Author: Analyst at Alphabeth Capital

Translation: Jordan, LianGuaiNews

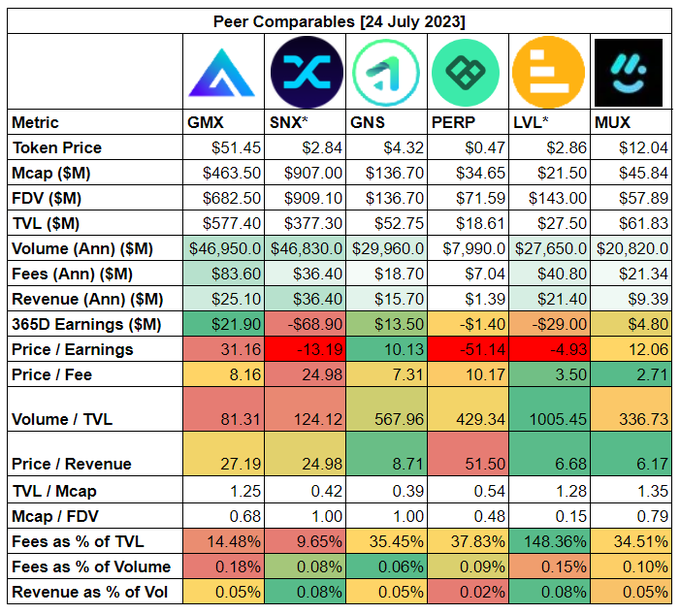

The field of on-chain derivatives is the most competitive area in DeFi, with dozens of protocols already launched and many new projects about to be released. This article will focus on the key indicators of 6 major on-chain derivatives protocols.

Although the raw data may indicate that a protocol appears to be a good investment, understanding the background is still very important, especially the protocol design and revenue sharing model.

- New player in the stablecoin race, what is the background of Binance’s newly launched FDUSD?

- The History of Bitcoin Supremacy (Part 1) ‘BTC is the Only Valuable Currency’ in the Eyes of Extreme Conservatives

- HUBDEX Exchange Former Blockchain Rising Star Accused of Pyramid Scheme Crime

(Note: The above table data was collected on July 24, 2023)

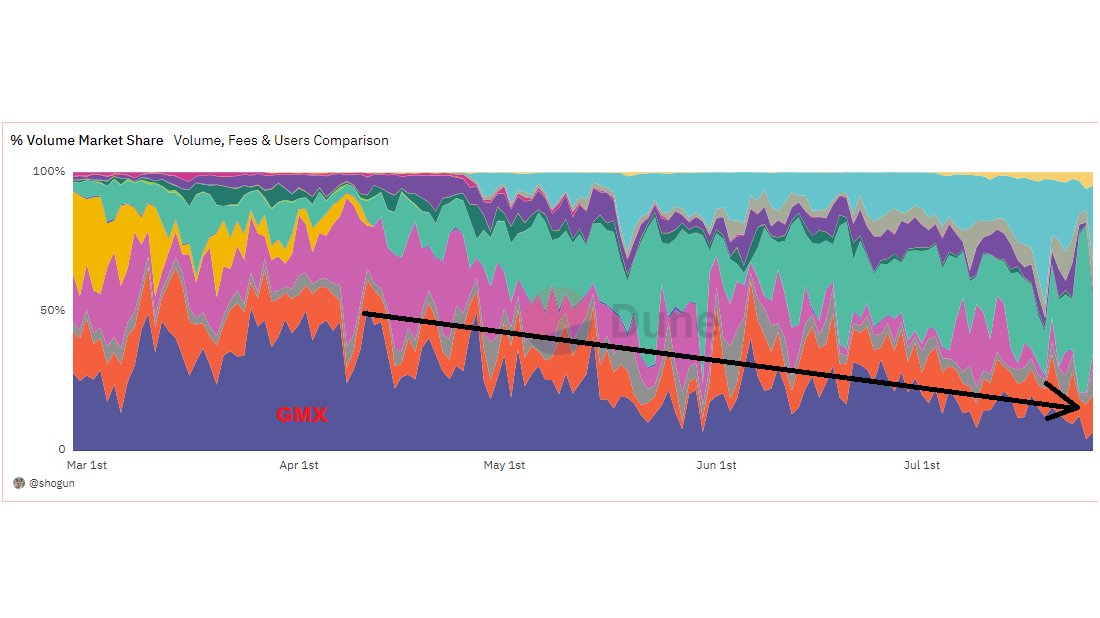

1. GMX

GMX is a perpetual synthetic decentralized exchange, and its most well-known feature is zero slippage trading. Based on indicators such as locked-in value, trading volume, fees, and revenue, GMX should be the largest derivatives protocol in terms of scale. They share 70% of the fee revenue with liquidity providers and 30% with GMX stakers, making GMX very popular and attractive to investors. Its price-to-earnings ratio (revenue minus token incentives) is 31.16, which means GMX is “relatively expensive,” but investors may consider the pricing of GMX v2. GMX V2, which will be launched in a few weeks, has the following features:

- Chainlink low-latency oracle provides better real-time market data

- Support for more assets (not just cryptocurrencies)

- Lower transaction fees

- Slippage will coexist in GMX v1 and v2

As competition intensifies, GMX’s market share is gradually decreasing. If v2 cannot bring more trading volume and fees to the platform, the fair price of GMX may fall to the $40 range, with a price-to-earnings ratio of approximately 20.

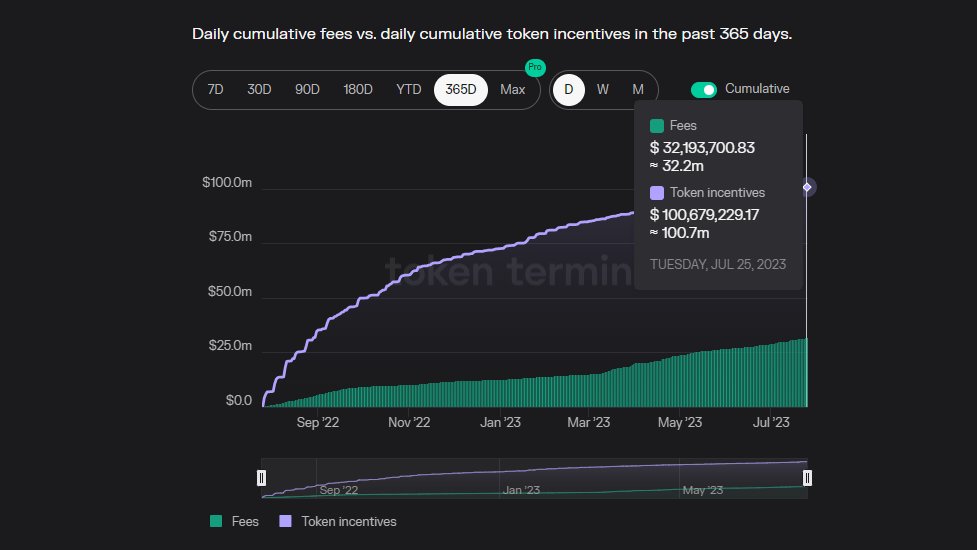

2. Synthetix

Synthetix allows users to mint synthetic assets based on its native token SNX. Other projects (such as Kwenta) can use Synthetix to build their own front-end to enable traders to access perpetual DEX trading. In terms of market capitalization and revenue, Synthetix is the largest among the six major derivatives protocols. They allocate 100% of the fee revenue to SNX token stakers, who are also liquidity providers themselves.

To incentivize liquidity provision, Synthetix rewards stakers by unlocking SNX tokens. Currently, SNX tokens worth over $100 million have been paid out as incentives to stakers. However, the protocol has only $36 million in fee revenue and a negative price-to-earnings ratio, indicating that they are operating at a loss.

Given the current valuation, fees, and token release volume, SNX seems to be a very expensive token. Without additional incentives, future trading volume may decline.

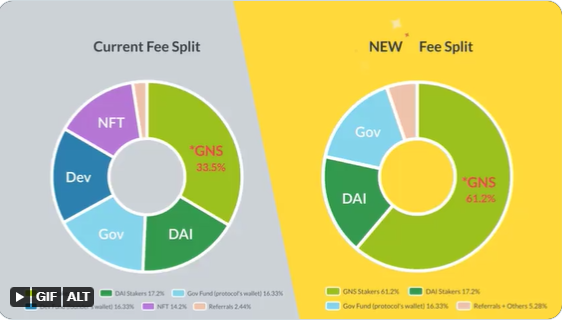

3. Gain Network

Gains Network is a comprehensive derivatives platform that allows for leveraged trading of cryptocurrencies, forex, and commodities. Currently, the platform shares about 33% of fee revenue with GNS token stakers and about 17% with liquidity providers. However, starting from September this year, the percentage of fee revenue shared with GNS token stakers will increase to 61%, which may boost its valuation.

Gains Network has the lowest P/E ratio among the six derivative protocols, at only 10, and a price-to-revenue ratio of 8.7. However, the transaction volume to locked ratio is relatively high at 568 without incentives. From key indicators, product development, and future updates, GNS may be an undervalued project.

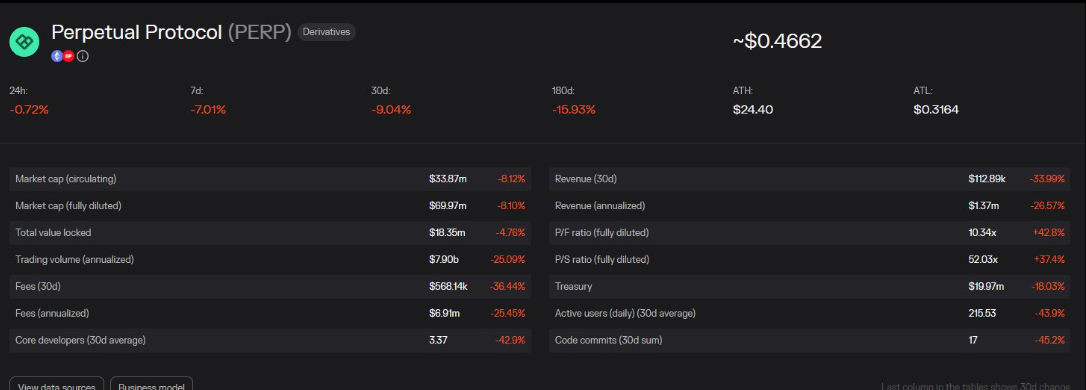

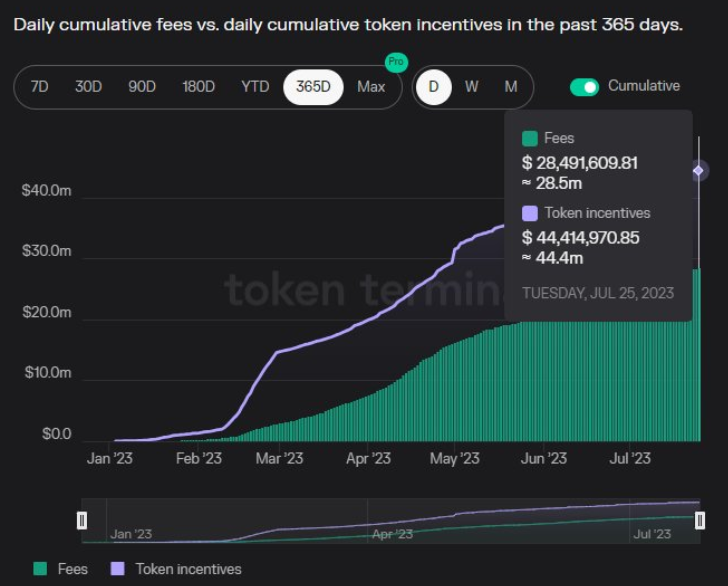

4. Perpetual Protocol

Perpetual Protocol is built on top of the Uniswap v3 smart contract. Currently, 80% of its fee revenue is allocated to liquidity providers, and about 14% is allocated to PERP token stakers. Perpetual Protocol has an annual revenue of $1.4 million, while the value of unlocked tokens is $2.8 million, meaning its annual yield is negative. Overall, Perpetual Protocol doesn’t seem attractive to investors and is difficult to compete with Kwenta (Synthetix) on Optimism.

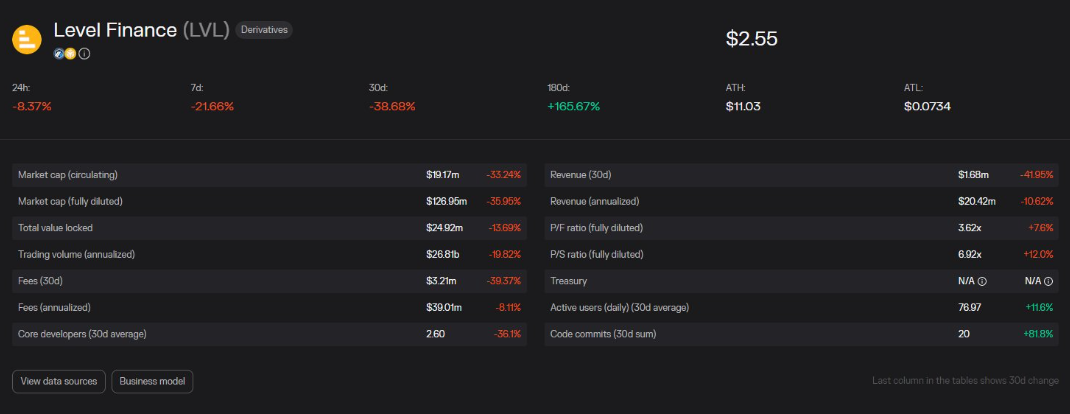

5. Level Finance

Level Finance protocol gained significant market attention in its early stages due to extensive trading incentives using LVL tokens. Currently, the protocol’s trading volume has been maintained at the level of billions of dollars. However, some key indicators are declining due to the decrease in token supply and price.

Considering that Level Finance has a design similar to GMX, a transaction volume to locked ratio of 1000 seems a bit high (possibly due to artificial factors). It should be noted that despite generating a significant amount of fee revenue, the protocol’s yield is negative, meaning that it distributes more tokens than it generates from fees.

Level Finance allocates 45% of fee revenue to liquidity providers, 10% to LVL token stakers, and 10% to LGO stakers (note: LGO is the second token launched in the Level ecosystem, with governance and financial rights). Some key indicators of Level, such as trading volume, seem inflated due to the early incentive stage, but its yield is negative, making it an unattractive investment choice.

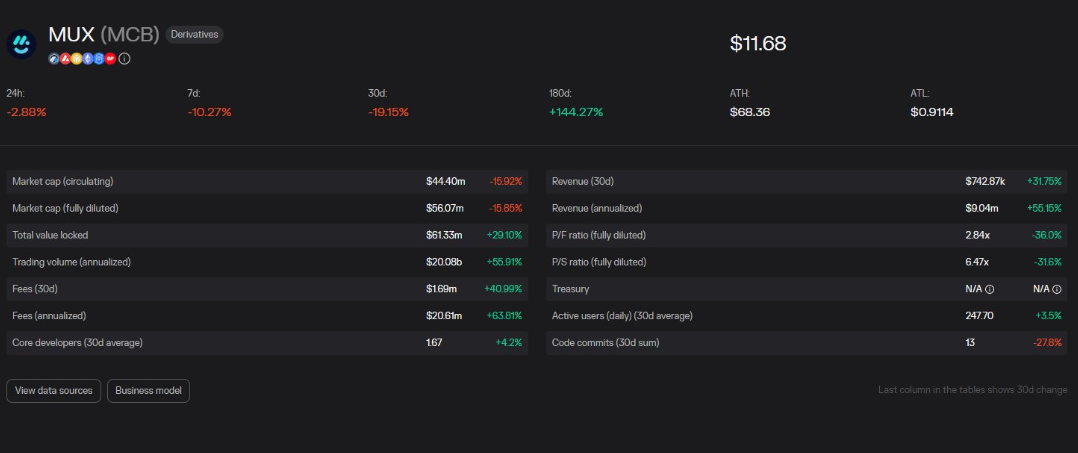

Six, MUX Protocol

MUX Protocol is both a transaction protocol and an aggregator. The protocol distributes 70% of the fee revenue to the liquidity providers who provide ETH and the MUX token stakers. Due to MUX being deployed on multiple widely adopted ecosystems such as perpetual trading platforms, options platforms, and betting platforms, there are different types of protocol combinations. MUX Protocol has a relatively low market value, but it exhibits good scalability and reliability, making MUX an “interesting” investment opportunity.

Summary

The competition among on-chain derivative protocols is becoming increasingly fierce. It is difficult to identify the most promising protocol and predict which protocol will succeed over time. This article does not constitute any financial advice.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!