Author: Biteye Core Contributor Fishery Isla

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

Recently, within just one month, the revenue models of two tweet-based social platforms, X (formerly Twitter) and FriendTech, have gained significant attention and traffic.

- Xshares friend.tech enters a new stage. Is there hope for the innovation of simulated trading?

- Exploring the relationship between Rollup and application development Is Micro-Rollup the future?

- Looking back at the principle of Tornado Cash A thorn in the side of regulators, yet the most sophisticated ZK application.

Although both of these revenue models have certain flaws, the fact that they have received such high attention proves the feasibility of the Financial + Social, or SocialFi, track.

In addition to the two platforms mentioned above, another noteworthy event in the SocialFi track recently is the launch of Debank Chain based on OP stack by Debank.

Debank has a steady and pragmatic working style. After building the Hi and Stream social functions, they started to work on the chain. Debank Chain serves as the encrypted asset layer that was built prior to the social functions.

It can be seen that the team’s goals are very clear: to split SocialFi based on functionality, first improve the Social (social) function, and then consider using blockchain technology to solve the demands of the Fi (financial) side.

Due to Debank’s meticulous layout in the social field, involving many clever designs, let’s first talk about the shortcomings that have already emerged in X and FriendTech, and then see if Debank can solve these problems.

Musk’s X has three obvious problems with its creator revenue model:

-

Lack of transparency: The calculation method for revenue is not explained in detail, so content creators find it difficult to understand their actual revenue.

-

Restrictions on the payment system: To receive X’s revenue from sharing, one needs to register for a Strip account, which has very strict restrictions based on the applicant’s country/region. Many creators can only watch revenue reminders helplessly, unable to open the payment service.

-

Fake accounts/bots: After X launched the creator revenue model, bot accounts and spam messages have become increasingly rampant, occupying the browsing space of normal users. Differentiating between real users and bots will be a major challenge for Musk in the future.

FriendTech’s creator revenue model also has some fatal problems:

-

The social functionality is not perfect: The webpage often has bugs.

-

High transaction wear and tear, unsustainable business model: Due to the presence of bot scalpers, the transaction wear and tear is very high. So far, these related bots have made profits exceeding 2 million US dollars. Even a profitable business model cannot sustain at such a rate of wear and tear.

-

Rough economic model, speculation-oriented: The price curve of Keys is only related to the number of holders, and creators cannot earn revenue when there are no transactions.

Next, starting from the asset layer and social layer, let’s talk about Debank’s social blueprint, in order to get a glimpse of whether Debank can solve the problems that similar products have encountered.

01. Debank Asset Layer: Debank Chain

The development of Debank Chain is based on the OP Stack, focusing on solving the above key issues while maintaining strong security: minimizing gas costs, providing a Web2-like account abstraction experience, and ensuring the security of L1 assets.

The Debank team has modified the consensus mechanism to reduce the gas cost of individual transactions by 100 to 400 times to adapt to the high-frequency nature of social interactions.

Furthermore, the team has integrated an account abstraction-like system at the chain level, allowing users to enjoy a Web2-like experience while maintaining 100% compatibility with the current EVM standard.

This new account system supports transactions signed with dedicated L2 private keys, reducing the use of L1 private keys in social scenarios and improving the security of user L1 assets.

Debank Chain launched its testnet on August 11th and plans to launch its mainnet in 2024. Currently, only Rabby Wallet has integrated the DeBank testnet, and the official public RPC has not been released. This greatly restricts bot and witch attacks.

Note that Debank Chain is not the Debank Layer2 that has already been launched on the Debank asset page. The former is still in the testnet stage.

The latter has been online for more than a year and is currently serving as the payment account for Debank’s social products. However, no detailed documentation or introductions can be found in public channels. This Debank L2 has also been targeted by many airdrop bloggers.

Looking at it today, the open-source Debank Chain is also positioned as a social asset chain, so it is likely to become a substitute for Debank L2.

02. Debank Social Layer

Debank Hi

Debank Hi is a Web3 instant messaging service, also known as a chat tool. For Web3 messaging applications, it has the following characteristics:

- Account system based on 0x addresses

- Open and permissionless

- Transparent

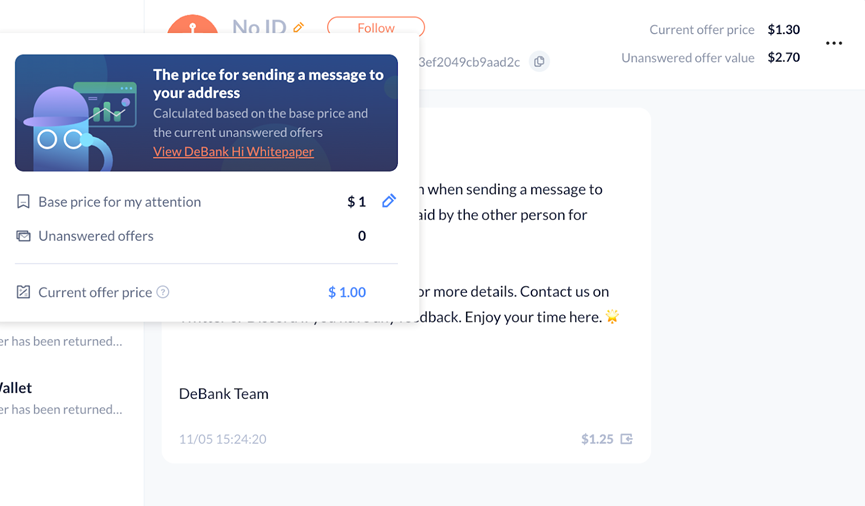

Its interface layout is similar to the built-in chat function of Twitter, but unlike common chat tools, Debank Hi effectively avoids spam messages by introducing the concept of “attention market”.

What is the attention market?

It defines the user’s attention to messages as a scarce asset and designs an attention asset trading market. Sending a message requires purchasing the recipient’s attention, and receiving a message is selling one’s own attention. Effective automated pricing models are used to reduce transaction friction.

Attention, as an asset, defines the user’s act of opening a message as an attention asset. However, it is worth noting that this definition does not include the attention spent on reading a particular message.

Different information provides different values to attract the attention of recipients, so the attention spent here cannot be simply priced and traded.

Introducing an attention market can effectively prevent spam messages and ensure decentralization, that is, no account will be blocked by algorithms.

Although zombie behavior is often blamed for disrupting the experience of normal users, it is not easy to kill zombies without centralized risks.

Marking and blocking potential zombie addresses are privileges that no decentralized platform should have. Building an effective attention market means that everyone should pay the same price, including robots. Therefore, zombies no longer need to be treated differently.

In Web2, users are constantly bombarded with information and advertisements. Platforms profit from advertising by selling users’ attention and achieve valuation growth. By trading their attention, users can regain control and receive compensation for their time and energy spent.

Debank Stream

Debank Stream is a fully Twitter-like posting system, characterized by Stream accounts being linked to Debank’s asset statistics. With the moat of asset statistics, Debank Stream can have many advanced and novel gameplay features.

One of them is the introduction of Contribution Value. As the official slogan “a Web3 social feed that calculates each user’s contributions to the platform itself!” says, Stream can calculate each user’s contribution to the platform itself! A true Web3 product needs to attribute every bit of value it obtains to its original creators.

With the concept of Contribution Value, the allocation of a reward pool can be realized. This is a post tipping feature that rewards not only the author but also all contributors during the post publishing process.

Every time a post is published in Stream, Debank will create a corresponding reward pool. In the next 3 days, any user can deposit assets into the pool.

Each user’s contribution to the post during these 3 days will be recorded to determine the rewards they can receive. The rewards will be settled after 3 days, and if the funds in the pool exceed the realized value of the post, the user will receive rewards matching their contributions, with the excess going to the author.

If the funds in the pool are less than the realized value, rewards will be distributed proportionally based on each user’s contribution to the realized value. Rewards are usually paid immediately after settlement.

The Debank team believes that users’ time and attention are valuable. Compared to Web2 platforms, every minute spent on Twitter becomes the foundation of its value and eventually translates into Twitter’s profits through advertising.

On DeBank Stream, every minute of user input, every article published or read, every comment and repost will be calculated as a contribution and recorded in your account.

Every natural day, users will receive a contribution record reflecting their contribution to the platform. For each post on DeBank Stream, its realized value will also be calculated, which describes the user attention value obtained during the dissemination process on DeBank Stream.

In the calculation, factors such as the number of users viewing, commenting, and forwarding, as well as the net assets of these users, are taken into account. This determines the contribution of individual users.

DeBank Stream can help users identify the reliability of content sources by considering user net worth and TVF (Total Value of Followers). This will ensure that DeBank Stream captures the attention value of real users, unlike the widespread imitation attacks on Twitter. (Traditional imitation accounts can inflate their number of followers, but cannot increase the total assets of fake followers. Brilliant!)

03. Summary

The Debank team has laid out multiple product lines, which is beneficial for storytelling as it is strong in narrative. However, the downsides are also obvious, as many innovative product features have been abandoned midway, such as:

Debank canceled the highly acclaimed Feed feature; Rabby removed the Debank entrance;

Furthermore, in the current situation where Debank Layer 2 is running normally, Debank Chain, with an unclear positioning, was released. These highlight the team’s lack of transparency in decision-making.

However, this also reflects the Debank team’s decisive execution. Currently, Debank is fully optimizing the social end of its product, utilizing its Web3 asset analysis technology to effectively solve the long-standing issues of imitation attacks and spam information plaguing X and FriendTech.

In addition, the attention market feature introduced in the chat tool Hi can effectively improve user experience and eliminate the disturbance of spam information.

On the asset side, Debank can solve the problem of payment restrictions in traditional Web2 through blockchain technology. Moreover, through highly customized OP Stack with abstract accounts, it is more suitable for social scenarios and effectively avoids the creation of spam accounts, which is far superior to the third-party Layer 2 Base relied on by FriendTech.

Whether FriendTech can improve its economic model remains to be seen, but Debank, with its accumulated strength, will definitely bring us surprises in the field of SocialFi in the future.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!