The rapid growth of LPDfi has caused a sensation and is hailed as the next hot narrative after LSDfi. All the information about LPDfi is in this article, hoping it will be helpful to you.

Table of Contents

1. What is LPDfi?

2. What problems does LDPfi solve?

- Binance Research Exploration of OP Stack Ecosystem and Super Chains

- Global AI giants gathering What did the Salt and Iron Conference in the AI era talk about?

- Will FTX lose money? If so, how much will it lose?

3. The first 6 projects in the LPDfi narrative

4. Personal feelings

01

What is LPDfi?

LPDfi (Liquidity Derivatives Finance) is a financial derivative product that uses Uniswap V3 LP (CLAMM) to create perpetual DEX, options, and currency markets.

It helps liquidity providers earn higher fees by more efficiently utilizing LPs on Uniswap V3.

Advantages of LPDfi products:

For users: Increase token incentives, reduce impermanent loss risks, and simplify centralized liquidity provision, experience higher returns from liquidity mining.

For Uniswap v3: Witness an increase in liquidity, user base, and trading volume.

For LPDfi: Solve the liquidity shortage problem of producing products at a reasonable cost.

(Note: The term LPDfi introduced by @logarithm_fi creates a new liquidity layer for LPs to unlock unprecedented returns on Uniswap LPs, creating a new asset market.)

02

What problems does LDPfi solve?

The DEX market is vast. According to data from DeFiLlama, Uniswap alone has a TVL of 3.26 billion US dollars, and the total TVL of all DEXs has exceeded 11.8 billion US dollars.

LPDfi mainly utilizes Uniswap, while other DEX protocols such as Curve, Balancer, and Velodrome still have abundant resources waiting to be developed.

Uniswap V3 has the potential to reduce impermanent loss, but it has not been fully utilized under existing strategies.

Uniswap V3, while increasing capital utilization, has also brought some liquidity problems.

For example, users need to constantly manually adjust LP positions to prevent impermanent loss, which is extremely complex and time-consuming.

In addition, many people are currently trying to protect their assets from fluctuations by purchasing options or futures contracts.

However, this method is also ineffective and requires high costs to avoid the risk of impermanent loss.

But with the advent of LPDfi, users no longer need to manage liquidity themselves.

They can optimize profits and protect assets by trusting the LDPfi project and protocol to automatically handle liquidity measures.

03

6 Recommended Projects in LPDFi Narrative

@logarithm_fi

Logarithm is one of the well-known projects in the LSDFI narrative. It has found that the current temporary loss prevention measures are not optimal for Uniswap V3.

This protocol allows users to:

– Earn unlimited LP fees through Uniswap V3, maximize liquidity returns, and minimize price risks.

– Hedge against impermanent loss risks for LPs, ensuring profitability under all market conditions.

In addition to the above, there are two more features:

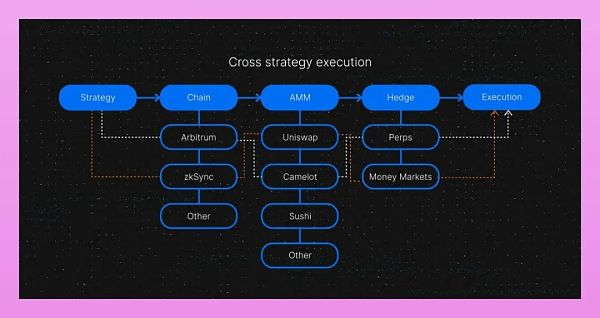

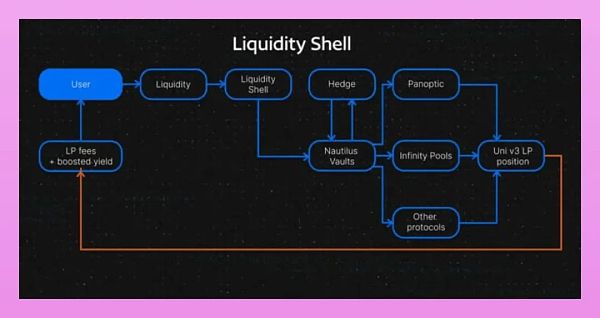

Liquidity Shell: Maximize the profitability of Logarithm users by allocating liquidity assets reasonably on the LPDfi platform.

Nautilus Vault: Maximize profits through delta-neutral strategies and reasonable allocation of liquidity assets.

@LimitlessFi_

Limitless operates on the Uniswap V3 platform, providing comprehensive solutions to participants.

In addition, Limitless takes measures to optimize the profitability of Uniswap liquidity providers and solve impermanent loss issues.

KyberSwap

The second protocol to introduce is KyberSwap, a platform built on @KyberNetwork, a liquidity protocol running on the blockchain.

Its main goal is to provide trading at optimized prices by integrating multiple liquidity sources.

@dopex_io

Dopex is a project centered around options trading, offering a range of products.

It is built on the Arbitrum ecosystem and aims to increase liquidity, reduce risks, and increase profits for options buyers.

Dopex uses a dual-token model:

– $DPX: Governance token used for voting and income sharing.

– $rDPX: Staking certificate whose value increases over time.

Option sellers and liquidity providers can earn DPX and rDPX tokens by staking assets.

Dopex V2 will integrate Uni v3 liquidity and create American-style options for contract execution before expiration.

(Note: Using options for hedging is one of the common ways for Uniswap V3 LPs to manage impermanent loss.)

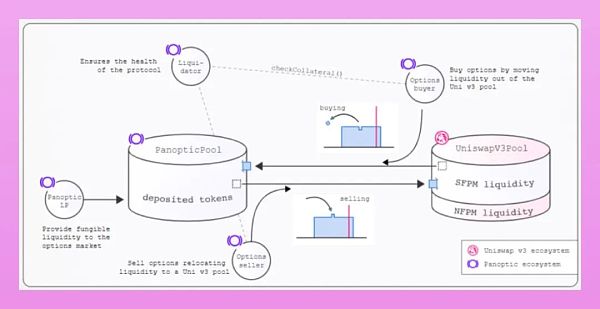

@LianGuainoptic_xyz

LianGuainoptic is an options trading protocol similar to #Dopex but focuses on Perps options.

Traders can trade long or short options with up to 10x unlimited leverage, similar to longing or shorting crypto assets.

LianGuainoptic utilizes Uniswap V3 LP to provide liquidity for option buyers and sellers.

By doing so, LianGuainoptic earns commissions and can also share with borrowers of assets in the LianGuainoptic pool (used for LP on Uni V3).

@goodentrylabs

Good Entry is a position protection product designed to protect traders from liquidation during major or artificial market fluctuations.

It provides 10x leverage and is built on Uniswap V3, utilizing mechanisms similar to options.

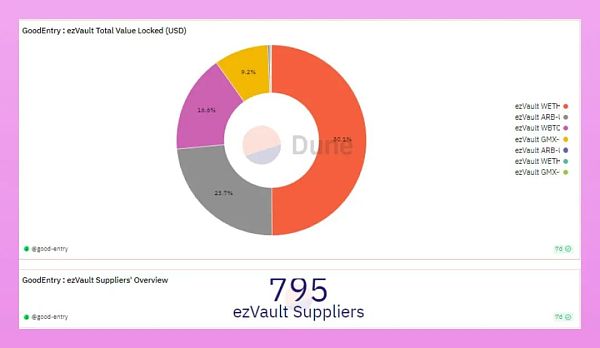

When users deposit on ezVault, the protocol optimally allocates their LP on Uniswap.

ezVault’s limited partners act as option sellers while traders act as option buyers at certain entry points (strike prices).

In just 3 months, ezVault has achieved the following:

– 795 Supplies

– $1.3 million TVL

– 4 main vaults ($WETH, $WBTC, $ARB, $GMX)

04 Personal Thoughts

In the constantly evolving DeFi market, different components are starting to generate continuous innovation. In these developments and innovations, LPDfi is becoming a potential participant that may shape future hot narratives.

The LPDfi project uses options to address impermanent loss and simplify CLAMM’s LP work, but ordinary DeFi users still face significant challenges when using options trading or perpetual contract protection and other end products.

This may hinder the sustainable development trend of LPDfi, and it may be more difficult than LSDfi.

LPDfi has the potential to simplify user experience, improve capital efficiency, and accelerate emerging protocols. Although there are currently some challenges, solutions will emerge as the DeFi community develops, ultimately improving the LPDfi model and strengthening its position in the financial field.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!