In June, while the cryptocurrency market rose sharply, with Bitcoin breaking through $30,000 to reach a new 12-month high, the NFT market did not rise synchronously, with relatively flat user activity and financing.

NFT is no longer just a digital collectible, and the attempts of many Web2 brands are gradually diversifying the application scenarios of NFT. For example, Louis Vuitton launched a high-end “Treasure Trunk” NFT series for €39,000.

Azuki, famous for its anime style, launched a new series, Azuki Elementals, which was criticized by the community, highlighting the importance of value creation and community participation for the success of NFT projects.

The data in this report comes from Footprint Analytics’ NFT Research page. The page provides an easy-to-use data panel with the most important data indicators for understanding the NFT industry, and is updated in real time. You can find the latest information on NFT markets, individual projects, financing, and more (↓click to read the original text).

- Bitcoin “stable” at $30,000, is a bullish signal on the way?

- Multi-dimensional analysis of NFT in the second quarter: Multi-chain competition intensifies outside of Ethereum, and Blur outstrips its competitors in terms of growth rate.

- Future Bull Market Checklist: Introduction to 15 Potential Projects

Key Points

Cryptocurrency Market Overview

-

In June 2023, Bitcoin experienced ups and downs, and on June 22 it reached a 12-month high of $31.2k. In the volatile cryptocurrency market, the price of Bitcoin maintained a sustained upward trend.

-

On June 22, Bitcoin unexpectedly broke through the $30,000 mark. At the end of June, Bitcoin’s closing price was $30.4k, indicating that $30,000 has become a solid support point.

NFT Market Overview

-

On June 27, the trading volume reached 61.45 million, largely due to Azuki, with a single series trading volume of 20 million.

-

NFT is not only a digital collectible, but can also help multiple industries achieve innovation.

Public Chain and NFT Trading Market

-

Ethereum still dominates the NFT market. In June, Ethereum’s trading volume accounted for 97.7% of the total NFT trading volume.

-

Although the BNB chain performed poorly in terms of trading volume, its wash trading ratio (42.14%) was the highest among all chains.

-

Although OpenSea Pro was launched in April, the data so far has not shown that the launch of OpenSea Pro has had a significant impact on Blur’s dominant position in transaction volume.

NFT Investment and Financing

-

This month, the financing market in the NFT field was relatively quiet, with only two major financing events.

This Month’s Hottest Topic: Azuki Elementals

-

By the end of the month, the lowest selling price of Azuki had dropped significantly to 7 ETH, and the floor price of Azuki Elementals had also fallen below the minting cost of 2 ETH.

Key News

-

The NFT work “The Goose” sold for $6.2 million at Sotheby’s auction.

-

Louis Vuitton released limited edition NFTs for selected customers, priced at 39,000 euros.

-

BAYC #2758 will appear in a Hollywood movie.

-

The Azuki team earned $38 million in sales in just 15 minutes.

-

BYTE CITY pays tribute to Bruce Lee with an immersive metaverse experience.

Cryptocurrency Market Overview

In June 2023, Bitcoin experienced ups and downs, reaching a 12-month high of $31.2k on June 22. In the volatile cryptocurrency market, the price of Bitcoin has maintained a continued upward trend.

BTC Price & ETH Price

In early June, the U.S. Securities and Exchange Commission (SEC) increased its regulatory efforts and filed lawsuits against Binance and Coinbase, the two largest cryptocurrency exchanges in the world. As a result of these regulatory actions, the price of Bitcoin fell to $24.7k.

However, on June 22, Bitcoin broke through the $30,000 mark. By the end of June, the closing price of Bitcoin was $30.4k, indicating that $30,000 had become a solid support level. This outstanding performance may have been driven by positive news in the cryptocurrency field, such as Blackrock’s resubmission of a Bitcoin spot ETF application, which may have boosted market optimism.

The cryptocurrency market seems to be entering a consolidation phase, gradually becoming better able to face regulatory trends and market turbulence.

NFT Market Overview

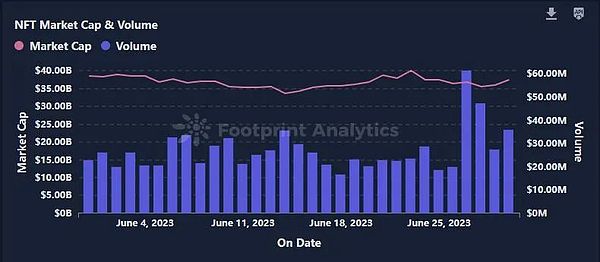

The NFT market has cooled down gradually, with its market cap falling slightly to $35.86 billion.

NFT Market Cap & Volume

In terms of trading volume, the NFT market experienced some fluctuations in June. At the beginning of the month, the trading volume was 26.2 million, dropping to a low point of 16.59 million on June 18, and rebounding to 35.86 million at the end of the month. On June 27, the trading volume reached 61.45 million, largely due to Azuki, with a single series trading volume of 20 million.

NFT Volume by Collection on June 27

On June 28, the release of Azuki Elementals led to a significant increase in trading volume. However, due to image quality issues, a large number of sell-offs soon appeared, which also affected the community sentiment towards the Azuki series. On that day, the number of Azuki series sellers was twice that of buyers. This massive sell-off represents the market’s reaction to the Azuki Elementals incident.

Azuki Buyer & Seller

This surge in trading volume highlights the sensitivity of the NFT market to news and developments. In this highly volatile market, it is crucial for investors to remain informed and cautious.

Daily Unique Users

In terms of active users, the NFT market is relatively stable, with active users hovering around 30,000. However, in the long run, the number of active users is continuing to decline. In particular, compared to the peak on January 27 of this year (129.39k active users), current user activity is about a quarter of the peak.

Despite the slowdown in the secondary market, there are still companies exploring and expanding the possibilities of NFTs. For example, Louis Vuitton has launched a high-end “treasure box” NFT series, priced at 39,000 euros, promoting the integration of the luxury goods industry with digital collectibles.

A rendering from the Louis Vuitton digital Treasure Chest NFT collection

In addition, Bored Ape #2758 will appear in a Hollywood movie, demonstrating the potential of NFTs in content creation and intellectual property.

NFTs are not only digital collectibles, but can also help multiple industries achieve innovation. As more and more brands and industries try and adopt NFTs, we can expect to see a wider range of applications and use cases beyond the traditional art and collectibles space. This diversification of use cases may be the key driver of the next wave of growth in the NFT market.

Public Chains and NFT Trading Markets

Ethereum still dominates the NFT market. In June, Ethereum’s transaction volume accounted for 97.7% of the total NFT transaction volume, consolidating its position as the preferred platform for NFT transactions. This dominance is still on the rise, with Ethereum’s market share increasing slightly every month according to data from 2023.

This trend suggests that users especially rely on Ethereum for high-value transactions during bear markets. The reputation, security, and widely recognized technical capabilities that Ethereum has built are crucial for the operation of NFTs.

Monthly Volume by Chain

In the past three months, Ethereum has not only maintained its dominant position in NFT trading, but the proportion of unique users is also gradually increasing. Although other public chains have the advantage of low Gas Fees, most users still prefer to use Ethereum for NFT transactions.

Monthly Unique User by Chain

In terms of daily transaction volume, Ethereum still leads by a large margin, but Polygon and Solana are close behind, ranking second and third respectively. Ethereum accounts for 50.34% of the transaction volume, Polygon accounts for 28.38%, and Solana accounts for 10.92%.

Although Ethereum still dominates, the large number of transaction counts on Polygon and Solana suggests that these platforms are also major competitors in the NFT space. Lower transaction fees and faster transaction times have attracted many small traders.

Daily Trades by Chain

In June, although BNB Chain did not perform well in terms of trading volume, its wash trading ratio (42.14%) was the highest among all chains.

Wash trading refers to when traders simultaneously buy and sell the same asset, artificially inflating trading volume. This may lead to a misunderstanding of the market activity and liquidity of BNB Chain, which can affect investment decisions. This month, the wash trading rates of specific projects such as Pentas NFT, AlBlockingca Finance NFT, and Binance Regular NFT exceeded 90%.

Top Washtrading Blockchains

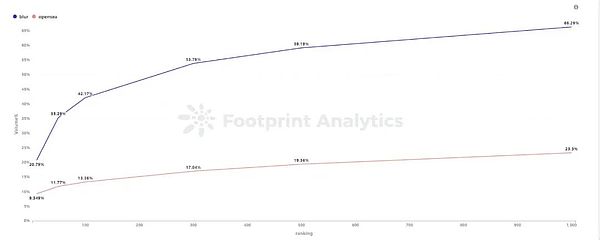

In terms of trading volume, Blur has been the market leader, accounting for nearly 70% of the trading volume in June. The veteran NFT marketplace OpenSea accounts for 22%, and in April it launched OpenSea Pro, which mainly targets professional NFT traders. However, the data so far has not shown a significant impact of the launch of OpenSea Pro on Blur’s dominant position in trading volume.

Monthly Value by Marketplace

However, from the perspectives of trading frequency and number of users, OpenSea continues to maintain its leading position with a market share of nearly 70%.

When we studied the largest NFT series in terms of trading volume on Opensea and Blur, Bored Ape Yacht Club (BAYC), we found a surprising difference. BAYC’s trading volume on Blur was 24.6 times that on OpenSea, but its number of buyers was only 1.86 times that on OpenSea. This phenomenon indicates that although the trading volume on the Blur platform is very high, the number of independent buyers participating in these transactions is relatively small.

While Blur may be the preferred platform for high-value transactions, OpenSea remains the preferred platform for more users.

OpenSea & Blur Collections

In addition, we observed that most of Blur’s trading volume is concentrated in wallets with relatively few addresses. More specifically, the trading volume of the top 300 wallet addresses accounted for 53.79% of the total trading volume on Blur. In comparison, on the OpenSea platform, the top 300 wallets only contributed 17.04% of the trading volume.

This data indicates that on Blur, the trading volume of top buyers is much higher than on OpenSea, and relatively few high-volume buyers or investors are driving most of Blur’s trading activity.

Volume v.s. Wallet Address

NFT Investment and Financing Situation

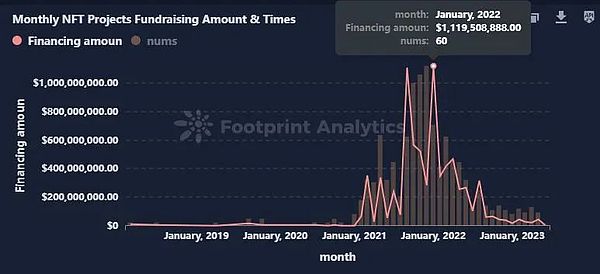

This month, the financing market in the NFT field has been relatively quiet, with only two major financing events. Due to market uncertainty and regulatory issues, financing activities have decreased significantly and investors are more cautious.

On June 14th, AI-supported NFT data platform Mnemonic completed a $6 million seed extension round of financing, with Salesforce Ventures leading the way. The funds from this round of financing will be used to expand the API suite.

At the same time, on June 28th, NFT native option protocol Hook Protocol announced the completion of a $3 million seed round of financing. The project allows traders to profit from the rising prices of NFT collections while allowing NFT holders to earn premiums on their NFTs and/or sell them at satisfactory prices.

On June 28th, the NFT native option protocol Hook completed a $3 million seed round of financing. The project creates an opportunity for traders to profit from the rising prices of NFT assets, while allowing NFT holders to earn income from premiums and sell their NFTs at satisfactory prices.

Monthly NFT Projects Fundraising Amount & Times

Since January 2022, financing activities related to the NFT industry have shown a downward trend, with investment actions in June being particularly sluggish.

However, even in a bear market, developers and innovators are still active, including some large Web2 companies that are optimistic about the potential of NFTs and have combined NFTs with their own brands. Persisting in innovation and construction during a period of market depression reflects people’s firm belief in the potential of the NFT field and paves the way for the NFT industry to embrace the next round of opportunities.

Historical experience tells us that the market always undergoes cyclical changes. When the next bull market comes, the developers and innovators who persist in building foundations during the bear market are likely to trigger a new wave of innovation and investment in the NFT field.

This Month’s Hot Topic: Azuki Elementals

Azuki, as a popular brand in the metaverse, is loved by fans for its unique anime art style. However, the release of the new series Azuki Elementals quickly turned community’s eager anticipation into disappointment and criticism due to excessive feature repetition.

Initially, community members questioned the Elementals series for its striking similarity to Azuki’s previous NFTs. However, as more NFTs were unlocked, many holders were surprised to find that their Elements were identical to others’. This was a blow for community members who were expecting to see novel, innovative work.

In addition, there were various issues with the minting process that raised questions. For example, the whitelist minting window was only a short ten minutes, and due to the rush, the website experienced a surge in traffic and crashed. More seriously, there was no upper limit on the number of Elementals that could be minted during the presale phase, which allowed some people to mint Elementals without restrictions.

Azuki & Elemental Floor Price

By the end of the month, the minimum selling price of Azuki had fallen sharply to 7 ETH, and the floor price of Azuki Elementals also fell below the minting cost of 2 ETH. The release of Elementals triggered a wave of selling, causing prices to plummet and market sentiment to hit rock bottom.

The Azuki incident further highlighted the importance of innovation and community in the NFT space. If a project is perceived to lack innovation or fairness, it will experience a rapid decline in market confidence and value, as was the case with Azuki Elementals.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!