing its name to Socket in February last year, it completed a $5 million seed round financing led by Framework Ventures in March. Subsequently, Socket launched the SocketLL feature and cross-chain trading product Bungee. On September 7th, Socket received a $5 million seed round financing led by Framework Ventures, with participation from Coinbase Ventures. The new funds will expand the cooperation between Socket and Coinbase, including providing an easy-to-use bridge for developers and users of Coinbase Wallet and Base.

Currently, Socket allows users to choose an acceptable slippage when using DEX or bridging protocols, meeting the need to cover addresses in multiple cross-chain trading centers. Socket plans to implement more user-friendly features in the future, such as enabling users to perform more operations, including bridging, swapping, depositing xTokens, borrowing yTokens, etc. In addition, Socket will explore splitting transactions between multiple bridging protocols to efficiently transfer liquidity between these different bridges.

Security score and robustness score are the considerations made by Socket to ensure the secure transfer of assets. Assessing the security of bridging protocols or services exposed through SocketLL and assigning a security score helps users or developers understand the security of specific bridging protocols or services to decide whether to execute asset transfers or other operations on them.

The robustness score refers to the difference between the actual bridging time of a specific bridging service and the reference time. If the difference between the actual bridging time and the reference time is small, the bridging service may be more stable and reliable, and vice versa. Evaluating robustness helps users or developers choose reliable bridging services to ensure smooth asset transfers.

Currently, Socket’s partners can charge fees during the asset transfer process. Socket plans to make its data more accessible and usable to facilitate various analyses by partners. Socket stated that it will explore more partnerships based on its existing ecosystem partners.

Reference reading: 1. Socket Protocol official documentation;

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!