The encrypted market has been in a deep bear market since the second quarter of this year, and the investment strategies and scale of major VCs have been shrinking. According to incomplete statistics from BlockBeats, in the past few months, the number of financing in the encryption field has remained at around 10 per week, while last year, this number was around 30 per week, and at most there were even 60 financing per week.

However, at the end of the third quarter, some first-tier encrypted VCs became active again. Taking a16z as an example, in just over a week, it consecutively led investment in 4 encrypted projects, with a total financing scale of 76.6 million US dollars. The “a16z” seems to have started its bottom-fishing action in the encryption industry.

What has happened to the encrypted market in the past half year without the “a16z”?

The same goes for a16z as the industry leader. According to incomplete statistics from BlockBeats, in 2022, a16z participated in a total of 58 investments in the encryption field, with the highest total financing amount in March 2022, exceeding 2.1 billion US dollars. At the same time, the highest investment led by a16z in 2022 was given to Yuga Labs, with an amount of 450 million US dollars.

But after entering 2023, its investment frequency and amount have shown a downward trend. In the first quarter of 2023, a16z completed 13 investments, and the total financing amount of the projects it participated in decreased by 86.7% compared to last year. The highest amount led by it was 150 million US dollars, given to AI startup Character.AI. The highest leading investment amount has dropped from 450 million in 2022 to 150 million in 2023. The extent of contraction can be imagined.

- Outlook for the Cryptocurrency Market in the Fourth Quarter Analysis of the Cancun Upgrade, RWA, and Investment Logic in Gaming

- Why is it said that the cryptocurrency market needs sky-high interest rates?

- In-depth analysis of Bitcoin market sentiment.

In the second quarter, a16z entered a relatively quiet period. From April to August, a16z only completed 4 leading financing, including 29.3 million US dollars seed round financing for on-chain IP infrastructure Story Protocol, 43 million US dollars Series A financing for blockchain-based AI computing protocol Gensyn, 20 million US dollars Series A financing for open-source software security solution Socket, and 16.5 million US dollars seed round financing for generative AI tool Ideogram AI.

In the past second quarter, the encrypted VC market can be described as experiencing a “withdrawal wave”. In addition to a16z, LianGuairadigm also modified its official website information at the end of May, claiming to be a “research-driven technology investment company” rather than a company specializing in investing in “disruptive encryption/Web3 companies and protocols”, seemingly indicating an exit from the encryption field.

Institutions with the attribute of “spiritual leader” in the industry have successively faded out of the market, and the industry has gradually entered a chaotic stage with memes and dog coins flying around.

In March, Arbitrum’s airdrop opened a short-lived and grand movement of wealth creation in the cryptocurrency circle. The legendary story of “creating thousands of accounts”, “getting hundreds of thousands of tokens”, and “becoming free overnight” spread once again. The community suddenly entered the era of mass airdrops, and the number of daily active users of zkSync and StarkNet increased by more than 10 times.

After a brief era of idle speculation, BRC20 took over. In May, the BRC20 token Ordi broke through $10, with a market capitalization of over $200 million, creating a FOMO frenzy in various communities. Compared to participating in airdrops, the BRC20 token seems to have a more pronounced wealth effect. Users do not need to engage in on-chain operations or worry about meeting strict conditions. They only need to mint the tokens at the time of issuance. Even during the early days of the Bitcoin blockchain, when congestion was not an issue, users only needed to pay a few U’s worth of gas fees to obtain a large number of Ordi tokens.

In the era of BRC20, memes also made their mark. A meme token called PEPE quietly went online and skyrocketed in just four days. The myth of getting rich overnight brought PEPE into the limelight, and the successive surges of Meme coins and Shiba Inu coins once again took center stage in the crypto market. Within a few days, dozens of meme coins emerged, with gains of several tens of times, causing half of the market to revel in the wealth creation myth and the other half to anxiously FOMO.

Returning to the recent hot public chain, Base. Without relying on “Odyssey” or airdrops, the Layer2 network Base launched by Coinbase ignited the market with the meme myth of BALD, which surged by a thousand times, attracting countless attention and achieving a 2000-fold increase in about 14 hours.

However, after just over 3 hours, BALD revealed its fangs and destroyed everything. The project team suddenly withdrew a total of 8660 ETH and 179 million BALD tokens in liquidity within 7 minutes, achieving a RUG pull. Interestingly, some on-chain detectives believe that SBF or the mastermind behind BALD was involved.

“Lead Sheep” is here to bottom fish?

On the other side of chaos, some people are leaving the scene in disappointment. Since the beginning of this year, several projects have announced dissolution and shutdown, and the rate at which projects are ceasing operations is increasing. From an average of 1 project per month to 5 projects per month. In September alone, 4 projects announced shutdown, including NFT platform Voice, DeFi projects Gro Protocol and Fuji Finance, as well as DeFi and NFT trading robot None Trading. Most of these projects reached the end due to “insufficient funds.”

The reason for “insufficient funds” may be seen in an article published by Jocy, the founder of IOSG, one of China’s largest crypto industry venture capital firms. After the TOKEN 2049 conference, Jocy pointed out in the article that the chill brought by the bear market may prevent many project teams from surviving until the winter of this year. At the same time, he also mentioned that current investment institutions in the crypto industry are more inclined to tighten their belts.

“For many teams, TOKEN 2049 basically became their last hope for fundraising. If the bear market does not end, this may be their team’s last brand exposure, because most early-stage teams have reached the bottom of their runway due to expansion in the past two years, and some teams have a very high burn rate.”

However, in stark contrast to the pessimistic tone of Jocy, there is a lively scene of the return of the Western cryptocurrency investment institution “Leading Sheep” to the market.

After changing the homepage description of the official website to “a research-driven technology investment company” in May, removing any content related to cryptocurrency, just over a month later, LianGuairadigm revoked this change and announced a return to the cryptocurrency field. Matt Huang, co-founder of LianGuairadigm, said that deleting all mentions of cryptocurrency on the website login page before was “a bit absurd and a mistake”. And emphasized that LianGuairadigm will not give up on cryptocurrency investments.

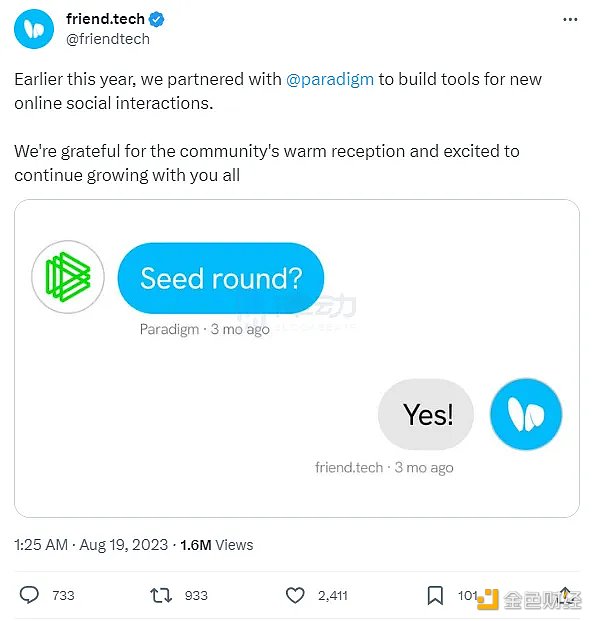

After returning to the cryptocurrency industry, LianGuairadigm immediately entered the “most active” MEV market and participated in Flashbots’ $60 million Series B financing completed in July, which increased its valuation by more than $1 billion. In addition to Flashbots, what is more impressive about LianGuairadigm in the past few months is its selection and investment in friend.tech, which has facilitated the rapid rise of the Web3 social newcomer with a market value of over $100 million in just two months.

In addition to investments, LianGuairadigm’s official website blog has also become unusually active. In July, LianGuairadigm released a notice titled “Collaborate with LianGuairadigm”, stating that they hope to collaborate with more outstanding talents in the cryptocurrency field and calling on entrepreneurs or projects in the seed or Series A funding stage to fill out a form to introduce their projects to LianGuairadigm.

Yesterday, Matt Huang published a long article, not only refuting the overly speculative and slow development pessimistic view of Crypto from another perspective, but also expressing confidence in the future of Crypto.

With LianGuairadigm’s high-profile return, a16z has also regained its vitality.

As can be seen from the chart below, from April to July this year, the entire second quarter of a16z seemed to have fallen silent, with an average of only one investment per month. However, starting from August, a16z seemed to have become active again, increasing from 2 investments in August to 5 investments in September, which is equivalent to the total of the past few months. Moreover, in the latter half of September alone, a16z made consecutive investments in 4 projects within 10 days.

On September 12th, a16z led a $15 million Series A financing for LianGuaihdo Labs, a metaverse platform development studio. On the 18th, a16z also led a $25 million seed round financing for Bastion, a startup that provides cryptocurrency custody services. On the 20th, a16z led a $3.6 million seed round financing for the decentralized information market protocol Freatic, and then led a $33 million seed round financing for the blockchain gaming startup Proof of Play the next day.

In the current market situation where multiple projects have been shut down and Oriental Capital is struggling, are the “a16z” making high-profile appearances and frequently taking action to bottom out the cryptocurrency industry?

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!