LianGuai Blockchain, September 16, 2022. On September 15, 2022, Ethereum underwent a merge – the Ethereum mainnet merged with the beacon chain, marking a historic shift to proof-of-stake. One year later, Ethereum’s energy consumption has significantly decreased, and network accessibility has improved. However, many technical issues still remain.

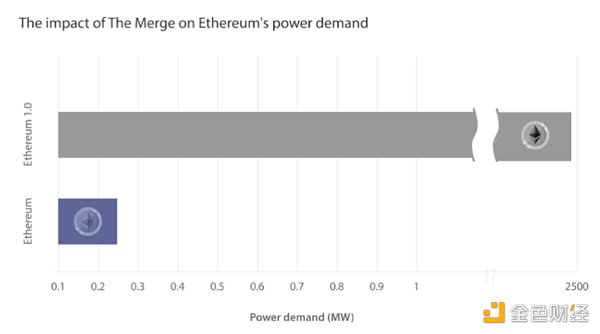

The most significant improvement after the merge is the transition from energy-intensive proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS) consensus mechanism, which has greatly reduced the total power consumption of the Ethereum network. According to data from the Cambridge Alternative Finance Center, Ethereum’s energy consumption has decreased by over 99.9% compared to the approximately 21 terawatt-hours of electricity consumed by PoW.

Ethereum falls into deflation

- Analyze the two pairs of ‘rivals,’ Sushiswap and Uniswap, and LooksRare and OpenSea, and explain what vampire attacks are.

- Liquid Restaked Token (LRT) The Script of the New Ponzi Token Economy Era

- Singapore Token2049 leader’s view Payments and RWA become key tracks, ETFs and regulations spark heated discussions

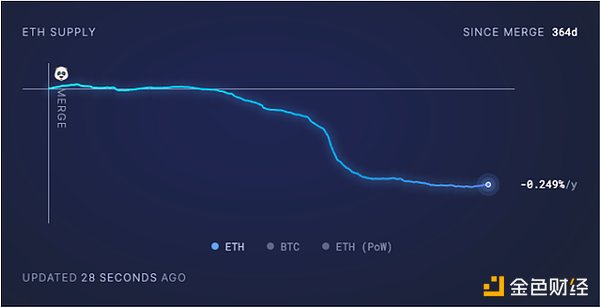

In addition to using less electricity, the merge has also led to deflation in the Ethereum network, meaning that the amount of ETH removed from circulation has exceeded the amount of new ETH minted to secure the Ethereum network.

According to data from Ethereum data provider Ultrasound.money, slightly over 300,000 ETH (worth approximately $488 million at current prices) has been burned since the merge. At the current burn rate, the total supply of ETH decreases by 0.25% per year.

Although many supporters believe that the price of Ethereum will skyrocket due to the new deflationary pressure, hopes for a significant increase in the Ethereum price have been dampened by a series of macroeconomic factors such as the banking crisis and rising inflation.

It is worth noting that compared to the growth in Bitcoin price, the growth in ETH appears lackluster. In the first quarter of this year, Bitcoin seemed to benefit from the traditional financial instability caused by the banking crisis and experienced an increase. Regardless of price behavior, the central theme of the proof-of-stake upgrade is the introduction of stakers to protect the network instead of miners. The subsequent Shapella upgrade in April 2023 drove a significant amount of ETH towards staking. The biggest beneficiaries of this shift are liquidity staking providers such as Lido and Rocket Pool.

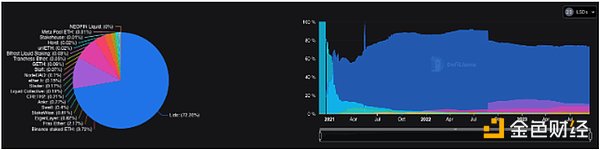

Rise of liquidity staking

According to data from DefiLlama, liquidity staking providers have dominated the Ethereum space since the merge, with over $19.5 billion worth of ETH staked through liquidity staking protocols. As of the time of this article’s publication, Lido is the largest staking provider, accounting for 72% of all staked ETH.

However, despite the praise from many Ethereum proponents, including Lachlan Feeny, CEO of Labry, for the shift to staking, one of the major concerns raised by the rise of liquidity staking is the level of control granted to miners by staking service providers, particularly Lido Finance. Lachlan Feeny explains, “Liquidity staking ultimately benefits the network by ensuring that governance is not limited to the wealthy. However, it also gives rise to its own set of problems.”

As of now, at least five Ethereum staking providers are working to implement a 22% staking limit rule to ensure the decentralization of the Ethereum network, but Lido is not participating. It is worth noting that Lido voted with a 99.81% majority in June to decide against self-imposed restrictions, leading Ethereum advocate Superphiz to declare that the staking provider “expressed an intention to control the majority of validators on the beacon chain.” This has sparked widespread concerns about the centralization of Ethereum validation.

Lachlan Feeny added, “Lido currently controls 32.26% of all staked Ether on the network, worth over $14 billion. In the long run, I believe that Ethereum is better off with liquid staking compared to non-liquid staking; however, there are still many challenges to overcome.”

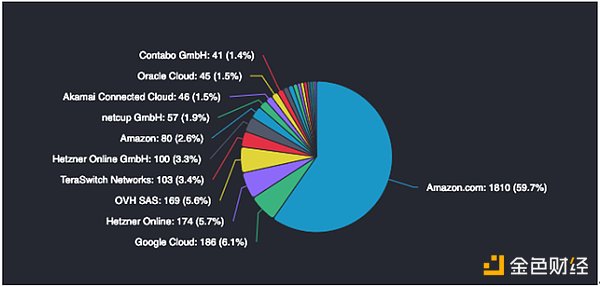

In addition to staking, customer diversity remains a core issue. On September 5th, Vitalik Buterin took the stage at the Korea Blockchain Week to discuss six key problems that need to be addressed to solve the centralization issue. Currently, the majority of the 5,901 active Ethereum nodes are operated through centralized network providers like Amazon Web Services, leading many experts to claim that this exposes the Ethereum blockchain to centralization failure points.

Vitalik Buterin believes that to maintain sufficient decentralization in the long term, it should be easier for ordinary people to run nodes, which means significantly reducing the costs and hardware requirements for node operators. The main solution he proposes is the concept of statelessness, which eliminates the reliance on centralized servers by reducing the data requirements of node operators close to zero.

Vitalik Buterin stated, “Today, running a node requires hundreds of gigabytes of data. With a stateless client, you can run a node with virtually zero data.”

While this is Vitalik Buterin’s most prominent concern regarding centralization issues, he explains that these problems may take another 10 to 20 years to be resolved. For Ethereum, which has only recently completed its first year of merging, perhaps only time can provide us with answers.

This article contains content compiled from CoinTelegraph.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!