Author: Defi_Mochi; Translation: Jaleel, BlockBeats

LSDfi is the latest narrative capturing the attention of Binance, with a potential market value of $16.9 billion and a growth of 102% in just three weeks!

In this LSDfi war, who will emerge victorious? Mochi analyzes the data from DuneAnalytics to help us find the answer!

- Unveiling the first digital asset “Ponzi scheme” sued by CFTC

- Frax is launching an Ethereum Layer2 network called Fraxchain.

- Balancer: Disabled the fee feature that may affect the mining pool, no funds are at risk.

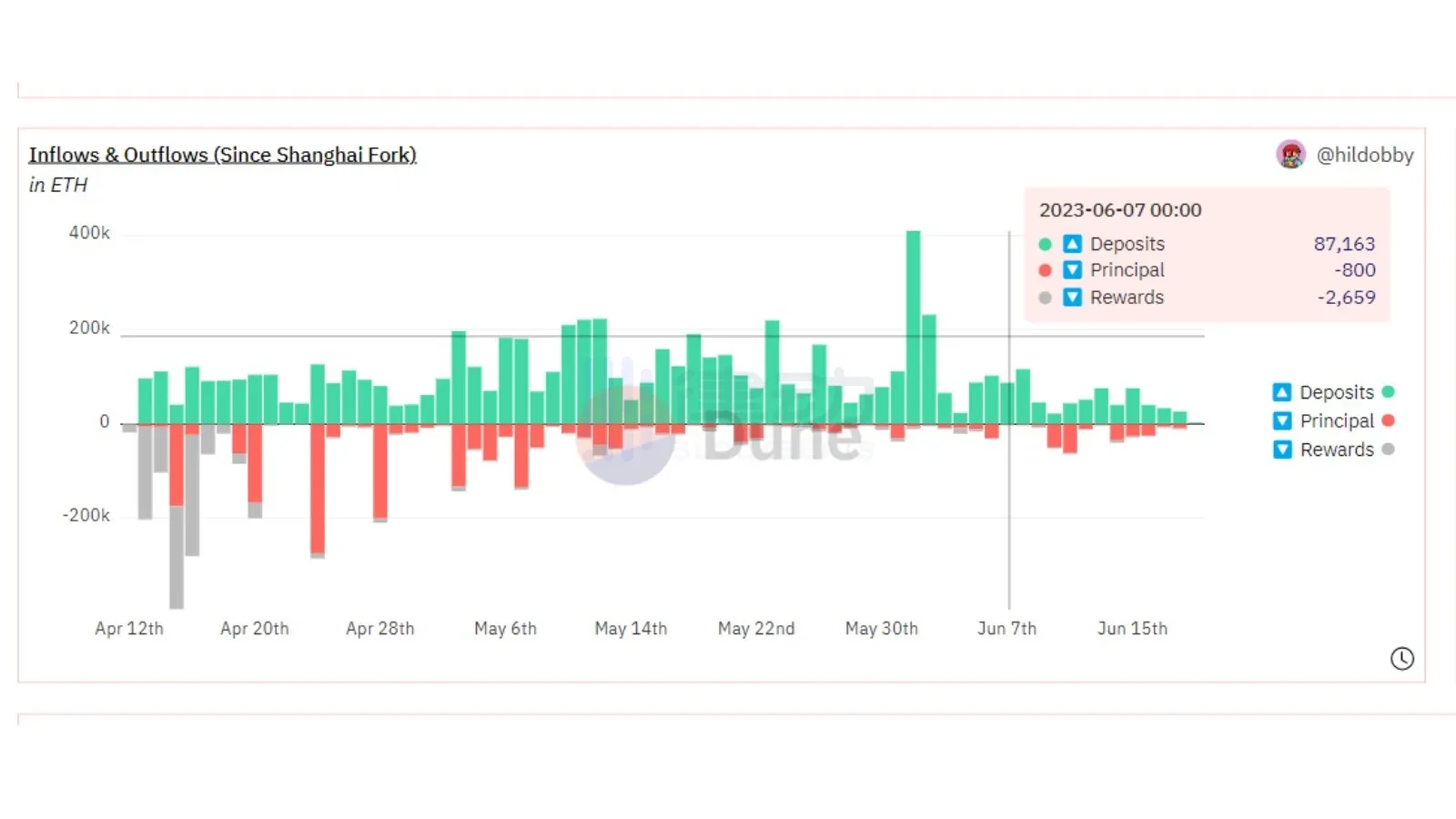

Since the Ethereum Shapella (Shapella = Shanghai + Capella) upgrade, Ethereum staking has been on the rise, with the total amount of $ETH staked increasing from 15.3% before the Shanghai upgrade to 19.2%. At the same time, the beacon chain received a large influx of deposits after the launch of @LidoFinance V2.

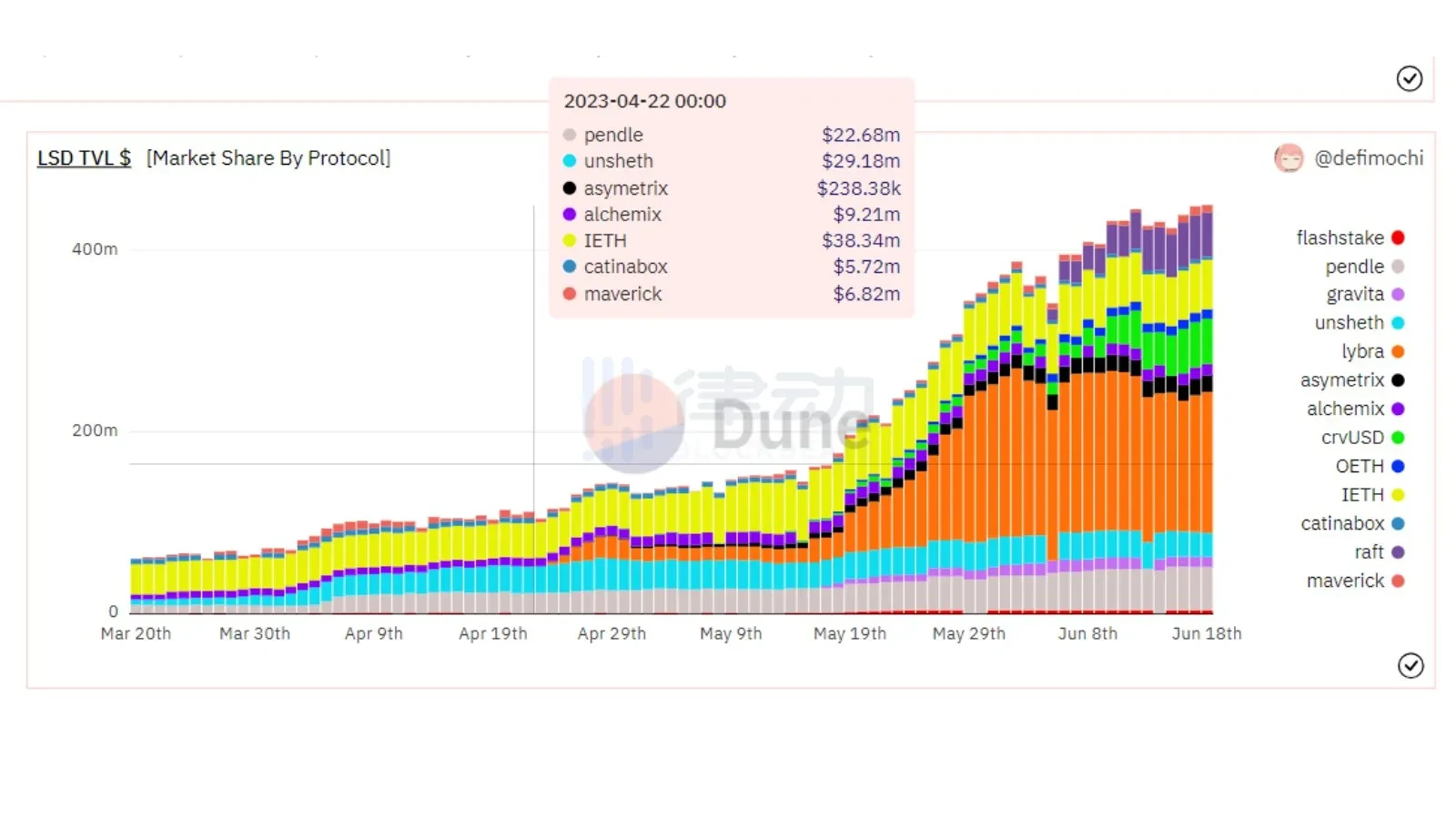

Since Mochi released this dashboard less than a month ago, LSDfi’s TVL has grown from $200 million to over $400 million in just a few weeks, including new protocols such as Swell, Maverick Protocol, and Raft.

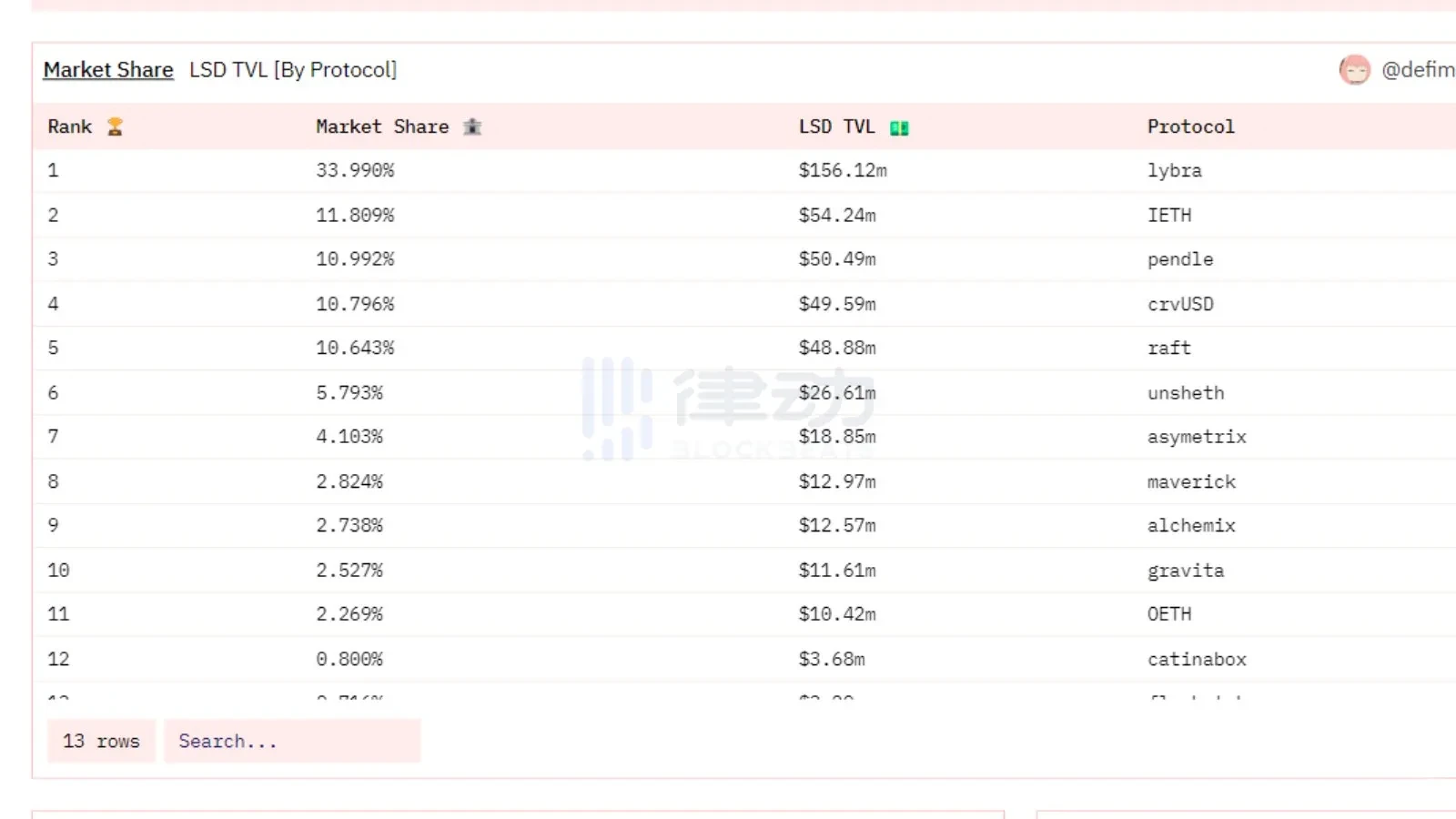

Surprisingly, Lybra Finance is still the leader in LSDfi market share, despite its token price falling by over 80%, which suggests a healthier issuance situation. Meanwhile, Raft, which launched in early June, has entered the top five, with a total value of $48 million for its $stETH.

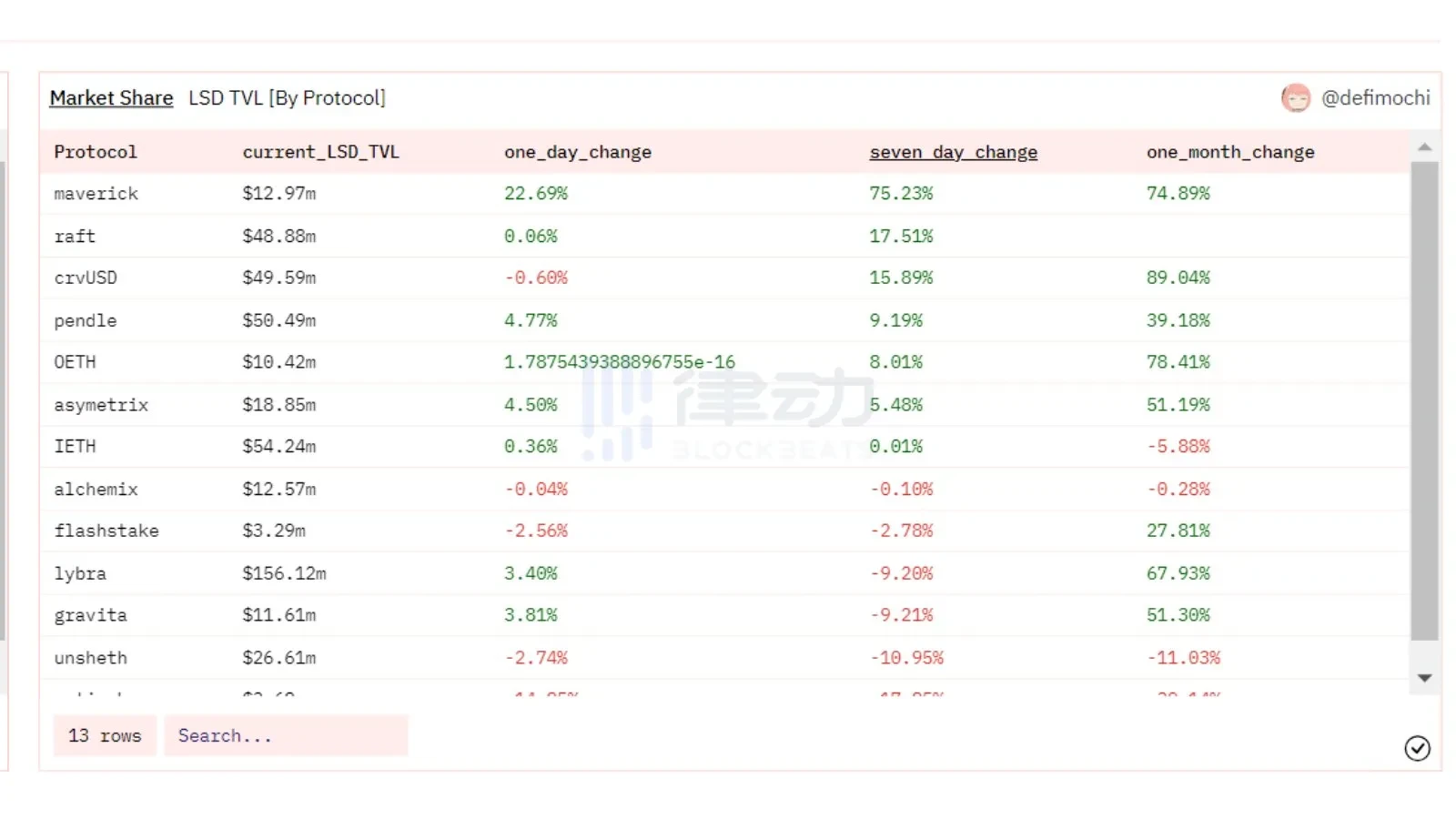

After enabling $wstETH as collateral, the growth of $crvUSD shows no signs of slowing down, with a monthly growth rate of over 89% and a weekly growth rate of 16%. Maverick Protocol’s TVL has risen significantly since the announcement of $MAV, attracting many LPs with the capital efficiency of its funding pool, while Pendle’s TVL continues to grow steadily.

Here are the biggest losers in terms of Total Value Locked (TVL) from last week: Lybra Finance’s TVL decreased as expected due to the drop in LBR price, and TVL may have flowed out of Gravita Protocol due to airdrop uncertainty. unshETH recently suffered an attack that drained $375k in funds.

Within the liquidity staking tokens (LSTs) in use, wstETH and stETH still dominate, with a market share of over 85%. This is not surprising, as the circulating supply of stETH is almost 10 times the sum of all other LSTs.

Another interesting observation is that the frequency of adoption of Swell has been steadily increasing, with LSDfi having used over $7 million out of the $45 million of circulating $swETH. With the launch of $frxETH v2 and all the plans on the frax chain, Mochi expects more people to adopt $sfrxETH.

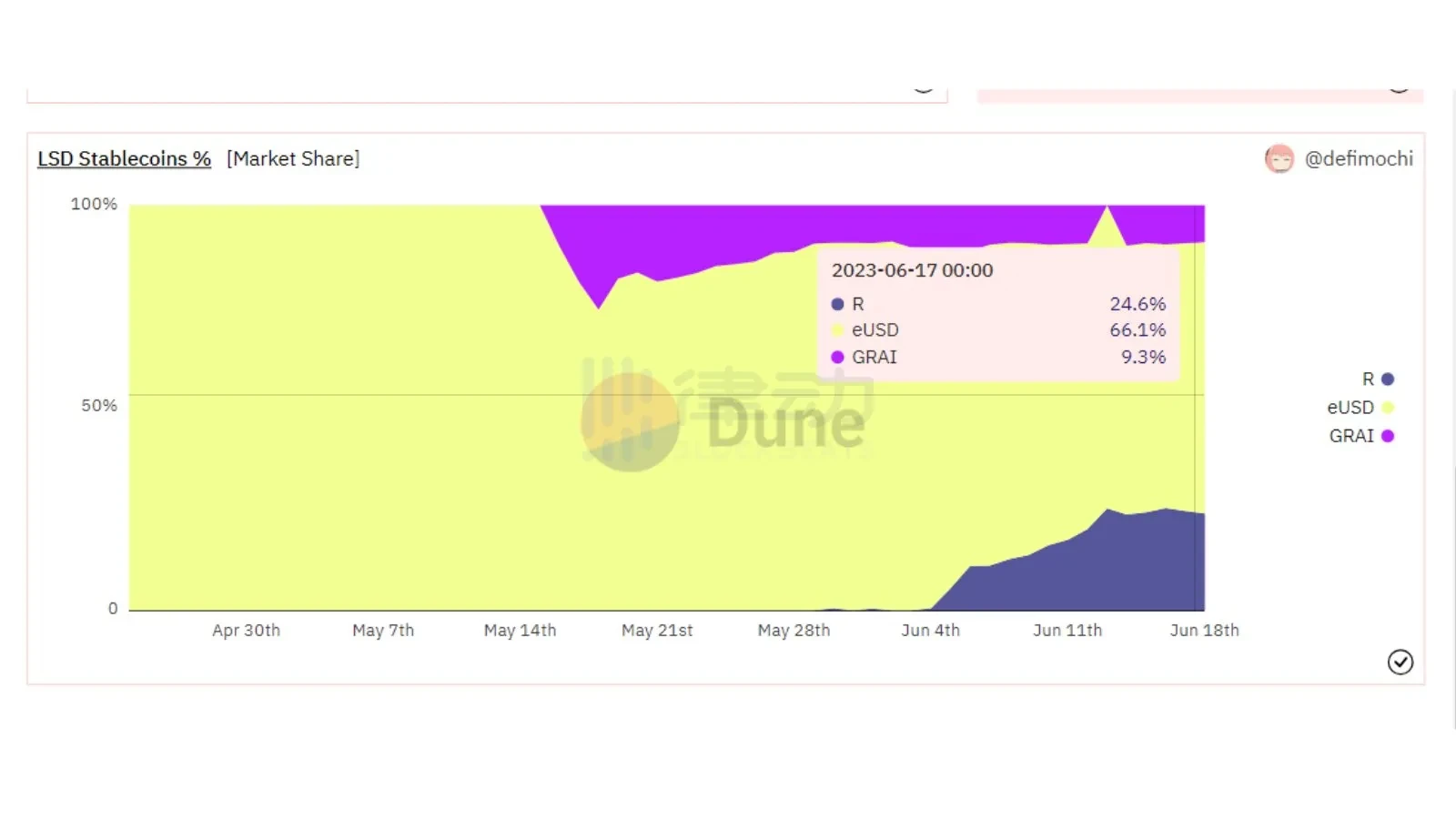

In the LSDfi stablecoins, Raft’s $R has quickly taken 24% of market share, while the circulation of $GRAI has decreased. Note that $crvUSD is not included in this chart.

Mochi’s Observations and Summary: Given LSDfi’s rapid expansion over the past month, Mochi’s argument that the industry will grow tenfold has been almost proven true, as it has grown over 102% in three weeks. Strangely, Flashstake’s adoption rate doesn’t seem to have grown by that much so far; Pendle continues to attract TVL through Penpie and Equilibria incentive pools; and despite the drop in LBR price, I’m still quite proud of @LybraFinanceLSD for maintaining TVL.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!