[Summary]

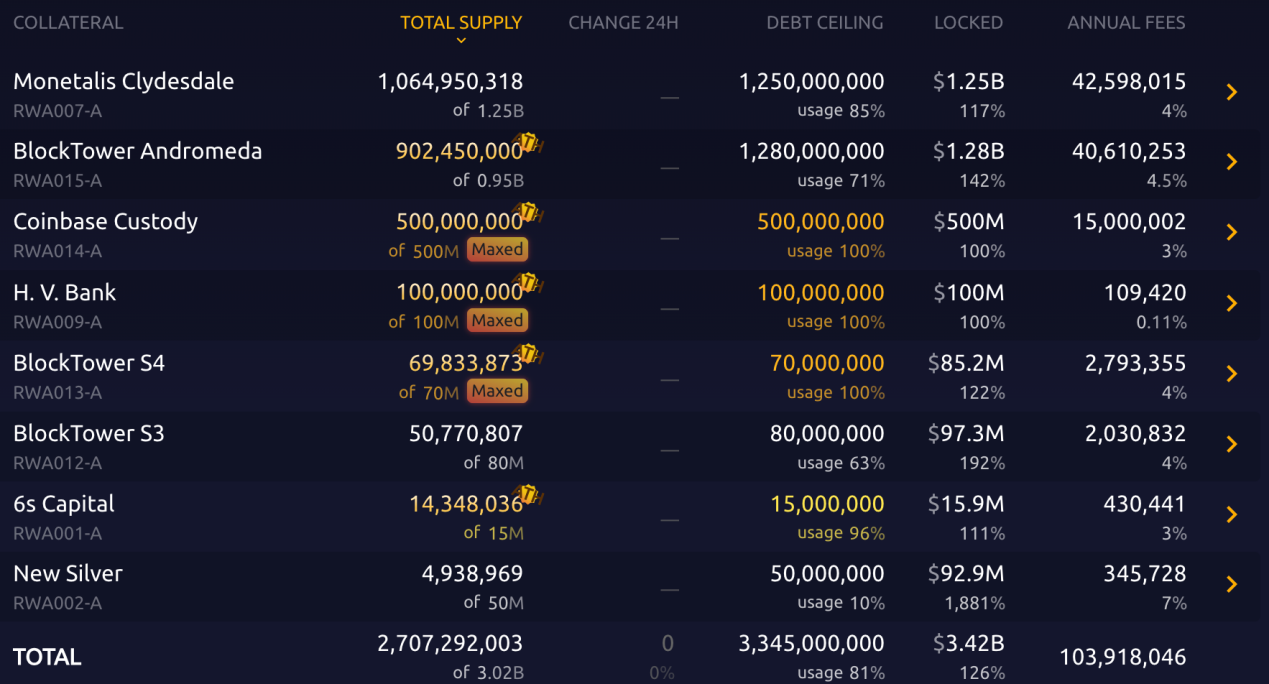

Lending: MakerDAO RWA scale has grown to 2.707 billion. Dai scale has grown to 5.511 billion, surpassing the previous high in the past six months.

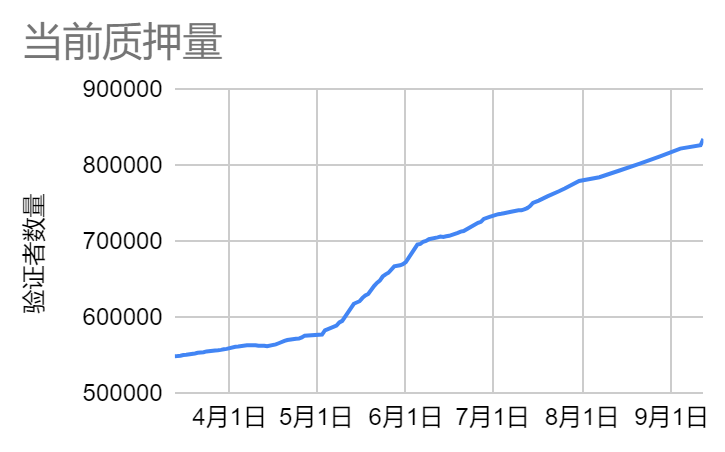

LSD: Last week, the ETH collateralization rate rose to 22.35%, an increase of 1.08% compared to the previous period. Last week, there were 26.87 million ETH locked in the beacon chain, corresponding to a collateralization rate of 22.35%, an increase of 1.08% compared to the previous period. Among them, there were 804,000 active validator nodes, an increase of 2.09% compared to the previous period, and 31,100 validator nodes in the queue, a decrease of 20.69% compared to the previous period. The current ETH collateralization rate is approximately 3.60%.

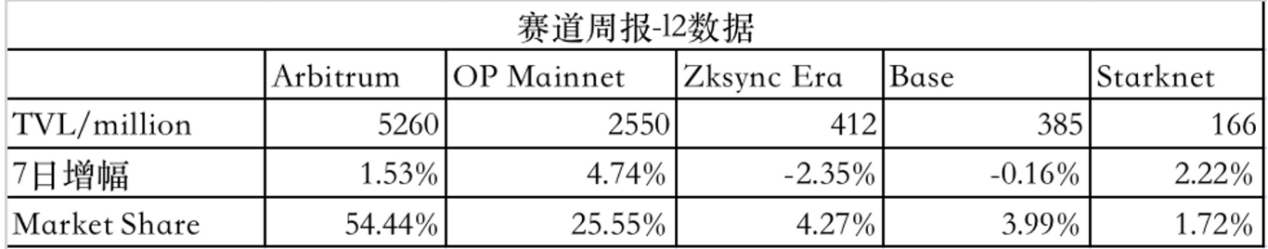

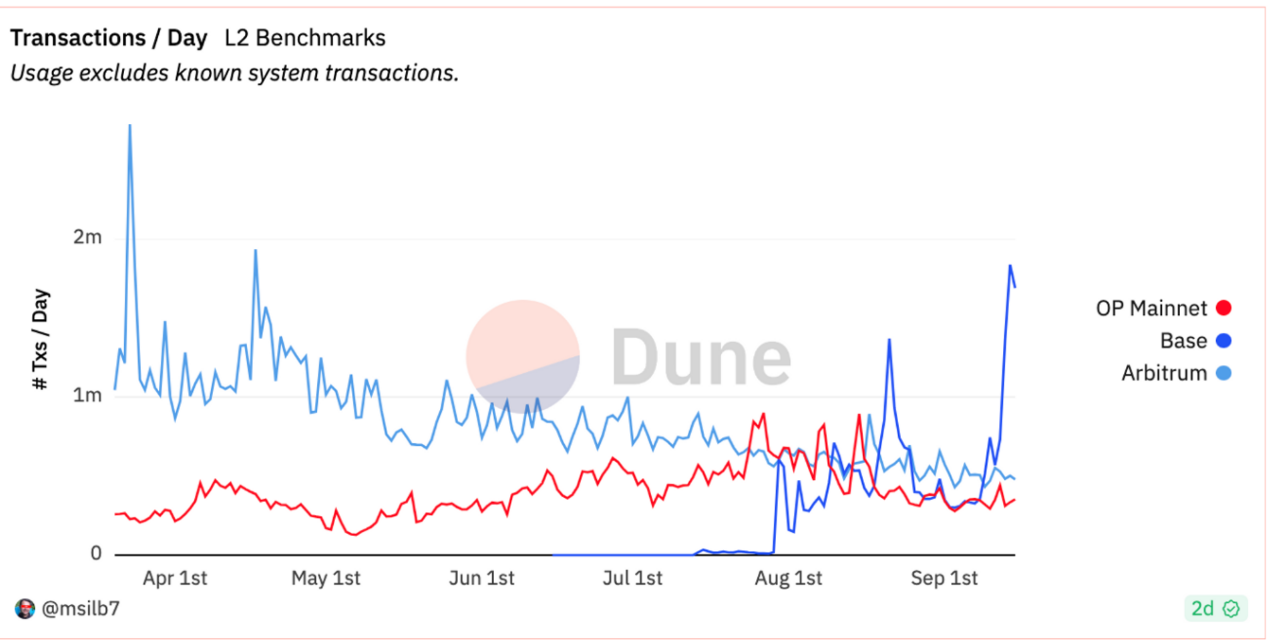

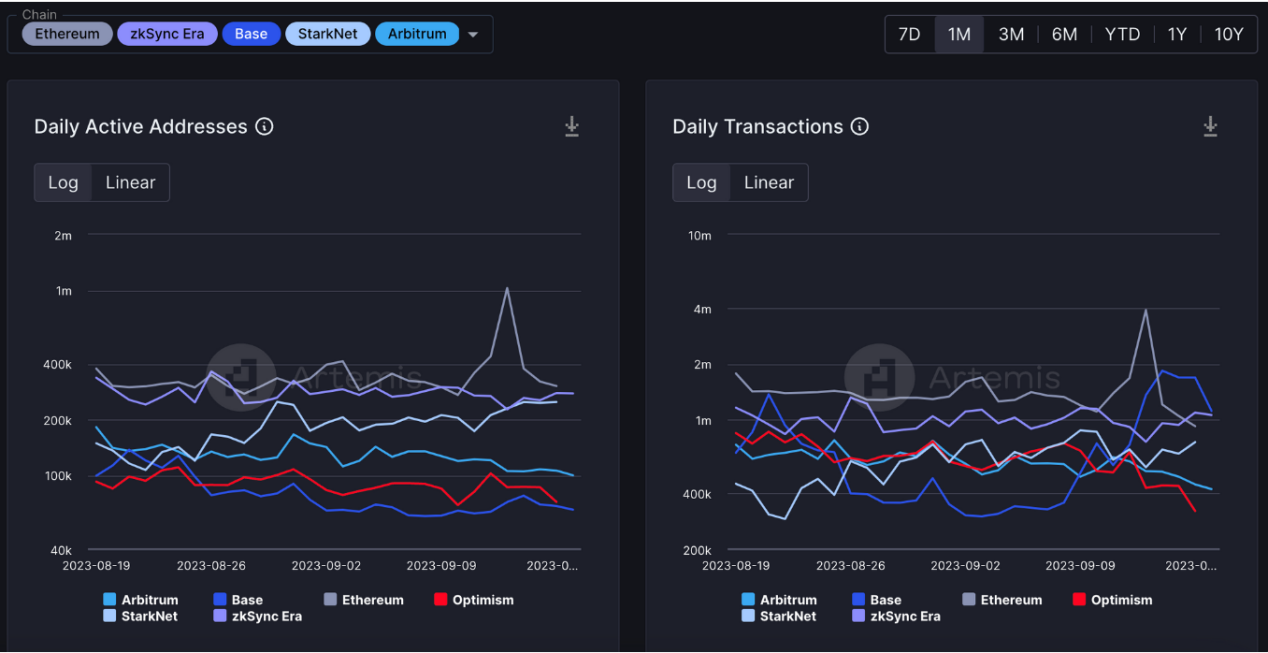

Ethereum Layer2: The total value locked (TVL) of Layer2 has increased by 260 million USD compared to last week, with a total locked amount of 9.66 billion USD. The data on Base has continued to rise, reaching a historical high. On September 14, the number of Base transactions exceeded the sum of Arbitrum and Optimism.

- Macro Weekly Report on September 18th Will the market remain bearish until the end of the year? What is the core of market speculation?

- Interpreting Mountain Protocol Will the profit-generating stablecoin USDM become the new underlying asset in the cryptocurrency market?

- Weekly Selection | Token2049 held in Singapore; Friend.tech regains popularity; FTX asset liquidation event causes market fluctuations

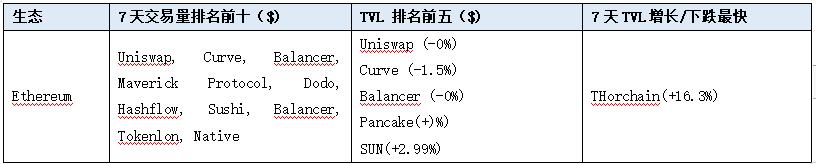

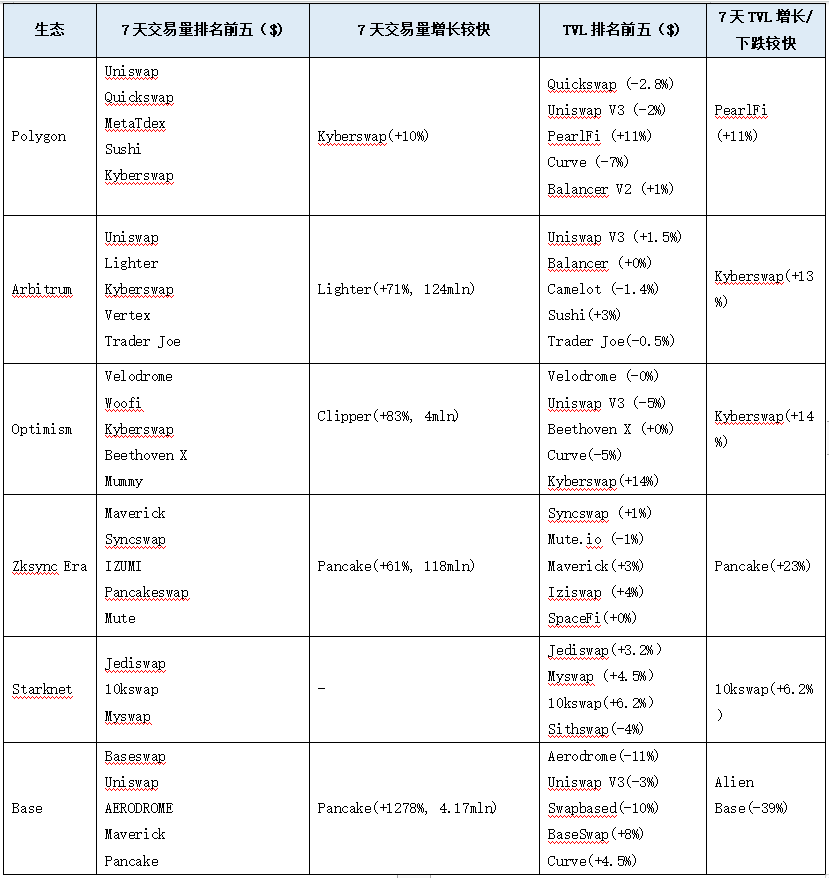

DEX: The combined TVL of DEX is 11.72 billion, which is unchanged from last week. The 24-hour trading volume of DEX is million, and the 7-day trading volume is 11.61 billion, an increase of 2.5 billion compared to last week. The market has rebounded this week, and the trading volume has recovered.

POW: With the rebound of BTC this week, the major projects in the POW track with high market capitalization have all shown significant increases. KSA performed the best, with a 7-day increase of 24.9%. BCH came second with a 7-day increase of 17.6%. LTC came third with a 7-day increase of 12.7%. FLUX had a smaller increase, only 2.8%. DNX was the weakest and still in a correction phase, with a decrease of 8.6%.

[Lending]

MakerDAO

The current RWA scale has reached 2.707 billion USD, nearly doubling in growth compared to three months ago. The Dai scale within DSR has grown to 1.58 billion, an increase of 270 million USD in one week, accounting for 28.7% of the total Dai supply.

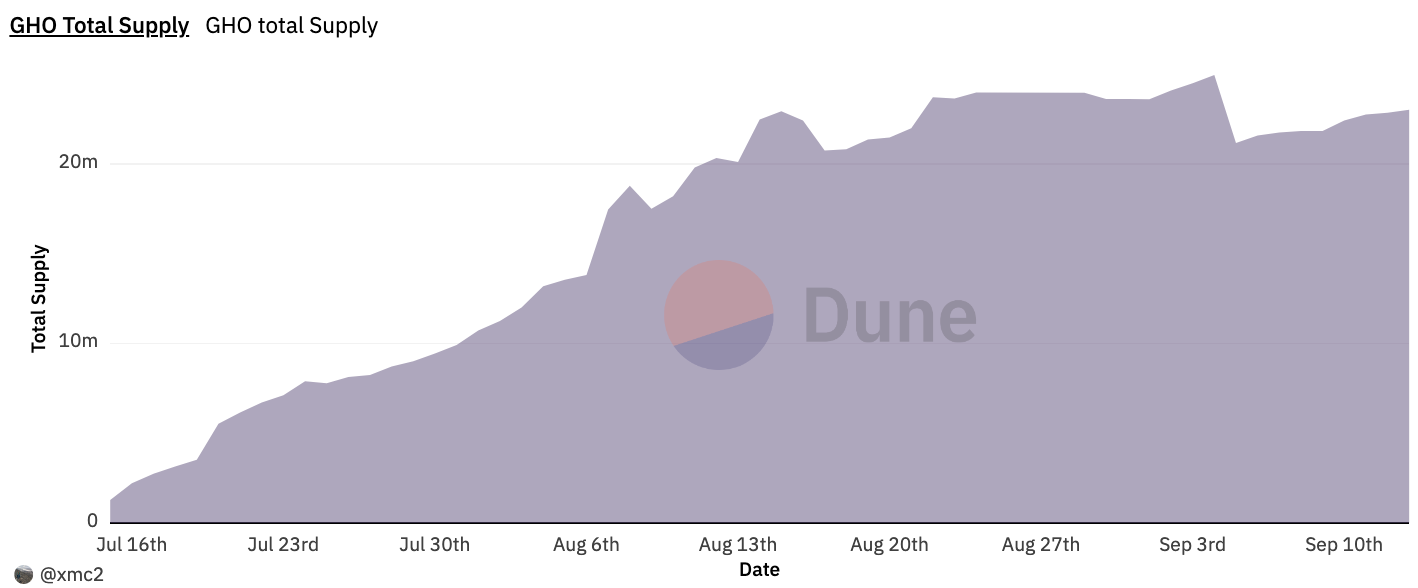

Aave

The Aave community is currently voting on a proposal to raise the GHO lending rate from 1.5% to 2.5% in order to maintain the peg of GHO. The total supply of GHO is 23.02 million, which has remained largely unchanged since August 13. The main issue remains the lack of use cases for the GHO stablecoin.

[LSD]

Last week, the ETH collateralization rate rose to 22.35%, an increase of 1.08% compared to the previous period. Last week, there were 26.87 million ETH locked in the beacon chain, corresponding to a collateralization rate of 22.35%, an increase of 1.08% compared to the previous period. Among them, there were 804,000 active validator nodes, an increase of 2.09% compared to the previous period, and 31,100 validator nodes in the queue, a decrease of 20.69% compared to the previous period. The current ETH collateralization rate is approximately 3.60%.

Increase of 1.08% in ETH collateralization rate compared to the previous period

This week’s ETH staking yield is 3.60%

Among the three major LSD protocols, in terms of price performance, LDO increased by 3.9% in the past week, RPL increased by 1.2%, and FXS increased by 4.8%; in terms of ETH staking volume, Lido increased by 0.72% in the past week, Rocket Pool increased by 0.45%, and Frax increased by 0.55%. The current balance of the Rocket Pool deposit pool is 18,348 ETH, the RPL staking rate is 49.01%, and the effective staking ratio is 91.25%. SSV has had 7 consecutive days of price increases, and its performance on the mainnet after entering the third phase is better than the overall market. It remains to be seen whether the subsequent growth of the protocol’s TVL exceeds expectations; Frax V3 is expected to release its whitepaper in late September.

[Ethereum L2]

TVL

The total Layer2 TVL increased by $260 million compared to last week, with a total locked amount of $9.66 billion

OP Mainnet

1. On September 14th, OP Labs announced that the first proof-of-failure system of OP Stack has made significant progress, and we are preparing to test the system on OP Goerli.

2. The opBNB mainnet was officially launched on September 13th, and in the future, it will focus on enhancing the network’s resilience and decentralization through Proof Enhancement, account abstraction, data availability with BNB Greenfield, interoperability with BNB Greenfield, and decentralized sorters.

Base

Thanks to the continuous popularity of FrienTech, the on-chain data on the base chain reached a record high last week. Among them, the number of independent user addresses exceeded 280,000, and the total value bridged exceeded 180,000 ETH. The number of transactions on September 14th exceeded the total number of transactions on the Arbitrum and Optimism mainnets.

Mantle

1. On September 14th, Mantle Network announced a partnership with the Telegram-affiliated Ton Foundation. The Ton mainnet will support the trading of Mantle’s token MNT, and Mantle can provide services to users using the built-in TON wallet in Telegram.

2. On September 13th, Mantle Network announced support for the tokenized note USDY of the structured protocol Ondo Finance to help Mantle expand into the RWA field.

On-chain activity

[DEX]

The combined TVL of DEX is $11.72 billion, which is the same as last week. The 24-hour trading volume of DEX is $1 million, and the 7-day trading volume is $11.61 billion, an increase of $2.5 billion compared to last week. The market rebounded this week, and the trading volume has recovered.

Ethereum

ETH L2/sidechain

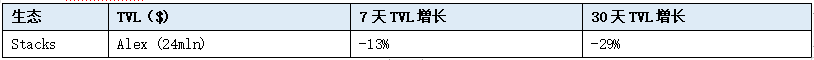

BTC L2/Sidechain

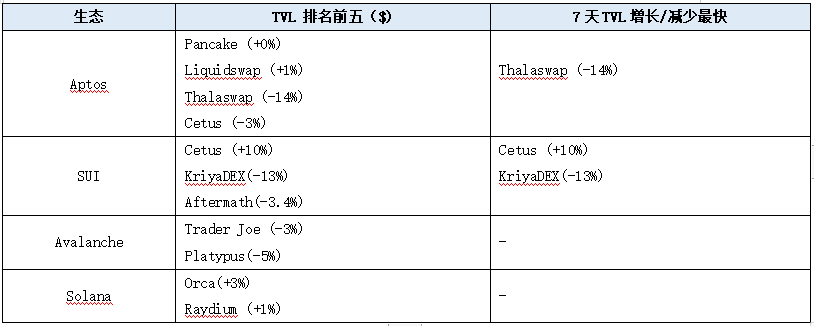

Alt L1

【POW】

This week, along with the rebound of BTC, several major projects in the POW track have shown obvious gains. KSA performed the best, with a 7-day increase of 24.9%. BCH followed, with a 7-day increase of 17.6%. LTC ranked third, with a 7-day increase of 12.7%. FLUX had a smaller increase of only 2.8%. DNX was the weakest and is still in a correction phase, with a decrease of 8.6%.

24-hour output and computing power

According to the information disclosed by F2Pool, we can see the 24-hour output and network-wide computing power of POW tokens. In terms of output ranking, KAS ranks third, second only to BTC and DOGE; LTC ranks fourth; BCH ranks sixth; DNX ranks ninth.

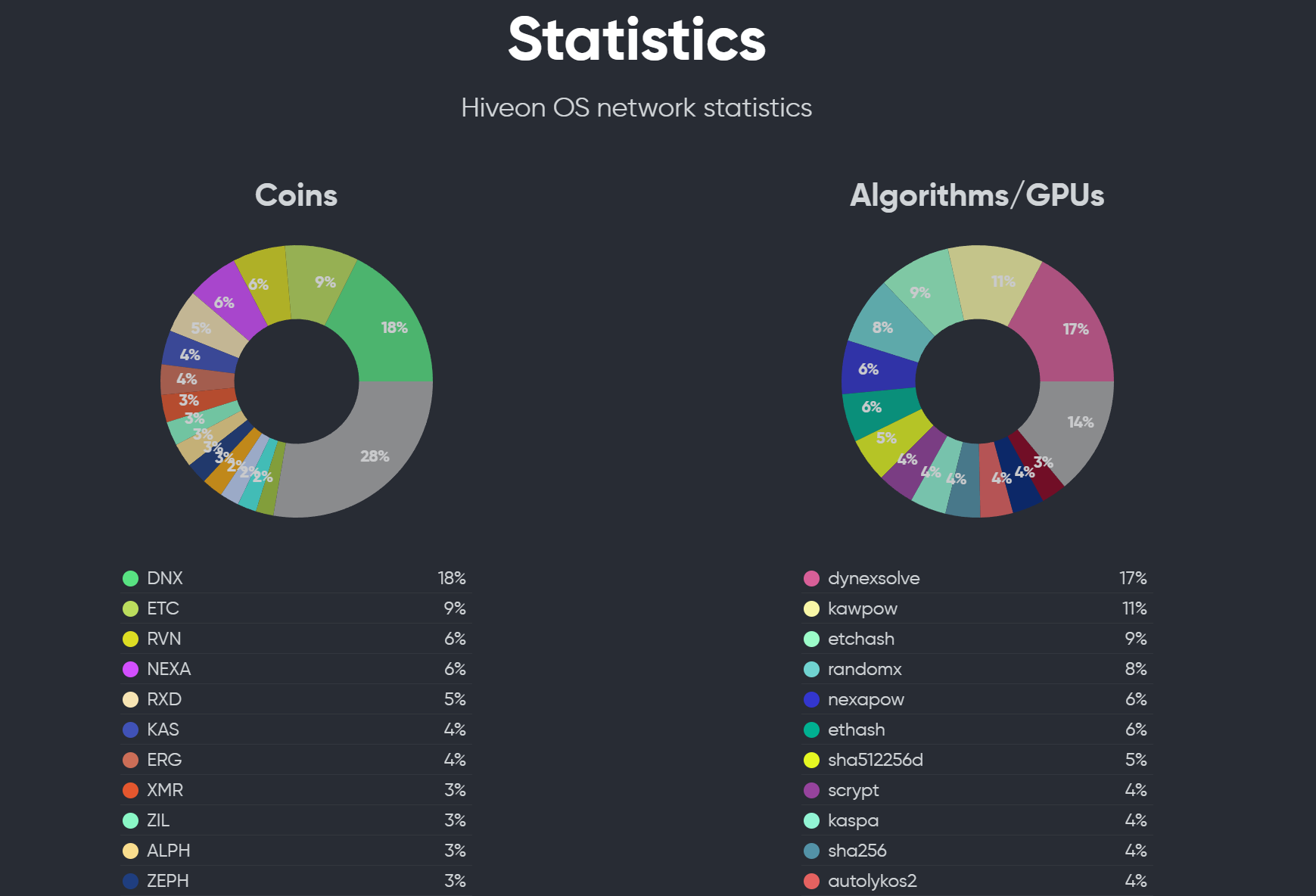

In GPU mining, DNX currently has the largest computing power, higher than ETC and RVN. After KAS switched to professional mining machines, its original GPU computing power transferred to DNX.

Project progress

LTC and BCH are earlier POW tokens with no major development in the project ecosystem, mainly relying on long-term accumulation and the position formed by the miner community.

KAS and DNX are new POW tokens generated after 2021. KAS absorbed the GPU computing power after Ethereum switched to POS and has developed rapidly. Its market value has exceeded 1 billion US dollars, and this week the price reached its historical high. The main progress in the past month includes:

– At the end of August, the Rusty KasLianGuai update was carried out.

Rust node development is divided into three parts: 1. Stress testing the network to withstand higher loads. 2. Release a stable Rust node that will replace the Go client on the main network (before any hard fork). 3. Improve the API to make integration and development on KasLianGuai easier.

The current progress is that the first two items have been basically completed and the code is being audited. In terms of API, the JavaScript/TypeScript WASM SDK (and all supporting infrastructure) is entering the final stage of development.

– On September 2nd, listed on Bitmart exchange.

– On September 6th, listed on Bybit exchange.

DNX is a cloud computing platform for AI training. The price previously rose to $1.3 and then entered a correction phase. Currently, the project still maintains a good POW output and occupies the largest computing power on GPUs. The main progress in the past month was the listing on F2Pool on September 5th.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!