Table of Contents

1. Abstract

2. Project Introduction

3. Project Architecture

- The ‘Waterloo’ Incident on zkSync Era? A Brief Analysis of the EraLend Flash Loan Attack

- EthSign CEO After talking to 250 investors, how did we find new application scenarios for decentralized electronic signatures?

- Data Insights Comparison of Key Indicators of 6 On-chain Derivative Protocols

4. Project Applications

5. Team Background

6. Financing Information

7. Development Achievements

8. Economic Model

9. Advantages and Risks

1. Abstract

This research report delves into the Stacks project, an innovative blockchain technology that aims to achieve high decentralization and scalability without increasing additional environmental impact by linking itself to the Bitcoin chain through its unique consensus mechanism called Proof of Transfer (POX). By providing smart contract functionality, Stacks enables Bitcoin to become a fully programmable asset, thereby offering broader applications for decentralized applications (dApps).

This report provides a detailed introduction to the main components of Stacks, including how it leverages the state and security of Bitcoin, as well as the features and advantages of creating smart contracts using the Clarity language. Additionally, the report will discuss how the Proof of Transfer (POX) consensus mechanism works and how it utilizes Bitcoin’s proof-of-work mechanism.

2. Project Introduction

Stacks is a blockchain project that links itself to the Bitcoin blockchain. Its goal is to provide a platform that shares security with the Bitcoin chain and allows for settlement of transactions on the Bitcoin chain. By extending the functionality of Bitcoin, Stacks turns Bitcoin into a fully programmable asset, unlocking trillions of dollars of passive Bitcoin capital and providing broader applications for decentralized applications.

The Stacks project links to Bitcoin through its unique consensus mechanism called Proof of Transfer (POX). PoX allows the Stacks chain to leverage the security of the Bitcoin chain, while also enabling Stacks token holders to earn Bitcoin rewards through “Stacking” behavior. This mechanism enhances the usability and scalability of Bitcoin by adding new features such as smart contracts and fast transactions on top of Bitcoin’s security foundation.

The vision of Stacks is to establish a fully decentralized network and application ecosystem based on Bitcoin. By providing new tools and technologies such as smart contracts and fast transactions, the Stacks project aims to drive further development of Bitcoin and its ecosystem, ultimately realizing a more secure, fair, and open Web3.

3. Project Architecture

The Stacks project links itself to the Bitcoin chain through its unique consensus mechanism called Proof of Transfer (PoX). This allows Stacks to leverage the state and security of the Bitcoin chain, providing a more secure and reliable platform for decentralized applications (dApps) and smart contracts. On this platform, all transactions are settled on the Bitcoin chain, thereby leveraging Bitcoin’s strong security.

The smart contract layer of Stacks has the following innovative features:

S (Secured): Stacks transactions are ultimately confirmed by Bitcoin.

After approximately 100 Bitcoin blocks or about one day of confirmation, transactions that occur on the Stacks layer are protected by the full hashing power of Bitcoin. This means that to reverse these transactions, an attacker would need enough computational power to reorganize the Bitcoin chain. Stacks transactions are settled on the Bitcoin blockchain and have the finality of Bitcoin. In addition, the Stack layer fully forks Bitcoin, meaning that any forks on the Bitcoin chain, such as soft forks or hard forks, will be reflected on the Stacks chain. This ensures that the Stacks chain can evolve with the development of the Bitcoin chain without conflicting with it.

T (Trust-minimized): Trustless Bitcoin anchoring mechanism; Writable Bitcoin

Stacks introduces a new decentralized and non-custodial Bitcoin-anchored asset called sBTC. This allows smart contracts to operate with Bitcoin-anchored assets in a faster and cheaper manner without compromising security. Furthermore, this enables contracts on the Stacks layer to write to Bitcoin through trustless anchoring transactions.

A (Atomic): Bitcoin atomic swaps and assets owned by Bitcoin addresses

Atomic swaps and assets: Stacks already has atomic swaps with Bitcoin, allowing Bitcoin addresses to own and move assets defined on the Stacks layer. Examples of trustless atomic swaps between Bitcoin L1 and assets on the Stacks layer include magic swaps and duplex swaps. Additionally, users can own assets on the Stacks layer, such as STX, stablecoins, and NFTs, on their Bitcoin addresses and transfer them using Bitcoin L1 transactions if desired.

C (Clarity): Clarity language for safer, determinable smart contracts

Stacks supports a secure and determinable smart contract language called Clarity. With Clarity, developers can know what a contract can and cannot do through mathematical determinism before executing the contract. Decentralized anchoring contracts benefit from the security properties of the Clarity language. As of December 2022, there are already 5000+ Clarity contracts deployed on the Stacks layer. The design of Clarity also avoids the issue of “gas estimation,” which is a common problem in many other smart contract languages like Solidity. In Clarity, the execution cost of a transaction can be accurately known before the transaction occurs, avoiding transaction failures due to insufficient fees. On Stacks, the creation and management of Bitcoin-anchored assets (such as sBTC) are implemented through a special smart contract called a decentralized anchoring contract. This contract leverages the security and reliability of the Clarity language to ensure the security and reliability of the process for creating and managing anchored assets.

K (Knowledge): Knowledge proofs of the full state of Bitcoin; Readable Bitcoin

Stacks has a complete understanding of the Bitcoin state, allowing it to read Bitcoin transactions and state changes without trust and execute smart contracts triggered by Bitcoin transactions. The ability to read Bitcoin helps maintain consistency between decentralized anchored states and BTC locked on the Bitcoin L1, and so on. Stacks’ Bitcoin reading functionality ensures that the decentralized anchored state (i.e. the state of sBTC) remains consistent with the BTC locked on the Bitcoin L1. This is because whenever a transaction occurs on the Bitcoin chain, Stacks can read these changes and update the state of sBTC accordingly. This allows users to ensure that their sBTC remains in sync with the BTC they have locked on the Bitcoin chain.

S (Scalable) Scalability, fast transactions on the btc settlement layer

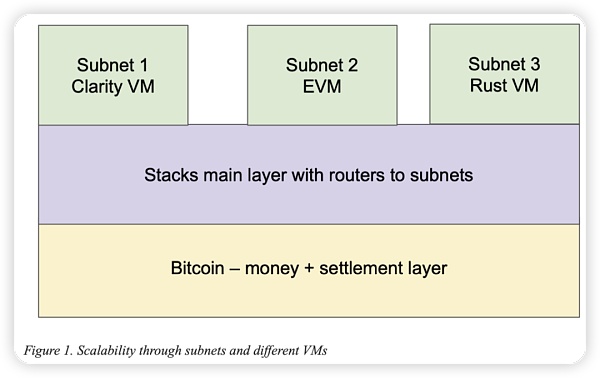

Stacks improves transaction processing speed by generating Stacks blocks faster between Bitcoin blocks. This means that transactions on the Stacks network can be completed and confirmed at a faster speed than Bitcoin. In addition, the subnet is a scalable layer of the Stacks network that can make different trade-offs between performance and decentralization. This means that the subnet can be optimized based on its specific needs and priorities, such as faster transaction speed or higher degree of decentralization. Stacks’ subnet can support other programming languages and execution environments, such as Ethereum’s Solidity language and EVM (Ethereum Virtual Machine). This means that smart contracts developed on the Ethereum network can run on the Stacks network, use Bitcoin-anchored assets, and settle on the Bitcoin chain. This greatly increases Stacks’ compatibility and application scope.

Proof of Transfer (PoX) consensus mechanism

Proof of Transfer (PoX) is a core component of the Stacks project. It is a novel consensus mechanism that utilizes Bitcoin’s proof of work (PoW) to achieve high decentralization and scalability. In PoX, Stacks chain nodes participate in block creation by “burning” Bitcoin. This means that nodes send Bitcoin to an inaccessible address to prove that they have contributed to the security of the network. These nodes may then be selected as nodes to create new blocks and receive Stacks tokens as rewards.

Stacks layer relies on STX and BTC for its novel consensus mechanism called Proof of Transfer (PoX), which utilizes both Stacks and Bitcoin layers. PoX is conceptually similar to Bitcoin’s proof of work (PoW) consensus: just as Bitcoin PoW miners spend electricity and receive BTC rewards, Stacks PoX miners spend (mined) BTC and receive STX rewards. Like PoW, PoX uses a Nakamoto-style single leader election: PoX miners simply bid by spending BTC, and they have a leader with a random probability based on the bidding weight. The leader election takes place on the Bitcoin chain, and new blocks are written on the Stacks layer. In this way, PoX reuses the work already done by Bitcoin miners and does not consume any significant additional power: only a regular laptop/computer is needed to bid BTC for Stacks node usage.

Another part of PoX is “Stacking”, which allows holders of Stacks tokens to participate in the security of the network. If holders choose to “Stack” their tokens, they will be rewarded with Bitcoin regularly. This is a unique mechanism that allows participants in the Stacks chain to directly receive Bitcoin as a reward, further strengthening the connection between the Stacks network and Bitcoin.

Stacks is a smart contract Bitcoin layer that is deeply and continuously connected to the Bitcoin chain, unlike sidechains such as RSK and Liquid. The Stacks layer allows applications and smart contracts to use Bitcoin (BTC) as their asset or currency and settle their transactions on the Bitcoin main chain. The goal of the Stacks layer is to expand the Bitcoin economy by transforming BTC from a passive asset to a productive asset and enabling various decentralized applications. Like sidechains such as RSK and Liquid, the Stacks layer has its own global ledger and execution environment to support smart contracts and prevent the Bitcoin blockchain from being overloaded due to additional transactions. However, the Stacks layer is unique because it has most of the desirable properties of Bitcoin smart contracts. It also provides high-performance mechanisms such as fast blocks, decentralized anchoring, and subnets.

IV. Project Applications

Utilizing Bitcoin as a fully programmable asset

Stacks provides Bitcoin with new functionalities and use cases. By leveraging Stacks, Bitcoin can be used as a fully programmable asset in decentralized applications and smart contracts. This innovative application allows Bitcoin to be widely used in various decentralized financial products and services such as lending, insurance, prediction markets, etc.

With the Stacks layer, developers can build any application they can build on other smart contract platforms like Ethereum, Solana, Avalanche, etc., but using BTC as their asset/currency and settling their transactions on the Bitcoin blockchain. They will be able to do this on the Clarity VM or using subnets on Solidity or other languages’ EVM or other virtual machines. Users can also directly exchange BTC from the Bitcoin chain to stablecoins and NFTs.

Unlocking passive Bitcoin capital

Stacks, through its smart contracts and decentralized applications, is able to unlock passive Bitcoin capital, allowing these capital to generate greater value. For example, by using Stacks, Bitcoin holders can put their Bitcoin into decentralized lending platforms to earn interest income. Additionally, Bitcoin holders can also use their Bitcoin for the security of the network by participating in the “Stacking” mechanism of Stacks and receive Bitcoin as a reward.

Providing fast transactions for Bitcoin

In addition to the above functionalities, Stacks also provides the ability for fast transactions for Bitcoin. Due to the design characteristics of Bitcoin, its transaction speed is slow, which may limit its applications in certain cases.

The Stacks Bitcoin Layer provides additional functionality to achieve higher performance, as well as greater versatility and security. Although the performance mechanisms of the Stacks layer have been described above, like Bitcoin, the Stacks layer optimizes for decentralization rather than low latency or high network throughput: users in remote areas should be able to run full Stacks and Bitcoin nodes using ordinary laptops and home Internet connections. However, the Stacks chain web layer can coordinate higher performance. The web also supports smart contracts and can make trade-offs between decentralization and performance that are different from the main Stacks chain or other webs. In addition, individual webs can support smart contracts in different programming languages and execution environments. Some webs may support Clarity and Clarity VM, which have security advantages, while others may support Ethereum’s Solidity language and EVM compatibility, or compatibility with the Ethereum Virtual Machine, which have the advantages of easy integration and development and can leverage all Ethereum smart contracts and tools. With Stacks, users can conduct faster Bitcoin transactions, enabling Bitcoin to be widely used in daily transactions and micro-payment scenarios.

5. Team Background

Currently, Stacks is a project composed of multiple independent entities and communities. In the early stages, Stacks was mainly led by Blockstack PBC (now renamed Hiro Systems PBC, abbreviated as Hiro). Hiro has 66 team members, with Muneeb Ali as the founder. The main members of the project team have many years of research and development experience in the field of distributed systems, including 6 PhDs in the field of distributed systems and 2 scientists who have received the US Presidential Career Award.

Muneeb Ali, Co-founder of Stacks and CEO of Hiro, is a computer science Ph.D. from Princeton University, specializing in researching full-stack solutions for building distributed applications.

Jude Nelson, Stacks Fund Research Scientist and former Hiro engineering partner, obtained a Ph.D. in computer science from Princeton University and was a core member of PlanetLab, which received the ACM Test of Time Award for implementing planet-scale experiments and deployments.

Aaron Blankstein, engineer, joined the Blockstack engineering team after obtaining a Ph.D. in 2017.

Mike Freedman, Hiro technical advisor, professor of distributed systems at Princeton University.

Albert Wenger, Hiro board member, managing partner at Union Square Ventures (USV). Prior to joining USV, Albert was president of del.icio.us until the company was sold to Yahoo. He is also an angel investor who has invested in Etsy and Tumblr.

6. Financing Information

The token fundraising sales amounted to 609.2 million, with a total financing of approximately $75.6 million. The founder and team reward amounted to 253.1 million. By the end of 2019, 441 million STX tokens will be unlocked, with 36% held by employees, founders, and Series A investors, and 52% held by Reg D investors.

7. Development Achievements

Currently, there are several well-known projects on the Stacks network:

Wallets:

Hiro Wallet is the most commonly used open-source wallet on the Stacks chain, helping users store, receive, or send assets on the Stacks network. It supports Ordinals but has not yet integrated with the Lightning Network.

Xverse is an non-custodial wallet that supports users to store, receive, or send assets on the Stacks blockchain. It supports Ordinals and has added biometric authentication to enhance wallet security and convenience. However, it has not yet integrated with the Lightning Network.

GoSats is a Bitcoin wallet developed by an Indian team, focusing on the Indian community. Its vision is to enable every shopper, consumer, and saver to use BTC. GoSats has launched GosSats Visa card, loyalty program, and more.

DeFi:

ALEX is a DEX built on the Stacks chain supported by the non-profit organization, ALEX Lab Foundation. Users can trade, stake, provide liquidity, cross-chain, and participate in features like lotteries and IDOs on this platform.

Stackswap claims to be the first feature-complete DEX on the Bitcoin chain. It allows users to trade assets, provide liquidity, stake, cross-chain, participate in LaunchLianGuaid, NFT, and more. STSW Token has been issued.

UWU is a lending protocol built on the Stacks chain based on the UWU Cash stablecoin. It was designed by nickole.btc from BitAcademy and is currently in the testing phase. Users can join the community and fill out a form to qualify for testing.

Liquidity Staking:

Planbetter is a liquidity staking protocol on the Stacks chain. Over 88,000 Stackers have staked 280 million STX, accumulating 25.42 BTC in rewards.

NFT:

Gamma is an NFT marketplace built for Bitcoin NFTs. It has integrated with Stacks and Ordinals.

Boom is the native NFT platform on the Stacks chain and has launched a new type of NFT called Boomboxes. It allows users to delegate lock their STX and receive an NFT as a reward for the locked portion automatically.

TradePort is a multi-chain aggregated NFT marketplace. It currently supports Stacks and Near chains and plans to expand to Aptos and Sui.

8. Economic Model

The initial supply is 1.32 billion. There will be a certain inflation rate every year, and it is expected to reach 1.842 billion by 2050 (v1 was 2.052 billion).

STX is the registered digital asset on Stack 2.0 (such as usernames, software licenses, podcasts, or other digital products) and is required to publish and run smart contracts. It is similar to gas fees in the Ethereum network, as STX is consumed when operating on the network. At the same time, STX can be used to pay transaction fees and is an incentive for miners to run mining nodes and developers to develop DApps.

The main attribute of STX is to cooperate with Stack 2.0 for network operation, regulate and balance various mechanisms. The long-term value of STX depends largely on the growth of the Stacks network and the demand for Clarity smart contracts.

In Stack 2.0, the acquisition of STX mainly involves participating in the PoX consensus mechanism, where you can submit BTC to obtain STX or stake STX to obtain BTC. In each locked reward cycle of STX, Bitcoin transferred by miners will be received as part of the transfer proof. Once the locked cycle is completed, the STX will be unlocked and can be freely used or staked again.

Nine, Advantages and Risks

Advantages

-

Smart contract capability for Bitcoin: Stacks provides Bitcoin with the ability to have smart contracts and dApps, which may attract a large number of users and developers. This may lead to the development of a new ecosystem of developers and users, thereby increasing the use and value of Bitcoin.

-

New applications and use cases: Stacks allows Bitcoin to be used as the underlying asset for smart contracts, which may open up a range of new applications and use cases, such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

-

Contribution to the Bitcoin economy: By enabling Bitcoin to participate in smart contracts and dApps, Stacks may have a positive impact on the Bitcoin economy. This may increase the demand for Bitcoin, thereby increasing its value. At the same time, by bringing transaction fees to the Bitcoin network, Stacks may also help maintain the security of the Bitcoin network in the long term.

Risks

-

Technological development and adoption: Although Stacks enhances Bitcoin’s capabilities with smart contracts and dApps, the development and adoption of this technology still face challenges. While the Clarity language is secure, not all developers are familiar with it. Additionally, although subnets provide higher performance and greater generality, implementing and maintaining these subnets may bring technical and governance challenges.

-

Network effects and user adoption: Stacks needs to attract a large number of users and developers to realize its potential. This will take time and require overcoming the challenges of network effects, where existing platforms (such as Ethereum) may have already attracted a large number of users and developers.

-

Regulatory risks: Some features of Stacks, such as STX mining and stacking, may be subject to regulatory restrictions in certain jurisdictions. Additionally, the global regulatory environment for cryptocurrencies and smart contracts is constantly changing, which may have an impact on Stacks.

Overall, despite facing some challenges, the outlook for Stacks looks promising. If these challenges can be successfully addressed, Stacks may have a profound impact on Bitcoin and the entire cryptocurrency ecosystem.

References

https://www.chaincatcher.com/article/2060385

https://www.odaily.news/post/5187830

Stacks: A Bitcoin Layer for Smart Contracts

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!