Recently, the emerging sector LSDFi has been favored by smart investors in the industry. Data shows that the total locked value of the LSDFi sector has exceeded $385 million. The following is a list of LSDFi protocols.

1. Lybra Finance – An interest-bearing stablecoin protocol supported by LSD

Lybra Protocol is an interest-bearing stablecoin protocol supported by LSD. One notable feature of Lybra Protocol is that users can earn periodic stable income by holding minted (borrowed) eUSD. This is supported by LSD (liquidity staking derivatives) income generated by deposited ETH and stETH.

In simple terms, when users deposit ETH or stETH and mint EUSD from them, they receive approximately 5%-7% stable income in stETH. These incomes are converted to EUSD through the protocol and distributed to them.

- What changes are there to Move to Earn game earnings between 2022 and 2023?

- Analysis and Discussion of the Current Status of Sui Ecosystem Based on Data and Facts

- Overview of Key Bitcoin Ecosystem Projects

Lybra Finance token is LBR, and the locked value of Lybra Finance is currently $181 million.

2. Asymetrix – Decentralized non-custodial protocol

Asymetrix is a decentralized non-custodial protocol for asymmetric yield distribution generated by collateral.

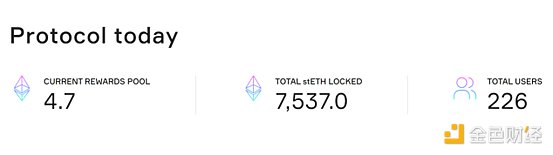

Asymetrix token is ASX, and the locked value of Asymetrix is currently about $14.26 million (7537 ETH), with a total of 226 users and a protocol pool reward of 4.7 ETH that day.

3. Pendle Finance – Yield trading protocol

Pendle Finance is a yield trading protocol that allows users to tokenize and trade future yields by leveraging top-tier yield generation protocols such as Aave, Compound, and Wonderland. Similar to stripping bonds in traditional finance, Pendle divides income-generating assets into tokenized ownership (zero-coupon bonds) and income components (coupons), providing innovative yield trading opportunities.

Pendle Finance token is PENDLE, and the locked value of Pendle Finance is currently $41.34 million.

4. Zero Liquid – Self-repaying loan based on LSD token

Zero Liquid is a self-repaying loan protocol based on the LSD token with no liquidation risk. Collateral assets will be dedicated to earning income and will ultimately automatically repay the debt.

5. Flashstake—–Fixed Rate Protocol

Flashstake protocol is a novel financial infrastructure that allows users to immediately earn yield on deposited assets at a fixed rate for a set period of time.

The Flashstake token is currently FLASH, valued at $7.77 million.

6. Gravita Protocol—-Decentralized Lending Protocol on Ethereum

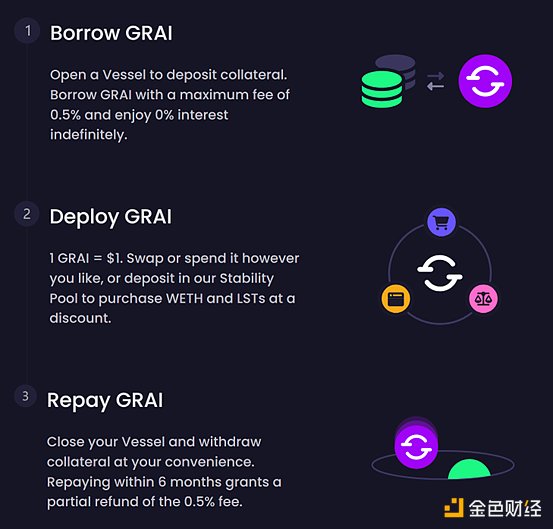

Gravita is a decentralized lending protocol on Ethereum that offers interest-free loans collateralized by both Liquid Staking Tokens (LST) and the Stability Pool (SP). Loans are issued in the form of minted GRAI tokens, and the loan amount can reach up to 90% of the value of the user’s collateral.

The Gravita Protocol token is GRAI, which can be minted by depositing collateral on Gravita Protocol. Gravita Protocol is currently valued at $1.14 million.

7. Curve Finance—-Decentralized DEX

Curve Finance is a decentralized exchange optimized for low slippage trades between stablecoins or similar assets (such as wBTC/renBTC). The protocol utilizes an automated market maker that specifically provides low slippage trades for DeFi users and stable fees for liquidity providers.

The Curve Finance token is CRV, and Curve Finance is currently valued at $13.03 million in the LSDFI section.

8. Alchemix Finance—-Synthetic Asset Protocol and Community DAO

Alchemix Finance is a synthetic asset protocol and community DAO backed by future yield. The DAO will focus on funding projects that contribute to the development of the Alchemix ecosystem, as well as the larger Ethereum community.

The Alchemix Finance token is ALCX, and is currently valued at $13.82 million in locked assets.

9. Parallax Finance—-LSD Yield Infrastructure

Parallax Finance is a liquidity layer infrastructure that focuses on maximizing LSD yield through an index system of yield baskets. Users can gain exposure to multiple LSD risk profiles at once and earn additional yield from PLX.

10. OriginEther—–ETH-based Yield Aggregator

OriginEther is live on the Ethereum mainnet, with Origin Dollar Governance (OGV) as the value-add and governance token for OETH. OGV stakeholders can vote on collateral allocation, future yield strategies, and fees for OETH holders. Users can mint OETH by depositing collateral on Ethereum or LSD, and the OriginEther treasury accepts wETH, stETH, rETH, and frxETH, as well as ETH and sfrxETH via Origin’s Zap feature. OriginEther generates yield daily in the form of OETH directly in the holder’s wallet, with no gas fees required.

OriginEther’s token is OGV, and the current locked value of OriginEther is $13.53 million.

Data Summary

According to data analyst @defimochi on Dune Analytics, LSDFi’s total locked value has surpassed $380 million and is currently at $385,107,618 compared to Lido Finance’s total locked value of $130.8 billion. Currently, the emerging sector of LSDFi still has a lot of room for growth.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!