Since the emergence of smart contract platforms, the inclusion of real-world assets (RWAs) as collateral in DeFi has been a dream for many in the cryptocurrency space. Tokenizing assets from the physical world promises to bring more diverse collateral, income streams, fractional ownership, and reduced costs and volatility to DeFi.

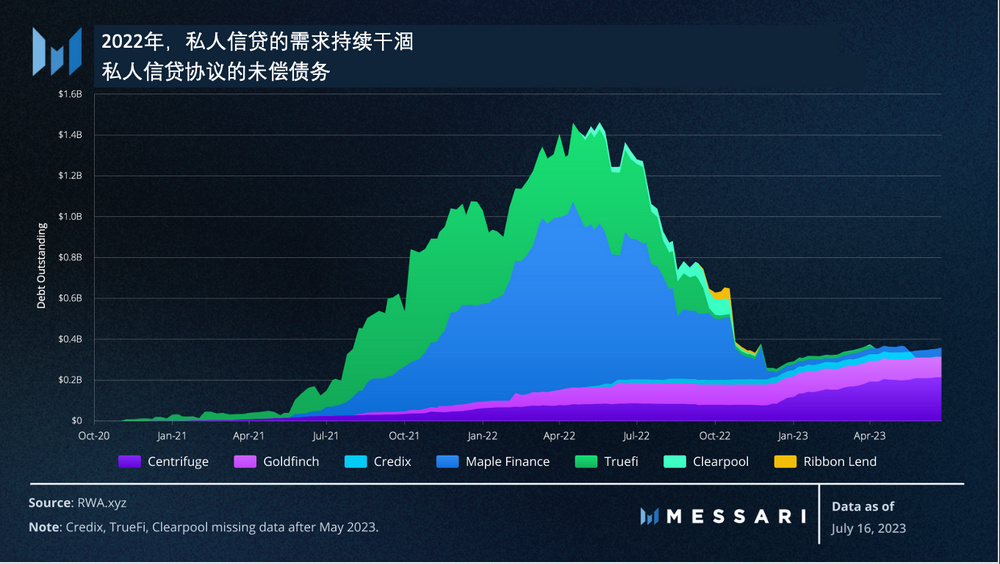

In 2018 and 2019, after an initial wave of tokenized real estate projects failed to take off, RWAs seemed to gain legitimate momentum in the 2021 bull market, thanks to private lending protocols such as Maple Finance, TrueFi, Goldfinch, and Centrifuge. The idea behind these protocols is that stablecoin lenders can earn above-average returns by lending funds to undercollateralized borrowers vetted by the protocol.

In theory, borrowers use these funds for productive investments in the real world. However, upon closer observation, it is apparent that much of the lending growth in 2021 and early 2022 was driven by crypto-native businesses using Maple Finance and TrueFi. These firms likely used the funds for cheap leverage or on-chain arbitrage strategies rather than providing entirely new services in the physical world.

- Bored Ape encounters a battle with mechs, what can we expect from the blockchain game Wreck League, which is being heavily promoted by Animoca?

- 6 long-term promising token inventory SOL, KAS, INJ……

- Analyzing the fastest growing stablecoin FDUSD

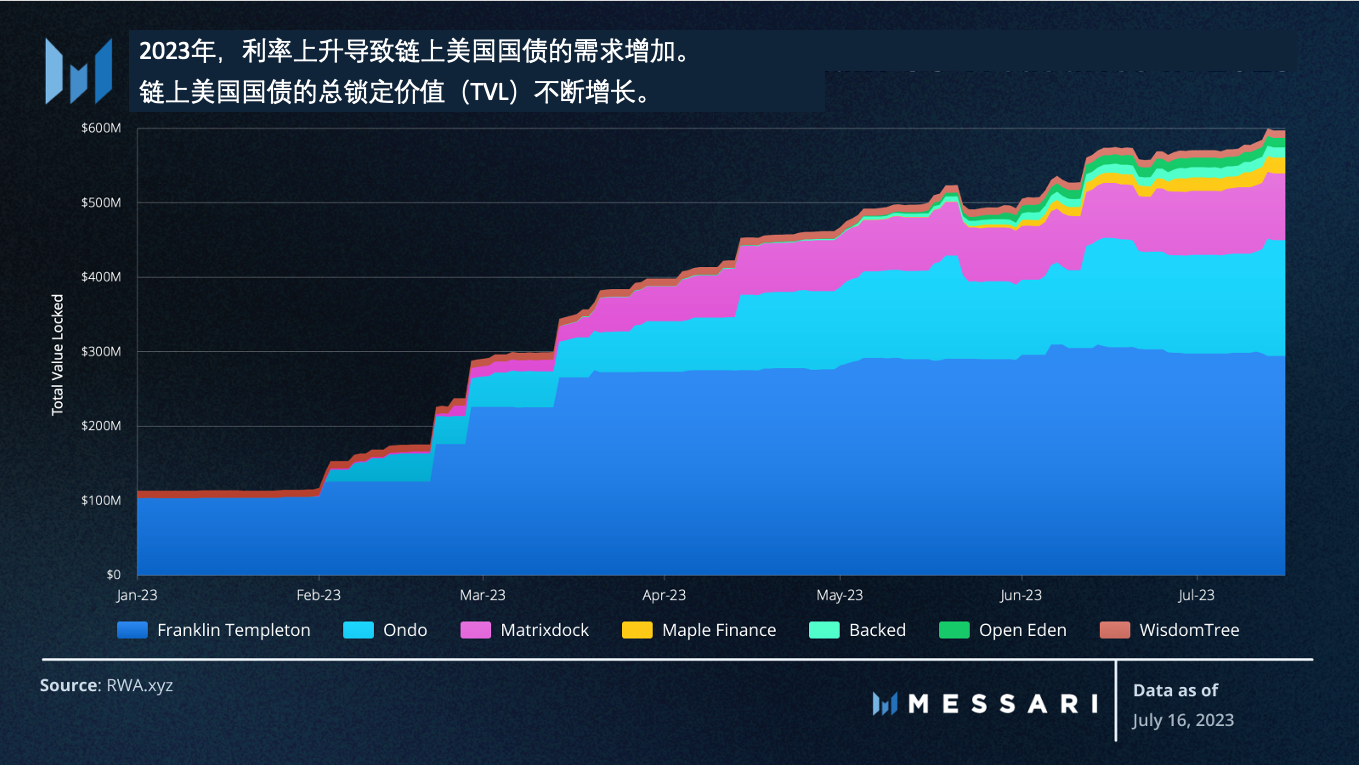

While private lending protocols like Centrifuge and Goldfinch are steadily growing, they pale in comparison to a newer subclass of RWAs that have consistently grown since 2023: on-chain US government debt.

Over the past 15 months, with historic interest rate hikes by the Federal Reserve, there has been a sharp increase in demand for US government debt yields, pushing the federal funds rate from 0.25% in March 2022 to 5.25% today. Currently, top-tier lending protocols in crypto offer stablecoin yields of approximately 3%, while US government debt yields provide a more attractive low-risk alternative. This has led to the rise of protocols that bring these offline yields onto the blockchain. Two notable protocols include:

1. Franklin Templeton’s US Government Money Market Fund – the largest on-chain fund with nearly $300 million in total investments. The fund has been tokenized on Stellar, but its application documents submitted to the US Securities and Exchange Commission (SEC) state that any offline ledger of the fund will take precedence over the blockchain in case of disputes.

2. Ondo Finance’s OUSG – a stablecoin that essentially wraps US Treasury note ETFs and passes on the interest to its holders. Ondo’s services are only open to qualified purchasers (individuals or families with investments exceeding $5 million), and OUSG can only be transferred between whitelisted addresses. Ondo offers a variant of Compound V2 called Flux Finance, which allows using OUSG as collateral to borrow stablecoins such as USDC, USDT, and Dai.

Although these projects have taken a step in the right direction, their limitations make it almost impossible for ordinary cryptocurrency investors to use them. Most protocols restrict their services to non-US users, and KYC (Know Your Customer) measures prevent the integration of tokenized assets with permissionless services in DeFi. Once again, it is emphasized that clear regulatory provisions are needed for tokenized national debts to obtain legal status in the crypto economy.

In the short term, US Treasury bonds will continue to play an important role in the two largest stablecoin protocols in the cryptocurrency. On June 21st, MakerDAO purchased an additional $700 million worth of US Treasury bonds, bringing its total holdings to $1.2 billion. The $2.3 billion RWA collateral of the protocol has now become the largest part of the protocol’s assets, accounting for 49% of Maker’s assets. These RWA components of MakerDAO also bring substantial fee income to the protocol. According to data from MakerDAO’s Strategic Financial Core Unit, stable fees from RWAs account for 78.5% of all stable fees to date. This shift indicates Maker’s commitment to building a diversified collateral base that can mitigate the volatility of DeFi.

On the same day that Maker recently purchased Treasury bonds, Circle reaffirmed its use of Treasury bonds to support its USDC stablecoin. Last month, the company liquidated all $24 billion worth of Treasury bonds and instead opted for overnight repurchase agreements during the US debt ceiling impasse. With the resolution of the debt ceiling conflict on June 3rd, Circle resumed purchasing Treasury bonds in its USDC reserve fund managed by BlackRock and plans to allocate its exposure between short-term Treasury bonds and repurchase agreements.

Key Events

Pendle

Pendle has become the best-performing DeFi asset this year with a 1700% price increase. This yield derivatives protocol allows users to split interest-bearing tokens into separate principal tokens (PTs) and yield tokens (YTs) and speculate on yield fluctuations. As the Ethereum staking ecosystem continues to rise, this has become an increasingly popular service. Pendle has recently achieved the most impressive performance in the past 30 days, with a price increase of 70.5% and TVL (Total Value Locked) growth of 37.5%.

The growth of TVL is mainly driven by deposits of stETH and GLP, as well as the recent addition of the swETH pool by Aura Finance. The swETH pool is the first LST pool on Pendle, allowing both parties to earn yield; users earn underlying staking rewards from Swell’s swETH while earning lending rewards from bbaWETH lent on Aave.

Pendle adopts a voting escrow (ve) governance system that allows users to lock PENDLE in exchange for vePENDLE and share in the protocol’s revenue share. vePENDLE holders receive 80% of the exchange fees, fees generated from all yield tokens of Pendle, and a portion of the unredeemed principal tokens and yield tokens after their expiration.

The recent price growth of Pendle has been driven by the “Pendle Wars” in early June. After the launch of Penpie and Equilibria, they quickly became the largest vePENDLE holders, leading to a decrease in circulating PENDLE supply. This supply change is correlated with a 101% price increase within 30 days of the launch of Penpie and Equilibria.

Another development that could drive future growth of the Pendle ecosystem is the support of other DeFi protocols for Pendle-based assets as collateral. Dolomite, a DEX and money market built on Arbitrum, added support for Pendle’s PT-GLP as collateral for borrowing and lending on June 28, making it the first lending protocol that allows Pendle users to leverage their assets. In the future, more integrations may bring further growth to the emerging Pendle ecosystem.

Drift’s Super Stake SOL

As the Solana ecosystem continues to recover from the crash triggered by SBF in 2022, SOL staking is becoming an attractive source of yield within the ecosystem. Drift Protocol has introduced its Super Stake service, which allows users to gain leveraged exposure to SOL staking rewards in a similar way to using yield farming strategies on Ethereum.

The Super Stake cycle works as follows:

1. Users deposit mSOL, a liquidity staking token provided by Marinade Finance.

2. Borrow SOL against mSOL.

3. Stake the borrowed SOL to earn more mSOL.

4. Repeat the above process.

Super Stake enables users to execute the cycling process in a single click and allows for up to 3x leverage. The Super Staking process has quickly become a popular service on Drift, with over 100,000 mSOL deposited. Drift plans to add support for other popular Solana liquidity staking tokens once reliable Pyth oracles for stSOL and jitoSOL are developed.

dYdX V4 Testnet

The highly anticipated dYdX V4 was launched on the testnet on July 5. Although the V4 testnet currently only supports BTC and ETH, it includes over 10 wallet integrations, including popular options like Metamask and Coinbase Wallet. This is important as most Cosmos-based networks lack support for the most popular wallets for EVM-compatible chains. Providing support for these wallets should help dYdX V4 attract users from EVM networks while abstracting away the relationship between dYdX and Cosmos, which has been emphasized by dYdX founder Antonio Juliano.

In the weeks leading up to the testnet launch, the technical details of dYdX V4 have been made public. The highlights of the new architecture include an off-chain order book and matching engine maintained by a set of validators on the dYdX Chain, as well as a custom-built indexing system that delivers the state of the on-chain order book to dYdX’s frontend.

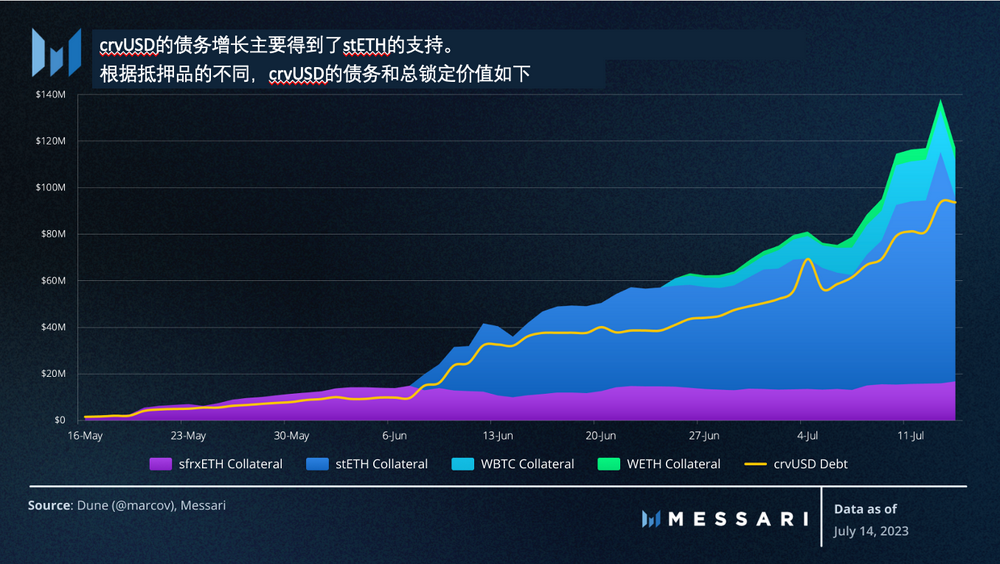

Increase in Adoption of crvUSD

After a slow start, adoption of crvUSD has increased in the past month, with the total locked value increasing from $48 million to $147 million, and crvUSD debt increasing from $37.6 million to $91 million.

The growth is mainly attributed to the addition of wstETH as collateral on June 8, which now accounts for 71.9% of the total locked value of crvUSD. Recently, WBTC and WETH were added as eligible collateral types on June 18 and 20 respectively. WBTC is close to surpassing sfrxETH as the second largest collateral type in terms of total locked value – wBTC accounts for 13.4% of the total locked value, while sfrxETH accounts for 14.1%. To further align with the protocol, Curve’s DAO has voted to allocate fees generated from crvUSD to veCRV holders. Despite the recent increase in total locked value and trading volume, there are less than 400 addresses holding crvUSD, indicating a high concentration of stablecoin usage among a few core DeFi users.

Aave GHO Launches on Ethereum Mainnet

In the future, with the launch of Aave’s long-anticipated GHO stablecoin on the Ethereum mainnet over the weekend, crvUSD will face increasing competition. The initial minting cap for GHO will be set at 100 million GHO, with a borrowing interest rate of 1.5% and a 30% discount when minting using stkAAVE as collateral.  With the introduction of GHO, Aave has created an additional revenue stream and gained more control over the supply side of its money market. This will lower Aave’s stablecoin funding costs as the protocol will no longer rely on attracting external stablecoins like USDC to meet user demand, solidifying Aave’s top-down supply service business model.

With the introduction of GHO, Aave has created an additional revenue stream and gained more control over the supply side of its money market. This will lower Aave’s stablecoin funding costs as the protocol will no longer rely on attracting external stablecoins like USDC to meet user demand, solidifying Aave’s top-down supply service business model.

DeFi Infographic

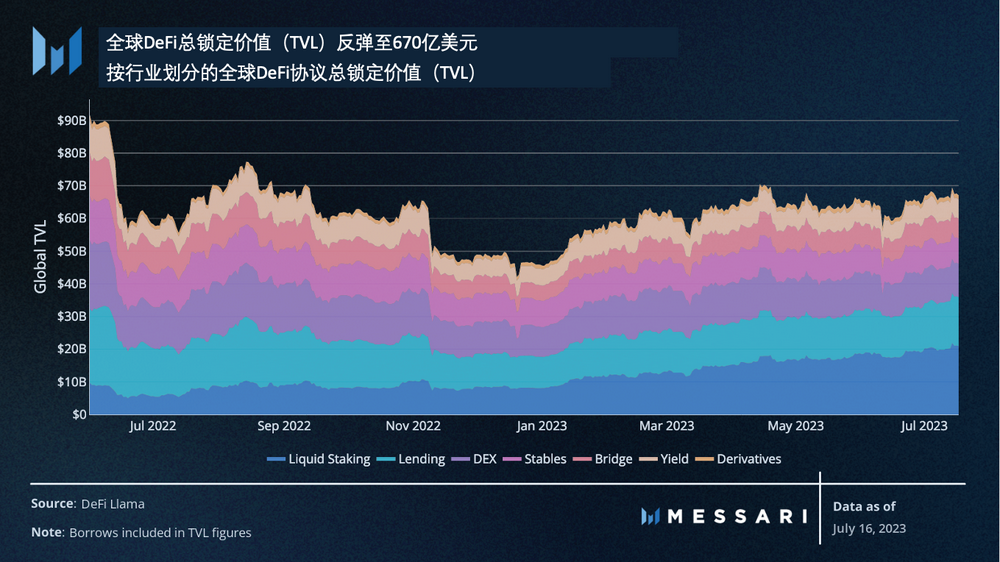

Total Value Locked (TVL) Worldwide

The global DeFi Total Value Locked (TVL) has experienced a regression in the past 30 days, following a sudden drop after the U.S. Securities and Exchange Commission (SEC) lawsuit against Coinbase and Binance US. The current TVL is $67 billion, close to the high point in late April 2023 ($70 billion).

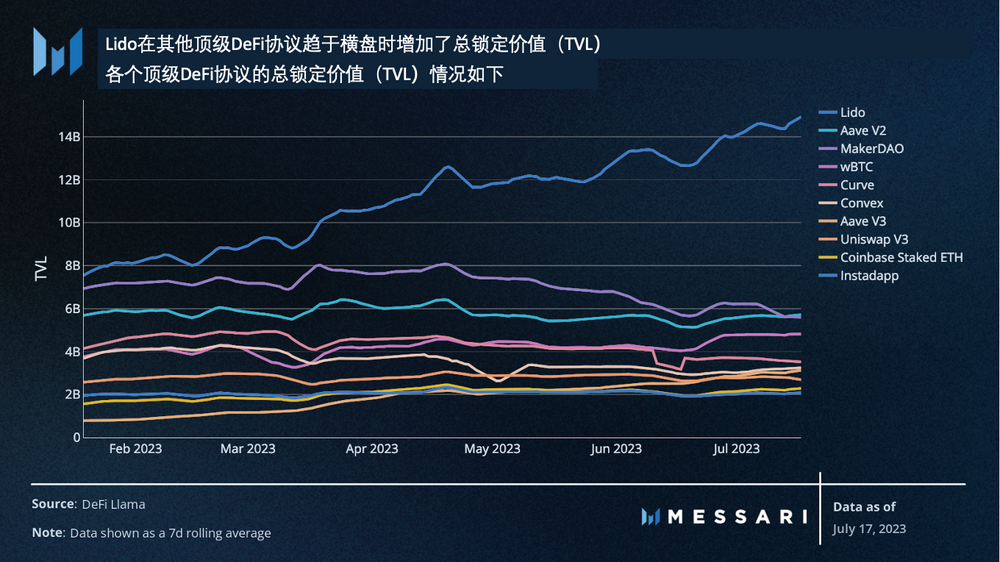

Lido still absorbs the most TVL among all DeFi protocols. In the past 30 days, this liquidity staking giant has added $25 billion TVL. As a comparison, Lido’s closest decentralized liquidity staking competitor, Rocket Pool, only has a TVL of $1.9 billion. Lido currently holds a dominant 32% market share in the staking space and is once again approaching the implied 33.3% limit, which would make Lido a single attack vector on Ethereum’s vitality.

Global User Count

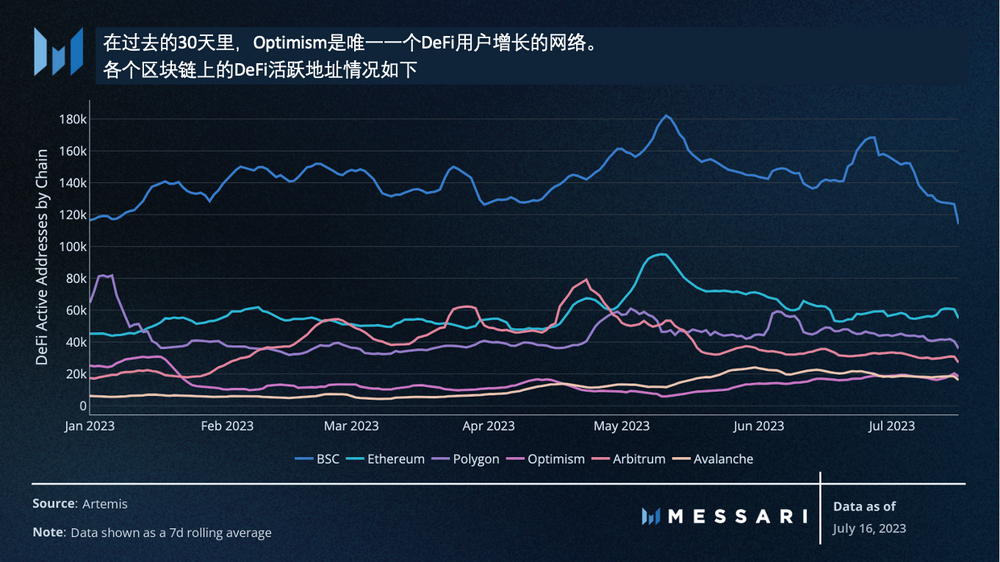

After a sharp decline in June, Binance Smart Chain has regained some DeFi users, but the network’s user change in the past 30 days still remains negative. This is the trend for all tracked networks except for Optimism. The active DeFi addresses on Optimism have grown by 9.8%. The growth in active addresses on Optimism is mainly due to increased trading activity on Uniswap and DEX aggregators Matcha and 1inch.

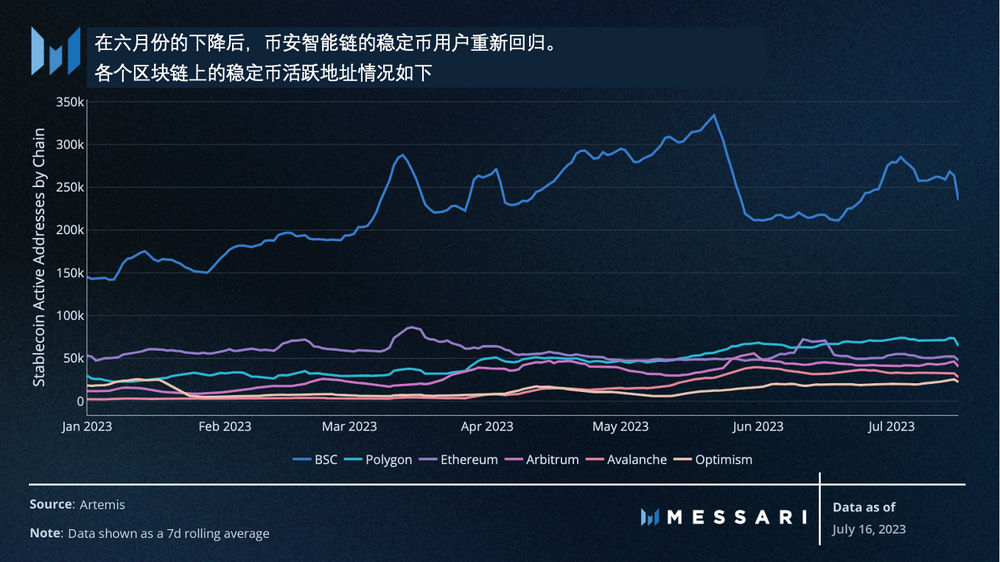

After a sharp decline in June, Binance Smart Chain has regained some DeFi users, but the network’s user change in the past 30 days still remains negative. This is the trend for all tracked networks except for Optimism. The active DeFi addresses on Optimism have grown by 9.8%. The growth in active addresses on Optimism is mainly due to increased trading activity on Uniswap and DEX aggregators Matcha and 1inch. In terms of stablecoin users, Binance Smart Chain has seen a significant portion of the active addresses it lost in June return, with a growth of 10.1%. Optimism is the only other network that has seen growth in stablecoin addresses, with an increase of 11.8%. It is worth noting that stablecoin active addresses on Ethereum have once again declined by 24%, which is a continuing trend following the meme coin frenzy on the Ethereum mainnet in May.

In terms of stablecoin users, Binance Smart Chain has seen a significant portion of the active addresses it lost in June return, with a growth of 10.1%. Optimism is the only other network that has seen growth in stablecoin addresses, with an increase of 11.8%. It is worth noting that stablecoin active addresses on Ethereum have once again declined by 24%, which is a continuing trend following the meme coin frenzy on the Ethereum mainnet in May.

DEX Trading Volume

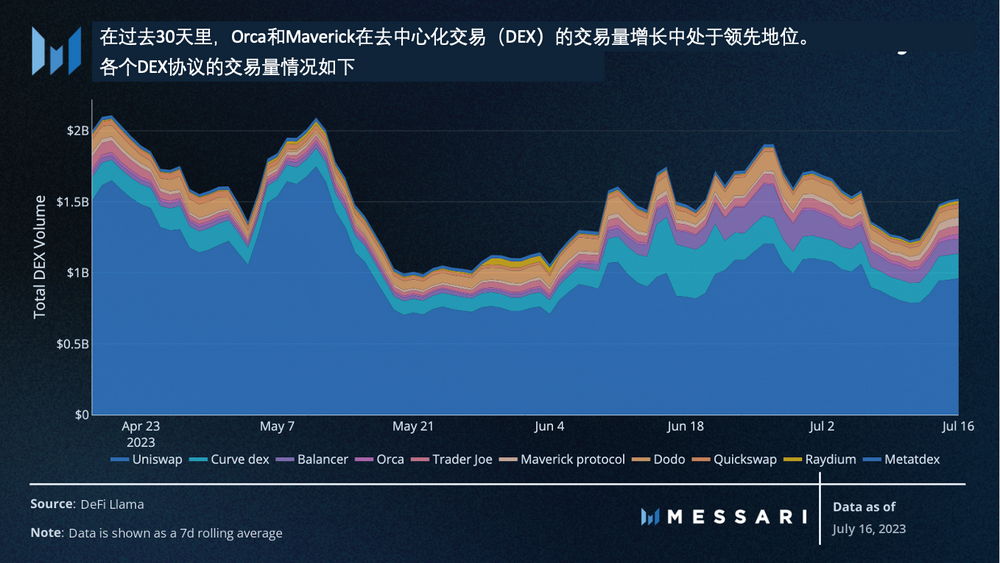

DEX trading volume has remained relatively stable over the past month. Orca and Maverick have seen the fastest growth in trading volume in recent weeks. Orca’s growth can be attributed to the renewed attention to Solana DeFi in recent weeks, while Maverick’s activity has benefited from its recent token issuance and incentive programs.

DEX trading volume has remained relatively stable over the past month. Orca and Maverick have seen the fastest growth in trading volume in recent weeks. Orca’s growth can be attributed to the renewed attention to Solana DeFi in recent weeks, while Maverick’s activity has benefited from its recent token issuance and incentive programs.

Lending Market

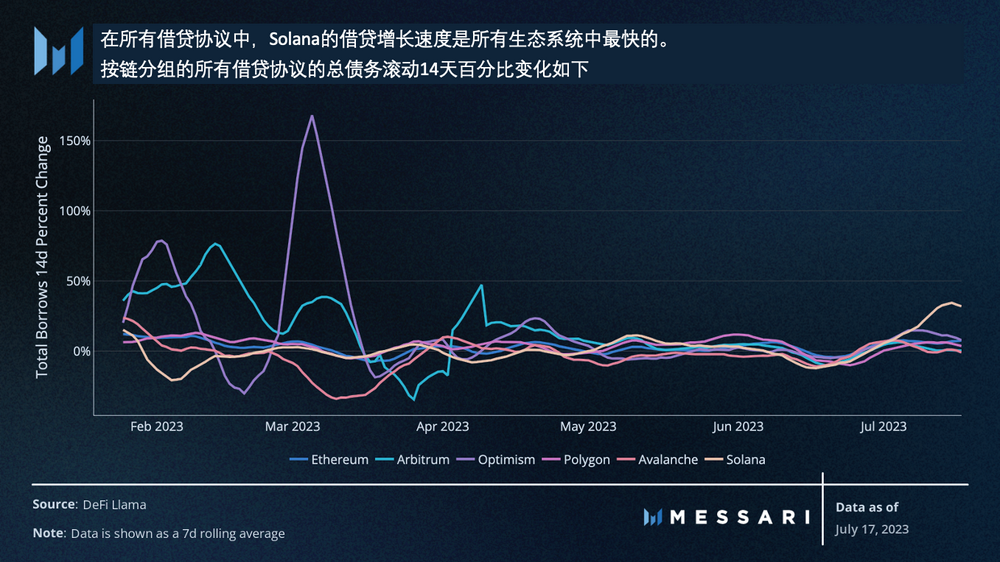

Global on-chain debt has grown by 14.7% over the past month, reaching $5.2 billion currently. Debt utilization has once again increased, while the price of Ethereum has remained stable over the past few months. Unlike the dramatic increase in utilization seen in the past 18 months, the current growth is slow and steady.

Currently, Solana has seen the fastest growth in lending among various independent ecosystems. This is mainly because Solana’s DeFi ecosystem is much smaller than other ecosystems, so any increase in activity is likely to result in larger percentage changes. Apart from the development of Drift’s super staking service, funds are flowing into MarginFi in hopes of potential airdrops related to lending activities on the protocol.

Yields

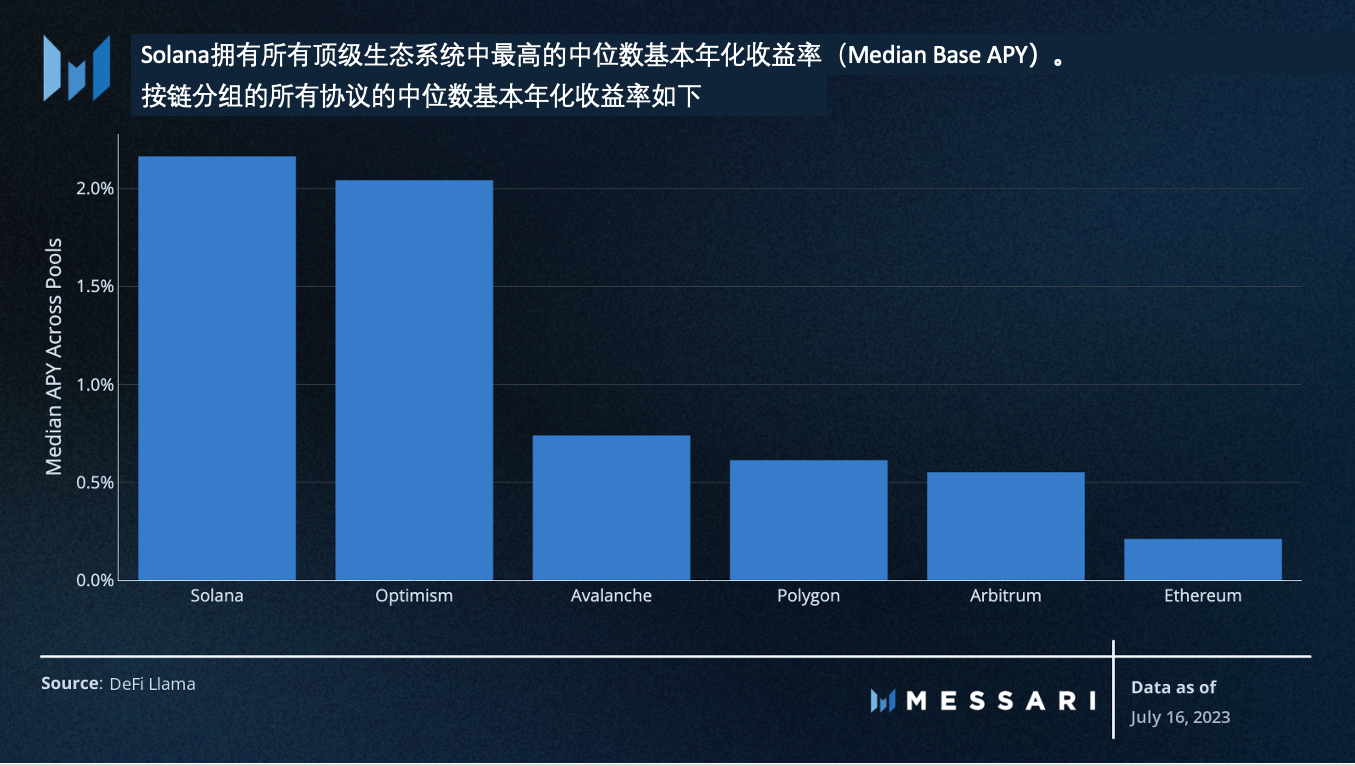

The renewed attention to Solana’s DeFi ecosystem is also reflected in Solana surpassing Optimism as the ecosystem with the highest yields (calculated by the median of all pools).

The emerging Credix continues to offer double-digit USDC yields to users willing to lend to traditional world enterprises, while Orca, Solana’s top decentralized exchange, continues to generate high yields in its concentrated liquidity pools.

Funding

- Alluvial Protocol – $12 million Series A

Alluvial is the development company behind Liquid Collective. In January of this year, it completed a seed round financing of $6.2 million. Just six months later, it completed a Series A financing of $12 million. Liquid Collective is currently composed of Coinbase Prime, Bitcoin Suisse, and Hashnote, aiming to provide regulated liquidity staking experiences for enterprises.

The supply of LsETH, the liquidity staking token of Liquid Collective, is only 2500 ETH. But this round of new financing indicates that investors are confident in Alluvial becoming a major participant in the enterprise ETH staking field in the coming years. This round of financing was co-led by Ethereal Ventures and Variant.

- Ambient Finance – $6.5 million seed round

Ambient Finance, formerly known as CrocSwap, announced the completion of a $6.5 million seed round financing, bringing the valuation of the protocol to $80 million. Ambient is an innovative decentralized exchange that supports concentrated liquidity and ambient liquidity (X*Y=K), as well as native limit orders. The fees for liquidity pools can be dynamically adjusted and automatically reinvested in the pool for compounding returns.

Ambient was launched on the Ethereum mainnet on June 12th and attracted a total locked value (TVL) of $6.5 million at the time of writing. Similar to the unreleased Uniswap V4, Ambient has the opportunity to gain attention before competitors launch similar services by the end of this year or early 2024.

- Maverick Protocol – $9 million venture capital round

Maverick Protocol, another decentralized exchange, raised $9 million in a financing round led by Founders Fund, bringing its total funding since its establishment in 2021 to $18 million. Maverick differentiates itself from its decentralized exchange competitors by automatically adjusting concentrated liquidity positions during price fluctuations.

Since its initial launch on the Ethereum mainnet in March 2023, Maverick has had the highest turnover rate (trading volume / TVL) among all decentralized exchanges and has also become the largest decentralized exchange on the zkSync Era. Shortly after the financing on June 21st, Maverick released its governance token.

- One Trading – $33 million Series A

BitLianGuainda Pro has become a new entity called One Trading and raised $33 million in a Series A financing. This Austrian exchange targets institutional and professional European traders and adopts a membership model instead of relying on a transaction-based fee business model. This round of financing is the latest example of international capital influx, demonstrating investors’ ongoing commitment to strengthening overseas exchange infrastructure while facing regulatory uncertainties in the United States. This round of financing was led by Peter Thiel’s Valar Ventures.

Original link: https://messari.io/report/us-treasuries-fuel-real-world-asset-growth?referrer=all-research

Translated by Terry | 胡子观币

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!